Global Airline Route Profitability Software Market Size, Share, and COVID-19 Impact Analysis, By Software (Fares Management and Pricing, Planning and Scheduling, Revenue Management), By End User (Domestic Airlines, International Airlines, Business Charters), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Airline Route Profitability Software Market Insights Forecasts to 2033

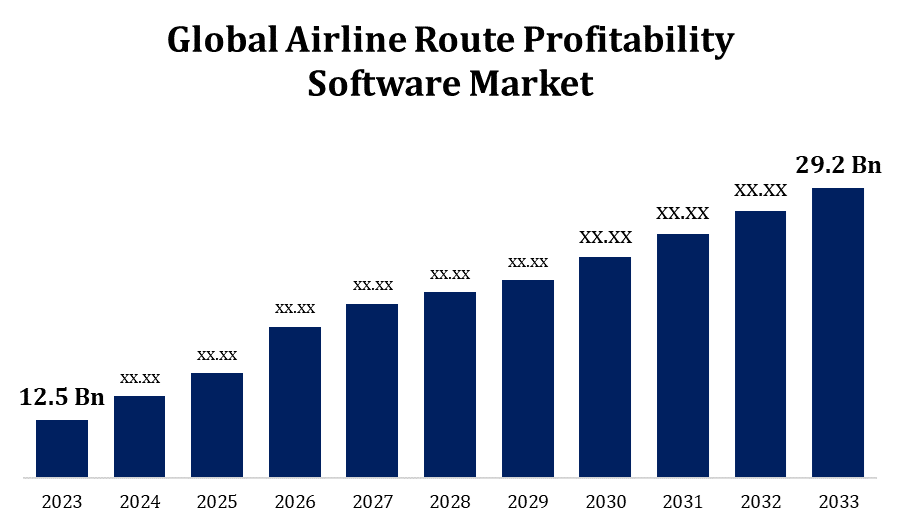

- The Airline Route Profitability Software Market Size was valued at USD 12.5 Billion in 2023.

- The Market Size is Growing at a CAGR of 8.85% from 2023 to 2033

- The Worldwide Market Size is Expected to reach USD 29.2 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Airline Route Profitability Software Market Size is Expected to reach USD 29.2 billion by 2033, at a CAGR of 8.85% during the forecast period 2023 to 2033.

The Airline Route Profitability Software market is growing rapidly, driven by airlines' need to optimize routes for profitability amid fluctuating fuel costs, demand variability, and competitive pressures. These software solutions provide comprehensive analysis by integrating various data points, such as passenger load factors, revenue per seat, and operational costs, enabling airlines to make data-driven decisions. The market is witnessing advancements in AI and machine learning, enhancing the accuracy of profitability forecasts. Additionally, cloud-based solutions are gaining traction due to their scalability and real-time analytics capabilities. Major players in this market are focusing on partnerships and acquisitions to strengthen their offerings. With increasing emphasis on cost management and efficiency, the market is poised for significant expansion, particularly in emerging regions where air travel demand is surging.

Airline Route Profitability Software Market Value Chain Analysis

The Airline Route Profitability Software market value chain involves several key components. It starts with data collection and integration, where airlines gather and centralize information on routes, passenger loads, and operational costs. This data is then processed by software providers using advanced analytics and algorithms to generate profitability insights. The analysis informs strategic decisions on route optimization and operational adjustments. The next stage involves implementation and support, where software solutions are integrated into airlines' existing systems and continuously updated. Finally, feedback from users is collected to refine and enhance the software. Key players in this value chain include data providers, software developers, integration service providers, and end-users, all contributing to the effective management and optimization of airline routes.

Airline Route Profitability Software Market Opportunity Analysis

The Airline Route Profitability Software market presents substantial opportunities driven by several factors. Increasing global air travel and competition compel airlines to seek efficiency improvements and cost reductions, creating demand for sophisticated profitability analysis tools. Emerging technologies, such as AI and machine learning, offer enhanced predictive capabilities and real-time insights, providing a competitive edge. Additionally, the rise of low-cost carriers and expanding routes in developing regions present new growth avenues. Cloud-based solutions offer scalability and flexibility, appealing to a broad range of airline sizes and types. Strategic partnerships and acquisitions by software providers can further accelerate market growth. With airlines focusing on data-driven decision-making and operational efficiency, the market is poised for significant expansion and innovation.

Global Airline Route Profitability Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 12.5 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 8.85% |

| 2033 Value Projection: | USD 29.2 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 267 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Software, By End User, By Region |

| Companies covered:: | Amadeus IT Group SA, GrandTrust Infotech (GTI) (P) Ltd., IBM, Lufthansa Systems, Maureva Ltd., Sabre Corporation, Seabury Solutions, SITA, Wipro Limited, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Market Dynamics

Airline Route Profitability Software Market Dynamics

Increasing air traffic globally to propel the market growth

The global increase in air traffic is a key driver propelling the growth of the Airline Route Profitability Software market. As more passengers take to the skies, airlines are under pressure to optimize their routes for maximum efficiency and profitability. This surge in air traffic intensifies competition, making it essential for airlines to leverage advanced software that offers real-time data analysis, predictive analytics, and cost management tools. By optimizing routes, adjusting capacity, and fine-tuning pricing strategies, these software solutions help airlines capitalize on the growing demand. Additionally, the rise of new routes, especially in emerging markets, further boosts the need for sophisticated profitability analysis. This trend underscores the critical role of innovative technology in sustaining and enhancing airline profitability in a rapidly expanding global market.

Restraints & Challenges

The Airline Route Profitability Software market faces notable challenges, including high implementation costs and the complexity of integrating advanced software into existing airline systems. Smaller airlines or those with tight budgets may struggle with these upfront investments. Data accuracy and consistency across multiple sources is crucial, yet difficult to maintain, potentially leading to flawed profitability analyses. Additionally, the fast-paced evolution of technology requires ongoing updates, which can be resource-intensive and disruptive. The need for specialized expertise to effectively utilize these tools poses another barrier, limiting their accessibility. Cybersecurity risks also present significant concerns, as sensitive operational and financial data must be protected from breaches. Furthermore, differing regulatory standards across regions add layers of complexity, making global implementation and compliance challenging for airlines.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Airline Route Profitability Software Market from 2023 to 2033. The United States military's emphasis on preserving air superiority and modernising its arsenal is driving demand for advanced weapon systems such as precision-guided munitions, stealth technology, and hypersonic missiles. Lockheed Martin, Raytheon Technologies, and Northrop Grumman are among the region's largest defence contractors, which play critical roles in designing and providing cutting-edge aircraft weaponry. Furthermore, ongoing research and development activities, backed by major government financing, are driving sector innovation. The presence of a solid testing and integration infrastructure boosts North America's market position. Canadian defence initiatives also contribute, albeit on a smaller scale.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Emerging economies and increasing disposable incomes are contributing to higher passenger volumes, prompting airlines to seek advanced tools for route optimization and profitability analysis. The adoption of AI, machine learning, and cloud-based solutions is on the rise, offering enhanced predictive capabilities and real-time data insights. However, challenges such as varying levels of technological maturity, regulatory differences, and infrastructure disparities exist. Despite these hurdles, the market is bolstered by increasing investments in technology and infrastructure, strategic partnerships, and a focus on efficiency. The region's dynamic growth presents significant opportunities for software providers and airlines alike.

Segmentation Analysis

Insights by Software

The planning and scheduling segment accounted for the largest market share over the forecast period 2023 to 2033. This segment enables airlines to efficiently allocate resources, manage routes, and adjust schedules based on real-time data and predictive analytics. The adoption of advanced technologies like AI and machine learning in planning and scheduling software allows for more accurate forecasting and scenario analysis, improving decision-making. Additionally, the shift toward cloud-based solutions offers greater flexibility and scalability, meeting the needs of airlines of all sizes. As airlines prioritize operational efficiency and profitability, the demand for robust planning and scheduling tools is expected to continue rising, fueling this segment's growth.

Insights by End User

The international airlines segment accounted for the largest market share over the forecast period 2023 to 2033. With expanding global networks and fluctuating international demand, these airlines require sophisticated software to optimize route profitability, manage costs, and enhance operational efficiency. The integration of AI, machine learning, and big data analytics enables precise forecasting and dynamic adjustments, essential for handling diverse market conditions and regulatory requirements. Cloud-based solutions are particularly attractive for international airlines, offering scalability and seamless access across multiple regions. As international travel demand rebounds and competition intensifies, this segment's growth is expected to accelerate, with airlines investing heavily in cutting-edge profitability software to maintain a competitive edge in the global market.

Recent Market Developments

- In January 2023, India has declared intentions to spend $552 million on air defence and naval weapons.

Competitive Landscape

Major players in the market

- Amadeus IT Group SA

- GrandTrust Infotech (GTI) (P) Ltd.

- IBM

- Lufthansa Systems

- Maureva Ltd.

- Sabre Corporation

- Seabury Solutions

- SITA

- Wipro Limited

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Airline Route Profitability Software Market, Software Analysis

- Fares Management and Pricing

- Planning and Scheduling

- Revenue Management

Airline Route Profitability Software Market, End User Analysis

- Domestic Airlines

- International Airlines

- Business Charters

Airline Route Profitability Software Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Airline Route Profitability Software Market?The global Airline Route Profitability Software Market is expected to grow from USD 12.5 billion in 2023 to USD 29.2 billion by 2033, at a CAGR of 8.85% during the forecast period 2023-2033.

-

2.Who are the key market players of the Airline Route Profitability Software Market?Some of the key market players of the market are Amadeus IT Group SA, GrandTrust Infotech (GTI) (P) Ltd., IBM, Lufthansa Systems, Maureva Ltd., Sabre Corporation, Seabury Solutions, SITA, and Wipro Limited.

-

3.Which segment holds the largest market share?The international airlines segment holds the largest market share and is going to continue its dominance.

-

4.Which region dominates the Airline Route Profitability Software Market?North America dominates the Airline Route Profitability Software Market and has the highest market share.

Need help to buy this report?