Global Ale Beer Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Pale Ale, India Pale Ale, Brown Ale, Amber Ale, Red Ale, Stout), By Alcohol Content (Low-Alcohol, Mid-Alcohol, High-Alcohol), By Flavors (Hoppy, Malty, Fruity, Citrusy, Spicey), By Distribution Channel (On-Trade and Off-Trade), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Food & BeveragesGlobal Ale Beer Market Insights Forecasts to 2033

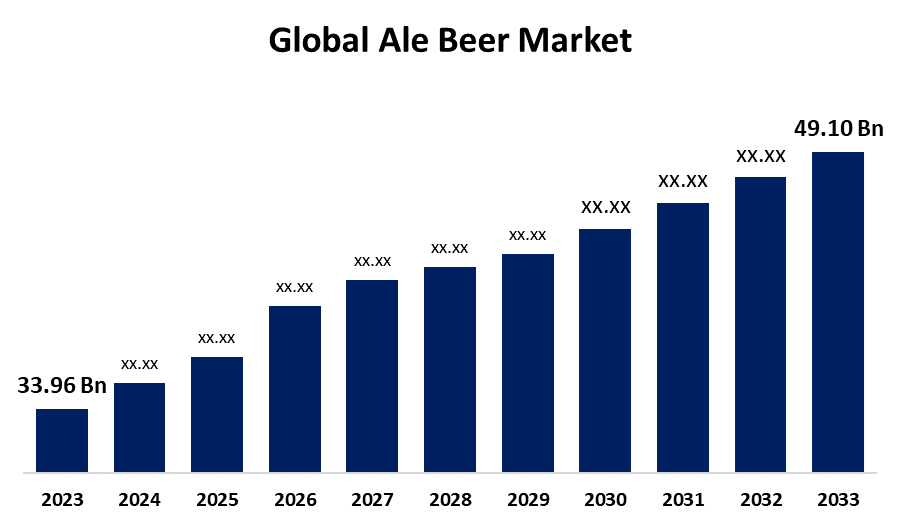

- The Global Ale Beer Market Size Was Estimated at USD 33.96 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 3.76% from 2023 to 2033

- The Worldwide Ale Beer Market Size is Expected to Reach USD 49.10 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Ale Beer Market Size Was Worth around USD 33.96 Billion in 2023 and is predicted to Grow to around USD 49.10 Billion by 2033 with a compound annual growth rate (CAGR) of 3.76% between 2023 and 2033. The ale beer industry is propelled by increasing consumer demand for craft beers, demand for distinct flavors, rising disposable income, and beer tourism popularity. Also, advances in brewing technology and shifts in social patterns towards premium alcoholic drinks propel the industry's growth.

Market Overview

The ale beer industry is the portion of the alcoholic drink sector that deals with the manufacturing, distribution, and consumption of ale; a style of beer commonly brewed with top-fermenting yeast at higher temperatures. Pale ale, stout, porter, and IPA are some of the varieties of ale. The industry includes mass-produced and craft ale products, fueled by taste, quality, and variety demand from consumers. People are becoming healthier and more concerned about the food they consume. They want something better and healthier than the standard alcoholic drinks. Ale beer is a lower-calorie and lower-carb beer compared to other beers, and it has antioxidants and other nutrients. Therefore, ale beer is increasingly being considered by healthier consumers seeking a better and healthier lifestyle. Current trends in the ale beer market involve the rise of sour and wild ales, which offer customers the chance to experience various tastes. Additionally, innovation in the process of brewing and experimentation with ingredients has enabled breweries to create numerous types of ales that are distinct. Brewers are more and more incorporating new malts, yeast strains, and hops to produce novel ales, which resonate with experimental beer consumers and stimulate market expansion.

Report Coverage

This research report categorizes the ale beer market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the ale beer market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the ale beer market.

Global Ale Beer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 33.96 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.76% |

| 2033 Value Projection: | USD 49.10 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 232 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Product Type, By Alcohol Content, By Flavors, By Distribution Channel, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Deschutes Brewery, Pernod Ricard, Lagunitas Brewing Company, Constellation Brands, Inc., Boston Beer Company, Carlsberg Group, Heineken N.V., Kirin Holdings Company, Limited, Rogue Ales, Diageo plc and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Ale beer is a low-calorie and low-carb beverage compared to other beers, and it also has antioxidants and other nutrients. Therefore, ale beer is increasingly becoming a favorite among health-conscious consumers who seek a healthier and more balanced lifestyle propelling the ale beer market. In addition, the increasing power of social media, beer festivals, and rising exposure to beer culture have further added to the popularity of ales. Beer consumers are now more active in sharing their experience of beer online, and increased exposure through beer influencers and online reviews has created awareness about new ale brands. Beer festivals and events also enhance tasting and sampling, thus expanding the market of ales further.

Restraining Factors

Craft ales, one of the major segments of the ale market, tend to be costly to make with high-end ingredients, lower production volumes, and more complex brewing cycles. The price at which they are sold is higher in comparison, which can restrict their market penetration, especially for price-conscious consumers. Additionally, some buyers might turn to light beers or healthy alternatives like low-calorie or low-alcohol beers, which can affect the demand for authentic or fuller ales further restricting its demand.

Market Segmentation

The ale beer market share is classified into product type, alcohol content, flavor and distribution channel.

- The India pale ale segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the ale beer market is divided into pale ale, India pale ale, brown ale, amber ale, red ale, and stout. Among these, the India pale ale segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to IPAs being renowned for their robust, hoppy taste, with many featuring citrus, pine, and floral flavors. Such intensity in flavor resonates with increasingly diverse consumers abandoning more traditional, moderate-tasting beers such as lagers. As consumers seek diversity and richness in what they drink, the IPA segment increases.

- The low-alcohol segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the alcohol content, the ale beer market is divided into low-alcohol, mid-alcohol, and high-alcohol. Among these, the low-alcohol segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth is driven due to low-alcohol ales tend to be positioned as a health-conscious version of the higher-alcohol beers, so they are an appealing choice for customers who want to cut back on the amount of alcohol but continue to get the taste of craft beer.

- The hoppy segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the flavors, the ale beer market is divided into hoppy, malty, fruity, citrusy, and spicey. Among these, the hoppy segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is due to Hops' being responsible for the bold, full flavors many customers enjoy. Beers with high hoppy contents have a distinguishable bitterness contrasted by the aromatic and fruit-like nature that makes them highly different compared to more old-style, malted beer offerings like pale lagers and lagers.

- The off-trade segment accounted for the largest share in 2023 and is anticipated to grow at a substantial CAGR during the forecast period.

Based on the distribution channel, the ale beer market is divided into on-trade and off-trade. Among these, the off-trade segment accounted for the largest share in 2023 and is anticipated to grow at a substantial CAGR during the forecast period. The growth is attributed to off-trade is defined as buying beer via retail channels such as supermarkets, liquor stores, convenience stores, and websites. These mediums provide convenient and easy access to ale beer at any time of day. Beer can be grabbed by consumers at their convenience without having to go to a bar or restaurant, which tends to be more limiting in terms of hours and accessibility.

Regional Segment Analysis of the Ale Beer Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the ale beer market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the ale beer market over the predicted timeframe. North America, particularly the United States, has an established craft brewing culture, and most breweries brew good-quality, innovative ales. The trend for craft beer as opposed to mass-produced lagers has boosted demand for several ale styles. The move to premium and artisanal beers, encompassing a range of ales, has promoted increased sales, especially amongst millennials and young adults who demand individuality and quality.

Asia Pacific is expected to grow at a rapid CAGR in the ale beer market during the forecast period. Although Asia tends to prefer lagers traditionally, there has also been a noteworthy increase in the number of craft beer breweries, particularly in China, Japan, South Korea, and India. Ales, especially pale ales and IPAs, are gaining popularity as craft beer culture takes root. With fast-growing economies in most Asia Pacific nations, disposable incomes have risen to enable consumers to try premium alcohol drinks such as ales. This is a very strong trend among younger, more urban consumers who are willing to pay a premium for craft beers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the ale beer market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Deschutes Brewery

- Pernod Ricard

- Lagunitas Brewing Company

- Constellation Brands, Inc.

- Boston Beer Company

- Carlsberg Group

- Heineken N.V.

- Kirin Holdings Company, Limited

- Rogue Ales

- Diageo plc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2023, Greene King introduced its new premium ale, Old Master Hen, within the Old Speckled Hen range. The 7% ABV ale is bottle-conditioned, meaning it can age and release more complex flavors over time. Intense and full-bodied with flavors of toffee, fruit, and citrus, this ale celebrates traditional English brewing methods.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the ale beer market based on the below-mentioned segments:

Global Ale Beer Market, By Product Type

- Pale Ale

- India Pale Ale

- Brown Ale

- Amber Ale

- Red Ale

- Stout

Global Ale Beer Market, By Alcohol Content

- Low-Alcohol

- Mid-Alcohol

- High-Alcohol

Global Ale Beer Market, By Flavors

- Hoppy

- Malty

- Fruity

- Citrusy

- Spicey

Global Ale Beer Market, By Distribution Channel

- On-Trade

- Off-Trade

Global Ale Beer Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the ale beer market over the forecast period?The global ale beer market is projected to expand at a CAGR of 3.76% during the forecast period.

-

2. What is the market size of the ale beer market?The global ale beer market size is expected to grow from USD 33.96 Billion in 2023 to USD 49.10 Billion by 2033, at a CAGR of 3.76% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the ale beer market?North America is anticipated to hold the largest share of the ale beer market over the predicted timeframe.

Need help to buy this report?