Global Airline Industry Sports Sponsorship Market Size, Share, and COVID-19 Impact Analysis, By Sports (Soccer, Motor Racing, Basketball, Multi-Sport Games, Baseball, American Football, Golf, Tennis, Ice Hockey and Cricket), By Product (Team, Federation, Venue, Athlete, Series and Event), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Airline Industry Sports Sponsorship Market Insights Forecasts to 2033

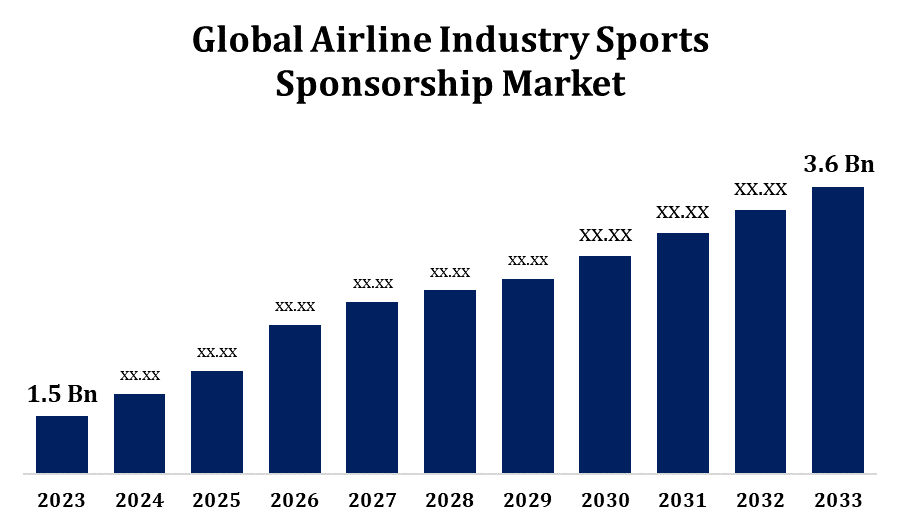

- The Global Airline Industry Sports Sponsorship Market was valued at USD 1.5 Billion in 2023.

- The Market is Growing at a CAGR of 9.15% from 2023 to 2033

- The Worldwide Airline Industry Sports Sponsorship Market is expected to reach USD 3.6 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Airline Industry Sports Sponsorship Market Size is Expected to reach USD 3.6 Billion by 2033, at a CAGR of 9.15% during the forecast period 2023 to 2033.

The airline industry actively engages in sports sponsorships, leveraging the global appeal of sports to enhance brand visibility and customer engagement. Airlines sponsor major sports events, teams, and athletes, capitalizing on the extensive media coverage and fanbase. This strategy fosters brand loyalty and expands market reach, particularly in international markets. Sponsorships range from football and basketball to tennis and golf, with airlines like Emirates, Qatar Airways, and Turkish Airlines leading the way. The partnerships often include naming rights, exclusive travel deals for fans, and VIP experiences, creating a strong association between the airline and the sport. This symbiotic relationship benefits both sectors, driving significant revenue and providing airlines with a powerful platform for marketing and customer interaction.

Airline Industry Sports Sponsorship Market Value Chain Analysis

The airline industry sports sponsorship market value chain comprises several key components that collaboratively enhance brand presence and consumer engagement. It begins with airlines identifying suitable sports properties, such as teams, events, or athletes, aligning with their brand values and target demographics. Next, sponsorship agreements are negotiated, involving financial investments, branding rights, and promotional activities. Sports organizations then activate these partnerships through marketing campaigns, media exposure, and event promotions, amplifying the airline's visibility. Concurrently, airlines leverage these sponsorships to offer exclusive travel packages, VIP experiences, and loyalty program incentives, enriching customer engagement. The value chain culminates in performance measurement, where both parties assess brand impact, return on investment, and audience reach, ensuring mutually beneficial and sustainable partnerships.

Airline Industry Sports Sponsorship Market Opportunity Analysis

Airlines can capitalize on the expansive fan bases of major sports like football, basketball, and tennis to enhance brand visibility and loyalty. Emerging markets, particularly in Asia and Africa, offer untapped potential due to rising sports viewership and travel activities. Technological advancements in digital media and streaming platforms allow airlines to engage with global audiences more effectively, providing targeted marketing and personalized offers. Moreover, sustainability-focused sponsorships can align with growing consumer preferences for environmentally conscious brands, enhancing corporate reputation. By strategically partnering with sports entities, airlines can not only boost their market presence but also foster deeper connections with diverse customer segments, driving long-term growth.

Global Airline Industry Sports Sponsorship Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.15% |

| 2033 Value Projection: | USD 3.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Sports, By Product, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Emirates Palace, Qatar Airways, Delta Airlines, United Airlines, NetJets, Turkish Airlines, Etihad Airways, Allegiant Airlines, Japan Airlines, Alaska Airlines, and other key vendors. |

| Growth Drivers: | Increasing reach and exposure that sports sponsorships |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Airline Industry Sports Sponsorship Market Dynamics

Increasing reach and exposure that sports sponsorships

Sports sponsorships significantly contribute to growth in the airline industry by expanding reach and exposure. These partnerships offer airlines a platform to connect with vast, diverse audiences, transcending geographical boundaries. Sponsoring high-profile sports events and teams ensures extensive media coverage, bolstering brand visibility on a global scale. Airlines benefit from associating with the positive attributes of sports, such as teamwork and excellence, enhancing their brand image. Engaging fans through exclusive travel packages, loyalty programs, and VIP experiences fosters customer loyalty and drives revenue. Additionally, digital and social media campaigns linked to sports sponsorships provide targeted marketing opportunities, reaching younger, tech-savvy demographics. This synergy between airlines and sports entities not only boosts market presence but also stimulates growth through increased customer engagement and brand differentiation.

Restraints & Challenges

High costs associated with major sponsorship deals can strain budgets, especially for smaller airlines. Measuring the return on investment (ROI) and determining the direct impact of sponsorships on sales and brand loyalty can be complex. The fluctuating nature of sports performance and potential scandals can unpredictably affect brand associations. Additionally, intense competition among airlines for prime sponsorship opportunities increases costs and reduces availability. Market saturation, with many brands vying for consumer attention, makes standing out difficult. Regulatory and geopolitical factors, such as travel restrictions and international tensions, can also impact the effectiveness of global sponsorships. Finally, the growing emphasis on sustainability requires airlines to balance sponsorship investments with environmentally responsible practices, complicating sponsorship strategies.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Airline Industry Sports Sponsorship Market from 2023 to 2033. Major airlines are capitalising on extensive media coverage and fan engagement. These partnerships enhance brand visibility and loyalty, offering exclusive travel packages and VIP experiences to fans. The growing popularity of sports like soccer and eSports further broadens sponsorship opportunities. However, high costs and intense competition pose challenges. Technological advancements enable targeted digital campaigns, amplifying reach. The focus on sustainability encourages airlines to align sponsorships with eco-friendly initiatives, catering to environmentally conscious consumers and ensuring long-term relevance in the dynamic North American market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Major airlines like Singapore Airlines, Cathay Pacific, and Qantas are increasingly investing in sponsorships of popular sports such as cricket, football, and rugby. These partnerships boost brand recognition and foster customer loyalty, leveraging the massive viewership of regional and international events. The rise of digital platforms and social media enhances engagement with younger audiences. However, challenges include high sponsorship costs and the need to navigate diverse cultural preferences across countries. Emphasizing sustainability, airlines align sponsorships with green initiatives, appealing to eco-conscious consumers. The market's growth potential is substantial, with emerging sports like eSports providing new avenues for impactful sponsorship opportunities.

Segmentation Analysis

Insights by Sports

The soccer segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines like Emirates, Qatar Airways, and Turkish Airlines have secured high-profile partnerships with major clubs, leagues, and tournaments, such as the FIFA World Cup and UEFA Champions League. These sponsorships offer airlines unparalleled exposure, associating their brands with the excitement and prestige of top-tier soccer. The sport's broad appeal across different demographics and regions allows airlines to reach diverse markets effectively. Moreover, soccer sponsorships facilitate unique marketing opportunities, including exclusive travel packages, matchday experiences, and digital campaigns targeting millions of fans worldwide. This strategic alignment not only enhances brand visibility and loyalty but also drives international market expansion and revenue growth.

Insights by Product

The team segment accounted for the largest market share over the forecast period 2023 to 2033. Top airlines sponsor elite teams in various sports, including soccer, basketball, and rugby, gaining extensive brand exposure. These collaborations involve branding on team kits, stadiums, and exclusive travel deals for fans, enhancing visibility and customer engagement. Sponsoring successful teams associates airlines with high performance and prestige, fostering brand loyalty. The rise of social media and digital platforms amplifies the reach of these sponsorships, targeting global fanbases.

Recent Market Developments

- In June 2023, Delta Air Lines acquired travel technology startup Fly.com in order to gain access to Fly.com's wide network of sports partnerships, which included agreements with the NFL, MLB, and NBA.

Competitive Landscape

Major players in the market

- Emirates Palace

- Qatar Airways

- Delta Airlines

- United Airlines

- NetJets

- Turkish Airlines

- Etihad Airways

- Allegiant Airlines

- Japan Airlines

- Alaska Airlines

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Airline Industry Sports Sponsorship Market, Sports Analysis

- Soccer

- Motor Racing

- Basketball

- Multi-Sport Games

- Baseball

- American Football

- Golf

- Tennis

- Ice Hockey

- Cricket

Airline Industry Sports Sponsorship Market, Product Analysis

- Team

- Federation

- Venue

- Athlete

- Series

- Event

Airline Industry Sports Sponsorship Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Airline Industry Sports Sponsorship?The global Airline Industry Sports Sponsorship Market is expected to grow from USD 1.5 billion in 2023 to USD 3.6 billion by 2033, at a CAGR of 9.15% during the forecast period 2023-2033.

-

2. Who are the key market players of the Airline Industry Sports Sponsorship Market?Some of the key market players of the market are Emirates Palace, Qatar Airways, Delta Airlines, United Airlines, NetJets, Turkish Airlines, Etihad Airways, Allegiant Airlines, Japan Airlines, Alaska Airlines.

-

3. Which segment holds the largest market share?The soccer segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Airline Industry Sports Sponsorship market?North America dominates the Airline Industry Sports Sponsorship market and has the highest market share.

Need help to buy this report?