Global Aircraft Wire and Cable Market Size, Share, and COVID-19 Impact Analysis, by Type (Aircraft Wire, Aircraft Cable and Aircraft Harness), by Fit (Line-Fit and Retrofit), by Application (Lighting, Flight Control System, Power Transfer, Data Transfer, Avionics and others), by Aircraft Type (Military Aircraft and Civil Aircraft) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aircraft Wire and Cable Market Insights Forecasts to 2033

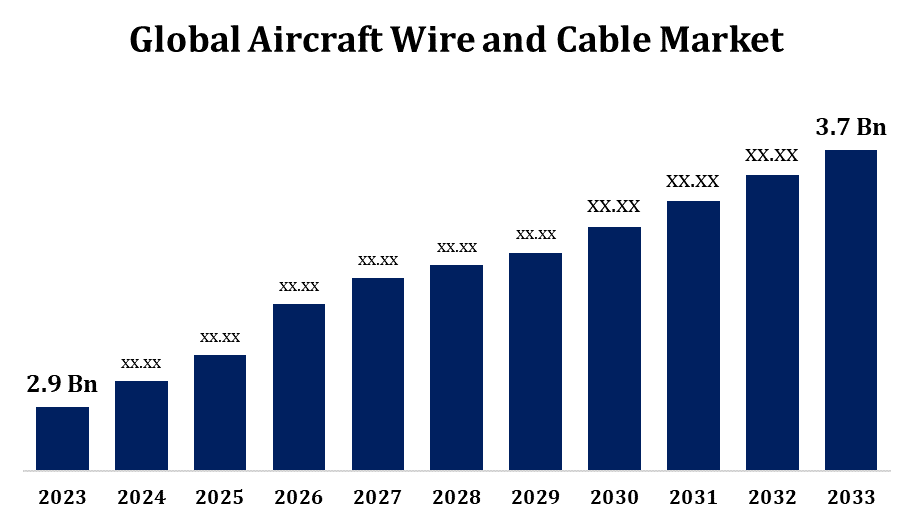

- The Aircraft Wire and Cable Market was valued at USD 2.9 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.47% from 2023 to 2033.

- The Worldwide Aircraft Wire and Cable Market Size is Expected to reach USD 3.7 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aircraft Wire and Cable Market Size is Expected to reach USD 3.7 Billion by 2033, at a CAGR of 2.47% during the forecast period 2023 to 2033.

The aircraft wire and cable market is experiencing steady growth, driven by increasing air traffic, advancements in aviation technology, and the rising demand for lightweight, high-performance materials. Wires and cables are essential components in modern aircraft, providing power, communication, and control systems. The growing trend of electric and hybrid-electric aircraft, along with the need for improved fuel efficiency, is pushing for innovations in wire and cable materials, such as lightweight, fire-resistant, and high-conductivity options. Furthermore, regulatory standards and safety requirements are enhancing the demand for more reliable and durable products. The market is also witnessing a rise in the replacement and retrofit of older systems, contributing to growth in both commercial and military aviation sectors globally.

Aircraft Wire and Cable Market Value Chain Analysis

The aircraft wire and cable market value chain involves several key stages, starting with raw material procurement. Manufacturers source materials such as copper, aluminum, and specialized alloys to produce high-performance wires and cables. The next stage is manufacturing, where these materials are processed into wires and cables designed to meet specific aviation requirements, including flexibility, durability, and fire resistance. These products are then integrated into various aircraft systems, including electrical, communication, and control systems. The distribution network plays a crucial role in supplying these components to original equipment manufacturers (OEMs) and suppliers. The final stages involve installation, maintenance, and retrofitting of these systems in both new and existing aircraft. The value chain also includes research and development, ensuring continual innovation in materials and technology to meet evolving industry standards and safety regulations.

Aircraft Wire and Cable Market Opportunity Analysis

The aircraft wire and cable market presents significant opportunities driven by various factors. The rising demand for electric and hybrid-electric aircraft is fueling the need for lightweight, high-efficiency wiring solutions. Manufacturers are increasingly focused on developing advanced materials like copper-clad aluminum and carbon nanotube cables to reduce weight and enhance performance. Additionally, the growing emphasis on sustainable aviation and fuel efficiency opens doors for innovations in wire and cable technology. The modernization and retrofitting of older aircraft also create a continuous demand for upgraded wiring systems. Increased air travel and a booming aviation sector in emerging markets, particularly in Asia-Pacific, offer further growth potential. Moreover, stringent safety regulations and advancements in aviation technology provide opportunities for companies to introduce more reliable, fire-resistant, and durable wire and cable products.

Aircraft Wire and Cable Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 2.9 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.47% |

| 2033 Value Projection: | USD 3.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Fit, By Application, By Aircraft Type |

| Companies covered:: | Amphenol Corporation (US), AMETEK, Inc. (US), Arrow Electronics, Inc. (US), Carlisle Companies Inc. (US), Leviton Manufacturing Co., Inc. (US), The Angelus Corporation (US), Radiall (France), Collins Aerospace (US), TE Connectivity (Switzerland), W.L.Gore & Associates, Inc. (US), NEXANS (France), and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aircraft Wire and Cable Market Dynamics

The increase in air traffic, coupled with the need for upgrades to in-flight connectivity systems

The growth of the aircraft wire and cable market is significantly influenced by the surge in air traffic and the growing demand for enhanced in-flight connectivity systems. As more passengers seek seamless internet and communication services during flights, airlines are investing in upgrading their aircraft with advanced technologies. This, in turn, drives the demand for high-performance wires and cables that can support sophisticated communication, entertainment, and navigation systems. Additionally, the increasing use of wireless connectivity solutions, including Wi-Fi and satellite communication, requires lightweight, durable, and high-capacity cables to ensure optimal performance. As the aviation industry continues to evolve, these technological advancements and the continuous rise in passenger numbers are creating substantial growth opportunities for the aircraft wire and cable market.

Restraints & Challenges

Manufacturers must meet high-performance and safety requirements, such as fire resistance and durability, while ensuring that products are lightweight to improve fuel efficiency. The complexity of certification processes can lead to delays and increased costs for new products. Another challenge is the rising material costs for specialized alloys and high-conductivity materials, which can impact profit margins. Additionally, the rapid pace of technological advancements in aviation, such as electric aircraft and automation, requires continuous innovation in wire and cable design, putting pressure on manufacturers to stay ahead of trends. Furthermore, supply chain disruptions and global economic factors can impact production and delivery timelines, adding uncertainty to market growth.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Wire and Cable Market from 2023 to 2033. The U.S. and Canada are key players, with a focus on both commercial and military aviation. The growing demand for lightweight, fire-resistant, and high-performance wiring systems to meet stringent safety standards is propelling market growth. Additionally, North America is witnessing increased investments in electric and hybrid-electric aircraft, further stimulating demand for specialized wire and cable solutions. The region also benefits from a robust research and development ecosystem, fostering innovation in materials and technologies. Furthermore, the modernization and retrofitting of older aircraft, alongside the rise in air travel, continue to contribute to steady market expansion.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The demand for advanced wire and cable systems is rising due to the need for lightweight, high-performance materials and in-flight connectivity solutions. Additionally, the growing trend of regional air travel and the push towards electric and hybrid-electric aircraft are creating new opportunities in the market. With an increasing focus on safety standards and technological advancements, Asia-Pacific is poised to become a significant contributor to the global aircraft wire and cable market, supported by strong infrastructure development and government initiatives.

Segmentation Analysis

Insights by Type

The aircraft harness segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the increasing complexity of aircraft systems and the demand for more efficient wiring solutions. As aircraft become more technologically advanced, the need for sophisticated wiring harnesses that integrate various electrical systems such as navigation, communication, and power is expanding. These harnesses must meet stringent safety standards, including fire resistance, while remaining lightweight to improve fuel efficiency. The rise of electric and hybrid-electric aircraft further contributes to the demand for advanced wiring harnesses, as these systems require highly reliable, durable, and energy-efficient components. Additionally, the trend of aircraft modernization and retrofitting older models with updated wiring systems is boosting growth in this segment. As a result, the aircraft harness segment is expected to continue its strong growth trajectory in the coming years.

Insights by Fit

The line fit segment accounted for the largest market share over the forecast period 2023 to 2033. Line fit refers to the installation of wiring and cable systems during the manufacturing process of new aircraft, which is critical for ensuring all electrical and communication systems are properly integrated. As air traffic and airline fleets continue to grow, OEMs are under pressure to meet delivery schedules, contributing to the rise in line fit installations. Additionally, the demand for more advanced technologies in avionics, in-flight entertainment, and connectivity systems has led to a greater need for high-performance, lightweight, and fire-resistant wire and cable solutions in new aircraft. This trend is expected to fuel continued growth in the line fit segment as aircraft manufacturers prioritize the integration of state-of-the-art wiring systems.

Insights by Aircraft Type

The civil aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. As airlines invest in new aircraft and upgrade existing fleets, the need for advanced wire and cable systems to support complex electrical, communication, and navigation systems is growing. The shift towards more fuel-efficient, lightweight, and durable materials to meet stringent safety standards is also contributing to the market's expansion. Additionally, the rise of in-flight entertainment, connectivity solutions, and automation technologies is driving the demand for higher-performance wiring solutions in civil aircraft. Furthermore, the growing trend of electric and hybrid-electric commercial aircraft is creating opportunities for specialized wiring systems. As a result, the civil aircraft segment is expected to continue its strong growth, supporting the overall expansion of the aircraft wire and cable market.

Insights by Application

The flight control system segment accounted for the largest market share over the forecast period 2023 to 2033. As modern aircraft become more automated and reliant on electronic flight control systems (EFCS), the demand for high-quality, reliable wire and cable systems to support these controls is rising. Flight control systems, which manage critical functions such as steering, thrust, and altitude adjustments, require highly durable and precise wiring to ensure smooth operation. The increasing shift toward fly-by-wire technology, where electronic signals replace traditional mechanical linkages, is further propelling growth in this segment. Additionally, with the growing focus on aircraft safety, the need for fire-resistant and robust wiring solutions is essential to meet regulatory standards. This makes the flight control system segment a key driver of the overall aircraft wire and cable market expansion.

Recent Market Developments

- In November 2021, Collins Aerospace, a division of Raytheon Technologies, has announced the acquisition of Dutch Thermoplastic Components (DTC), a leading developer and manufacturer of structural thermoplastic composite parts. This acquisition will enable Collins to enhance the use of advanced thermoplastics, contributing to the creation of lighter and more fuel-efficient aircraft.

Competitive Landscape

Major players in the market

- Amphenol Corporation (US)

- AMETEK, Inc. (US)

- Arrow Electronics, Inc. (US)

- Carlisle Companies Inc. (US)

- Leviton Manufacturing Co., Inc. (US)

- The Angelus Corporation (US)

- Radiall (France)

- Collins Aerospace (US)

- TE Connectivity (Switzerland)

- W.L.Gore & Associates, Inc. (US)

- NEXANS (France)

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Wire and Cable Market, Type Analysis

- Aircraft Wire

- Aircraft Cable

- Aircraft Harness

Aircraft Wire and Cable Market, Fit Analysis

- Line-Fit

- Retrofit

Aircraft Wire and Cable Market, Application Analysis

- Lighting

- Flight Control System

- Power Transfer

- Data Transfer

- Avionics

- Others

Aircraft Wire and Cable Market, Aircraft Type Analysis

- Military Aircraft

- Civil Aircraft

Aircraft Wire and Cable Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aircraft Wire and Cable Market?The global Aircraft Wire and Cable Market is expected to grow from USD 2.9 billion in 2023 to USD 3.7 billion by 2033, at a CAGR of 2.47% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aircraft Wire and Cable Market?Some of the key market players of the market are the Amphenol Corporation (US), AMETEK, Inc. (US), Arrow Electronics, Inc. (US), Carlisle Companies Inc. (US), Leviton Manufacturing Co., Inc. (US), The Angelus Corporation (US), Radiall (France), Collins Aerospace (US), TE Connectivity (Switzerland), W.L.Gore & Associates, Inc. (US), NEXANS (France)

-

3. Which segment holds the largest market share?The civil aircraft segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?