Global Aircraft Seals Market Size, Share, and COVID-19 Impact Analysis, By Type (Dynamic Seals, Static Seals, Composite Seals), By Material (Metals, Polymers, Composites), By Application (Engine, Airframe, Flight Control Surfaces, Landing Gear), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Seals Market Insights Forecasts to 2033

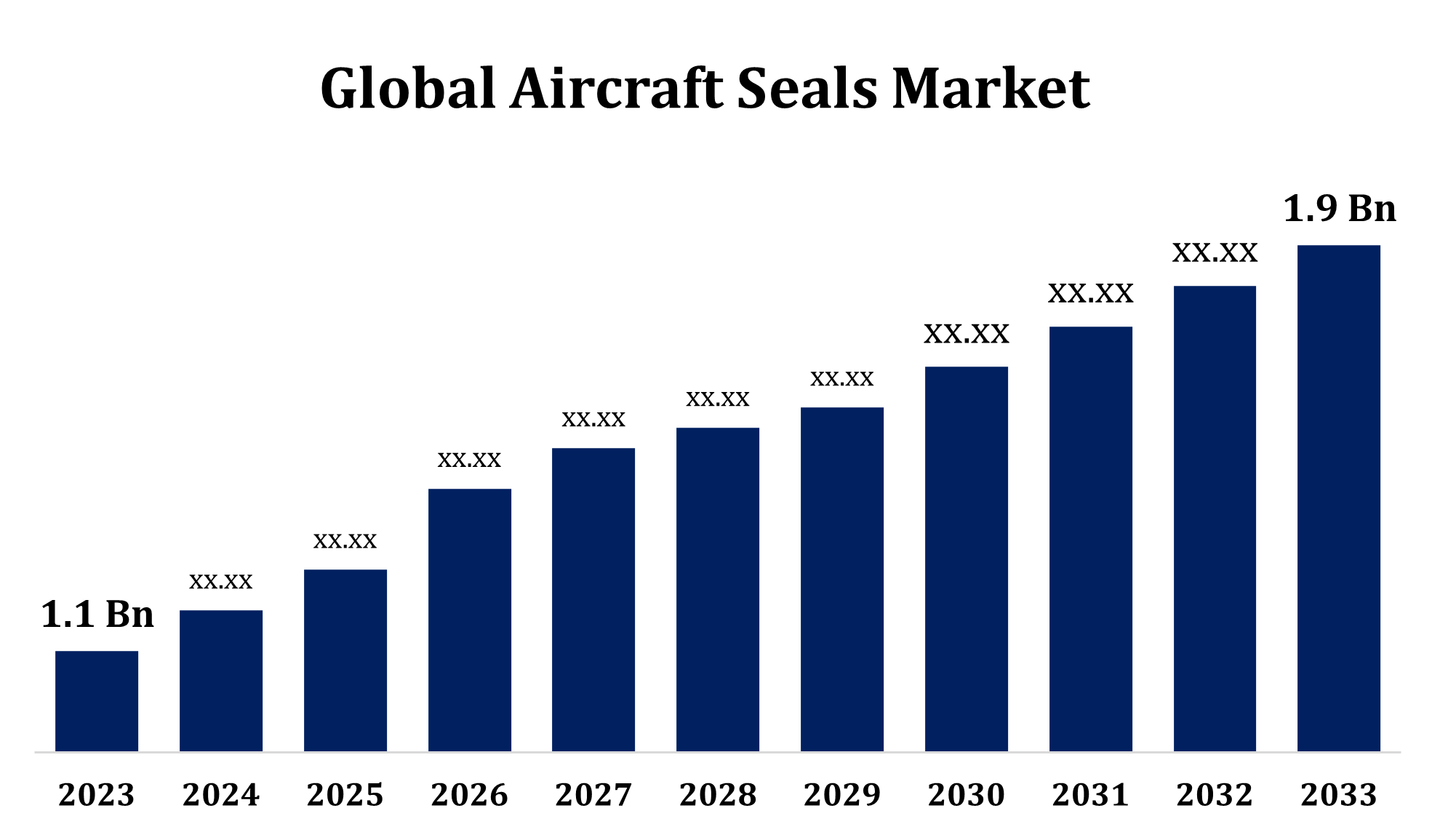

- The Global Aircraft Seals Market Size was valued at USD 1.1 Billion in 2023.

- The Market is Growing at a CAGR of 5.62% from 2023 to 2033.

- The Worldwide Aircraft Seals Market Size is expected to reach USD 1.9 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aircraft Seals Market is Expected to reach USD 1.9 Billion by 2033, at a CAGR of 5.62% during the forecast period 2023 to 2033.

The global aircraft seals market is experiencing steady expansion, driven by increasing air travel, technological advancements, and rising demand for fuel-efficient aircraft. The aircraft seals market size is projected to grow due to expanding commercial and military aviation sectors. Key aircraft seals market trends include the adoption of lightweight materials and high-performance sealing technologies. According to aircraft seals industry analysis, OEMs and MRO services are major contributors to growth. The aircraft seals market forecast indicates rising investments in aerospace innovation, boosting aerospace seals market share. Growing aerospace seals market demand is fueled by stringent safety regulations and the need for reliable aircraft sealing solutions industry products. The market will continue expanding with advancements in elastomers, composites, and metal-based sealing solutions.

Aircraft Seals Market Value Chain Analysis

The aircraft seals market value chain involves multiple stages, from raw material sourcing to end-user applications. It begins with raw material suppliers providing elastomers, composites, and metal alloys used in manufacturing seals. Manufacturers and OEMs then design and produce high-performance aircraft seals for applications in engines, landing gear, and hydraulic systems. Distributors and suppliers play a key role in delivering these products to aircraft manufacturers and MRO service providers. Maintenance, Repair, and Overhaul (MRO) providers ensure the longevity and reliability of seals in operational aircraft. Finally, end users, including commercial airlines, military aviation, and aerospace organizations, utilize these seals to enhance performance and safety. Advancements in materials and sealing technologies continue to optimize efficiency and durability across the value chain.

Aircraft Seals Market Opportunity Analysis

The aircraft seals market presents significant growth opportunities driven by rising air travel, fleet expansion, and increasing demand for fuel-efficient aircraft. The growing adoption of advanced materials, such as lightweight elastomers and composites, offers new possibilities for enhancing seal performance and durability. Expanding Maintenance, Repair, and Overhaul (MRO) services create further opportunities, as airlines focus on extending aircraft lifespan. Emerging markets in Asia-Pacific and the Middle East provide lucrative growth prospects due to increasing defense budgets and commercial aviation investments. Additionally, stringent safety regulations drive the need for high-performance sealing solutions. Technological advancements, including 3D printing and smart seals with predictive maintenance capabilities, further enhance market potential. Companies investing in sustainable and high-temperature-resistant seals will gain a competitive edge in this evolving industry.

Global Aircraft Seals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.1 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.62% |

| 023 – 2033 Value Projection: | USD 1.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 246 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Type, By Material, By Regional Analysis and COVID-19 Impact Analysis. |

| Companies covered:: | SKF (Sweden), Saint-Gobain Group (France), Trelleborg AB (Sweden), Meggitt PLC (U.K.), Parker Hannifin Corp. (U.S.), METAX GmbH (Germany), PAULSTRA SNC (France), Harwal Ltd (U.A.E), Dichtomatik (Germany), SHIJIAZHUANG Langrong Chemical Co., Ltd (China), Temel Gaskets (Turkey), Kastas Sealing Technologies Europe GmbH (Germany), W. L. Gore & Associates, Inc. (U.S.), Repack-S (Italy), Eaton (U.S.), Dp Seals Ltd. (U.K.), Rexnord Corporation (U.S.), PPG Industries, Inc. (U.S.), STACEM (France), Nicholsons Sealing Technologies Ltd. (U.K.), and Other key Vendors. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Seals Market Dynamics

Growing demand for improved fuel efficiency

The growing demand for improved fuel efficiency is a key driver of aircraft seals market growth. Airlines and aircraft manufacturers are focusing on reducing fuel consumption by enhancing aerodynamics and minimizing energy losses. Advanced sealing solutions, including lightweight elastomers and high-performance composites, help improve engine efficiency, reduce friction, and prevent fluid leakage. As aviation regulations become more stringent, the need for durable and temperature-resistant seals continues to rise. Additionally, the shift toward next-generation aircraft, such as fuel-efficient commercial jets and electric aircraft, further boosts the demand for innovative sealing technologies. The increasing adoption of Maintenance, Repair, and Overhaul (MRO) services also supports market expansion by ensuring optimal performance and longevity of seals. Companies investing in sustainable and high-performance sealing solutions will gain a competitive edge.

Restraints & Challenges

The complexity of aircraft sealing solutions, required to withstand extreme temperatures and pressures, demands constant innovation and research. Additionally, fluctuating raw material prices, such as those for elastomers, composites, and metals, pose challenges for manufacturers in terms of cost control. The integration of advanced technologies like smart seals also requires substantial investment in R&D and infrastructure. The growing need for lightweight and durable materials places further pressure on manufacturers to develop cost-effective solutions. Moreover, the market is highly competitive, with major players vying for market share, requiring continuous improvements in quality, performance, and customer service. Addressing these challenges is key to sustaining long-term growth.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Seals Market from 2023 to 2033. The region is home to leading aircraft manufacturers, including Boeing and Lockheed Martin, as well as key MRO (Maintenance, Repair, and Overhaul) service providers, fueling the demand for high-performance sealing solutions. The U.S. military’s robust defense budget further boosts market growth, with advanced sealing technologies required for military aircraft. Additionally, increasing air travel and fleet modernization contribute to the rising need for durable and fuel-efficient aircraft seals. North America also leads in the adoption of innovative materials, such as advanced elastomers, composites, and polymers, which are enhancing seal performance in challenging operating conditions. This trend is expected to continue, solidifying the region’s leadership in the global market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, and Japan are investing heavily in aerospace infrastructure and technology, creating substantial demand for high-performance sealing solutions. The rise of domestic aircraft manufacturing and MRO services in this region further boosts market expansion. Additionally, the growing focus on fuel efficiency and environmental sustainability in aviation is driving the adoption of advanced sealing materials, such as lightweight elastomers and composites. As the Asia-Pacific aviation industry continues to expand, the demand for durable and reliable aircraft seals will increase, offering significant growth opportunities for market players in the region.

Segmentation Analysis

Insights by Type

The dynamic seals segment accounted for the largest market share over the forecast period 2023 to 2033. As aircraft manufacturers focus on improving fuel efficiency and performance, the demand for advanced dynamic seals that can handle extreme temperatures, pressures, and motion increases. These seals are designed to prevent leakage, reduce friction, and ensure smooth operation in components subject to constant movement. With rising investments in new aircraft models and the expanding fleet of commercial and military planes, the dynamic seals segment is poised for continued growth. Additionally, innovations in materials such as elastomers, composites, and metal alloys are improving the durability and performance of dynamic seals, further boosting their adoption. This trend is expected to continue as aerospace technology advances.

Insights by Material

The polymers segment accounted for the largest market share over the forecast period 2023 to 2033. Polymers, such as elastomers and thermoplastics, are highly resistant to wear, temperature fluctuations, and harsh chemicals, making them ideal for use in aerospace applications. These materials are widely used in seals for engines, hydraulic systems, and landing gear components. As the aerospace industry focuses on enhancing fuel efficiency and reducing weight, polymer-based seals offer significant advantages due to their lightweight nature and ability to withstand high pressures and temperatures. Moreover, innovations in polymer blends and composites are enhancing their performance and expanding their application across next-generation aircraft. The growing demand for MRO services and the rise of commercial and military aircraft further support the growth of the polymers segment.

Insights by Application

The engine segment accounted for the largest market share over the forecast period 2023 to 2033. Engine seals are crucial for preventing fluid leakage, reducing friction, and ensuring the overall efficiency and safety of engine components. As aircraft manufacturers focus on developing more fuel-efficient and environmentally friendly engines, the demand for advanced sealing solutions to withstand extreme temperatures, pressures, and mechanical stresses has increased. Innovations in materials, such as high-temperature-resistant elastomers, composites, and metals, are boosting the performance and durability of engine seals. Additionally, the growing fleet of commercial and military aircraft, along with expanding Maintenance, Repair, and Overhaul (MRO) services, is further fueling the demand for engine seals. This trend is expected to continue as aerospace technology advances and engines become more complex.

Recent Market Developments

- In March 2023, Parker Hannifin Corporation has launched the new Resilon 4350 polyurethane material, specifically engineered for dynamic hydraulic and pneumatic sealing applications.

Competitive Landscape

Major players in the market

- SKF (Sweden)

- Saint-Gobain Group (France)

- Trelleborg AB (Sweden)

- Meggitt PLC (U.K.)

- Parker Hannifin Corp. (U.S.)

- METAX GmbH (Germany)

- PAULSTRA SNC (France)

- Harwal Ltd (U.A.E)

- Dichtomatik (Germany)

- SHIJIAZHUANG Langrong Chemical Co., Ltd (China)

- Temel Gaskets (Turkey)

- Kastas Sealing Technologies Europe GmbH (Germany)

- W. L. Gore & Associates, Inc. (U.S.)

- Repack-S (Italy)

- Eaton (U.S.)

- Dp Seals Ltd. (U.K.)

- Rexnord Corporation (U.S.)

- PPG Industries, Inc. (U.S.)

- STACEM (France)

- Nicholsons Sealing Technologies Ltd. (U.K.)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Seals Market, Type Analysis

- Dynamic Seals

- Static Seals

- Composite Seals

Aircraft Seals Market, Material Analysis

- Metals

- Polymers

- Composites

Aircraft Seals Market, Application Analysis

- Engine

- Airframe

- Flight Control Surfaces

- Landing Gear

Aircraft Seals Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Seals Market?The Global Aircraft Seals Market is expected to grow from USD 1.1 billion in 2023 to USD 1.9 billion by 2033, at a CAGR of 5.62% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Seals Market?Some of the key market players of the market are SKF (Sweden), Saint-Gobain Group (France), Trelleborg AB (Sweden), Meggitt PLC (U.K.), Parker Hannifin Corp. (U.S.), METAX GmbH (Germany), PAULSTRA SNC (France), Harwal Ltd (U.A.E), Dichtomatik (Germany), SHIJIAZHUANG Langrong Chemical Co., Ltd (China), Temel Gaskets (Turkey), Kastas Sealing Technologies Europe GmbH (Germany), W. L. Gore & Associates, Inc. (U.S.), Repack-S (Italy), Eaton (U.S.), Dp Seals Ltd. (U.K.), Rexnord Corporation (U.S.), PPG Industries, Inc. (U.S.), STACEM (France), and Nicholsons Sealing Technologies Ltd. (U.K.).

-

3. Which segment holds the largest market share?The polymers segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Seals Market?North America dominates the Aircraft Seals Market and has the highest market share.

Need help to buy this report?