Global Alcoholic Beverages Market Size, Share, and COVID-19 Impact Analysis, By Type (Distilled Spirits, Beer, Champagne, Wine, Other), By Alcohol Content (High, Medium, Low), By Distribution Channel (Liquor Stores, Supermarkets/Hypermarkets, Bars/ Clubs, Restaurants, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Food & BeveragesGlobal Alcoholic Beverages Market Insights Forecasts to 2033

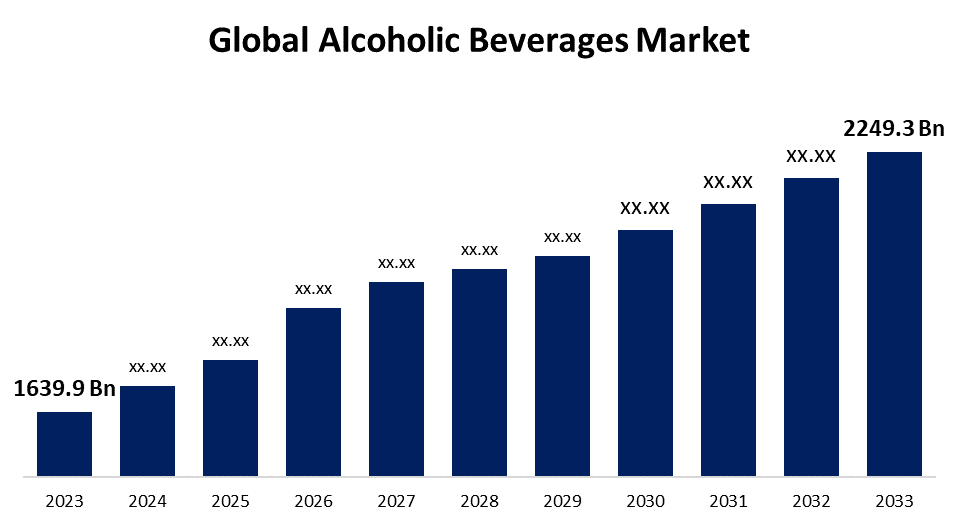

- The Global Alcoholic Beverages Market Size was Valued at USD 1639.9 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.21% from 2023 to 2033.

- The Worldwide Alcoholic Beverages Market Size is Expected to Reach USD 2249.3 Billion by 2033.

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Alcoholic Beverages Market Size is Anticipated to Exceed USD 2249.3 Billion by 2033, Growing at a CAGR of 3.21% from 2023 to 2033.

Market Overview

Alcoholic beverages are liquids with an alcoholic content that are typically made by fermentation. Yeast is used in their production method to convert sugars found in a variety of ingredients, including grains, fruits, and sugarcane, into carbon dioxide and alcohol. Alcohol is usually consumed, either for personal relaxation or to be enjoyed in social settings. Furthermore, the rising use of alcoholic beverages is prompting market trends, mostly in growing economies such as China, India, Indonesia, and Singapore. The market's growth can be attributed to the growing demand for high-quality alcoholic beverages. In response, manufacturers have turned their attention to providing a broad collection of ready-to-mix hybrid beverages to satisfy consumers' continuously changing tastes and preferences. Moreover, to open up new avenues for market growth, this trend highlights how crucial innovation and adaptation are to satisfying customer demands. As of this, it is predicted that the market for upscale alcoholic beverages will keep increasing shortly. Additionally, the sales of alcoholic beverages are driven by young individuals who have easy access to alcohol, a high family income, and a significant social media following. Urban areas have higher rates of alcohol intake because of high-pressure employment and the perception that alcohol calms the mind. Manufacturers of alcoholic beverages are often adding new flavors to their lineup.

Report Coverage

This research report categorizes the market for the global alcoholic beverages market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global alcoholic beverages market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global alcoholic beverages market.

Global Alcoholic Beverages Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1639.9 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.21% |

| 2033 Value Projection: | USD 2249.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Alcohol Content, By Distribution Channel, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Tsingtao Brewery Company Limited, Kirin Holdings Company, Limited, MillerCoors (Molson Coors Brewing Company), Heineken Holdings N.V., Beijing Yanjing Brewery Co. Ltd., Carlsberg Breweries A/S, Diageo plc, Bacardi & Company Limited, Anheuser-Busch InBev SA/NV, Olvi Oyj and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A growing population means there is a greater demand for alcoholic drinks, which should lead to plenty of room for market expansion. Fulfilling the rising demand from the population will require a rise in crop output, trade volumes, and farming activities. Because of the growing population over the projected period, companies in the alcoholic beverage market are anticipated to profit from the rising demand for alcoholic beverage products. Moreover, digital marketing plays a major role in the success of alcohol brands. Alcohol beverage firms are using these platforms more and more to communicate directly with their customers. Furthermore, the development in internet marketing is also a factor in the rise in the popularity of alcoholic beverages and cocktails. In addition, several businesses, including Aperol, rose to become one of the liqueur brands in Germany, Italy, and Austria with the fastest rates of growth. Throughout the projected period of the alcoholic beverage market, these variables will play a major role in growth.

Restraining Factors

As consumers' opinions of their health and well-being impact their purchase decisions, non-alcoholic and energy drinks are posing a danger to the alcohol industry by gradually replacing various alcoholic beverages. Heavy alcohol drinking can lead to the development of serious conditions over time, including heart disease, stroke, liver disease, high blood pressure, and digestive problems. More than ever, consumers are concerned about their health, which could present a problem for the alcohol industry because people are more aware of the risks associated with drinking.

Market Segmentation

The global alcoholic beverages market share is classified into type, alcohol content, and distribution channel.

- The beer segment is expected to hold the largest share of the global alcoholic beverages market during the forecast period.

Based on the type, the global alcoholic beverages market is divided into distilled spirits, beer, champagne, wine, and others. Among these, the beer segment is expected to hold the largest share of the global alcoholic beverages market during the forecast period. Companies have been able to establish long-lasting ties with their clientele by having an understanding of consumer preferences for various beer tastes and events. The popularity of beer taprooms is rising, and they are helping to crowdsource new beer varieties.

- The high segment is expected to grow at the fastest pace in the global alcoholic beverages market during the forecast period.

Based on the alcohol content, the global alcoholic beverages market is divided into high, medium, and low. Among these, the high segment is expected to grow at the fastest pace in the global alcoholic beverages market during the forecast period. The market for high alcohol content is fueled by customer preferences for potent spirits and liquors, which are frequently connected to high-end, elegant drinking occasions. These drinks are preferred for luxury consumption and special events; their appeal is mostly due to their exclusivity, brand reputation, and high level of craftsmanship.

- The liquor stores segment is expected to grow at the greatest pace in the global alcoholic beverages market during the forecast period.

Based on the distribution channel, the global alcoholic beverages market is divided into liquor stores, supermarkets/hypermarkets, bars/clubs, restaurants, and others. Among these, the liquor stores segment is expected to grow at the greatest pace in the global alcoholic beverages market during the forecast period. Particularly in urban areas, liquor stores offer a quick and simple option to buy alcoholic beverages without having to go far or stand in large lines. They are accessible and convenient. Liquor stores respond to a variety of consumer interests and preferences by offering a wide selection of items, including local and craft beverages in addition to branded liquors.

Regional Segment Analysis of the Global Alcoholic Beverages Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

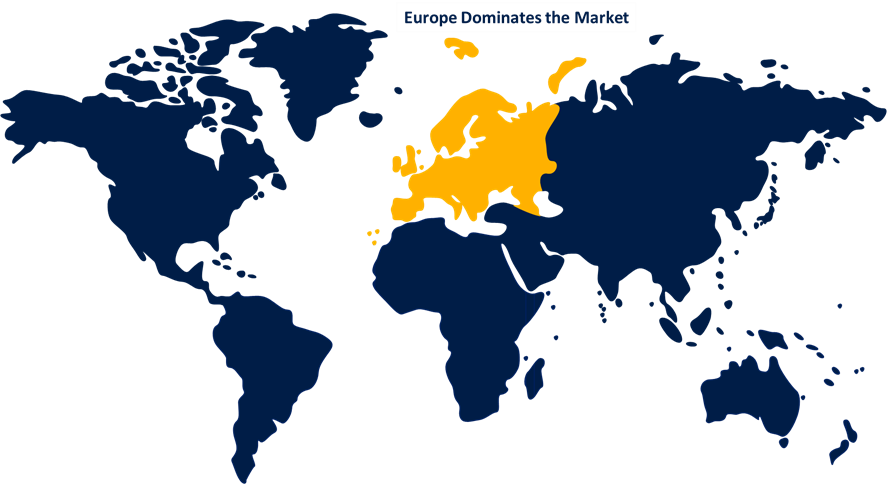

Europe is anticipated to hold the largest share of the global alcoholic beverages market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the global alcoholic beverages market over the predicted timeframe. The growing trend of European consumers favoring premium and craft alcoholic beverages is the driving force behind the market's expansion. Local breweries, distilleries, and wineries that cater to the tastes of European customers are proliferating as a result of their growing need for distinctive and premium beverages. Additionally, the regional growing disposable income and stable economy have increased the consumption of alcoholic beverages, especially luxury and foreign brands. Furthermore, consumer confidence and product quality have been enhanced by strict but clear government laws about the production, distribution, and labeling of alcohol. A thriving and growing market is also facilitated by Europe's rich cultural legacy and varied drinking customs, as customers are willing to try a various types of conventional and cutting-edge alcoholic beverages.

North America is expected to grow at the fastest pace in the global alcoholic beverages market during the forecast period. This might be related to the growing demand for polished malt scotch whisky in North America and the United States. Market expansion will be aided by the rising renown of classic American alcoholic beverage brands like Arnold Palmer Spiked Half & Half, Burgasko, and Bergenbier. Moreover, market expansion is anticipated to be accelerated by the funds provided by private corporations in Canada to purchase luxury alcoholic beverages. Furthermore, the market for alcoholic beverages in the United States had the most market share, while the market in Canada had the quickest rate of growth in the area.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global alcoholic beverages along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tsingtao Brewery Company Limited

- Kirin Holdings Company, Limited

- MillerCoors (Molson Coors Brewing Company)

- Heineken Holdings N.V.

- Beijing Yanjing Brewery Co. Ltd.

- Carlsberg Breweries A/S

- Diageo plc

- Bacardi & Company Limited

- Anheuser-Busch InBev SA/NV

- Olvi Oyj

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, With the completion of the deal, Bacardi Limited became the exclusive owner of ILEGAL Mezcal, a top-tier, artisanal mezcal. The company is family-owned.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global alcoholic beverages market based on the below-mentioned segments:

Global Alcoholic Beverages Market, By Type

- Distilled spirits

- Beer

- Champagne, Wine

- Other

Global Alcoholic Beverages Market, By Alcohol Content

- High

- Medium

- Low

Global Alcoholic Beverages Market, By Distribution Channel

- Liquor Stores

- Supermarkets/Hypermarkets

- Bars/ Clubs

- Restaurants

- Others

Global Alcoholic Beverages Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Tsingtao Brewery Company Limited, Kirin Holdings Company, Limited, MillerCoors (Molson Coors Brewing Company), Heineken Holdings N.V., Beijing Yanjing Brewery Co. Ltd., Carlsberg Breweries A/S, Diageo plc, Bacardi & Company Limited, Anheuser-Busch InBev SA/NV, Olvi Oyj, and Others.

-

2. What is the size of the global alcoholic beverages market?The global alcoholic beverages market is expected to grow from USD 1639.9 Billion in 2023 to USD 2249.3 Billion by 2033, at a CAGR of 3.21% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Europe is anticipated to hold the largest share of the global alcoholic beverages market over the predicted timeframe.

Need help to buy this report?