Global Aircraft Synthetic Vision Systems Market Size, Share, and COVID-19 Impact Analysis, By Type (Primary Flight Display, Navigation Display, Heads-up, and Helmet-mounted Display, and Others), By End User (Military, Commercial, and General Aviation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Synthetic Vision Systems Market Insights Forecasts to 2033

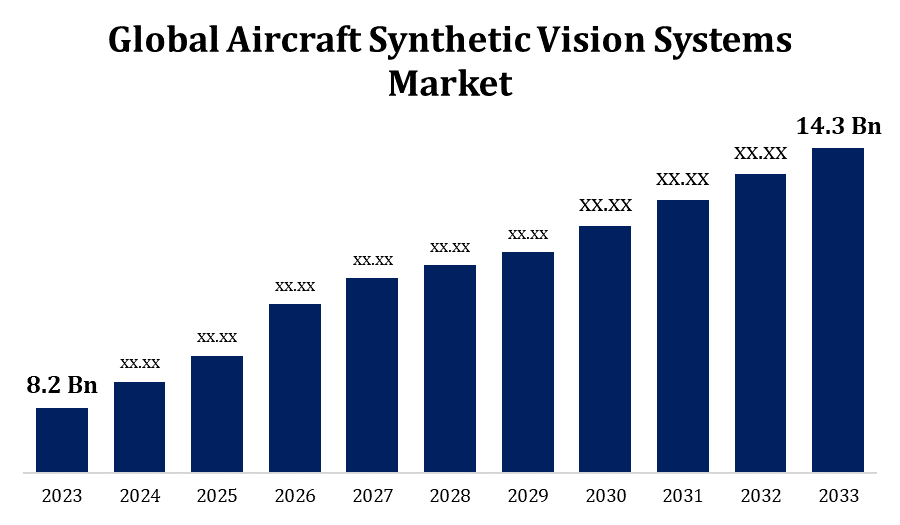

- The Global Aircraft Synthetic Vision Systems Market Size was valued at USD 8.2 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.72% from 2023 to 2033

- The Worldwide Aircraft Synthetic Vision Systems Market Size is expected to reach USD 14.3 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Synthetic Vision Systems Market Size is expected to reach USD 14.3 Billion by 2033, at a CAGR of 5.72% during the forecast period 2023 to 2033.

The Aircraft Synthetic Vision Systems (SVS) market is experiencing notable growth, driven by increasing demand for advanced avionics that enhance situational awareness and flight safety. SVS integrates 3D terrain mapping, obstacle detection, and flight path visualization, providing pilots with clear visibility in all weather conditions, especially during night or low-visibility flights. With advancements in AI and sensor technologies, SVS has become a critical component in modern cockpits, reducing pilot workload and improving decision-making capabilities. The market's expansion is further fueled by rising air traffic, the adoption of SVS in commercial and military aircraft, and stringent safety regulations.

Aircraft Synthetic Vision Systems Market Value Chain Analysis

The Aircraft Synthetic Vision Systems (SVS) market value chain involves several key components, from raw material suppliers to end users. It starts with the procurement of high-quality sensors, processors, and display units from specialized manufacturers. These components are then integrated into SVS by avionics system providers, who design and develop the software and hardware needed to create real-time 3D visualizations of the aircraft's environment. Collaboration with aircraft manufacturers is crucial to ensure seamless integration into the cockpit. Distribution channels involve OEMs and aftermarket service providers, who deliver the final products to airlines, private jet operators, and military customers. The value chain is further supported by regulatory bodies, ensuring compliance with safety standards, and by continuous R&D efforts to enhance system capabilities and reliability.

Aircraft Synthetic Vision Systems Market Opportunity Analysis

The Aircraft Synthetic Vision Systems (SVS) market presents significant opportunities driven by advancements in technology and the growing focus on flight safety. The increasing adoption of SVS in both commercial and military aviation, due to its ability to enhance situational awareness and reduce pilot workload, offers a lucrative market potential. Emerging economies, particularly in Asia-Pacific, are witnessing a surge in air travel and fleet expansion, creating a demand for advanced avionics like SVS. Additionally, the integration of AI and machine learning in SVS opens up opportunities for more intelligent and adaptive systems. The push for green aviation and fuel efficiency also drives the need for optimized flight paths, where SVS plays a crucial role. Aftermarket services for upgrading existing aircraft fleets with SVS further expand market opportunities.

Global Aircraft Synthetic Vision Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.72%. |

| 2033 Value Projection: | USD 14.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End User, By Region |

| Companies covered:: | Hilton Software, Universal Avionics System, ADB Airfield Solutions LLC, Rockwell Collins, Rockwell, Astronics Corporation, L-3 Avionics Systems, Garmin Ltd., ATG Airports Ltd., Honeywell International Inc., and other key companies. |

| Growth Drivers: | Increasing need for new aeroplanes drives the market |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aircraft Synthetic Vision Systems Market Dynamics

Increasing need for new aeroplanes drives the market

As global air traffic continues to increase, airlines are expanding and modernizing their fleets to accommodate more passengers and improve operational efficiency. Newer aircraft models are being equipped with advanced avionics, including SVS, to enhance safety and situational awareness in all weather conditions. SVS provides pilots with real-time 3D visuals of the terrain, obstacles, and flight path, making it an essential feature for modern cockpits. Additionally, the push for more fuel-efficient and environmentally friendly aircraft necessitates sophisticated systems like SVS that aid in optimized flight operations. As a result, the need for advanced avionics in new aircraft significantly contributes to the growth of the SVS market.

Restraints & Challenges

High development and integration costs are significant barriers, particularly for smaller airlines and operators in emerging markets. The complexity of SVS technology requires rigorous testing and certification, which can be time-consuming and expensive. Additionally, the integration of SVS with existing aircraft systems poses challenges, as retrofitting older aircraft with advanced avionics can be technically demanding and costly. The market also faces challenges related to cybersecurity, as SVS relies heavily on data from various sensors and networks, making it vulnerable to potential cyber threats. Furthermore, the reliance on accurate and real-time data for effective SVS operation means that any disruptions in data quality or availability can impact system performance and safety, presenting a critical challenge.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Synthetic Vision Systems Market from 2023 to 2033. The U.S., home to leading aerospace companies and a significant military aviation sector, is the largest contributor to market growth. The presence of major aircraft manufacturers and SVS developers accelerates technological advancements and adoption in both commercial and military aviation. Strict regulatory standards for flight safety in North America further boost the integration of SVS into new and existing aircraft. Additionally, the region's high air traffic volume and ongoing fleet modernization initiatives create sustained demand for SVS. The push towards next-generation aviation technologies, including AI and enhanced situational awareness systems, positions North America as a key player in the global SVS market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region is investing heavily in modernizing their aviation infrastructure, leading to increased adoption of advanced avionics such as SVS. The region's booming commercial aviation market, with growing fleets and new aircraft deliveries, is a key driver of SVS integration. Additionally, the rise of low-cost carriers and regional airlines in Asia-Pacific further fuels demand for cost-effective yet advanced safety solutions like SVS. Government initiatives to enhance flight safety standards and the growing focus on improving situational awareness in both commercial and military aviation make Asia-Pacific a pivotal market for SVS growth.

Segmentation Analysis

Insights by Type

The primary flight display segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the increasing focus on enhancing pilot situational awareness and safety. PFDs, which present critical flight information such as attitude, altitude, and speed, are being increasingly integrated with SVS to provide real-time 3D terrain visualization and obstacle detection. This integration allows pilots to maintain better spatial orientation, especially in low-visibility conditions, thereby reducing the risk of accidents. The rising adoption of glass cockpits in both commercial and military aircraft is further propelling the demand for advanced PFDs equipped with SVS capabilities.

Insights by End User

The military segment accounted for the largest market share over the forecast period 2023 to 2033. Military aircraft, including fighter jets, transport planes, and helicopters, benefit from SVS by providing pilots with real-time 3D terrain visualization, even in challenging weather conditions or during night operations. This technology enhances mission effectiveness and reduces the risk of accidents, especially during low-altitude or high-speed flights. The rising investment in modernizing military fleets and integrating next-generation avionics systems further boosts the demand for SVS in the defense sector. Additionally, the adoption of SVS in unmanned aerial vehicles (UAVs) for reconnaissance and combat missions contributes to the segment's growth within the market.

Recent Market Developments

- In October 2022, Collins Aerospace has received a technical standard order (TSO) for its combined vision system (CVS) for business aircraft. The CVS offers pilots with clarity in all weather conditions, allowing them to manoeuvre aircraft confidently and securely through low visibility scenarios.

Competitive Landscape

Major players in the market

- Hilton Software

- Universal Avionics System

- ADB Airfield Solutions LLC

- Rockwell Collins

- Rockwell, Astronics Corporation

- L-3 Avionics Systems

- Garmin Ltd.

- ATG Airports Ltd.

- Honeywell International Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Synthetic Vision Systems Market, Type Analysis

- Primary Flight Display

- Navigation Display

- Heads-up

- Helmet-mounted Display

- Others

Aircraft Synthetic Vision Systems Market, End User Analysis

- Military

- Commercial

- General Aviation

Aircraft Synthetic Vision Systems Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Synthetic Vision Systems Market?The global Aircraft Synthetic Vision Systems Market is expected to grow from USD 8.2 billion in 2023 to USD 14.3 billion by 2033, at a CAGR of 5.72% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Synthetic Vision Systems Market?Some of the key market players of the market are Hilton Software, Universal Avionics System, ADB Airfield Solutions LLC, Rockwell Collins, Rockwell, Astronics Corporation, L-3 Avionics Systems, Garmin Ltd., ATG Airports Ltd., Honeywell International Inc.

-

3. Which segment holds the largest market share?The military segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Synthetic Vision Systems Market?North America dominates the Aircraft Synthetic Vision Systems Market and has the highest market share.

Need help to buy this report?