Global Aircraft Seating Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Commercial, Business Jets, Regional Aircraft, and Transport Aircraft), By Class (Economy Class, Premium Economy Class, Business Class, and First Class), By Seat Type (9G Seats, 16G Seats, and 21G Seats), By Component (Structure, Foams, Actuators, Electrical Fittings, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Seating Market Insights Forecasts to 2033

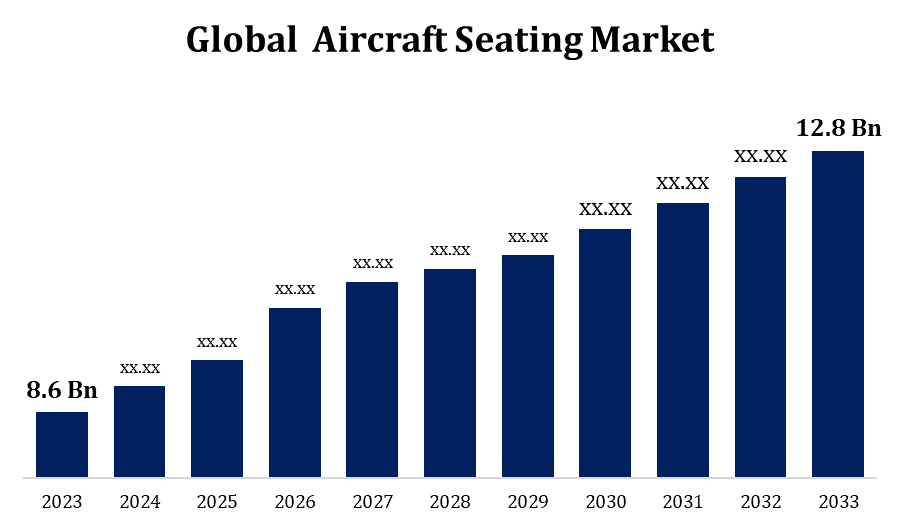

- The Aircraft Seating Market Size was valued at USD 8.6 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.06% from 2023 to 2033.

- The Global Aircraft Seating Market is expected to reach USD 12.8 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global Aircraft Seating Market is expected to reach USD 12.8 billion by 2033, at a CAGR of 4.06% during the forecast period 2023 to 2033.

The global aircraft seating market is poised for significant growth, driven by increasing air travel, rising demand for lightweight and fuel-efficient seats, and the expansion of low-cost carriers. The market is segmented by seat class, aircraft type, and materials used, catering to different airline preferences and customer needs. Technological advancements, such as ergonomic designs, enhanced passenger comfort, and in-seat power solutions, are further propelling market expansion. Additionally, the post-COVID-19 resurgence in air travel and the growth of long-haul flights are boosting demand for premium seating options. Key players are focusing on innovative designs and collaborations to maintain competitiveness. However, stringent safety regulations and high costs associated with advanced seating pose challenges to market growth, requiring constant adaptation and innovation within the industry.

Aircraft Seating Market Value Chain Analysis

The aircraft seating market value chain encompasses several key stages, including raw material sourcing, manufacturing, distribution, and end-user deployment. Initially, raw materials such as metals, plastics, and textiles are procured from suppliers. These materials are then transformed into seating components through advanced manufacturing processes, focusing on safety and comfort. Next, these components are assembled into finished seats by specialized manufacturers, who adhere to stringent aviation standards. Once produced, seats are distributed to aircraft manufacturers and retrofit service providers, often involving collaborations with airlines to meet specific needs. Finally, airlines install these seats in their fleets, enhancing passenger experience. The value chain also includes after-sales services like maintenance and refurbishment, ensuring compliance with regulations and extending product life, thereby adding value throughout the market.

Aircraft Seating Market Opportunity Analysis

The aircraft seating market presents numerous opportunities driven by evolving consumer preferences and technological advancements. The growing demand for air travel, particularly in emerging economies, encourages airlines to expand their fleets and enhance passenger experience. Innovations in materials and designs, such as lightweight and sustainable options, create avenues for manufacturers to differentiate their products. The rise of low-cost carriers and the increasing trend of premium economy class present additional growth prospects, allowing airlines to cater to diverse customer segments. Furthermore, retrofitting existing aircraft with modern seating solutions offers significant market potential, particularly as airlines seek to improve comfort and fuel efficiency. Lastly, incorporating smart technologies, like in-flight entertainment systems and connectivity features, can enhance the overall passenger experience, making it a lucrative area for investment and development.

Global Aircraft Seating Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.6 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.06% |

| 2033 Value Projection: | USD 12.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 254 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Aircraft Type, By Class, By Seat Type, By Region |

| Companies covered:: | Safran Group, RECARO Aircraft Seating GmbH & Co. KG, Jamco Corporation, Thompson Aero Seating, Hong Kong Aircraft Engineering Company Limited, Airbus Atlantic SAS, RTX Corporation, Expliseat S.A.S., ZIM Aircraft Seating GmbH, Geven SPA, Adient Aerospace LLC, Aviointeriors s.p.a., Mirus Aircraft Seating Ltd, and Iacobucci HF Aerospace S.p.A. |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Market Dynamics

Aircraft Seating Market Dynamics

Increased Passenger Air Traffic Will Fuel Market Expansion

Increased passenger air traffic is a primary driver of expansion in the aircraft seating market. As global travel demand surges, fueled by economic growth and rising disposable incomes, airlines are compelled to upgrade their fleets and enhance passenger comfort. This trend is particularly pronounced in emerging markets, where burgeoning middle classes are seeking affordable air travel options. Additionally, the resurgence of long-haul flights and the growing popularity of low-cost carriers necessitate the installation of versatile seating configurations that cater to diverse passenger needs. As airlines strive to improve customer satisfaction and differentiate themselves in a competitive landscape, investments in innovative seating solutions, including ergonomic designs and advanced in-flight entertainment systems, become critical. This focus on enhancing the travel experience will further drive market growth and attract significant investment in the aircraft seating sector.

Restraints & Challenges

One significant issue is the high cost of advanced seating solutions, which can deter airlines from investing in new technologies and designs. Additionally, stringent safety regulations and certification processes can prolong product development timelines and increase costs. The recent fluctuations in fuel prices and economic uncertainties can also impact airlines' capital expenditures on fleet upgrades and retrofits. Furthermore, the competition among manufacturers is intensifying, with companies striving to innovate while maintaining affordability. This pressure can lead to potential compromises in quality and safety. Lastly, evolving passenger preferences, particularly in post-pandemic travel, require constant adaptation to design and comfort features, posing a challenge for manufacturers to keep pace with changing demands.

Regional Forecasts

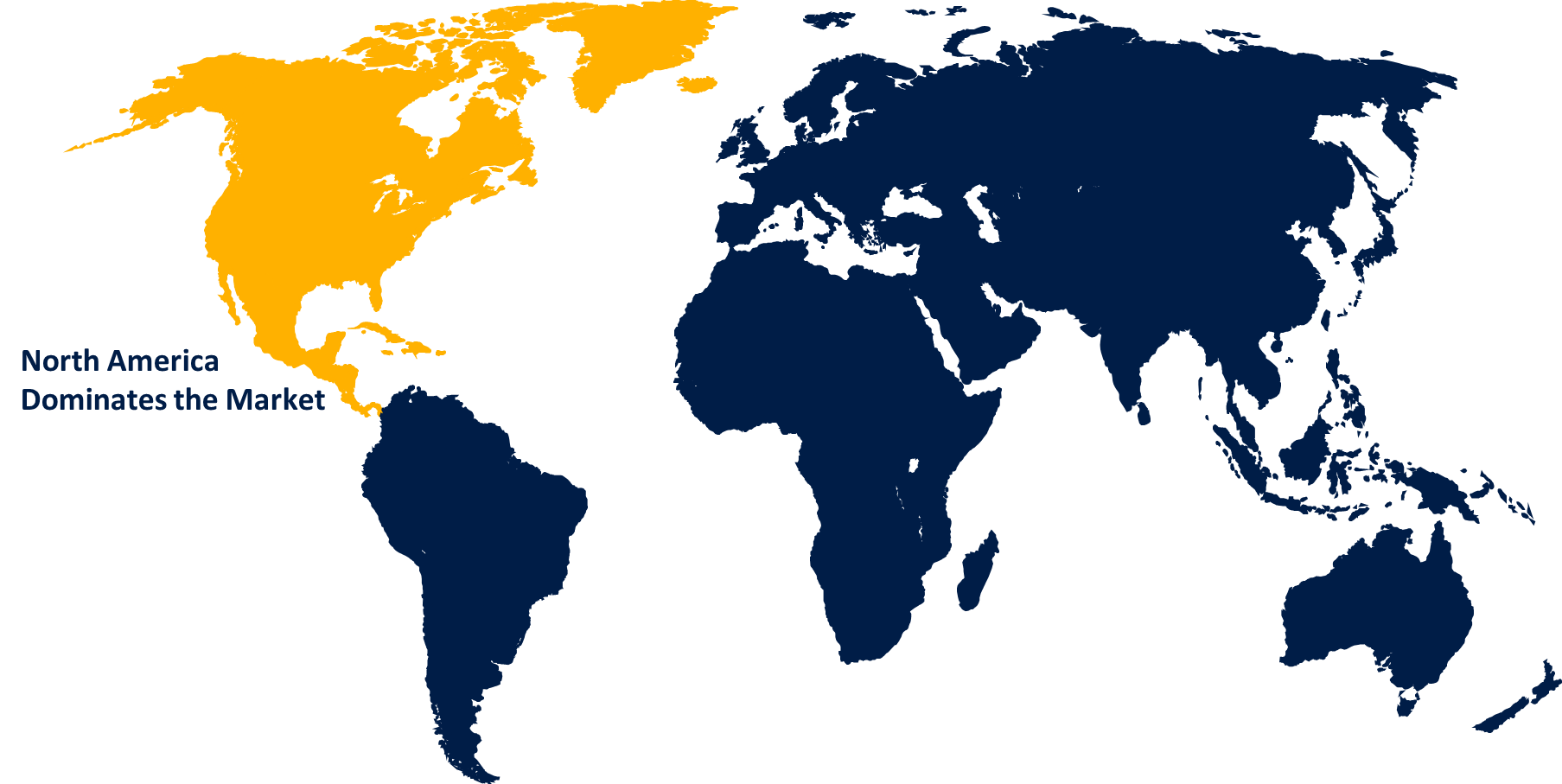

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Seating Market from 2023 to 2033. The United States and Canada are home to numerous leading airlines and aircraft manufacturers, contributing to significant demand for innovative seating solutions. Factors such as increasing passenger expectations for comfort and the need for fuel-efficient designs are prompting airlines to invest in advanced seating options. The market is characterized by a growing trend towards premium economy and business class seats, reflecting consumer preferences for enhanced travel experiences. Additionally, the expansion of low-cost carriers is boosting demand for versatile seating configurations. However, challenges such as stringent regulatory requirements and competition among seating manufacturers require continuous innovation to maintain market leadership in this dynamic landscape.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries like China, India, and Southeast Asian nations are witnessing increased passenger numbers due to rising disposable incomes and a growing middle class. This region is characterized by a high proliferation of low-cost carriers, which are investing in efficient seating configurations to maximize capacity and enhance passenger experience. Additionally, major international airlines are upgrading their fleets with modern seating solutions to cater to evolving consumer preferences. The market is also bolstered by technological advancements, including lightweight materials and smart seating designs. However, challenges such as supply chain disruptions and varying regulatory standards across countries require manufacturers to adapt swiftly to remain competitive in this dynamic market landscape.

Segmentation Analysis

Insights by Aircraft Type

The commercial aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. As more passengers seek affordable travel options, airlines are investing in new aircraft and upgrading existing fleets to enhance comfort and safety. This segment encompasses various seating configurations, including economy, premium economy, and business class, catering to diverse consumer preferences. The rise of low-cost carriers is further propelling demand for efficient seating designs that maximize passenger capacity while maintaining comfort. Additionally, advancements in materials and technology enable the development of lightweight and ergonomic seats, contributing to fuel efficiency. However, manufacturers must navigate challenges such as regulatory compliance and competition to capitalize on the burgeoning opportunities within the commercial aircraft segment.

Insights by Class

The economy class segment accounted for the largest market share over the forecast period 2023 to 2033. With more passengers opting for budget-friendly options, airlines are expanding their economy offerings and retrofitting existing fleets to accommodate rising passenger volumes. This segment focuses on maximizing seating density while ensuring passenger comfort through ergonomic designs and innovative materials. Additionally, the proliferation of low-cost carriers is a major factor, as they prioritize high-capacity seating configurations to maintain competitive pricing. Technological advancements, such as in-seat entertainment and improved legroom, are enhancing the overall travel experience in economy class. However, airlines must balance cost management with passenger satisfaction, leading to continuous innovation and improvement in economy seating solutions to meet evolving consumer expectations in this dynamic market.

Insights by Seat Type

The 16G seats segment accounted for the largest market share over the forecast period 2023 to 2033. These seats, designed to withstand greater forces during turbulence or emergencies, are becoming essential for modern aircraft, particularly in the context of evolving aviation safety standards. Airlines are increasingly investing in 16G seating solutions to enhance safety features while also appealing to safety-conscious travelers. Furthermore, the demand for business and first-class segments is rising, as premium airlines aim to provide a superior travel experience that includes advanced safety measures. Technological advancements in seat materials and designs are enabling manufacturers to create lightweight yet robust 16G seats, contributing to fuel efficiency. This combination of safety, comfort, and regulatory compliance is driving growth in the 16G seat segment within the broader aircraft seating market.

Insights by Component

The structure segment accounted for the largest market share over the forecast period 2023 to 2033. This segment encompasses the framework and support systems of aircraft seats, which are critical for ensuring passenger safety during flight. With increasing regulatory requirements for crashworthiness and the demand for lightweight solutions, manufacturers are innovating with robust yet lightweight materials such as advanced composites and aluminum alloys. The rise of long-haul flights and the growing emphasis on passenger comfort are also pushing airlines to invest in improved seating structures that provide enhanced support and durability. Additionally, as airlines expand their fleets and retrofit existing aircraft, the focus on high-quality seat structures that can withstand wear and tear is becoming paramount, further propelling growth in this segment of the market.

Recent Market Developments

- In February 2024, Recaro Aircraft Seating has been chosen by Air India to provide premium economy and economy seating for its widebody expansion initiative, part of a historic order for 470 aircraft.

Competitive Landscape

Major players in the market

- Safran Group

- RECARO Aircraft Seating GmbH & Co. KG

- Jamco Corporation

- Thompson Aero Seating

- Hong Kong Aircraft Engineering Company Limited

- Airbus Atlantic SAS

- RTX Corporation

- Expliseat S.A.S.

- ZIM Aircraft Seating GmbH

- Geven SPA

- Adient Aerospace LLC

- Aviointeriors s.p.a.

- Mirus Aircraft Seating Ltd

- Iacobucci HF Aerospace S.p.A.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Seating Market, Aircraft Type Analysis

- Commercial, Business Jets

- Regional Aircraft

- Transport Aircraft

Aircraft Seating Market, Class Analysis

- Economy Class

- Premium Economy Class

- Business Class

- First Class

Aircraft Seating Market, Seat Type Analysis

- 9G Seats

- 16G Seats

- 21G Seats

Aircraft Seating Market, Component Analysis

- Structure

- Foams

- Actuators

- Electrical Fittings

- Others

Aircraft Seating Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Seating Market?The global Aircraft Seating Market is expected to grow from USD 8.6 billion in 2023 to USD 12.8 billion by 2033, at a CAGR of 4.06% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Seating Market?Some of the key market players of the market are Safran Group; RECARO Aircraft Seating GmbH & Co. KG; Jamco Corporation; Thompson Aero Seating; Hong Kong Aircraft Engineering Company Limited; Airbus Atlantic SAS; RTX Corporation; Expliseat S.A.S.; ZIM Aircraft Seating GmbH; Geven SPA; Adient Aerospace LLC; Aviointeriors s.p.a.; Mirus Aircraft Seating Ltd; Iacobucci HF Aerospace S.p.A.

-

3. Which segment holds the largest market share?The commercial aircraft segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Seating Market?North America dominates the Aircraft Seating Market and has the highest market share.

Need help to buy this report?