Global Airport Duty-free Liquor Market Size, Share, and COVID-19 Impact Analysis, By Product (Whiskey, Vodka, Rum, Gin, Wine, Cognac, and Others), By Distribution Channel (Duty-Free Shops, Airlines, and Online Retailers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Consumer GoodsGlobal Airport Duty-free Liquor Market Insights Forecasts to 2033

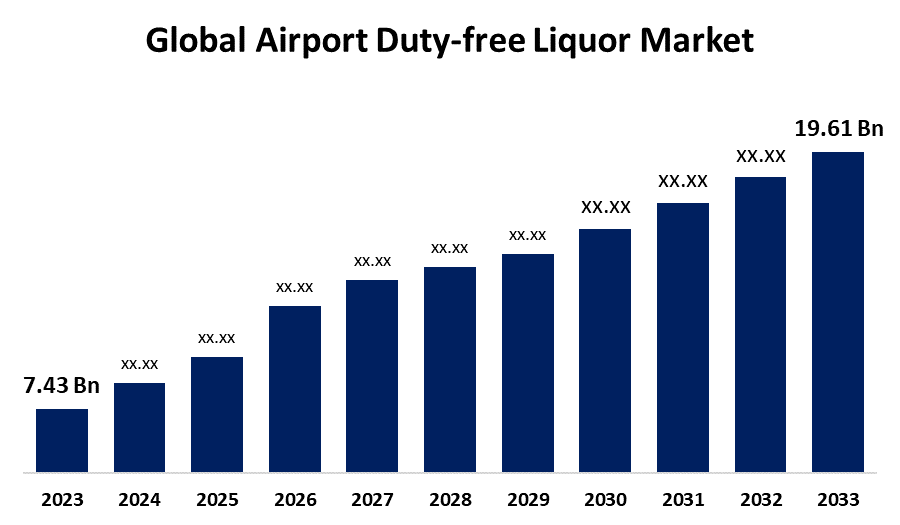

- The Global Airport Duty-free Liquor Market Size was Valued at USD 7.43 Billion in 2023

- The Market Size is Growing at a CAGR of 10.19% from 2023 to 2033

- The Worldwide Airport Duty-free Liquor Market Size is Expected to Reach USD 19.61 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Airport Duty-free Liquor Market Size is Anticipated to Exceed USD 19.61 Billion by 2033, Growing at a CAGR of 10.19% from 2023 to 2033.

Market Overview

Airport duty is the tax collected to transport a commodity across international borders. When a product is purchased in one country, tax is paid but, when the product is transported to another country, tax may be required again. Purchasing something "duty-free" indicates no taxes are paid in the country wherever the product was purchased. Airport duty-free liquor is alcohol sold at airports that are excluded from local fees, federal taxes, and charges. International airport duty-free booze retailers provide a 10% to 20% reduction on liquor bottles. At the airport, tourists who are going from one country to another can buy alcohol duty-free. The rise in the market can be ascribed to the rise in airport traffic. Passengers can purchase liquor at these venues at a lower cost because they are free from government taxes and duties. Moreover, before leaving for their home countries, travelers frequently choose to use any spare foreign currency to purchase booze from duty-free stores. It is projected that these variables will have a major impact on market growth in the upcoming years. Rapid urbanization, the rise of the travel and tourism industry, increasing financial resources, and rising alcohol demand and consumption are some of the factors propelling the growth of the duty-free liquor market. Furthermore, government rules have a significant impact on the way the market develops. Duty-free stores are governed by various national regulations. For example, up to two liters or two bottles of alcohol may be purchased by foreign visitors to India, according to official regulations.

Report Coverage

This research report categorizes the market for the airport duty-free liquor market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the airport duty-free liquor market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the airport duty-free liquor market.

Global Airport Duty-free Liquor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.43 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.19% |

| 2033 Value Projection: | USD 7.43 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 223 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Distribution Channel, By Region |

| Companies covered:: | Heineken N.V., Diageo plc, Pernod Ricard, REMY COINTREAU, Constellation Brands, Inc., The Brown-Forman Corporation, Rémy Cointreau, Accolade Wines, Edrington, Glen Moray, King Power Group, Brown-Forman, William Grant & Sons Ltd, Bacardi Limited, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The airport duty-free liquor market is driven by several factors including one of the main forces driving the industry's growth is consumer demand for pleasant beers that facilitate digestion. Furthermore, the growing demand for artisanal spirits in developing nations such as China and India is anticipated to support market expansion. The growth of the global middle class and the continued increase in international air travel are the main factors driving the airport duty-free liquor market. These groups have disposable income and travel for leisure purposes. The chance to obtain duty-free liquor rises as more individuals leave abroad for both business and pleasure.

Restraining Factors

One of the main obstacles in the market is the constantly shifting regulatory environment that controls duty-free sales and the importation of alcohol into various nations. Consumer purchasing behavior can be strongly impacted by stricter laws governing the purchase of alcohol, including restrictions on the amounts and values that can be imported into a nation tax-free.

Market Segmentation

The airport duty-free liquor market share is classified into product and distribution channel.

- The whiskey segment dominates the market with the highest market share through the forecast period.

Based on the product, the airport duty-free liquor market is categorized into whiskey, vodka, rum, gin, wine, cognac, and others. Among these, the whiskey segment dominates the market with the highest market share through the forecast period. The segment dominance attributed to the advanced economies is seeing an increase in demand for fine whiskey. Whisky is a popular duty-free product because people believe it is an effective expenditures, present, or memento. To meet the demand for flavored alcoholic beverages, premium whiskey is growing increasingly prevalent in the United States. Additionally, because whiskey is a premium product with a stellar reputation, demand for it is predicted to soar during the projection period.

- The duty-free shops segment is anticipated to grow at the highest CAGR during the forecast period.

Based on the distribution channel, the airport duty-free liquor market is categorized into duty-free shops, airlines, and online retailers. Among these, the duty-free shops segment is anticipated to grow at the highest CAGR during the forecast period. Travelers frequently choose duty-free shops because of their competitive costs and a large variety of liquors. They offer convenience and a greater product selection, allowing customers to make purchases from the comfort of their residences. The growth of e-commerce and the increasing popularity of online shopping are expected to drive the expansion of this market.

Regional Segment Analysis of the Airport Duty-free Liquor Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the airport duty-free liquor market over the predicted timeframe.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the airport duty-free liquor market over the predicted timeframe. This dominance is due to many tourists from developing nation’s spending money on alcohol because airports provide it at low prices. Additional key drivers of market expansion include improving economic conditions in developing nations and rising disposable income. The market drive continue to be focused by rising travel and tourism in this area as a result of a greater number of millennials who are prepared to spend money on exploration and leisure travel.

Europe is expected to grow at the fastest CAGR growth in the airport duty-free liquor market during the forecast period. This is caused by the rising demand in wealthy nations for high-end alcoholic beverages. Additionally, the UK leads the region in the sale of duty-free liquors from airport shops, contributing to the expansion of the regional market. The market will expand as a result of the growing desire in the area to drink classic alcoholic beverage brands including Burgasko, Bergenbier, and Arnold Palmer Spiked Half & Half. Furthermore, it is projected that the funds given by local private companies to purchase upscale alcoholic beverages at the airport will accelerate market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the airport duty-free liquor market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Heineken N.V.

- Diageo plc

- Pernod Ricard

- REMY COINTREAU

- Constellation Brands, Inc.

- The Brown-Forman Corporation

- Rémy Cointreau

- Accolade Wines

- Edrington

- Glen Moray

- King Power Group

- Brown-Forman

- William Grant & Sons Ltd

- Bacardi Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, At Hyderabad Rajiv Gandhi International Airport, Hyderabad Duty Free expanded its selection of spirits by including Wise Monkey, the initial Indian rum to win gold at the London Spirits Competition.

- In September 2024, Changi Airport Group (CAG) revealed the new edition of World of Wines and Spirits (WOWS) from September to December 2024, in partnership with LOTTE Duty Free. The event features over 100 premium and uncommon fine liquors from 66 prominent companies, which are accessible for purchasing using the WOWS website.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the airport duty-free liquor market based on the below-mentioned segments:

Global Airport Duty-free Liquor Market, By Product

- Whiskey

- Vodka

- Rum

- Gin

- Wine

- Cognac

- Others

Global Airport Duty-free Liquor Market, By Distribution Channel

- Duty-Free Shops

- Airlines

- Online Retailers

Global Airport Duty-free Liquor Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global airport duty-free liquor market over the forecast period?The global airport duty-free liquor market is to expand at 10.19% during the forecast period.

-

2. Which region is expected to hold the highest share of the global airport duty-free liquor market?The Asia Pacific region is expected to hold the largest share of the global airport duty-free liquor market.

-

3. Who are the top key players in the airport duty-free liquor market?The key players in the airport duty-free liquor market are Heineken N.V., Diageo plc, Pernod Ricard, REMY COINTREAU, Constellation Brands, Inc., The Brown-Forman Corporation, Rémy Cointreau, Accolade Wines, Edrington, Glen Moray, King Power Group, Brown-Forman, William Grant & Sons Ltd, Bacardi Limited, and others.

Need help to buy this report?