Global Airport Quick Service Restaurant Market Size, Share, and COVID-19 Impact Analysis, By Cuisine Type (Fast Food Chains, Beverages, Bakery & Confectionery, International Cuisine), By Franchise Type (Branded Chains, Local Brands), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Airport Quick Service Restaurant Market Insights Forecasts to 2033

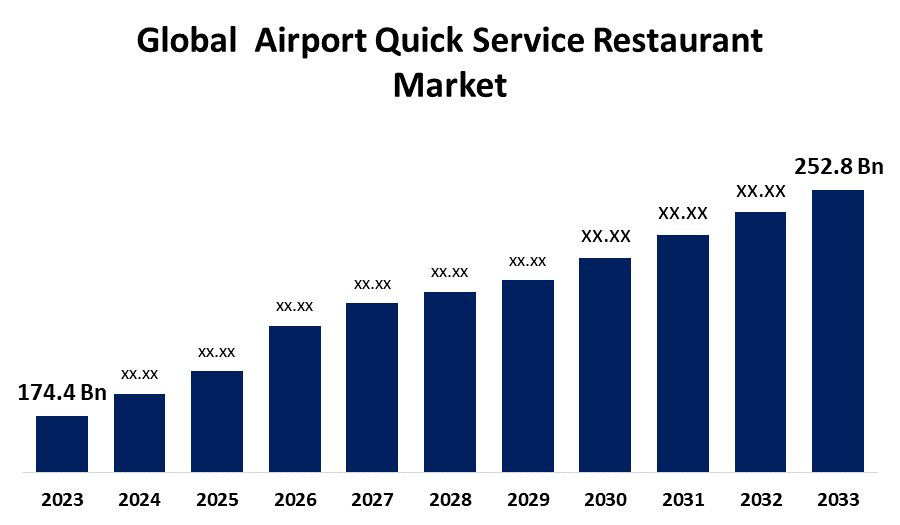

- The Airport Quick Service Restaurant Market was valued at USD 174.4 billion in 2023.

- The market is growing at a CAGR of 3.78% from 2023 to 2033.

- The global Airport Quick Service Restaurant Market is expected to reach USD 252.8 billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global Airport Quick Service Restaurant Market is expected to reach USD 252.8 billion by 2033, at a CAGR of 3.78% during the forecast period 2023 to 2033.

The Airport Quick Service Restaurant (QSR) market is expanding rapidly, driven by the growing number of air travelers and a demand for fast, convenient dining options. Offering a variety of food choices, from global fast-food chains to local specialties, these restaurants cater to diverse tastes and preferences. The market is influenced by factors such as increased global travel, evolving consumer lifestyles, and a shift towards healthier, on-the-go food options. Digital innovation, including contactless payments and mobile ordering, is enhancing the passenger experience, while sustainability and local sourcing trends are gaining importance. As airports strive to enhance non-aeronautical revenue, QSRs play a crucial role in attracting passengers and boosting dwell time, making them a vital component of the modern airport ecosystem.

Airport Quick Service Restaurant Market Value Chain Analysis

The Airport Quick Service Restaurant (QSR) market value chain involves several key components, starting with food and beverage suppliers who provide raw materials to the QSR operators. These suppliers include local producers, global food brands, and specialty vendors who meet stringent airport standards for safety and quality. QSR operators then transform these materials into ready-to-eat meals, leveraging efficient kitchen operations and streamlined supply chains to ensure fast service. Distribution partners, including logistics providers and airport concessionaires, facilitate the delivery and availability of these products within airport terminals. The final link in the chain is the customer interface, where digital platforms, self-service kiosks, and traditional point-of-sale systems enable smooth transactions. Value is created by optimizing inventory management, reducing waste, and enhancing the passenger dining experience through speed, variety, and convenience.

Airport Quick Service Restaurant Market Opportunity Analysis

The Airport Quick Service Restaurant (QSR) market presents significant growth opportunities driven by rising global air travel, increasing passenger traffic, and evolving consumer preferences for convenience and speed. With airports seeking to diversify non-aeronautical revenue, there is an opportunity for QSRs to capture a growing share of travelers’ spending by offering diverse, high-quality, and locally inspired food options. Expanding digital ordering capabilities, including mobile apps and contactless payments, can enhance customer convenience and reduce wait times, further boosting sales. Additionally, there is potential for innovation in healthier and sustainable menu options to appeal to health-conscious and eco-friendly consumers. As airports focus on enhancing the passenger experience, the demand for unique, quick-service dining options is expected to grow, offering ample room for market expansion and differentiation.

Global Airport Quick Service Restaurant Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 174.4 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.78% |

| 2033 Value Projection: | USD 252.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 254 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Cuisine Type, By Franchise Type, and By Region |

| Companies covered:: | Chick-fil-A, KFC, McDonald’s, Pizza Hut Express, Starbucks, Subway, and Tim Hortons |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Airport Quick Service Restaurant Market Dynamics

Rising in demand of passenger traffic to propel the market growth

The rising demand for passenger traffic is a key driver of growth in the Airport Quick Service Restaurant (QSR) market. As global air travel continues to recover and expand, airports are experiencing increased foot traffic, leading to higher demand for quick, convenient dining options. Travelers, often pressed for time, prefer QSRs for their speed, variety, and ability to cater to diverse tastes. This surge in passenger numbers directly correlates with increased sales and the need for more QSR outlets within airports. Additionally, the growth in low-cost carriers and longer layover times has further fueled the demand for quick-service dining. Airports are responding by enhancing their food and beverage offerings, making QSRs an integral part of the passenger experience, and contributing significantly to non-aeronautical revenue growth.

Restraints & Challenges

High operating costs, including rent, labor, and compliance with stringent airport regulations, strain profit margins. Additionally, fluctuating passenger volumes due to seasonal trends, economic uncertainties, or unexpected events like pandemics or geopolitical tensions pose a risk to consistent revenue generation. The need to cater to diverse international tastes while maintaining quick service also adds complexity to menu planning and inventory management. Increased competition from other airport dining options, such as full-service restaurants and vending machines, intensifies the battle for customers. Furthermore, sustainability concerns require QSRs to invest in eco-friendly packaging and sourcing practices, which can further elevate costs. Addressing these challenges is crucial for sustained growth and market competitiveness.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Airport Quick Service Restaurant Market from 2023 to 2033. The region's major airports, such as those in the U.S. and Canada, serve as global travel hubs, creating significant demand for diverse, fast, and accessible dining options. North American airports are increasingly integrating QSRs that offer a range of foods from well-known fast-food chains to healthier, locally sourced options to cater to varied traveler preferences. The adoption of digital solutions like mobile ordering, self-service kiosks, and contactless payments is enhancing operational efficiency and the customer experience. However, challenges such as high operating costs, intense competition, and evolving consumer expectations require continuous innovation and adaptation for sustained market growth.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Major airports are witnessing record passenger traffic, creating substantial demand for quick, convenient dining options. This market is characterized by a blend of international fast-food brands and regional specialties, catering to diverse tastes and dietary preferences. Digital transformation, including mobile ordering and contactless payment systems, is being embraced to enhance efficiency and customer satisfaction. However, the market faces challenges such as navigating regulatory complexities, fluctuating passenger volumes due to economic uncertainties, and the need to adapt to local consumer preferences, necessitating strategic innovation and flexibility for sustained growth.

Segmentation Analysis

Insights by Cuisine Type

The fast food chains segment accounted for the largest market share over the forecast period 2023 to 2033. As air passenger traffic rises, fast food brands capitalize on their strong brand recognition and standardized offerings to attract a broad range of customers. These chains are expanding their presence in airports globally, providing diverse menus that cater to various dietary needs, from classic comfort foods to healthier alternatives. Additionally, they are leveraging digital innovations like mobile apps, self-service kiosks, and contactless payments to streamline service and reduce wait times, enhancing customer satisfaction. However, growth is tempered by high competition, strict airport regulations, and the need to balance speed with food quality and sustainability practices.

Insights by Franchise Type

The roadways segment accounted for the largest market share over the forecast period 2023 to 2033. As airports increasingly recognize the importance of attracting passengers en route to or from the airport, they are expanding QSR offerings in roadside locations and transit points. This segment growth is fueled by the convenience it provides to travelers looking for quick, familiar dining options without entering the main airport terminals. Partnerships with fuel stations, rental car centers, and public transit hubs further enhance accessibility. Digital innovations like drive-thru services, mobile ordering, and pre-payment options are also contributing to this growth. However, the segment faces challenges such as fluctuating foot traffic, operational costs, and the need for high-speed service while maintaining food quality.

Recent Market Developments

- In August 2023, McDonald's opened a restaurant at the Mumbai International Airport, claiming to be the first drive-thru restaurant in the country. Under the management of McDonald's India (West & South), the location is only a hundred meters away from the international airport's Terminal 2.

Competitive Landscape

Major players in the market

- Chick-fil-A

- KFC

- McDonald’s

- Pizza Hut Express

- Starbucks

- Subway

- Tim Hortons

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Airport Quick Service Restaurant Market, Cuisine Type Analysis

- Fast Food Chains

- Beverages

- Bakery & Confectionery

- International Cuisine

Airport Quick Service Restaurant Market, Franchise Type Analysis

- Branded Chains

- Local Brands

Airport Quick Service Restaurant Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Airport Quick Service Restaurant Market?The global Airport Quick Service Restaurant Market is expected to grow from USD 174.4 billion in 2023 to USD 252.8 billion by 2033, at a CAGR of 3.78% during the forecast period 2023-2033.

-

2. Who are the key market players of the Airport Quick Service Restaurant Market?Some of the key market players of the market are Chick-fil-A, KFC, McDonald’s, Pizza Hut Express, Starbucks, Subway, and Tim Hortons.

-

3. Which segment holds the largest market share?The fast food chains segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Airport Quick Service Restaurant Market?North America dominates the Airport Quick Service Restaurant Market and has the highest market share.

Need help to buy this report?