Global Aircraft Refurbishing Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Wide-Body Aircraft And Narrow-Body Aircraft), By Application (Passenger to Freighter, Commercial Cabin Refurbishing And VP Cabin Refurbishing), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Refurbishing Market Insights Forecasts to 2033

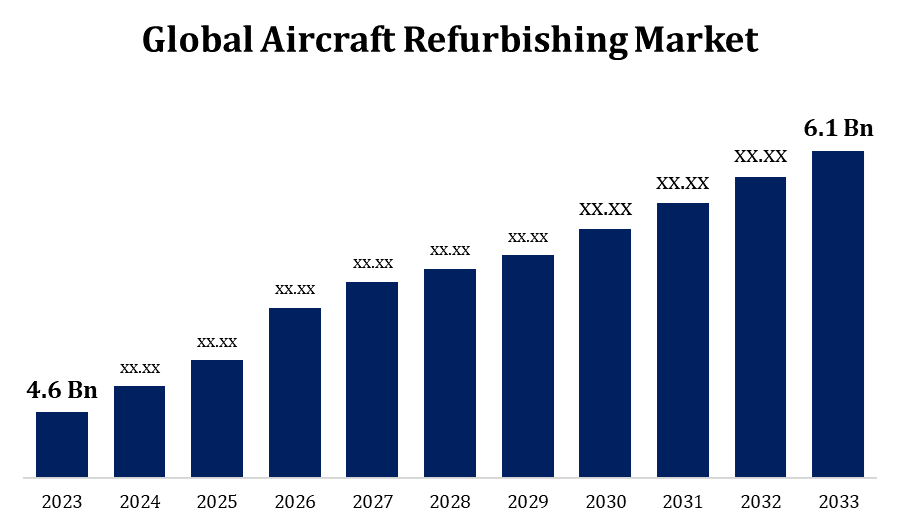

- The Aircraft Refurbishing Market Size was valued at USD 4.6 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.86% from 2023 to 2033

- The Worldwide Aircraft Refurbishing Market Size is Expected to reach USD 6.1 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Refurbishing Market Size is Expected to reach USD 6.1 Billion by 2033, at a CAGR of 2.86% during the forecast period 2023 to 2033.

The aircraft refurbishing market is experiencing significant growth, driven by the rising demand for enhanced passenger comfort, sustainability, and cost-effective fleet management. Airlines and private jet owners are increasingly investing in refurbishments to modernize interiors, improve fuel efficiency, and extend the lifespan of their aircraft. The market encompasses a range of services, including cabin redesign, seating upgrades, in-flight entertainment enhancements, and retrofitting with advanced materials. Key trends include the adoption of eco-friendly materials, personalized designs, and cutting-edge technology integration. The Asia-Pacific region is emerging as a major hub due to the expanding aviation sector. With the industry's focus on sustainability and cost optimization, the aircraft refurbishing market is poised for continued expansion, offering lucrative opportunities for service providers and suppliers.

Aircraft Refurbishing Market Value Chain Analysis

The aircraft refurbishing market value chain involves multiple stages, from raw material suppliers to end-users. It begins with suppliers of advanced materials, including lightweight composites, eco-friendly fabrics, and high-tech electronic components. These materials are then used by OEMs (Original Equipment Manufacturers) and specialized refurbishing companies to redesign and retrofit aircraft interiors, encompassing seating, cabin systems, and in-flight entertainment. Service providers, including engineering and design firms, play a crucial role in customizing and executing refurbishment projects. The process culminates with airlines, private jet owners, and leasing companies, who are the end-users seeking to enhance the value, aesthetics, and efficiency of their aircraft. Regulatory bodies also play a key role in ensuring safety and compliance throughout the refurbishing process, influencing the market dynamics.

Aircraft Refurbishing Market Opportunity Analysis

The aircraft refurbishing market presents substantial growth opportunities, driven by the increasing demand for aircraft modernization, sustainability, and personalized travel experiences. As airlines and private jet owners seek to enhance passenger comfort and operational efficiency, there is a growing need for innovative refurbishing solutions, such as advanced seating configurations, eco-friendly materials, and state-of-the-art in-flight entertainment systems. The rise of low-cost carriers in emerging markets, particularly in Asia-Pacific, is creating a demand for cost-effective refurbishment services to extend aircraft lifespans. Additionally, the trend towards sustainable aviation is opening avenues for green refurbishing practices, including the use of recyclable materials and energy-efficient systems. Companies offering specialized services and cutting-edge technology integration are well-positioned to capitalize on these evolving market needs.

Global Aircraft Refurbishing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.6 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 2.86% |

| 2033 Value Projection: | USD 6.1 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Aircraft Type, By Application, By Region |

| Companies covered:: | Raytheon Technologies, Jamco America Inc., Lufthansa Technik, B/E Aerospace, Sabreliner Aviation LLC, Safran SA, Diehl Shiftung & Co. KG, Timco Aviation Services, Gulfstream Aerospace Ltd., AFI KLM E&M, Nextant Aerospace, Hong Kong Aircraft Engineering Co. Ltd, Zodiac Aerospace, Inc, Jet Aviation AG, Rose Aircraft Services, SIA Engineering Co. Ltd, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Market Dynamics

Aircraft Refurbishing Market Dynamics

Growing commercial aviation operations as a result of a large increase in air travel activity drive market growth

The surge in commercial aviation operations, fueled by a significant increase in global air travel, is a key driver of growth in the aircraft refurbishing market. As passenger volumes rise, airlines are under pressure to enhance the comfort, aesthetics, and functionality of their fleets to remain competitive. This demand extends beyond new aircraft, with many operators opting to refurbish existing planes to improve passenger experience and align with modern standards. The need to optimize operational efficiency and extend aircraft lifespans further propels refurbishing activities, as it offers a cost-effective alternative to purchasing new aircraft. Additionally, the expansion of low-cost carriers and regional airlines in emerging markets contributes to this growth, as these operators seek affordable refurbishing solutions to meet rising travel demand.

Restraints & Challenges

High costs associated with refurbishment projects, including advanced materials and labor, can be prohibitive, particularly for smaller airlines and private jet owners. Regulatory compliance is another significant hurdle, as stringent aviation safety and environmental standards require meticulous planning and execution, often leading to project delays and increased expenses. The industry also grapples with supply chain disruptions, which can affect the availability of specialized components and materials, delaying refurbishment timelines. Additionally, the rapid pace of technological advancements necessitates continuous updates to refurbishing processes, posing a challenge for companies to stay competitive.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Refurbishing Market from 2023 to 2033. With a high concentration of airlines, private jet owners, and leasing companies, the demand for refurbishing services is robust, particularly for enhancing cabin interiors, upgrading in-flight entertainment, and improving fuel efficiency. The region's emphasis on sustainability and innovation further propels the market, with companies adopting eco-friendly materials and advanced technologies to meet regulatory standards and consumer expectations. The presence of leading aerospace manufacturers and refurbishing firms in the U.S. and Canada, coupled with strong investment in aviation infrastructure, bolsters the market. Additionally, the growth of low-cost carriers and regional airlines in North America amplifies the need for cost-effective refurbishment solutions.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region's burgeoning middle class and the proliferation of low-cost carriers are key drivers, prompting airlines to invest in cabin upgrades, in-flight entertainment, and fuel-efficient retrofits to stay competitive. Additionally, the region's focus on sustainability and the adoption of eco-friendly materials are shaping market trends. The presence of major aircraft manufacturers and a growing network of maintenance, repair, and overhaul (MRO) facilities in Asia-Pacific further strengthens the market, positioning it as a key growth hub in the global industry.

Segmentation Analysis

Insights by Aircraft Type

The wide body segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines are increasingly investing in refurbishing wide-body aircraft to modernize cabins, upgrade seating, and integrate advanced in-flight entertainment systems, catering to premium and economy passengers alike. The shift towards sustainable aviation also encourages the retrofitting of wide-body jets with fuel-efficient engines and lightweight materials, reducing operational costs and environmental impact. Additionally, the expansion of international routes by carriers, particularly in emerging markets, fuels the demand for wide-body refurbishments. As airlines seek to maximize the lifespan and value of their wide-body fleets, this segment's growth is expected to remain strong, offering lucrative opportunities for service providers.

Insights by Application

The passenger to freighter segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the global surge in e-commerce and demand for air cargo. Airlines and leasing companies are increasingly converting older passenger aircraft into freighters to extend their useful life and meet the growing need for cargo capacity. This trend is particularly strong for wide-body and narrow-body aircraft, which are being adapted to accommodate larger volumes of goods. The P2F conversion offers a cost-effective solution compared to purchasing new freighters, making it an attractive option for operators. Additionally, the expansion of global trade and the shift towards more efficient logistics networks are fueling this segment's growth. With sustained demand for air freight services, the P2F market is poised for continued expansion.

Recent Market Developments

- In October 2021, Lufthansa Technik has confirmed the renewal of a major base maintenance contract with EasyJet Switzerland SA, a Swiss low-cost airline, for more than 140 aircraft. The contract was first signed in 2016.

Competitive Landscape

Major players in the market

- Raytheon Technologies

- Jamco America Inc.

- Lufthansa Technik

- B/E Aerospace

- Sabreliner Aviation LLC

- Safran SA

- Diehl Shiftung & Co. KG

- Timco Aviation Services

- Gulfstream Aerospace Ltd.

- AFI KLM E&M

- Nextant Aerospace

- Hong Kong Aircraft Engineering Co. Ltd

- Zodiac Aerospace, Inc

- Jet Aviation AG

- Rose Aircraft Services

- SIA Engineering Co. Ltd

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Refurbishing Market, Aircraft Type Analysis

- Wide-Body Aircraft

- Narrow-Body Aircraft

Aircraft Refurbishing Market, Application Analysis

- Passenger to Freighter

- Commercial Cabin Refurbishing

- VP Cabin Refurbishing

Aircraft Refurbishing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Aircraft Refurbishing Market?The global Aircraft Refurbishing Market is expected to grow from USD 4.6 billion in 2023 to USD 6.1 billion by 2033, at a CAGR of 2.86% during the forecast period 2023-2033.

-

2.Who are the key market players of the Aircraft Refurbishing Market?Some of the key market players of the market are Raytheon Technologies, Jamco America Inc., Lufthansa Technik, B/E Aerospace, Sabreliner Aviation LLC, Safran SA, Diehl Shiftung & Co. KG, Timco Aviation Services, Gulfstream Aerospace Ltd., AFI KLM E&M, Nextant Aerospace, Hong Kong Aircraft Engineering Co. Ltd, Zodiac Aerospace, Inc, Jet Aviation AG, Rose Aircraft Services, SIA Engineering Co. Ltd.

-

3.Which segment holds the largest market share?The passenger to freighter segment holds the largest market share and is going to continue its dominance.

-

4.Which region dominates the Aircraft Refurbishing Market?North America dominates the Aircraft Refurbishing Market and has the highest market share.

Need help to buy this report?