Global Aircraft Turbine Engine Market Size, Share, and COVID-19 Impact Analysis, by End-User (Civil and Commercial Aviation, Military Aviation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Turbine Engine Market Insights Forecasts to 2033

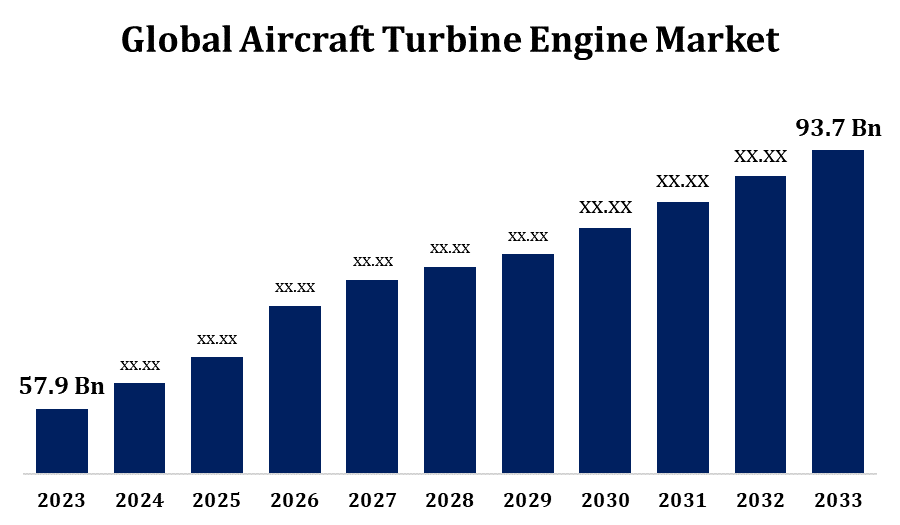

- The Global Aircraft Turbine Engine Market Size was valued at USD 57.9 Billion in 2023.

- The Market is Growing at a CAGR of 4.93% from 2023 to 2033.

- The Worldwide Aircraft Turbine Engine Market Size is Expected to reach USD 93.7 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aircraft Turbine Engine Market Size is Expected to reach USD 93.7 Billion by 2033, at a CAGR of 4.93% during the forecast period 2023 to 2033.

The global aircraft turbine engine market is experiencing significant growth, driven by increasing air travel demand, advancements in engine technology, and the rising focus on fuel efficiency. Turbine engines, primarily jet engines, dominate the aviation sector due to their superior performance in commercial, military, and cargo aircraft. Key trends include the development of lightweight materials, improved aerodynamics, and the adoption of hybrid-electric propulsion systems to reduce emissions. Major manufacturers like General Electric, Rolls-Royce, and Pratt & Whitney are investing in research and development to meet stringent environmental regulations and enhance engine efficiency. The market is also benefiting from the rise in defense spending and aircraft fleet expansions in emerging economies, with Asia-Pacific expected to be the fastest-growing region in the coming years.

Aircraft Turbine Engine Market Value Chain Analysis

The aircraft turbine engine market value chain involves several key stages, from raw material sourcing to end-user applications. It begins with the procurement of high-performance materials, such as titanium, nickel alloys, and composites, essential for withstanding extreme temperatures and stress. Engine manufacturers like General Electric, Rolls-Royce, and Pratt & Whitney then design, develop, and assemble turbine engines, incorporating advanced technologies like 3D printing and AI for improved performance. These engines are integrated into commercial, military, and cargo aircraft by original equipment manufacturers (OEMs). The aftermarket segment includes maintenance, repair, and overhaul (MRO) services, ensuring engine longevity and reliability. Suppliers, distributors, and service providers play critical roles throughout the chain, while regulatory bodies ensure safety and compliance. The value chain is increasingly focused on sustainability and fuel efficiency to meet environmental standards.

Aircraft Turbine Engine Market Opportunity Analysis

The aircraft turbine engine market offers significant growth opportunities driven by the increasing demand for air travel, technological advancements, and sustainability goals. As airlines seek fuel-efficient and environmentally friendly engines, there is rising interest in developing hybrid-electric engines and engines compatible with sustainable aviation fuels (SAF). Emerging economies, particularly in Asia-Pacific and the Middle East, are expanding their commercial and military fleets, creating a strong demand for new turbine engines. The aftermarket services, including maintenance, repair, and overhaul (MRO), present further opportunities as global fleets age and require regular upgrades. Additionally, advancements in materials, 3D printing, and AI-driven predictive maintenance are opening avenues for cost reduction and enhanced engine performance, positioning manufacturers to capitalize on growing trends in efficiency and green aviation.

Global Aircraft Turbine Engine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 57.9 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.93% |

| 2033 Value Projection: | USD 93.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 227 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By End-User, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Honeywell International Inc., GE Aviation, Rolls-Royce PLC, Kratos Defense & Security Solutions Inc., Raytheon Technologies Corporation, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Turbine Engine Market Dynamics

Growing Military and Defense Budgets

Countries like the U.S., China, India, and Russia are heavily investing in advanced fighter jets, drones, and surveillance aircraft to enhance their defense capabilities. This surge in military expenditure drives demand for high-performance turbine engines, which power both manned and unmanned aerial systems. Additionally, the development of next-generation military aircraft, including stealth fighters and supersonic jets, requires advanced turbine engines with enhanced fuel efficiency, durability, and power. Increased defense spending also boosts the demand for maintenance, repair, and overhaul (MRO) services to ensure fleet readiness. As geopolitical tensions rise, defense budgets are expected to continue growing, further fueling the market.

Restraints & Challenges

Environmental regulations are becoming stricter, requiring manufacturers to develop engines with lower emissions, which can increase development costs and complexity. High R&D costs associated with creating more fuel-efficient and eco-friendly engines, such as hybrid-electric or SAF-compatible models, also present financial hurdles. Raw material price fluctuations, particularly for high-performance alloys and composites, add to cost pressures. Supply chain disruptions, exacerbated by global events, can delay production timelines and affect engine delivery. Additionally, maintenance, repair, and overhaul (MRO) services for turbine engines face challenges due to labor shortages and the increasing complexity of newer engine models. Finally, as competition intensifies, particularly from emerging markets, manufacturers must balance innovation with cost-efficiency to stay competitive.

Regional Forecasts

North America Market Statistics

North America is anticipated to dominate the Aircraft Turbine Engine Market from 2023 to 2033. The region's robust defense sector, with high military spending by the U.S., significantly contributes to demand for advanced turbine engines in fighter jets, helicopters, and drones. In the commercial aviation segment, North America is witnessing a steady increase in air traffic and fleet expansion, further driving demand for fuel-efficient and environmentally friendly engines. The region also has a well-established aftermarket service industry, with strong capabilities in maintenance, repair, and overhaul (MRO). Additionally, advancements in aerospace technologies, including hybrid-electric propulsion and sustainable aviation fuel (SAF), offer new growth opportunities for the North American turbine engine market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries like China, India, Japan, and South Korea are investing heavily in both commercial aviation and military modernization programs, boosting the demand for advanced turbine engines. The region is expected to witness the highest growth in airline fleet expansion, particularly in low-cost carriers, which fuels the need for fuel-efficient and eco-friendly engines. Asia-Pacific is also focusing on defense, with significant investments in fighter jets, drones, and surveillance aircraft, contributing to the demand for high-performance turbine engines. Additionally, the region’s aftermarket services, including maintenance, repair, and overhaul (MRO), are expanding as aircraft fleets grow and age. Opportunities for innovation in sustainable aviation technologies also present growth prospects.

Segmentation Analysis

Insights by End User

The civil and commercial segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines are increasingly focused on reducing operating costs and carbon emissions, leading to heightened demand for next-generation turbine engines that offer greater fuel efficiency and lower emissions, such as those compatible with sustainable aviation fuels (SAF) and hybrid-electric propulsion systems. The growth of low-cost carriers, particularly in emerging markets like Asia-Pacific and Latin America, is fueling the need for new aircraft and engines. Additionally, as commercial fleets age, the aftermarket services sector, including maintenance, repair, and overhaul (MRO), is also growing. Increased investments in research and development by major engine manufacturers are propelling innovation and performance improvements in the commercial segment.

Recent Market Developments

- In October 2023, Sikorsky, a subsidiary of Lockheed Martin, is currently installing a new Improved Turbine Engine (IITP) on its Raider X aircraft, developed for the U.S. Army’s Future Attack Reconnaissance Aircraft (FARA) program.

Competitive Landscape

Major players in the market

- Honeywell International Inc.

- GE Aviation

- Rolls-Royce PLC

- Kratos Defense & Security Solutions Inc.

- Raytheon Technologies Corporation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Turbine Engine Market, End User Analysis

- Civil and Commercial Aviation

- Military Aviation

Aircraft Turbine Engine Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Turbine Engine Market?The global Aircraft Turbine Engine Market is expected to grow from USD 57.9 billion in 2023 to USD 93.7 billion by 2033, at a CAGR of 4.93% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Turbine Engine Market?Some of the key market players of the market are Honeywell International Inc., GE Aviation, Rolls-Royce PLC, Kratos Defense & Security Solutions Inc., Raytheon Technologies Corporation.

-

3. Which segment holds the largest market share?The civil and commercial segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Turbine Engine Market?North America dominates the Aircraft Turbine Engine Market and has the highest market share.

Need help to buy this report?