Global Airline Reservation System Software Market Size, Share, and COVID-19 Impact Analysis, By Deployment Type (On-Premise, Cloud-Based), By System Type (Passenger Service System, Airliner Inventory System, Departue Control System), By End-users(Full Service Carriers, Low Cost Carriers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Airline Reservation System Software Market Insights Forecasts to 2033

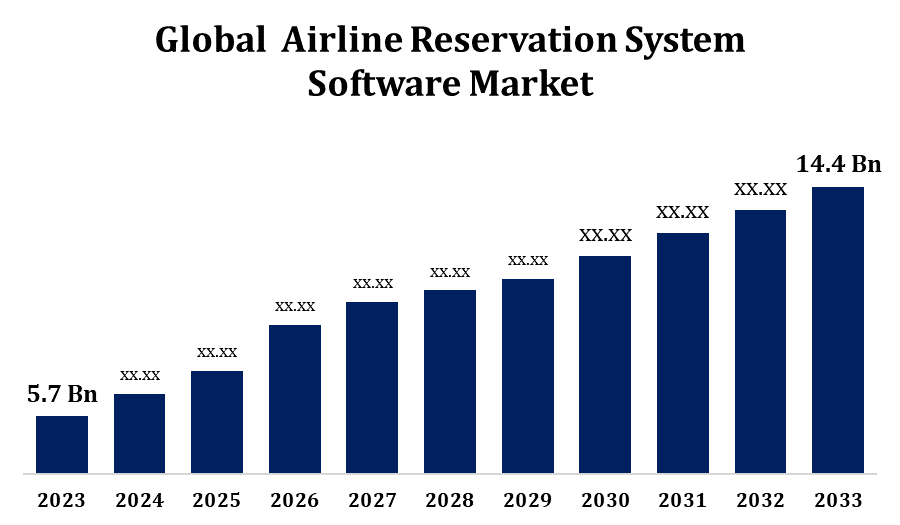

- The Airline Reservation System Software Market Size was valued at USD 5.7 Billion in 2023.

- The Market Size is Growing at a CAGR of 9.71% from 2023 to 2033

- The Worldwide Airline Reservation System Software Market Sze is Expected to reach USD 14.4 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Airline Reservation System Software Market Size is Expected to reach USD 14.4 Billion by 2033, at a CAGR of 9.71% during the forecast period 2023 to 2033.

The Airline Reservation System Software market is rapidly evolving, driven by increasing demand for efficient passenger service, real-time data management, and streamlined booking processes. This market encompasses software solutions that manage flight bookings, inventory, schedules, and customer data for airlines, travel agencies, and passengers. The rise in global air travel, adoption of cloud-based solutions, and integration with advanced technologies like AI and big data analytics are key factors propelling growth. Key players are focusing on enhancing user experience and operational efficiency through mobile-friendly platforms and personalized services. North America and Europe currently lead the market, but emerging markets in Asia-Pacific are witnessing significant growth due to rising disposable incomes and expanding airline networks. Competition remains intense, driving continuous innovation.

Airline Reservation System Software Market Value Chain Analysis

The value chain of the Airline Reservation System Software market involves several critical components that ensure efficient airline operations and enhanced customer experience. It begins with software developers and solution providers who design and build the reservation systems, incorporating booking engines, inventory management, and passenger data handling. These systems are integrated with Global Distribution Systems (GDS), which connect airlines to travel agencies and online platforms, facilitating bookings worldwide. Airlines leverage these systems to manage flight schedules, pricing, and customer interactions. Downstream, travel agencies, and online travel portals utilize these systems to offer comprehensive booking services to end customers. Continuous feedback from airlines, agencies, and passengers fuels innovation and improvement, enhancing system functionality and user experience, while partnerships and collaborations further strengthen the market's ecosystem.

Airline Reservation System Software Market Opportunity Analysis

The Airline Reservation System Software market offers significant growth opportunities driven by the increasing digital transformation in the aviation industry. As airlines seek to optimize operations and improve customer service, there is a strong demand for advanced, cloud-based reservation solutions with features like real-time inventory updates, dynamic pricing, and personalized customer experiences. The growing adoption of mobile platforms and the rise of direct booking channels present opportunities for software providers to offer mobile-friendly, seamless solutions. Emerging markets in Asia-Pacific, the Middle East, and Africa, with expanding air traffic and low-cost carriers, provide fertile ground for new deployments. Additionally, the integration of AI, machine learning, and big data analytics presents opportunities to enhance predictive analytics, revenue management, and customer relationship management, driving market innovation and growth.

Global Airline Reservation System Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.71% |

| 2033 Value Projection: | USD 14.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 197 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Deployment Type, By System Type, By End-users, By Region |

| Companies covered:: | Priceline, Navitaire, Farelogix, Hopper, OpenJaw Technologies, Ramco Systems, Travelport Worldwide, Datalex, Sabre, Radixx International, SITA, Mercator, Amadeus IT Group, Travelfusion, CarTrawler and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Airline Reservation System Software Market Dynamics

Growing Demand for Air Travel to Propel the Market Growth

The growing global demand for air travel is a key driver of growth in the Airline Reservation System Software market. As more people travel for business and leisure, airlines require advanced software solutions to manage increased passenger volumes, complex schedules, and dynamic pricing efficiently. The surge in low-cost carriers and expanding route networks, especially in emerging markets like Asia-Pacific, the Middle East, and Africa, further fuels demand for robust reservation systems. These systems enable airlines to optimize booking processes, manage inventory, and enhance the passenger experience through real-time updates and personalized services. Additionally, the rise of mobile bookings and online travel platforms calls for software that integrates seamlessly across channels, providing opportunities for vendors to innovate and cater to the evolving needs of both airlines and travelers.

Restraints & Challenges

The Airline Reservation System Software market faces several challenges that could impact its growth. Data security and privacy concerns are paramount, as these systems handle vast amounts of sensitive passenger information, making them targets for cyberattacks. Integration complexities also pose a challenge, as software must seamlessly connect with legacy systems, Global Distribution Systems (GDS), and various third-party applications, which can be costly and time-consuming. Additionally, the market is highly competitive, with numerous players vying for airline partnerships, often leading to price pressures and reduced margins. Compliance with ever-evolving aviation regulations and standards adds another layer of complexity. Moreover, fluctuating airline revenues due to economic downturns, geopolitical tensions, or pandemics can lead to reduced IT budgets, slowing the adoption of new reservation systems and technologies.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Airline Reservation System Software Market from 2023 to 2033. Major airlines in the U.S. and Canada invest heavily in advanced reservation systems to enhance operational efficiency, improve passenger experience, and optimize revenue management. The region’s robust technological infrastructure and widespread adoption of cloud-based solutions facilitate seamless integration of these systems with Global Distribution Systems (GDS) and third-party platforms. Additionally, the presence of leading software providers and ongoing innovations in AI, machine learning, and data analytics contribute to market growth. However, the market faces challenges like stringent regulatory requirements and cybersecurity threats. Despite these, North America remains a key market, with continued demand for next-generation, mobile-friendly reservation solutions.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Emerging nations are experiencing a surge in passenger traffic, prompting airlines to invest in advanced reservation systems to manage dynamic pricing, inventory, and customer engagement. The growing adoption of digital technologies and mobile platforms across the region supports the shift towards cloud-based, integrated software solutions. However, the market faces challenges like integration with diverse legacy systems and varying regulatory frameworks across countries. Despite these, the region presents vast opportunities for software providers, particularly in enhancing mobile compatibility, personalization, and localization to cater to the unique needs of the diverse and expanding customer base.

Segmentation Analysis

Insights by Deployment Type

The on-premise segment accounted for the largest market share over the forecast period 2023 to 2033. Large carriers, particularly those with extensive operations, prefer on-premise solutions as they provide greater flexibility in tailoring the software to specific business needs and integrating it with legacy systems and proprietary tools. On-premise deployments offer increased data protection, an essential factor for airlines dealing with sensitive customer information and compliance with stringent regulatory standards. Although cloud-based solutions are gaining traction, the on-premise segment continues to appeal to airlines in regions where internet infrastructure is less reliable or where data sovereignty laws mandate local data storage. This segment’s growth is underpinned by continued investment in IT infrastructure and security enhancements by major airlines.

Insights by System Type

The passenger service system segment accounted for the largest market share over the forecast period 2023 to 2033. PSS integrates core functions like reservations, inventory management, check-in, and departure control, providing a seamless end-to-end service for both airlines and passengers. The growing emphasis on personalized travel experiences, real-time updates, and streamlined services is prompting airlines to adopt advanced PSS solutions that leverage AI, big data, and analytics. Additionally, the rise of low-cost carriers and increased competition are encouraging airlines to innovate in their service offerings through PSS platforms. Cloud-based and mobile-friendly PSS solutions are becoming more popular, supporting scalability, agility, and improved customer engagement across various digital touchpoints.

Insights by End Users

The low cost carriers segment accounted for the largest market share over the forecast period 2023 to 2033. LCCs focus on maximizing seat occupancy, dynamic pricing, and efficient route management, necessitating advanced reservation systems that support real-time data processing and integration with various sales channels. As LCCs continue to increase their share in global air travel, particularly in emerging markets like Asia-Pacific and Latin America, they are investing in flexible, cloud-based reservation software to reduce operational costs and enhance customer service. The demand for mobile-friendly and user-centric systems is also rising, enabling LCCs to offer seamless booking experiences and personalized services, further accelerating the segment’s growth within the broader software market.

Recent Market Developments

- In November 2021, Sabre Air Price IQ and Sabre Ancillary IQ, the first two products in the company's Retail Intelligence suite, are designed to dynamically price airfare and ancillaries, respectively. Sabre Corporation is the leading software and technology corporation that powers the international travel industry, including airline reservation software.

Competitive Landscape

Major players in the market

- Priceline

- Navitaire

- Farelogix

- Hopper

- OpenJaw Technologies

- Ramco Systems

- Travelport Worldwide

- Datalex

- Sabre

- Radixx International

- SITA

- Mercator

- Amadeus IT Group

- Travelfusion

- CarTrawler

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Airline Reservation System Software Market, Deployment Type Analysis

- On-Premise

- Cloud-Based

Airline Reservation System Software Market, System Type Analysis

- Passenger Service System

- Airliner Inventory System

- Departue Control System

Airline Reservation System Software Market, End Users Analysis

- Full Service Carriers

- Low Cost Carriers

Airline Reservation System Software Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Airline Reservation System Software Market?The global Airline Reservation System Software Market is expected to grow from USD 5.7 billion in 2023 to USD 14.4 billion by 2033, at a CAGR of 9.71% during the forecast period 2023-2033.

-

2. Who are the key market players of the Airline Reservation System Software Market?Some of the key market players of the market are Priceline, Navitaire, Farelogix, Hopper, OpenJaw Technologies, Ramco Systems, Travelport Worldwide, Datalex, Sabre, Radixx International, SITA, Mercator, Amadeus IT Group, Travelfusion, CarTrawler.

-

3. Which segment holds the largest market share?The low cost carriers segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Airline Reservation System Software Market?North America dominates the Airline Reservation System Software Market and has the highest market share.

Need help to buy this report?