Global Aircraft Radome Market Size, Share, and COVID-19 Impact Analysis, By Application (Commercial Aircraft, Military Aircraft, Business Jets), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Radome Market Insights Forecasts to 2033

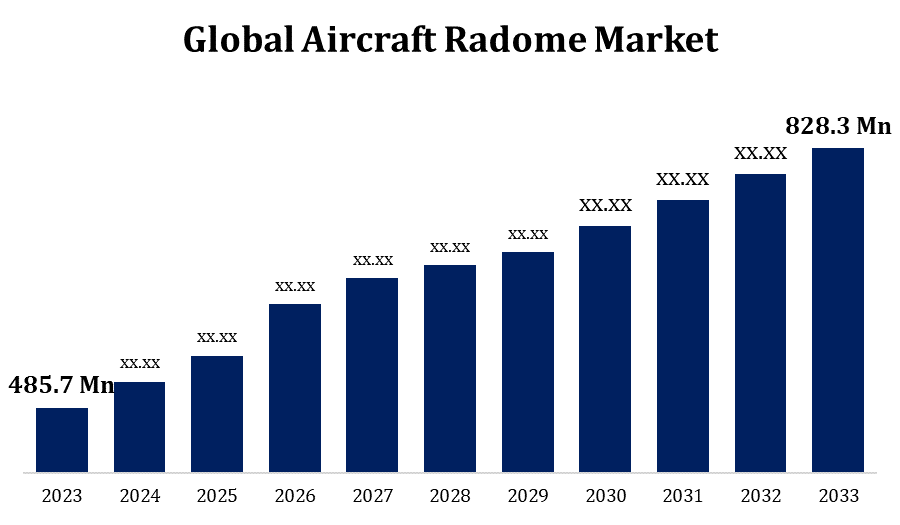

- The Global Aircraft Radome Market Size was valued at USD 485.7 Million in 2023.

- The Market Size is Growing at a CAGR of 5.48% from 2023 to 2033

- The Worldwide Aircraft Radome Market Size is expected to reach USD 828.3 Million by 2033

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Radome Market Size is expected to reach USD 828.3 Million by 2033, at a CAGR of 5.48% during the forecast period 2023 to 2033.

The aircraft radome market is experiencing significant growth due to advancements in aerospace technology and increasing demand for enhanced aircraft performance. Radomes, protective covers for radar systems, are essential for maintaining radar functionality while shielding it from environmental factors. Key drivers include the rise in air travel, the need for upgraded radar systems, and advancements in materials technology. Manufacturers are focusing on lightweight, durable materials like composite polymers to improve radar performance and fuel efficiency. The market is also influenced by the expansion of defense and commercial aviation sectors globally. Innovations in radome design and material science are expected to drive future growth, addressing the increasing requirements for advanced aircraft systems and operational efficiency.

Aircraft Radome Market Value Chain Analysis

The aircraft radome market value chain comprises several key stages: raw material supply, manufacturing, assembly, and distribution. Initially, raw materials like composite polymers and ceramics are sourced from suppliers. These materials are then processed and manufactured into radomes, often involving advanced molding and curing technologies. The manufacturing stage also includes rigorous testing to ensure performance standards. Following production, radomes are assembled into aircraft systems and integrated with radar equipment. Distribution involves logistics and supply chain management to deliver the final product to aircraft manufacturers or maintenance facilities. Throughout the value chain, quality control and compliance with aviation standards are critical. Collaboration among material suppliers, manufacturers, and aerospace companies ensures the delivery of high-performance radomes for various aircraft applications.

Aircraft Radome Market Opportunity Analysis

The increasing demand for advanced radar systems in both commercial and military aviation boosts the need for high-performance radomes. Technological advancements in materials, such as lightweight composites and improved durability, offer potential for market growth. Additionally, the expansion of the aviation industry and the rise in air travel globally create a continuous need for new aircraft and radar upgrades. Emerging markets in developing regions and modernization programs for existing aircraft fleets further enhance opportunities. Innovations in radome design to improve aerodynamic efficiency and radar capabilities also provide avenues for growth. The market is poised for expansion as stakeholders invest in cutting-edge technologies and adapt to evolving industry demands.

Global Aircraft Radome Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 485.7 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.48% |

| 2033 Value Projection: | USD 828.3 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Application, By Region |

| Companies covered:: | General Dynamics, Airbus, Nordam, Saint-Gobain, Meggitt, Starwin Industries, Kitsap Composites, Orbital ATK, Jenoptik, Harris, Vermont Composites, Pacific Radomes, Royal Engineered Composites, AVIC, ATK, Kelvin Hughes, Raytheon, Leonardo, Ducommun, and other key companies. |

| Growth Drivers: | Increasing aircraft deliveries worldwide to propel market growth |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aircraft Radome Market Dynamics

Increasing aircraft deliveries worldwide to propel market growth

As airlines expand their fleets and aircraft manufacturers ramp up production, the demand for advanced radomes to enhance radar performance and ensure reliable operations increases. New aircraft models, incorporating state-of-the-art radar systems, require high-quality radomes for optimal functionality and protection. Additionally, the replacement of older fleets and modernization initiatives contribute to the growing need for upgraded radome technology. The expanding aviation sector, driven by rising passenger traffic and economic development, further accelerates radome demand. As aircraft deliveries continue to rise, the radome market is expected to experience robust growth, driven by innovations in materials and design to meet evolving industry requirements.

Restraints & Challenges

Advanced materials, such as composites and ceramics, are expensive and require precise fabrication processes, impacting overall production costs. Additionally, radomes must meet stringent aerospace standards for performance and safety, demanding rigorous testing and quality control, which can further complicate production. Supply chain disruptions and raw material shortages can also affect market stability. Furthermore, the need for continuous innovation to keep pace with advancements in radar technology and aircraft design presents an ongoing challenge. The market must also address environmental concerns and regulations related to material sustainability. Balancing cost, performance, and regulatory compliance remains a critical challenge for industry stakeholders.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Radome Market from 2023 to 2033. The United States and Canada are major players, with numerous aircraft manufacturers, defense contractors, and commercial airlines driving demand for advanced radome solutions. The emphasis on upgrading radar systems for both commercial and military aircraft fuels market expansion. Additionally, North America's focus on research and development fosters innovation in radome materials and designs, enhancing performance and durability. The presence of key industry players and a well-established aerospace infrastructure further supports market growth. However, challenges such as high production costs and regulatory requirements must be managed to capitalize on the region's opportunities.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region's focus on modernizing aircraft fleets and enhancing radar systems further propels radome demand. Advances in local manufacturing capabilities and materials technology also support market growth. However, challenges include managing supply chain complexities and meeting stringent regulatory standards. Additionally, competition from regional and global players intensifies, requiring continuous innovation and cost-effective solutions. Despite these challenges, the Asia-Pacific market presents promising opportunities, driven by technological advancements and a burgeoning aerospace sector.

Segmentation Analysis

Insights by Application

The commercial aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. The expansion of global air travel and increasing fleet sizes fuel the demand for advanced radome technology to enhance radar performance and ensure operational reliability. Airlines are investing in new aircraft with state-of-the-art radar systems, which require high-quality radomes for optimal functionality. The replacement of aging fleets and the introduction of next-generation aircraft models also contribute to market growth. Additionally, rising passenger expectations for in-flight connectivity and safety push airlines to adopt advanced radome solutions. The segment's growth is further supported by technological advancements in materials and design, improving performance while reducing weight and cost, making it a key area for radome market development.

Recent Market Developments

- In January 2020, Starwin Industries LLC announced the successful purchase of a firm-fixed-price indefinite-delivery/indefinite-quantity contract of USD 9,554,000. This contract is for the construction of F-16 Bugeye radomes, which are designed to improve the performance of AESA radars on F-16 aircraft.

Competitive Landscape

Major players in the market

- General Dynamics

- Airbus

- Nordam

- Saint-Gobain

- Meggitt

- Starwin Industries

- Kitsap Composites

- Orbital ATK

- Jenoptik

- Harris

- Vermont Composites

- Pacific Radomes

- Royal Engineered Composites

- AVIC

- ATK

- Kelvin Hughes

- Raytheon

- Leonardo

- Ducommun

- CPI

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Radome Market, Application Analysis

- Commercial Aircraft

- Military Aircraft

- Business Jets

Aircraft Radome Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Radome Market?The global Aircraft Radome Market is expected to grow from USD 485.7 million in 2023 to USD 828.3 million by 2033, at a CAGR of 5.48% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Radome Market?Some of the key market players of the market are General Dynamics, Airbus, Nordam, Saint-Gobain, Meggitt, Starwin Industries, Kitsap Composites, Orbital ATK, Jenoptik, Harris, Vermont Composites, Pacific Radomes, Royal Engineered Composites, AVIC, ATK, Kelvin Hughes, Raytheon, Leonardo, Ducommun, and CPI.

-

3. Which segment holds the largest market share?The commercial aircraft segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Radome Market?North America dominates the Aircraft Radome Market and has the highest market share.

Need help to buy this report?