Global Airport Baggage Handling System Market Size, Share, and COVID-19 Impact Analysis, By Type (Destination-coded Vehicle (DCV), Conveyors, Sorters, Self-bag Drop (SBD)), By Mode of Operation (Automated and Manual), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Airport Baggage Handling System Market Insights Forecasts to 2033

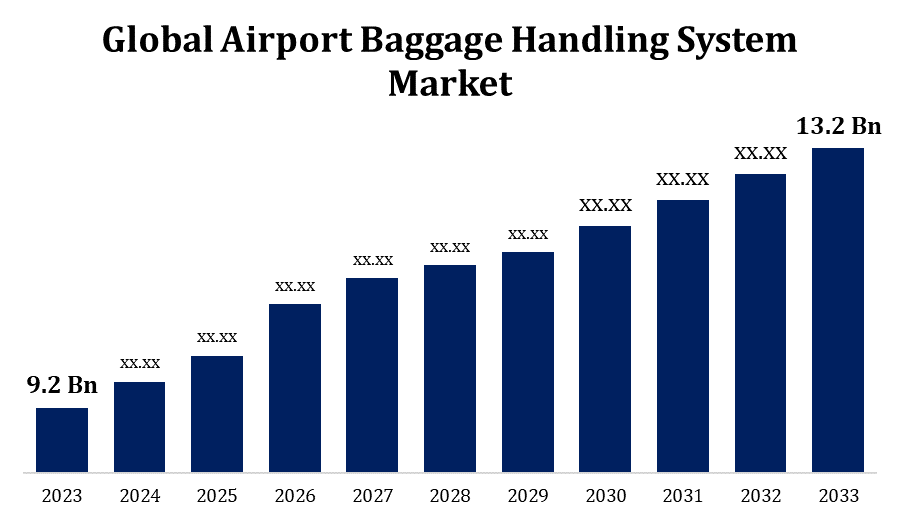

- The Global Airport Baggage Handling System Market Size was valued at USD 9.2 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.68% from 2023 to 2033

- The Worldwide Airport Baggage Handling System Market Size is expected to reach USD 13.2 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Airport Baggage Handling System Market Size is expected to reach USD 13.2 Billion by 2033, at a CAGR of 3.68% during the forecast period 2023 to 2033.

The Airport Baggage Handling System market is growing rapidly due to the increasing number of air travelers and the need for efficient airport operations. This market includes automated systems that manage the transportation, tracking, and sorting of passenger baggage from check-in to boarding. Advanced technologies like RFID, IoT, and AI are driving innovations in baggage handling, improving speed, accuracy, and security. The rise in airport modernization projects and the expansion of existing infrastructure are also fueling market growth. However, high installation and maintenance costs may pose challenges. Key players are focusing on developing integrated and scalable solutions to meet the demands of large and small airports alike, ensuring seamless baggage processing and enhancing the passenger experience.

Airport Baggage Handling System Market Value Chain Analysis

The Airport Baggage Handling System (BHS) value chain involves several key stages. It begins with design and engineering, where companies develop customized solutions to meet airport requirements. Manufacturing follows, where components such as conveyor belts, scanners, and sorters are produced. Next is integration, where these components are assembled and tested to ensure compatibility and efficiency. Installation comes next, involving the setup of systems at airports, often requiring coordination with airport operations. Maintenance and support services ensure the system operates smoothly over time, addressing any issues and performing regular updates. Finally, upgrades and innovation are critical to incorporate emerging technologies and improve system performance, thus enhancing overall efficiency and passenger satisfaction. This value chain highlights the importance of continuous improvement and adaptation in the BHS market.

Airport Baggage Handling System Market Opportunity Analysis

The Airport Baggage Handling System (BHS) market presents significant opportunities due to increasing global air travel and airport expansion. The demand for more efficient, automated systems driven by advancements in technology, such as RFID and AI, opens avenues for innovation. Opportunities exist in upgrading existing systems to enhance efficiency, accuracy, and security. Additionally, emerging markets in developing regions, where airport infrastructure is expanding rapidly, offer substantial growth potential. Investments in smart baggage handling solutions and integration with broader airport management systems are also promising. The need for enhanced passenger experiences and operational efficiency drives demand for advanced, scalable solutions, making the BHS market ripe for technological advancements and strategic investments.

Global Airport Baggage Handling System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 9.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.68% |

| 2033 Value Projection: | USD 13.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Mode of Operation, By Region |

| Companies covered:: | Beumer Group, Daifuku Co. Ltd., Fives Group, G&S Airport Conveyor, Glidepath group, Grenzebach Group, Logplan LLC, Pteris Global Limited, Siemens AG, Vanderlande Industries B.V, and other key companies. |

| Growth Drivers: | Integration of Baggage 4.0 Infrastructure to Increase Operational Demand |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Airport Baggage Handling System Market Dynamics

Integration of Baggage 4.0 Infrastructure to Increase Operational Demand

The integration of Baggage 4.0 infrastructure is poised to significantly boost operational demand in the airport baggage handling system market. Baggage 4.0 leverages advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and real-time data analytics to create a more efficient, automated baggage handling environment. This infrastructure enhances operational efficiency by streamlining baggage tracking, reducing handling errors, and minimizing delays. Airports adopting Baggage 4.0 can achieve higher throughput, better resource management, and improved passenger satisfaction. The shift towards smart baggage handling systems also aligns with broader trends in digital transformation and smart airport initiatives, driving increased demand for innovative solutions and creating substantial growth opportunities in the market.

Restraints & Challenges

High installation and maintenance costs can be a barrier, especially for smaller airports or those in developing regions. Integrating new technologies with existing infrastructure often involves complex, costly upgrades. Additionally, ensuring system reliability and minimizing downtime are critical, as baggage handling disruptions can impact passenger satisfaction and airport efficiency. Security concerns, such as protecting against theft or tampering, also pose challenges. The rapid pace of technological advancement means that systems can quickly become outdated, requiring ongoing investment in upgrades and innovation. Balancing these factors while managing operational efficiency and cost-effectiveness remains a significant challenge for stakeholders in the BHS market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Airport Baggage Handling System Market from 2023 to 2033. Major airports are investing in state-of-the-art baggage handling systems to enhance efficiency, security, and passenger satisfaction. The integration of advanced technologies such as automated sorting, RFID tracking, and AI-driven analytics is transforming baggage handling processes. The region's focus on improving infrastructure and operational efficiency supports market expansion. However, high installation costs and the need for regular maintenance present challenges. The demand for scalable, innovative solutions that can handle high passenger volumes and adapt to evolving technologies creates significant opportunities for growth in North America's BHS market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Emerging economies and rapidly expanding airports in countries like China, India, and Southeast Asian nations drive demand for advanced baggage handling solutions. The market benefits from the adoption of cutting-edge technologies such as automation, RFID, and AI to enhance efficiency, accuracy, and security. However, challenges include varying infrastructure levels across different countries and high initial costs of advanced systems. Despite these obstacles, the region’s emphasis on improving airport operations and accommodating growing passenger numbers presents substantial growth opportunities for the market.

Segmentation Analysis

Insights by Type

The conveyors segment accounted for the largest market share over the forecast period 2023 to 2033. As airports expand and modernize, there is a rising demand for advanced conveyor systems that can handle increased passenger volumes and streamline operations. Innovations in conveyor technology, including automated, high-speed, and flexible systems, contribute to improved operational efficiency, reduced labor costs, and enhanced baggage security. The shift towards integrating conveyor systems with automated sorting and tracking technologies further drives market growth. Additionally, the need for reliable, low-maintenance conveyors to minimize downtime and improve overall baggage handling processes supports the segment’s expansion in the market.

Insights by Mode of Operation

The automated segment accounted for the largest market share over the forecast period 2023 to 2033. Automated systems, including conveyor belts, sorting machines, and robotic handling units, enhance the speed and reliability of baggage processing. Innovations such as real-time tracking, AI-driven analytics, and automated sorting technologies contribute to smoother operations and reduced manual intervention. The growing focus on enhancing passenger experience and minimizing delays further drives the adoption of automated solutions. Additionally, airports are investing in automated systems to handle higher passenger volumes and improve overall efficiency, fueling the growth of this segment in the BHS market.

Recent Market Developments

- In December 2022, Siemens Logistics, in collaboration with local consortium T7 Global BHD, has acquired the Kuala Lumpur airport terminal extension project, which includes the methodical erection, design, installation, and commissioning of a new baggage handling system.

Competitive Landscape

Major players in the market

- Beumer Group

- Daifuku Co. Ltd.

- Fives Group

- G&S Airport Conveyor

- Glidepath group

- Grenzebach Group

- Logplan LLC

- Pteris Global Limited

- Siemens AG

- Vanderlande Industries B.V

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Airport Baggage Handling System Market, Type Analysis

- Destination-coded Vehicle (DCV)

- Conveyors, Sorters

- Self-bag Drop (SBD)

Airport Baggage Handling System Market, Mode of Operation Analysis

- Automated

- Manual

Airport Baggage Handling System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Airport Baggage Handling System Market?The global Airport Baggage Handling System Market is expected to grow from USD 9.2 billion in 2023 to USD 13.2 billion by 2033, at a CAGR of 3.68% during the forecast period 2023-2033.

-

2. Who are the key market players of the Airport Baggage Handling System Market?Some of the key market players of the market are Beumer Group, Daifuku Co. Ltd., Fives Group, G&S Airport Conveyor, Glidepath group, Grenzebach Group, Logplan LLC, Pteris Global Limited, Siemens AG, and Vanderlande Industries B.V.

-

3. Which segment holds the largest market share?The automated segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Airport Baggage Handling System Market?North America dominates the Airport Baggage Handling System Market and has the highest market share.

Need help to buy this report?