Global Alkyl Ketene Dimer Market Size, Share, and COVID-19 Impact Analysis, By Type (Wax, Emulsion, and Others), By Grade (Technical Grade, Reagent Grade, and Chemical Grade), By Application (Printing Paper, Cardboard, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Specialty & Fine ChemicalsGlobal Alkyl Ketene Dimer Market Insights Forecasts to 2033

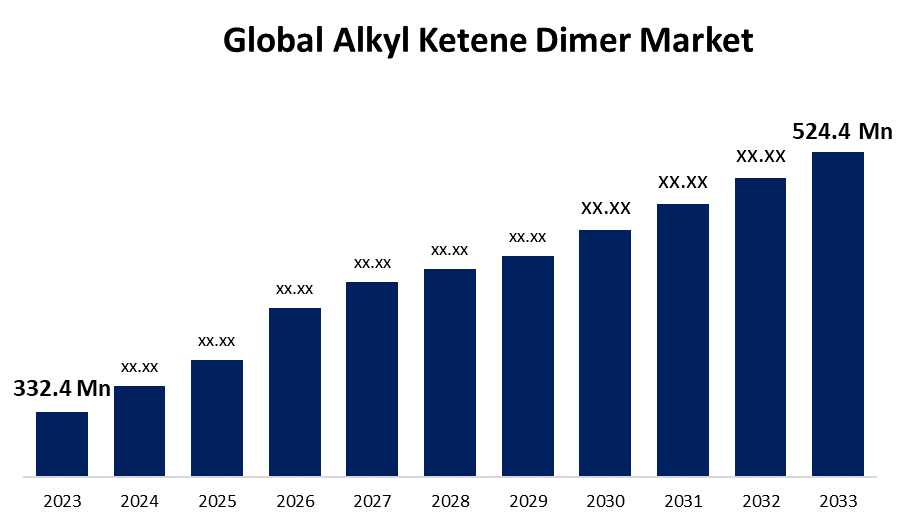

- The Global Alkyl Ketene Dimer Market Size was Valued at USD 332.4 Million in 2023

- The Market Size is Growing at a CAGR of 4.66% from 2023 to 2033

- The Worldwide Alkyl Ketene Dimer Market Size is Expected to Reach USD 524.4 Million by 2033

- Aisa Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Alkyl Ketene Dimer Market Size is Anticipated to Exceed USD 524.4 Million by 2033, Growing at a CAGR of 4.66% from 2023 to 2033.

Market Overview

Alkyl ketene dimer (AKD) is a chemical molecule commonly used as a sizing agent in the paper and pulp industries. It is used in the paper manufacturing process to increase water resistance and improve the printability of paper and paperboard products. Alkyl ketene dimer works by producing a hydrophobic layer on paper fibers, inhibiting water penetration and improving the quality of printed products. It is typically formed through the interaction of fatty acids with ketones derived from acetic acid or its derivatives. The alkyl ketene dimer market includes the manufacture and marketing of alkyl ketene dimer, a papermaking ingredient. It is used as a sizing agent to add strength and smoothness to paper. Alkyl ketene dimer interacts with cellulose fibers to produce ketals that increase paper's water resistance. The global alkyl ketene dimer market has been steadily growing due to the increasing demand for better-grade paper.

Report Coverage

This research report categorizes the market for alkyl ketene dimer market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the alkyl ketene dimer market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the alkyl ketene dimer market.

Global Alkyl Ketene Dimer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 332.4 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.66% |

| 2033 Value Projection: | USD 524.4 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 217 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Grade, By Application, By Region. |

| Companies covered:: | Aries Chemical, Inc., SEIKO PMC, Yanzhou Tiancheng Chemical, Arakawa Chemical Industries, Atlas Organics Industries, Kemira Oyj, Oleon NV, GO YEN Chemical Industries Co., Ltd., Haihang Industry, Brightgreen, Plasmine Technology, Finor Piplaj Chemicals, Solenis, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The alkyl ketene dimer AKD market's growth is primarily driven by its crucial role as a sizing agent in the paper and packaging industry, where it enhances water resistance and printability. AKD serves as a crucial additive in the paper industry, enhancing paper strength, stability, and quality by improving sizing effects. Regions like Asia Pacific, particularly China and India, are witnessing substantial growth in paper packaging, supported by AKD's role in meeting packaging sector demands. Technological advancements in production methods and product innovation contribute to increased efficiency and quality, stimulating market demand. Economic factors, including growth in paper manufacturing and disposable incomes, influence AKD consumption.

Restraining Factors

The alkyl ketene dimer (AKD) market faces challenges including stringent regulatory requirements, competition from substitute products like rosin-based agents, fluctuating raw material costs, technological limitations, economic downturns affecting paper demand, geopolitical uncertainties, changing consumer preferences towards digital media, and health and safety concerns related to alkyl ketene dimer production.

Market Segmentation

The alkyl ketene dimer market share is classified into type, grade, and application.

- The wax segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the alkyl ketene dimer market is classified into wax, emulsion, and others. Among these, the wax segment is estimated to hold the highest market revenue share through the projected period. The wax segment is attributed to its superior performance and versatility. The wax effectively modifies the surface properties of materials such as paper and cardboard, enhancing strength, absorbency, and barrier properties. Its small particle size allows deep penetration into non-woven fibers, improving the sizing, brightness, and printability of papers. AKD wax also addresses challenges in recycling by reducing porosity and controlling the absorbency of recycled fibers. Additionally, AKD wax's long alkyl chains provide moisture resistance, extending the shelf life of papers in hygienic and food contact applications.

- The technical grade segment is anticipated to hold the largest market share through the forecast period.

Based on the grade, the alkyl ketene dimer market is divided into technical grade, reagent grade, and chemical grade. Among these, the technical grade segment is anticipated to hold the largest market share through the forecast period. The technical grade segment is attributed to their ability to encounter rigorous industry specifications for paper and paperboard applications. Technical grade AKDs boast precise control over molecular weight distribution, ensuring efficient penetration into paper fibers without causing viscosity issues on paper machines. The precision allows for effective treatment at lower levels, reducing costs and waste while meeting the demands of high-quality graphical and specialty papers that rely on consistent AKD performance.

- The printing paper segment dominates the market with the largest market share through the forecast period.

Based on the application, the alkyl ketene dimer market is categorized into printing paper, cardboard, and others. Among these, the printing paper segment dominates the market with the largest market share through the forecast period. Alkyl ketene dimers (AKDs) play a vital role in enhancing the quality and processability of paper in high-speed printing applications. For printing, AKD treatments optimize paper surface properties, improving ink absorption and drying rates to minimize issues like ink picking and feathering. The results in sharper halftones and text at fast press speeds while preventing ink set-off. The demand is rising particularly in digitally printed papers requiring high resolutions and speeds, where AKDs ensure reliable performance. Additionally, the strong demand from precision printing and writing applications solidifies printing papers as the primary application area driving the growth of the alkyl ketene dimer market.

Regional Segment Analysis of the Alkyl Ketene Dimer Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the alkyl ketene dimer market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the alkyl ketene dimer market over the predicted timeframe. The North American AKD emulsifier market is being driven by rising demand for paper and pulp products in the region. The United States and Canada are the region's main players in the alkyl ketene dimer market. The increased consumption of paper-based products such as tissue paper, printing paper, and packaging materials enhances the growth of the AKD market in the North American region. Furthermore, the region's need for AKD emulsifiers is being driven by a desire for sustainable and environmentally friendly products. The growing awareness of the environmental impact of traditional sizing agents used in the paper and pulp industry has resulted in a shift toward more sustainable alternatives, such as AKD emulsions. Additionally, the presence of key companies in the region is pushing the expansion of the alkyl ketene dimer market. Solenis LLC, Evonik Industries AG, Buckman Laboratories International Inc., and BASF SE are among the leading participants in the North American alkyl ketene dimer market.

Asia Pacific is expected to grow at the fastest CAGR growth of the alkyl ketene dimer market during the forecast period. The growing demand for alkyl ketene dimer in the Asia Pacific is being driven by increased development and production activities in industries such as paper and construction. Countries such as China and India have emerged as high-growth hotspots as a result of rapidly rising paper production volumes from small and large paper mills in diverse locations. The Asian paper industry's expansion is primarily due to increased domestic paper consumption for packaging, printing, writing, and tissue materials. Furthermore, expanding agricultural development in the region is increasing the demand for agrochemicals and soil modifiers including alkyl ketene dimer.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the alkyl ketene dimer market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aries Chemical, Inc.

- SEIKO PMC

- Yanzhou Tiancheng Chemical

- Arakawa Chemical Industries

- Atlas Organics Industries

- Kemira Oyj

- Oleon NV

- GO YEN Chemical Industries Co., Ltd.

- Haihang Industry

- Brightgreen

- Plasmine Technology

- Finor Piplaj Chemicals

- Solenis

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, Kamira announced the price for AKD wax-based sizing products in APAC is expected to rise by 10-30%. The price change will be made immediately or as per the current contracts. The decision is caused by price hikes for major raw commodities.

- In August 2023, Kemira and Jain Chem. announced their ongoing partnership to develop and commercialize aqueous barrier coatings for recyclable paper and board products in the Americas region.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the alkyl ketene dimer market based on the below-mentioned segments:

Global Alkyl Ketene Dimer Market, By Type

- Wax

- Emulsion

- Others

Global Alkyl Ketene Dimer Market, By Grade

- Technical Grade

- Reagent Grade

- Chemical Grade

Global Alkyl Ketene Dimer Market, By Application

- Printing Paper

- Cardboard

- Others

Global Alkyl Ketene Dimer Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the alkyl ketene dimer market over the forecast period?The alkyl ketene dimer market is projected to expand at a CAGR of 4.66% during the forecast period.

-

2. What is the market size of the alkyl ketene dimer market?The Global Alkyl Ketene Dimer Market Size is Expected to Grow from USD 332.4 Million in 2023 to USD 524.4 Million by 2033, at a CAGR of 4.66% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the alkyl ketene dimer market?North America is anticipated to hold the largest share of the alkyl ketene dimer market over the predicted timeframe.

Need help to buy this report?