Global Aircraft Tire Market Size, Share, and COVID-19 Impact Analysis, By Type (Radial-ply Tires and Bias-ply Tires), By Position (Main-Landing Tire and Nose-Landing Tire), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Specialty & Fine ChemicalsGlobal Aircraft Tire Market Insights Forecasts to 2033

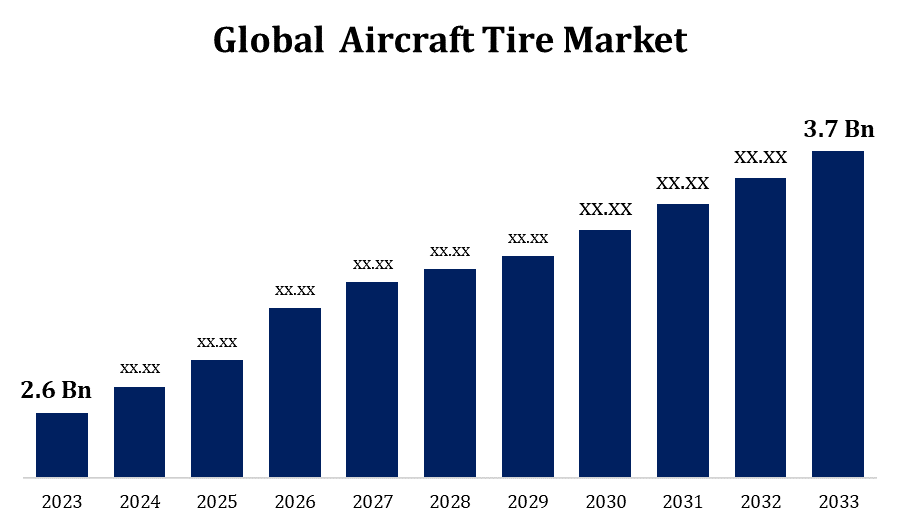

- The Aircraft Tire Market Size was valued at USD 2.6 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.59% from 2023 to 2033

- The Worldwide Aircraft Tire Market is Expected to reach USD 3.7 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Tire Market Size is Expected to reach USD 3.7 billion by 2033, at a CAGR of 3.59% during the forecast period 2023 to 2033.

The aircraft tire market is experiencing significant growth, driven by increasing air travel, rising demand for new aircraft, and the need for maintenance of the existing fleet. With advancements in technology, modern aircraft tires are designed for greater durability, improved performance, and enhanced safety. The Asia-Pacific region, particularly China and India, is witnessing robust growth due to expanding aviation sectors. Key players are focusing on innovation and strategic partnerships to maintain a competitive edge. However, challenges like fluctuating raw material costs and stringent regulations may impact market dynamics in the coming years.

Aircraft Tire Market Value Chain Analysis

The aircraft tire market value chain encompasses several key stages, from raw material sourcing to end-user delivery. It begins with the procurement of essential materials like natural and synthetic rubber, fabric, and steel, which are crucial for tire manufacturing. Manufacturers then design and produce the tires, incorporating advanced technologies for enhanced performance. These products undergo rigorous testing and quality control before being distributed to original equipment manufacturers (OEMs) and the aftermarket. The OEMs supply tires for new aircraft, while the aftermarket caters to maintenance, repair, and overhaul (MRO) activities. Distributors and suppliers play a vital role in ensuring timely delivery to airlines and MRO providers. The value chain is influenced by innovation, regulatory compliance, and the need for continuous product enhancement to meet evolving industry demands.

Aircraft Tire Market Opportunity Analysis

The surge in new aircraft deliveries, especially in emerging markets like Asia-Pacific and the Middle East, creates a strong demand for high-performance tires. Additionally, the growing emphasis on fuel efficiency and environmental sustainability drives innovation in tire design, offering opportunities for manufacturers to develop lightweight, durable, and eco-friendly products. The aftermarket segment, particularly in maintenance, repair, and overhaul (MRO) services, offers substantial opportunities due to the continuous need for tire replacements and retreading in aging fleets. Furthermore, advancements in materials and technology, such as smart tires with embedded sensors, present new avenues for growth, enhancing safety, and operational efficiency in the aviation sector.

Global Aircraft Tire Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.6 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.59% |

| 2033 Value Projection: | USD 3.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 231 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Position, By Region |

| Companies covered:: | Bridgestone Corp Goodyear Tire and Rubber Company Specialty Tires of America Inc. Dunlop Aircraft Tyres Limited Michelin Aviation Tires and Treads of America Qingdao Century Tires Company Limited Wilkerson Aircraft Tires Petlas Tire Corporation |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Market Dynamics

Aircraft Tire Market Dynamics

Large commercial and military aviation fleets are driving market expansion

The expansion of the aircraft tire market is significantly driven by large commercial and military aviation fleets. The continuous growth of global air travel has led to increased fleet sizes among major airlines, boosting the demand for high-performance tires capable of withstanding frequent takeoffs and landings. In parallel, military aviation fleets, with their rigorous operational demands and diverse aircraft types, require specialized tires that offer enhanced durability and safety. The need for regular maintenance, repair, and overhaul (MRO) of these extensive fleets further amplifies tire demand, particularly in the aftermarket. As both commercial and military sectors prioritize operational efficiency and safety, manufacturers are focusing on advanced tire technologies that deliver longer service life, fuel efficiency, and better overall performance, driving market expansion.

Restraints & Challenges

Fluctuating raw material costs, particularly rubber and steel, create pricing pressures for manufacturers. Additionally, stringent regulatory standards and safety certifications demand continuous investment in research and development, increasing operational costs. The complexity of designing tires that can withstand extreme conditions while maintaining durability and performance adds to the challenges. The market also contends with the slow pace of innovation adoption in certain regions, limiting the penetration of advanced tire technologies. Furthermore, the global push for sustainability requires manufacturers to develop eco-friendly products, which can be costly and technologically challenging. Finally, supply chain disruptions, whether due to geopolitical tensions or pandemics, pose risks to the timely production and distribution of aircraft tires.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Tire Market from 2023 to 2033. The presence of major airlines, coupled with high air traffic, fuels consistent demand for high-performance tires. Additionally, the region's advanced aerospace industry and strong focus on safety and efficiency support the adoption of innovative tire technologies, such as radial tires and smart tire systems. The robust maintenance, repair, and overhaul (MRO) sector further boosts the aftermarket demand for aircraft tires, ensuring regular replacements and retreading. The United States, as a leading player, significantly contributes to the market with its large fleet of commercial and military aircraft.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The increasing demand for air travel, coupled with rising disposable incomes and urbanization, is leading to a surge in new aircraft deliveries, fueling tire demand. Additionally, the region's growing military expenditures contribute to the market, with significant investments in defense aviation. The burgeoning maintenance, repair, and overhaul (MRO) industry also supports robust aftermarket tire demand. Regional manufacturers are increasingly adopting advanced tire technologies to meet international standards, further driving market growth.

Segmentation Analysis

Insights by Type

The radial-ply tires segment accounted for the largest market share over the forecast period 2023 to 2033. Radial-ply tires offer enhanced fuel efficiency, longer service life, and better heat dissipation, making them increasingly popular among commercial and military aircraft operators. The demand for these tires is particularly strong in regions with high air traffic, such as North America and Asia-Pacific, where airlines seek to reduce operational costs and improve efficiency. Additionally, advancements in materials and manufacturing technologies have led to the development of lighter and more robust radial-ply tires, further boosting their adoption. As the aviation industry continues to prioritize safety, performance, and cost-effectiveness, the radial-ply tire segment is expected to see sustained growth in the coming years.

Insights by Position

The main-landing tires segment accounted for the largest market share over the forecast period 2023 to 2033. These tires are subject to high stress, requiring advanced durability, heat resistance, and performance capabilities. As global air traffic increases, airlines are focusing on reliable main-landing tires that can withstand frequent operations, particularly in large commercial jets and military aircraft. The growing trend of replacing older aircraft with newer models equipped with advanced main-landing tires is also driving market expansion. Moreover, the need for regular maintenance, repair, and overhaul (MRO) services to ensure optimal tire performance is boosting demand in the aftermarket segment. This segment's growth is further supported by innovations in tire materials and design, enhancing safety and efficiency.

Recent Market Developments

- In March 2022, ChemChina's aircraft tire subsidiary Shuguang Rubber Industry Research & Design Institute will work with engineering firm Haohua Chemical Science & Technology to develop a new civil aviation tire production facility.

Major players in the market

- Bridgestone Corp

- Goodyear Tire and Rubber Company

- Specialty Tires of America Inc.

- Dunlop Aircraft Tyres Limited

- Michelin

- Aviation Tires and Treads of America

- Qingdao Century Tires Company Limited

- Wilkerson Aircraft Tires

- Petlas Tire Corporation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Tire Market, Type Analysis

- Radial-ply Tires

- Bias-ply Tires

Aircraft Tire Market, Position Analysis

- Main-Landing Tire

- Nose-Landing Tire

Aircraft Tire Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Tire Market?The global Aircraft Tire Market is expected to grow from USD 2.6 billion in 2023 to USD 3.7 billion by 2033, at a CAGR of 3.59% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Tire Market?Some of the key market players of the market are Bridgestone Corp, Goodyear Tire and Rubber Company, Specialty Tires of America Inc., Dunlop Aircraft Tyres Limited, Michelin, Aviation Tires and Treads of America, Qingdao Century Tires Company Limited, Wilkerson Aircraft Tires, Petlas Tire Corporation.

-

3. Which segment holds the largest market share?The radial-ply tires segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Tire Market?North America dominates the Aircraft Tire Market and has the highest market share.

Need help to buy this report?