Global Ajinomoto Build-Up Film Substrate Market Size, Share, and COVID-19 Impact Analysis, By Type (4-8 Layers ABF Substrate, 8-16 ABF Substrate), By Application (Networking, Industrial, Automotive, Consumer Electronics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Ajinomoto Build-Up Film Substrate Market Insights Forecasts to 2033

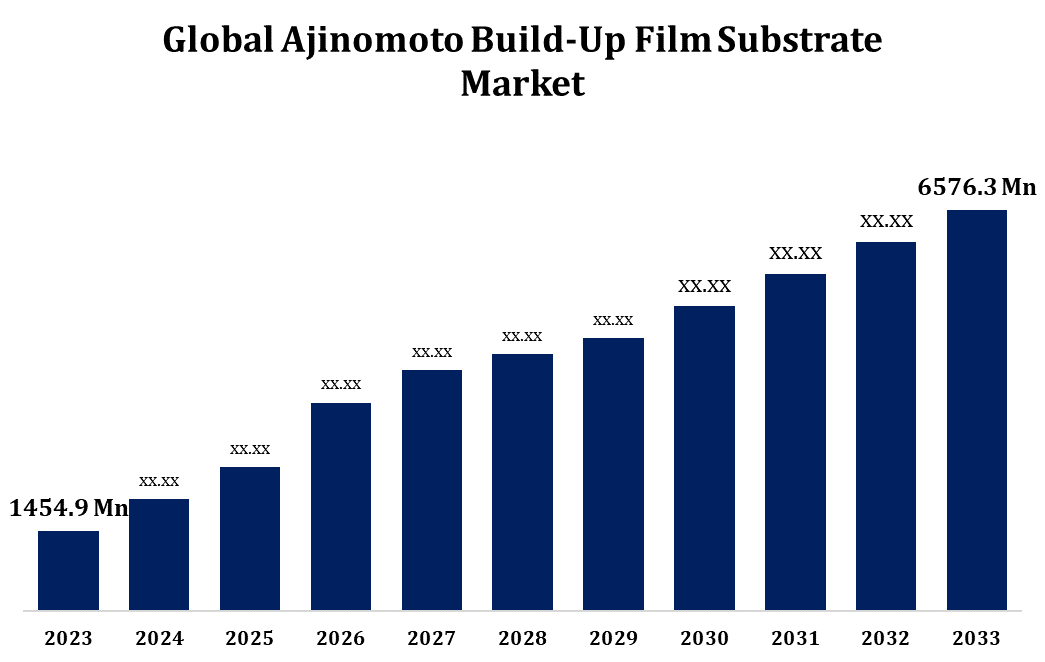

- The Ajinomoto Build-Up Film Substrate Market Size was valued at USD 1454.9 Million in 2023.

- The Market Size is Growing at a CAGR of 16.28% from 2023 to 2033.

- The Worldwide Ajinomoto Build-Up Film Substrate Market Size is Expected to reach USD 6576.3 Million by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Ajinomoto Build-Up Film Substrate Market Size is Expected to reach USD 6576.3 Million by 2033, at a CAGR of 16.28% during the forecast period 2023 to 2033.

The Ajinomoto Build-Up Film (ABF) substrate market is witnessing significant growth due to the increasing demand for advanced packaging solutions in the semiconductor industry. ABF substrates, known for their superior thermal performance, high reliability, and lightweight properties, are essential for supporting complex integrated circuits and high-density interconnects. The market is driven by the rise in electronic devices, including smartphones, tablets, and IoT devices, necessitating compact and efficient packaging. Key players in the market are investing in R&D to enhance product offerings and meet the evolving needs of manufacturers. Additionally, the push for miniaturization and increased functionality in electronics is further fueling the adoption of ABF substrates, positioning the market for continued expansion in the coming years.

Ajinomoto Build-Up Film Substrate Market Value Chain Analysis

The Ajinomoto Build-Up Film (ABF) substrate market value chain comprises several key stages, starting with raw material suppliers who provide essential components such as resins and adhesive materials. These materials are then processed by manufacturers to create ABF substrates, integrating advanced technologies for enhanced performance and reliability. The processed substrates are supplied to semiconductor companies, which utilize them in the production of integrated circuits and advanced packaging solutions. Following this, the finished products reach original equipment manufacturers (OEMs) and electronics manufacturers who incorporate ABF substrates into devices like smartphones and IoT products. Finally, the end-users, including consumers and businesses, benefit from the high-performance electronics enabled by ABF substrates, driving further demand and innovation throughout the value chain.

Ajinomoto Build-Up Film Substrate Market Opportunity Analysis

The Ajinomoto Build-Up Film (ABF) substrate market presents numerous opportunities, primarily driven by the rapid growth of the semiconductor and electronics industries. The increasing demand for miniaturized and high-performance electronic devices, such as smartphones, wearables, and IoT products, creates a substantial need for advanced packaging solutions. Additionally, the trend toward 5G technology and automotive electronics enhances opportunities for ABF substrates, as they support higher data rates and improved thermal management. Emerging markets in Asia-Pacific and the ongoing transition to electric vehicles further contribute to the demand for innovative packaging. Furthermore, advancements in manufacturing processes and materials will allow companies to enhance performance, reduce costs, and differentiate their products, thereby capitalizing on the evolving landscape of electronic applications.

Global Ajinomoto Build-Up Film Substrate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1454.9 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 16.28% |

| 2033 Value Projection: | USD 6576.3 |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 199 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Ajinomoto Co., Inc., Unimicron Technology Corp, Nan Ya Printed Circuit Board Corporation, AT & S, Samsung Electro-Mechanics (SEMCO), Kyocera, TOPPAN, ASE Material, LG Inno Tek, Shennan Circuit, IBIDEN CO., LTD, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Ajinomoto Build-Up Film Substrate Market Dynamics

Growth in the Consumer Electronics Industry to propel the market growth

The growth of the consumer electronics industry is a significant driver for the Ajinomoto Build-Up Film (ABF) substrate market. With the increasing demand for advanced electronic devices like smartphones, tablets, and smart home appliances, manufacturers are seeking innovative packaging solutions to meet performance and efficiency standards. ABF substrates, known for their high reliability, thermal performance, and compact design, are essential for supporting the complex circuitry found in modern electronics. As consumer preferences shift toward smarter, faster, and more feature-rich devices, the need for reliable packaging materials intensifies. Additionally, trends such as 5G deployment and the proliferation of Internet of Things (IoT) devices further boost the demand for ABF substrates, positioning them as critical components in the rapidly evolving consumer electronics landscape.

Restraints & Challenges

The Ajinomoto Build-Up Film (ABF) substrate market faces several challenges that could hinder its growth. One primary concern is the rising costs of raw materials and production processes, which can affect profit margins and pricing strategies for manufacturers. Additionally, the semiconductor industry is characterized by rapid technological advancements, requiring constant innovation and adaptation from ABF substrate producers. This fast-paced environment can lead to increased competition and the risk of obsolescence for outdated products. Supply chain disruptions, exacerbated by global events such as pandemics or geopolitical tensions, may also impact the availability of critical materials and timely delivery. Furthermore, regulatory pressures and environmental concerns regarding material sustainability can pose significant hurdles, compelling companies to invest in eco-friendly alternatives and processes.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Ajinomoto Build-Up Film Substrate Market from 2023 to 2033. ABF substrates, known for their high performance in thermal management and signal integrity, are essential for manufacturing integrated circuits used in smartphones, computers, and other electronic devices. The rise in consumer electronics, coupled with advancements in 5G technology and IoT applications, is propelling the adoption of ABF substrates. Key players in the market are focusing on innovations and collaborations to enhance their product offerings. Additionally, the push for miniaturization in electronic components is expected to further boost the demand for ABF substrates in North America, creating opportunities for manufacturers and suppliers in the region.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries of this region are key players, driving innovation and production capabilities. The proliferation of consumer electronics, automotive applications, and 5G technology is significantly increasing the need for high-performance ABF substrates, which offer enhanced thermal and electrical properties. Additionally, the shift towards miniaturization and high-density packaging in electronics is further propelling market growth. Leading manufacturers are investing in R&D to develop advanced materials and improve production efficiency, positioning themselves to meet the rising demands of the evolving electronics landscape in the Asia-Pacific region.

Segmentation Analysis

Insights by Type

The 4-8 Layers ABF Substrate segment accounted for the largest market share over the forecast period 2023 to 2033. This segment caters to applications requiring higher performance and enhanced functionality, such as smartphones, tablets, and high-performance computing systems. The demand for multi-layer substrates is fueled by the need for improved thermal management, electrical performance, and miniaturization in electronic components. As manufacturers strive to meet the rising requirements for advanced packaging solutions, the 4-8 layers segment is becoming pivotal. Furthermore, advancements in manufacturing technologies and materials are enabling the production of more intricate designs, which are crucial for next-generation electronics. This trend is expected to continue as industries evolve towards higher-density, multi-functional devices.

Insights by Application

The consumer electronics segment accounted for the largest market share over the forecast period 2023 to 2033. With the proliferation of smartphones, tablets, wearables, and smart home products, manufacturers are seeking advanced packaging solutions that provide enhanced performance, thermal management, and miniaturization. ABF substrates offer these benefits, making them ideal for compact, high-performance applications. Additionally, the rise of 5G technology and the Internet of Things (IoT) is further propelling the need for efficient and reliable semiconductor packaging in consumer electronics. As companies focus on innovation and improving device functionality, the demand for ABF substrates within this segment is expected to accelerate, creating new opportunities for manufacturers and suppliers in the market.

Recent Market Developments

- In May 2023, Ibiden started producing large quantities of its next-generation ABF substrate, stating that it performed better and was more reliable than the previous model.

Competitive Landscape

Major players in the market

- Ajinomoto Co., Inc.

- Unimicron Technology Corp

- Nan Ya Printed Circuit Board Corporation

- AT & S

- Samsung Electro-Mechanics (SEMCO)

- Kyocera

- TOPPAN

- ASE Material

- LG Inno Tek

- Shennan Circuit

- IBIDEN CO., LTD

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Ajinomoto Build-Up Film Substrate Market, Type Analysis

- 4-8 Layers ABF Substrate

- 8-16 ABF Substrate

Ajinomoto Build-Up Film Substrate Market, Application Analysis

- Networking

- Industrial

- Automotive

- Consumer Electronics

Ajinomoto Build-Up Film Substrate Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Ajinomoto Build-Up Film Substrate Market?The global Ajinomoto Build-Up Film Substrate Market is expected to grow from USD 1454.9 million in 2023 to USD 6576.3 million by 2033, at a CAGR of 16.28% during the forecast period 2023-2033.

-

2. Who are the key market players of the Ajinomoto Build-Up Film Substrate Market?Some of the key market players of the market are Ajinomoto Co., Inc., Unimicron Technology Corp, Nan Ya Printed Circuit Board Corporation, AT & S, Samsung Electro-Mechanics (SEMCO), Kyocera, TOPPAN, ASE Material, LG Inno Tek, Shennan Circuit, and IBIDEN CO., LTD .

-

3. Which segment holds the largest market share?The consumer electronics segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Ajinomoto Build-Up Film Substrate Market?North America dominates the Ajinomoto Build-Up Film Substrate Market and has the highest market share.

Need help to buy this report?