Global Airline Technology Integration Market Size, Share, and COVID-19 Impact Analysis, By Technology (Internet of Things {IoT}, Cybersecurity, Artificial Intelligence, Advance Analytics, Biometrics, Blockchain, Wearable Technology), By Offering (Software and Hardware), By Deployment (On-Premises and Cloud), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Aerospace & DefenseGlobal Airline Technology Integration Market Insights Forecasts to 2032

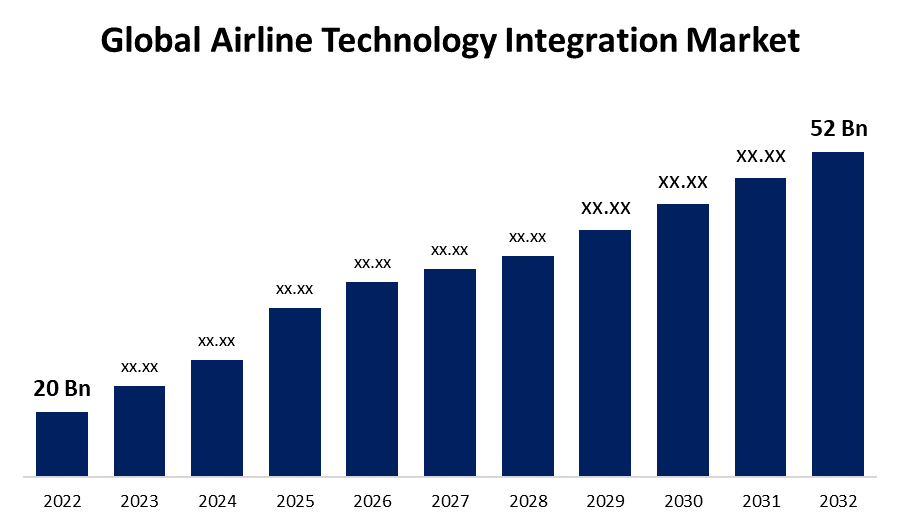

- The Global Airline Technology Integration Market Size was valued at USD 20 Billion in 2022.

- The Market is growing at a CAGR of 10.03% from 2022 to 2032.

- The Worldwide Airline Technology Integration Market size is expected to reach USD 52 Billion by 2032.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Airline Technology Integration Market Size is expected to reach USD 52 Billion by 2032, at a CAGR of 10.03% during the forecast period 2022 to 2032.

Market Overview

The process of integrating multiple technologies and systems used in the aviation sector to increase operational efficiency, improve customer experience, and optimize overall airline operations is referred to as airline technology integration. It entails integrating software, hardware, and data systems to allow for seamless communication, coordination, and automation across many airline services including reservations, ticketing, check-in, boarding, baggage handling, flight operations, and maintenance. Airlines technology integration refers to the process of integrating numerous technologies and systems used in the aviation industry to boost operational efficiency, improve customer experience, and optimize overall airline operations. It requires integrating software, hardware, and data systems to provide seamless communication, coordination, and automation across a wide range of airline services such as reservations, ticketing, check-in, boarding, baggage handling, aircraft operations, and maintenance.

Report Coverage

This research report categorizes the global airline technology integration market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global airline technology integration market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global airline technology integration market. Technological innovation and advancement will further optimize the performance of the product, enabling it to acquire a wider range of applications in the downstream market.

Global Airline Technology Integration Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 20 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 10.03% |

| 022 – 2032 Value Projection: | USD 52 Bn |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Technology, By Offering, By Deployment, By Region. |

| Companies covered:: | Airbus, Amadeus IT Group SA, Boeing, Collins Aerospace, General Electrics, Honeywell, IBM, L3 Harris Corporation, Lufthansa Technik, Oracle, Raytheon Technologies Corporation, Sabre, Thale Group., and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rising economic growth, rising disposable incomes, changing demographics, business globalization, and more tourism are all driving up demand for air travel. The growing demand for air travel places a major strain on airline technology integration. As more people travel for business or pleasure, there is a growing demand for advanced technology solutions to enable seamless and efficient operations across various aspects of the aviation industry, such as reservations and ticketing, flight operations, passenger services, baggage handling, security, and so on. As a result, the growing demand for air travel throughout the world is driving the need for sophisticated technology solutions to manage increasing passenger numbers, maximize capacity utilization, and increase operational efficiency, consequently boosting the airline technology integration market. Also, airline technology integration is critical to meeting consumers' increased expectations for a smooth travel experience, streamlining airline operations, and improving safety and security measures. As a result, the airline technology integration industry is expanding. Artificial intelligence (AI), the Internet of Things (IoT), data analytics, biometrics, and blockchain are rapidly being incorporated into airline operations to boost efficiency, improve the customer experience, and maximize resources.

Restraining Factors

The high cost of airline technology integration is projected to limit the market's growth. Implementing and integrating new technologies in the aviation sector incurs enormous expenditures, including software development, hardware infrastructure, system integration, training, and continuing maintenance and support. This presents issues for airlines, particularly those with limited financial resources, in justifying investments in technological integration, and may delay or hinder the adoption of new technologies.

Market Segmentation

- In 2022, the Internet of Things {IoT} segment is dominating the largest market share over the forecast period.

Based on the technology, the global airline technology integration market is segmented into the Internet of Things IoT, cybersecurity, artificial intelligence, advanced analytics, biometrics, blockchain, and wearable technology. Among these segments, the IoT segment is expected to have significant development potential during the forecast period IoT technologies including linked aircraft, baggage tracking, smart airports, and predictive maintenance are gradually being incorporated into the airline sector, boosting market revenue growth. IoT sensors are being deployed in airplanes to collect data on performance, passenger preferences, and maintenance requirements. This information may be utilized to optimize flight schedules, improve maintenance operations, and improve the passenger experience.

- In 2022, the software segment is influencing the market with the largest market share during the forecast period.

Based on the offering, the global airline technology integration market is bifurcated into software and hardware. Among these segments, the software segment is dominating the market with the largest revenue share during the forecast period. Software applications include information technology, application software, and aviation systems. Many airport software companies provide off-the-shelf solutions for particular activities such as maintenance or airport operations, while others provide integrated systems comprised of modules for various functions. Such applications will expand the potential of the aviation software sector, boosting demand for airline technology integration.

- In 2022, the on-premises segment is dominating the market with the largest market share over the forecast period.

Based on deployment, the global airline technology integration market is divided into on-premises and cloud. Among these segments, the on-premises segment is dominating the market with the largest revenue share during the forecast period. On-premises airline analytics solutions and services leverage predictive and prescriptive analytics applications to improve performance while lowering costs and downtime. Because end users choose internal software infrastructure and services that provide high levels of data protection, these solutions are often placed on-premises. As a result, many major airports employ local aviation analytics rather than cloud-based technologies. On-premises aviation analytics systems are mostly employed by large airports because small airports and airline companies cannot afford them owing to their high prices.

Regional Segment Analysis of the Airline Technology Integration Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America influenced the market with the largest market share over the forecast period

Get more details on this report -

North America is influencing significant market growth over the forecast period due to this region has built robust air transportation infrastructure, and airlines and airports have been consistently spending in updating technology in recent years, therefore expanding the industry. North America was among the first to use Al-based technologies in airports and aircraft. Because of the strong demand for air travel, the area is expected to witness major expenditures in the integration of Al technology into airports and airplanes. Because of business globalization, international air travel has expanded in the United States and Canada.

Asia Pacific is expected to experience high revenue market growth during the forecast period owing to providing substantial growth possibilities for the airline technology integration market participants. Major worldwide suppliers like Sabre, Amadeus, and Travelport, as well as regional providers such as Radixx International, Intelisys Aviation Systems, and Crane PAX, have a prominent presence in Asia Pacific. Local suppliers are also developing to meet the specialized needs of the Asia Pacific region's different marketplaces.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the global airline technology integration market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Airbus

- Amadeus IT Group SA

- Boeing

- Collins Aerospace

- General Electrics

- Honeywell

- IBM

- L3 Harris Corporation

- Lufthansa Technik

- Oracle

- Raytheon Technologies Corporation

- Sabre

- Thale Group.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2023, Honeywell and Lufthansa Technik cooperated to improve the customer experience in aviation analytics by strengthening Lufthansa's digital platform, AVIATAR. As part of this initiative, Honeywell's Connected Maintenance analytics will be incorporated into AVIATAR's Predictive Health Analytics (PHA) package. This suite will include over 100 predictors for various Boeing and Airbus aircraft models, enabling more accurate predictive maintenance and increased operating efficiency.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Global Airline Technology Integration Market based on the below-mentioned segments:

Global Airline Technology Integration Market, By Technology

- IOT

- Cybersecurity

- Artificial Intelligence

- Advance Analytics

- Biometrics, Blockchain

- Wearable Technology

Global Airline Technology Integration Market, By Offering

- Software

- Hardware

Global Airline Technology Integration Market, By Deployment

- On-Premises

- Cloud

Airline Technology Integration Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?