Global Airspace and Procedure Design Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Airspace and Procedure Design Market Insights Forecasts to 2033

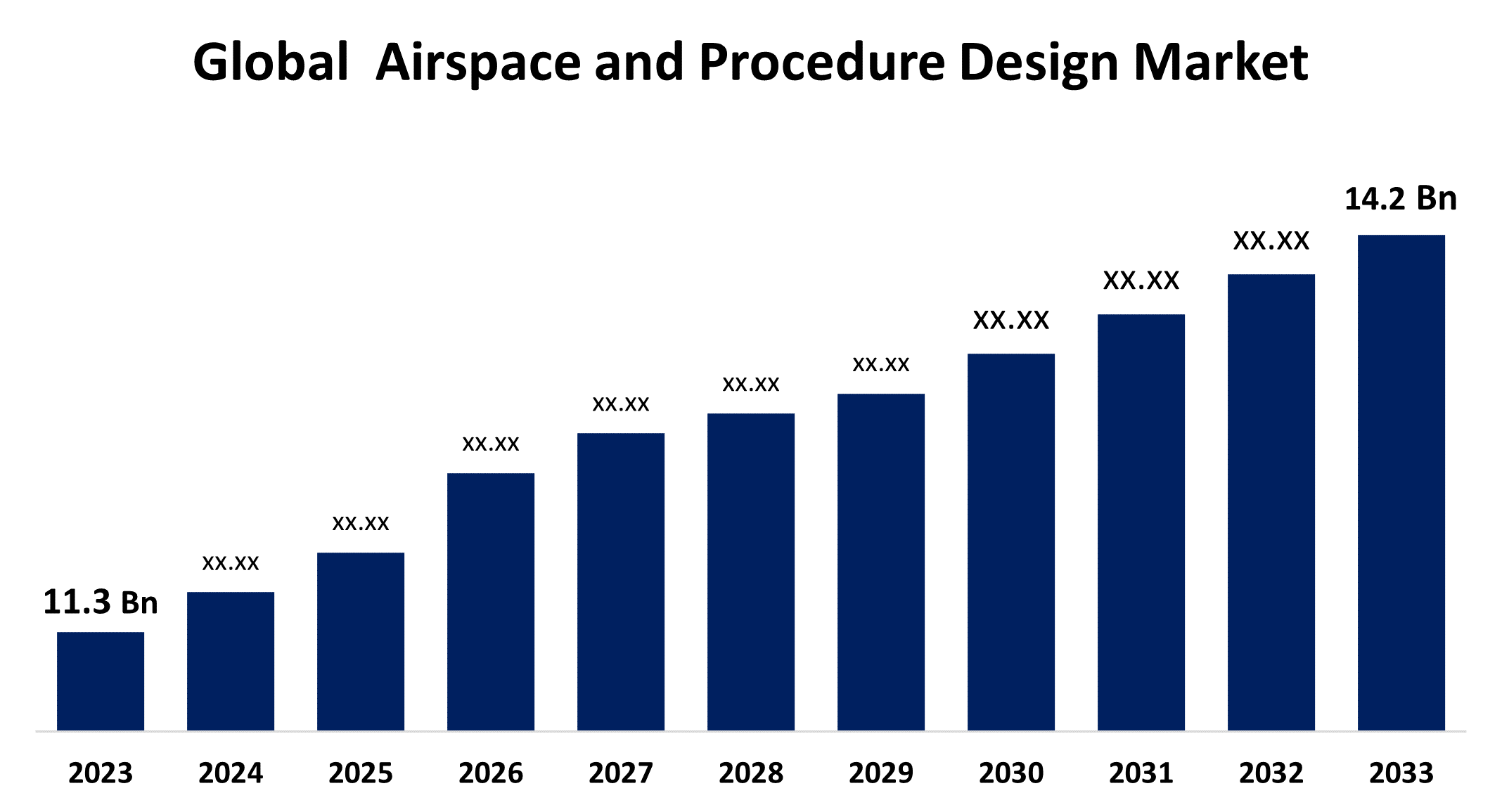

- The Global Airspace and Procedure Design Market Size was valued at USD 11.3 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.31% from 2023 to 2033.

- The Worldwide Airspace and Procedure Design Market is expected to reach USD 14.2 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The global Airspace and Procedure Design Market is expected to reach USD 14.2 billion by 2033, at a CAGR of 2.31% during the forecast period 2023 to 2033.

The airspace and procedure design market is a dynamic sector focused on optimizing the efficiency and safety of air traffic management. It involves designing and implementing airspace structures, flight procedures, and navigation systems to accommodate growing air traffic demands and advancements in technology. Key drivers include the increasing complexity of global airspace, the need for improved air traffic flow, and regulatory requirements for enhanced safety and environmental sustainability. Major players in the market include aviation authorities, air navigation service providers, and specialized consulting firms. Innovations such as satellite-based navigation and automation are reshaping the industry, offering more precise and flexible solutions. The market is expected to grow as the aviation sector continues to expand and evolve.

Global Airspace and Procedure Design Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 11.3 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.31% |

| 2033 Value Projection: | USD 14.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 217 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Region |

| Companies covered:: | Lockheed Martin Corporation, Indra Sistemas, S.A., Raytheon Technologies Corporation, BAE Systems plc, L3Harris Technologies, Inc., Advanced Navigation and Positioning Corporation, Northrop Grumman Corporation, Honeywell International Inc., Thales, Saab AB, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Airspace and Procedure Design Market Value Chain Analysis

The airspace and procedure design market value chain encompasses several key stages. It begins with data collection and analysis, where information on air traffic, geography, and regulations is gathered. This is followed by the design phase, where airspace structures and flight procedures are created using advanced simulation and modeling tools. Next, the implementation phase involves integrating these designs into operational systems, often requiring collaboration with regulatory bodies and technology providers. After implementation, the monitoring and evaluation phase ensures the designs function as intended, involving ongoing adjustments and updates. Key players include data analysts, design engineers, technology developers, and regulatory agencies. The value chain emphasizes efficiency, safety, and adaptability to evolving aviation needs and technological advancements.

Airspace and Procedure Design Market Opportunity Analysis

The airspace and procedure design market presents significant opportunities driven by the expansion of global air traffic and technological advancements. Increasing air travel demands necessitate more efficient airspace management solutions to enhance capacity and safety. Innovations such as satellite-based navigation and automation offer potential for more precise and flexible airspace designs. Additionally, the growing emphasis on reducing environmental impact presents opportunities for designing procedures that minimize fuel consumption and emissions. Emerging markets in developing regions are also expanding, creating new demands for modern airspace solutions. As regulatory requirements evolve and technology advances, there is ample opportunity for companies to innovate and provide solutions that address both current and future aviation challenges.

Market Dynamics

Airspace and Procedure Design Market Dynamics

Growth in passenger traffic over the past few years

Over the past few years, passenger traffic has experienced substantial growth, significantly impacting the airspace and procedure design market. As global air travel surged, driven by economic recovery and increasing demand for mobility, airspace systems have had to adapt to manage higher volumes of flights efficiently. This growth has intensified the need for advanced airspace designs and optimized flight procedures to ensure safety and minimize delays. Innovations in technology, such as satellite navigation and automated systems, have become crucial in managing the increased traffic. The market has seen heightened investments in modernizing air traffic management infrastructure to cope with the rising number of flights and to enhance overall operational efficiency and passenger experience.

Restraints & Challenges

One major issue is the complexity of integrating new technologies with existing systems, which can lead to interoperability problems. Additionally, balancing the need for increased capacity with safety and environmental regulations is a persistent challenge. Regulatory compliance across different regions can be cumbersome, as standards and requirements vary globally. Furthermore, the rapid pace of technological advancement can make it difficult for stakeholders to keep up, potentially leading to outdated systems. There is also a need for substantial investment in training and development to ensure that personnel are skilled in using new systems and technologies.

Regional Forecasts

North America Market Statistics

Get more details on this report -

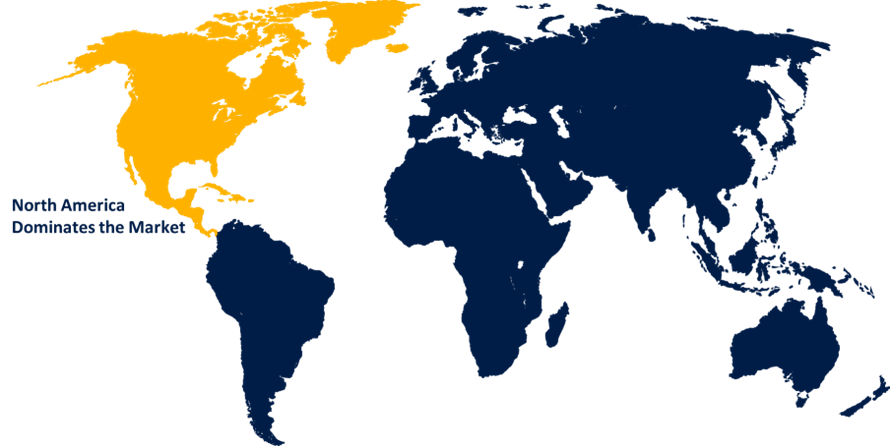

North America is anticipated to dominate the Airspace and Procedure Design Market from 2023 to 2033. The region's significant investments in modernization and technology integration reflect the need to manage increasing flight operations efficiently. Innovations such as NextGen (Next Generation Air Transportation System) in the U.S. are central to enhancing air traffic management, improving safety, and reducing delays. Regulatory bodies like the Federal Aviation Administration (FAA) and Transport Canada play critical roles in shaping market dynamics, focusing on upgrading airspace design and procedures to meet contemporary demands. Challenges include managing congestion and integrating new technologies while complying with stringent regulations. Overall, North America's market remains a leader in developing and implementing cutting-edge airspace solutions.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries are investing heavily in modernizing their air traffic management systems to handle increasing flight volumes and enhance operational efficiency. The region's diverse airspace and varying levels of technological advancement present both opportunities and challenges for airspace design. Innovations such as satellite-based navigation and advanced data analytics are being adopted to improve safety and capacity. However, regulatory harmonization across different countries remains a challenge, as standards and practices vary widely. The market is driven by the need to optimize airspace usage and improve air traffic flow, ensuring that the region can support its growing aviation demands effectively.

Segmentation Analysis

Insights by Component

The hardware segment accounted for the largest market share over the forecast period 2023 to 2033. Key hardware components include radar systems, communication equipment, and navigation aids, which are essential for accurate air traffic management and safety. The integration of next-generation technologies, such as advanced surveillance systems and high-performance computers, has accelerated the adoption of new hardware solutions. Additionally, modernization projects and the need to replace outdated equipment are contributing to the growth. Investments in hardware are crucial for enhancing system reliability, capacity, and operational efficiency. As the aviation industry evolves, the demand for innovative and robust hardware solutions continues to rise, supporting the overall development of airspace and procedure design.

Recent Market Developments

- In June 2022, Advanced ATC Inc., an air traffic control academy located in Georgia, United States, has announced a USD 4.7 million investment at Craig Airfield to set up the first remote air traffic control center for managing traffic across multiple airports.

Competitive Landscape

Major players in the market

- Lockheed Martin Corporation

- Indra Sistemas

- S.A.

- Raytheon Technologies Corporation

- BAE Systems plc

- L3Harris Technologies, Inc.

- Advanced Navigation and Positioning Corporation

- Northrop Grumman Corporation

- Honeywell International Inc.

- Thales

- Saab AB

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Airspace and Procedure Design Market, Component Analysis

- Hardware

- Software

Airspace and Procedure Design Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Airspace and Procedure Design Market?The global Airspace and Procedure Design Market is expected to grow from USD 11.3 billion in 2023 to USD 14.2 billion by 2033, at a CAGR of 2.31% during the forecast period 2023-2033.

-

2. Who are the key market players of the Airspace and Procedure Design Market?Some of the key market players of the market are Lockheed Martin Corporation, Indra Sistemas, S.A., Raytheon Technologies Corporation, BAE Systems plc, L3Harris Technologies, Inc., Advanced Navigation and Positioning Corporation, Northrop Grumman Corporation, Honeywell International Inc., Thales, Saab AB.

-

3. Which segment holds the largest market share?The hardware segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Airspace and Procedure Design Market?North America dominates the Airspace and Procedure Design Market and has the highest market share.

Need help to buy this report?