Global Aircraft Weapons Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Fixed-Wing Aircraft, Rotary-Wing Aircraft, Unmanned Aerial Vehicles (UAVS)), By End User (Military, Army, Navy, Civilian, Security Agencies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Weapons Market Insights Forecasts to 2033

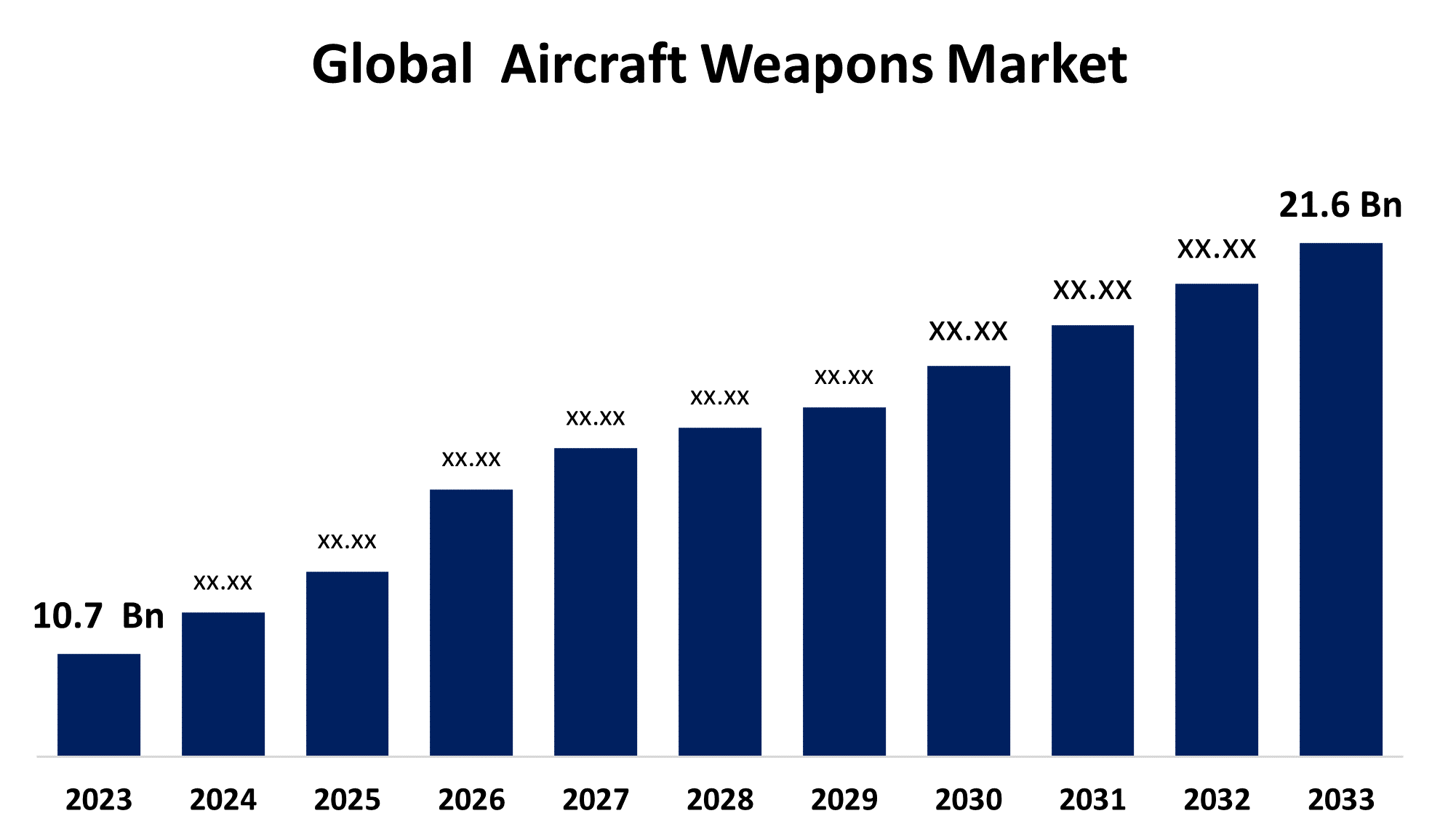

- The Global Aircraft Weapons Market Size was valued at USD 10.7 Billion in 2023.

- The Market is Growing at a CAGR of 7.28% from 2023 to 2033

- The Worldwide Aircraft Weapons Market Size is Expected to reach USD 21.6 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Weapons Market Size is expected to reach USD 21.6 billion by 2033, at a CAGR of 7.28% during the forecast period 2023 to 2033.

The aircraft weapons market is witnessing substantial growth driven by increasing defense budgets and modernization programs globally. Rising geopolitical tensions and military advancements are prompting nations to upgrade their aerial combat capabilities. The market includes a wide range of products such as missiles, bombs, and guns integrated into various aircraft platforms like fighter jets, helicopters, and UAVs. Technological innovations, such as precision-guided munitions and autonomous systems, are enhancing the effectiveness and accuracy of these weapons. Additionally, the integration of advanced sensors and targeting systems is fueling market demand. North America and Asia-Pacific are key regions, with significant investments from the U.S., China, and India. The market's growth is also supported by ongoing research and development efforts aimed at next-generation weapon systems.

Global Aircraft Weapons Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 10.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.28% |

| 2033 Value Projection: | USD 21.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 202 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Aircraft Type, By End User, By Region |

| Companies covered:: | Boeing Company, General Dynamics, Northrop Grumman, SAAB, Thales Group, Lockheed Martin, MDBA, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Aircraft Weapons Market Value Chain Analysis

The aircraft weapons market value chain comprises several key stages, beginning with the sourcing of raw materials, including advanced alloys and electronics. Manufacturers then design and produce various weapon systems such as missiles, bombs, and cannons, integrating cutting-edge technologies like guidance systems and propulsion units. The next phase involves the assembly and integration of these weapons into aircraft platforms, requiring collaboration with airframe manufacturers and defense contractors. Testing and validation are crucial to ensure performance and safety standards. Once completed, these systems are delivered to military clients through procurement programs, often involving complex logistical and regulatory processes. The value chain is further supported by aftermarket services, including maintenance, upgrades, and training, ensuring the long-term operational effectiveness of the weapon systems.

Aircraft Weapons Market Opportunity Analysis

The aircraft weapons market presents significant opportunities driven by the increasing focus on modernizing air defense systems globally. As nations enhance their military capabilities, there is growing demand for advanced weapon systems, including precision-guided munitions, hypersonic missiles, and autonomous weapons. Emerging technologies such as AI, machine learning, and advanced sensors are creating avenues for innovation, allowing for more accurate, efficient, and intelligent weapon systems. The rise in unmanned aerial vehicles (UAVs) and their integration with sophisticated armaments further expands market potential. Additionally, regional tensions and defense spending in Asia-Pacific, the Middle East, and Europe provide lucrative opportunities for market players. Collaborations between governments and defense contractors, along with substantial R&D investments, are expected to drive future growth and technological advancements in the sector.

Market Dynamics

Aircraft Weapons Market Dynamics

The need for precision-guided munitions (PGMs) and smart weaponry

The demand for precision-guided munitions (PGMs) and smart weaponry is rising rapidly in the aircraft weapons market, driven by the need for greater accuracy, effectiveness, and reduced collateral damage in military operations. PGMs, which include laser-guided bombs, GPS-guided missiles, and smart bombs, offer the ability to strike targets with pinpoint accuracy, even in challenging environments. This capability is essential in modern warfare, where minimizing civilian casualties and achieving mission objectives with fewer resources is crucial. The integration of advanced technologies, such as AI and autonomous systems, further enhances the functionality of these smart weapons, allowing for real-time decision-making and adaptability in dynamic combat situations. As global defense strategies shift towards precision warfare, the adoption of PGMs and smart weaponry is expected to continue growing.

Restraints & Challenges

One of the primary issues is the high cost of research, development, and production of advanced weapon systems, which can strain defense budgets. Regulatory hurdles and stringent international arms control agreements, such as the Missile Technology Control Regime (MTCR), limit the export and proliferation of sophisticated weaponry, restricting market expansion. Additionally, the rapid pace of technological advancements requires continuous investment in innovation, posing a challenge for companies to stay competitive. The increasing complexity of modern warfare also demands interoperability and integration with various platforms, complicating system development. Furthermore, geopolitical instability and shifting defense priorities can lead to unpredictable procurement cycles, creating uncertainty in demand for aircraft weapons.

Regional Forecasts

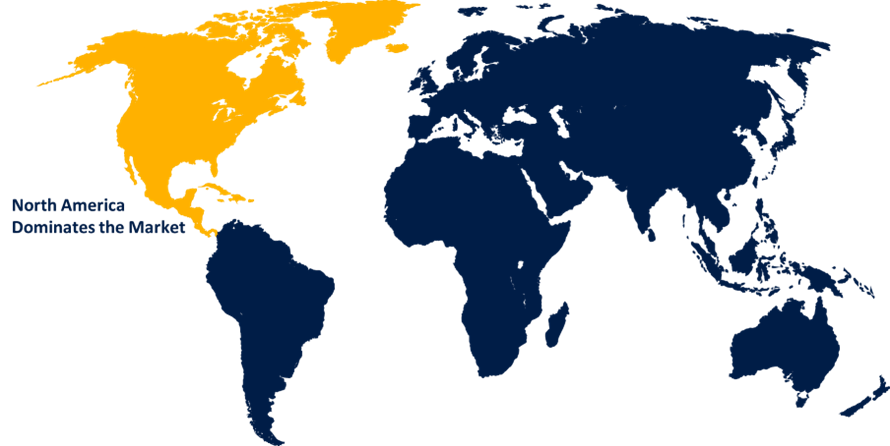

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Weapons Market from 2023 to 2033. The U.S. military’s focus on maintaining air superiority and modernizing its arsenal is a key factor fueling demand for advanced weapon systems, including precision-guided munitions, stealth technology, and hypersonic missiles. The region is home to leading defense contractors like Lockheed Martin, Raytheon Technologies, and Northrop Grumman, which play a pivotal role in developing and supplying cutting-edge aircraft weaponry. Additionally, ongoing research and development efforts, supported by significant government funding, are propelling innovation in the sector. The presence of robust infrastructure for testing and integration further strengthens North America's position in the market. Canada’s defense initiatives also contribute, though on a smaller scale.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Rising geopolitical tensions, particularly in the South China Sea and along the India-Pakistan border, are prompting these nations to invest heavily in advanced weaponry, including precision-guided munitions, stealth technologies, and next-generation missile systems. China's ambitious military expansion and indigenous development programs are particularly noteworthy, positioning it as a major competitor in the global market. India is also enhancing its air defense capabilities through procurement and domestic production initiatives under its "Make in India" campaign. Regional collaborations, joint ventures, and technology transfers are further fueling market growth, making Asia-Pacific a key focus for defense contractors worldwide.

Segmentation Analysis

Insights by Aircraft Type

The fixed wing aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. Nations are investing in modernizing their air forces to maintain air superiority and address evolving security threats. This includes equipping fixed-wing platforms with state-of-the-art weapon systems, such as precision-guided munitions, long-range missiles, and advanced electronic warfare capabilities. The development and deployment of fifth and sixth-generation fighters, like the F-35 and future combat air systems, are key contributors to this growth. Additionally, the integration of cutting-edge technologies, including stealth, hypersonics, and AI-driven systems, is enhancing the lethality and effectiveness of fixed-wing aircraft. This segment’s expansion is further supported by increased defense spending and strategic initiatives worldwide.

Insights by End Use

The military segment accounted for the largest market share over the forecast period 2023 to 2033. As global threats evolve, nations are prioritizing the modernization of their military forces, with a significant focus on enhancing their aerial strike capabilities. This includes the procurement of sophisticated weapons for fighter jets, bombers, and unmanned aerial vehicles (UAVs). The demand for precision-guided munitions, hypersonic missiles, and smart bombs is particularly high, as these systems offer greater accuracy and effectiveness in combat. The development of next-generation military aircraft, such as stealth fighters and multi-role platforms, further accelerates this growth. Additionally, regional tensions and strategic military alliances are prompting increased investments in cutting-edge aircraft weaponry, solidifying the military segment's dominance in the market.

Recent Market Developments

- In January 2023, India announced plans to spend USD 552 million on air defence and naval weapons.

Competitive Landscape

Major players in the market

- Boeing Company

- General Dynamics

- Northrop Grumman

- SAAB

- Thales Group

- Lockheed Martin

- MDBA

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Weapons Market, Aircraft Type Analysis

- Fixed-Wing Aircraft

- Rotary-Wing Aircraft

- Unmanned Aerial Vehicles (UAVS)

Aircraft Weapons Market, End User Analysis

- Military

- Army

- Navy

- Civilian

- Security Agencies

Aircraft Weapons Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Aircraft Weapons Market?The Global Aircraft Weapons Market is expected to grow from USD 10.7 billion in 2023 to USD 21.6 billion by 2033, at a CAGR of 7.28% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Weapons Market?Some of the key market players of the market are Boeing Company, General Dynamics, Northrop Grumman, SAAB, Thales Group, Lockheed Martin, and MDBA.

-

3. Which segment holds the largest market share?The military segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aircraft Weapons Market?North America dominates the Aircraft Weapons Market and has the highest market share.

Need help to buy this report?