Global Alternative Protein Market Size, Share, and COVID-19 Impact Analysis, By Source (Plant-Based, Microbial-Based, Insect-Based, and Others), By Application (Animal Feed, Food and Beverages, Nutraceuticals, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Food & BeveragesGlobal Alternative Protein Market Insights Forecasts to 2033

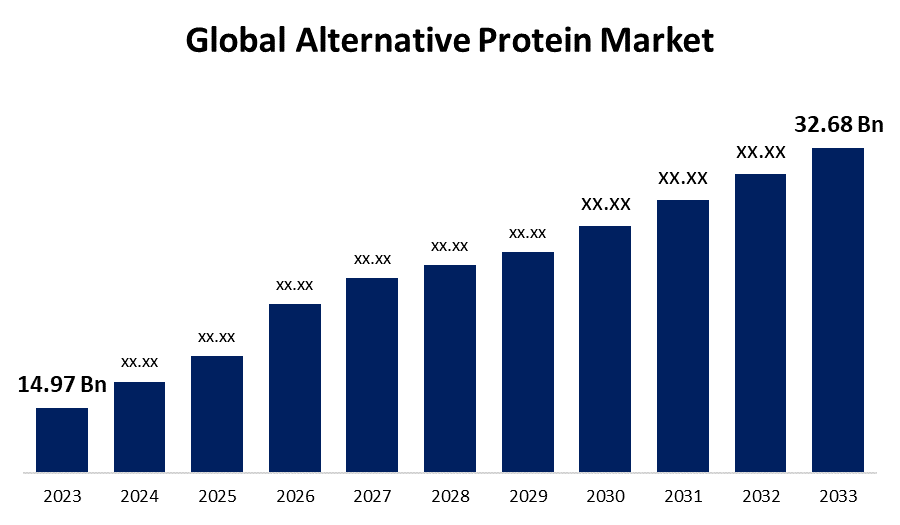

- The Global Alternative Protein Market Size was Valued at USD 14.97 Billion in 2023.

- The Market Size is Growing at a CAGR of 8.12% from 2023 to 2033.

- The Worldwide Alternative Protein Market Size is Expected to Reach USD 32.68 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Alternative Protein Market Size is Anticipated to Exceed USD 32.68 Billion by 2033, Growing at a CAGR of 8.12% from 2023 to 2033.

Market Overview

Alternative protein is a renowned protein that is frequently used by health-conscious individuals to enhance and improve their health conditions. These proteins are frequently utilized to replace animal-based proteins including meat, eggs, and other sources, allowing consumers to regularly consume vegan food items. It is anticipated that consumer interest in health, ethical considerations, and minimum intake of protein calories will enhance the market for alternative proteins. Alternative proteins are utilized in dairy-free and meat-free diets, such as meat analogs and other animal feed products. Customers are becoming more aware of the benefits of eating plant-based proteins and the environmental harm that comes from eating meat-based foods. The past several years have seen a sharp rise in the vegan and vegetarian movements, which is fueling the market's expansion. Additionally, consumers' growing knowledge of and acceptance of proteins sourced sustainably as well as the rise in clean protein intake are projected to drive product demand. The alternative protein has several health advantages, including boosting the body's nutritional makeup and bolstering the immune system, which could encourage the expansion of the alternative protein market for food applications.

Report Coverage

This research report categorizes the market for the global alternative protein market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global alternative protein market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global alternative protein market.

Global Alternative Protein Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 14.97 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.12% |

| 2033 Value Projection: | USD 32.68 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Source, By Application, By Region |

| Companies covered:: | Cargill Inc., ADM, Impossible Foods Inc., Lightlife Foods, Inc., Ingredion Inc., International Flavors & Fragrances, Inc., Glanbia plc, Emsland Group, Kerry Group, Axiom Foods Inc., Bunge Limited, SunOpta Inc., Tate & Lyle PLC, Louis Dreyfus Company LLC., AGT Food and Ingredients, Glanbia plc, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

Growing consumer demand for plant-based and vegan products is a key element anticipated to propel market revenue expansion. The demand for meat alternatives has increased as a result of growing awareness of the negative effects linked to the eating of meat and products containing meat. This is anticipated to increase market revenue growth and raise demand for substitute protein products. It is anticipated that expanding microbial protein research and development will accelerate market revenue growth. Furthermore, governments and regulatory bodies in various countries are increasingly promoting the alternative protein industry. Some have implemented policies to encourage research and development in this field, fund startups, and promote the use of alternative protein products through initiatives such as dietary guidelines and labeling regulations. In addition, the market for alternative proteins has grown beyond conventional products made from soy and tofu. Many alternatives are now available from companies, such as dairy alternatives, proteins that have been cultured or grown in a lab, and plant-based meat substitutes. The expansion of the customer base has been facilitated by this diversification of product offerings.

Restraining Factors

However, the higher costs of alternative protein in comparison to conventional protein, as well as consumers' strong preference for animal-based products, limit the market's growth. Moreover, the industry's growth is hampered by allergies related to alternative proteins, such as those derived from plants and insects. Furthermore, the cattle industry's strict adherence to feed regulations is impeding market expansion.

Market Segmentation

The global alternative protein market share is classified into source and application.

- The plant-based segment is expected to hold the largest share of the global alternative protein market during the forecast period.

Based on the source, the global alternative protein market is divided into plant-based, microbial-based, insect-based, and others. Among these, the plant-based segment is expected to hold the largest share of the global alternative protein market during the forecast period. The rising desire for vegan and plant-based products, as well as the increased health hazards connected with meat eating, are likely to drive up demand for plant-based alternative protein sources. Furthermore, the pharmaceutical industry's interest in plant-based proteins expands their application reach while also increasing their perceived worth as functional and therapeutic constituents. Due to these factors, the plant-based segment dominates the global alternative protein market.

- The animal feed segment is expected to grow at the fastest CAGR in the global alternative protein market during the forecast period.

Based on the application, the global alternative protein market is divided into animal feed, food and beverages, nutraceuticals, and others. Among these, the animal feed segment is expected to grow at the fastest CAGR in the global alternative protein market during the forecast period. Convergence of numerous elements that correspond to changing consumer choices, environmental concerns, and advances in nutritional science. One important factor is the growing concern among pet owners and livestock producers about the environmental impact of traditional animal-based protein sources like meat and fishmeal.

Regional Segment Analysis of the Global Alternative Protein Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global alternative protein market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global alternative protein market over the predicted timeframe. Growing environmental concerns, ethical issues surrounding animal protein consumption, the rise in veganism, the number of investments in alternative protein products, the demand for wholesome, nutritious foods, and the increased emphasis on sustainable protein production due to advancements in food industry technology are all factors contributing to North America's leading position in the alternative protein market.

Asia Pacific is expected to grow at the fastest pace in the global alternative protein market during the forecast period. The demand for alternative protein sources is being driven by growing consumer interest in ethical and sustainable consumption. For example, the rising demand for plant-based meat substitutes in the area, such as Omnipork, is indicative of consumers' increased inclination toward ethical and sustainable food choices. Additionally, the highest share of the alternative protein market in the region is held by China. Due to the nation's large population and quick urbanization, there is a huge market for alternative protein products as a result of the rising demand for protein. To meet this increasing demand, Chinese businesses like Whole Perfect Food are investing in plant-based meat substitutes. Because of these factors, the alternative protein market is anticipated to develop at the fastest CAGR in the Asia Pacific region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global alternative protein market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill Inc.

- ADM

- Impossible Foods Inc.

- Lightlife Foods, Inc.

- Ingredion Inc.

- International Flavors & Fragrances, Inc.

- Glanbia plc

- Emsland Group

- Kerry Group

- Axiom Foods Inc.

- Bunge Limited

- SunOpta Inc.

- Tate & Lyle PLC

- Louis Dreyfus Company LLC.

- AGT Food and Ingredients

- Glanbia plc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2022, ADM said that it has increased its soy ingredients to meet the increasing demand for plant-based proteins through cooperation with the agricultural technology business Benson Hill. As part of the agreement, ADM obtained exclusive North American rights to produce and market its patented ingredients, which are derived from Benson Hill's Ultra-High Protein soybeans. Through the partnership, cutting-edge ingredients with considerable water and carbon sustainability benefits and less-processed proteins made possible by Benson Hill genetics were scaled up. The partnership aims to pave the road for the manufacture of higher-value alternative protein products on a commercial scale.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global alternative protein market based on the below-mentioned segments:

Global Alternative Protein Market, By Source

- Plant-Based

- Microbial-Based

- Insect-Based

- Others

Global Alternative Protein Market, By Application

- Animal Feed

- Food and Beverages

- Nutraceuticals

- Others

Global Alternative Protein Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Cargill Inc., ADM, Impossible Foods Inc., Lightlife Foods, Inc., Ingredion Inc., International Flavors & Fragrances, Inc., Glanbia plc, Emsland Group, Kerry Group, Axiom Foods Inc., Bunge Limited, SunOpta Inc., Tate & Lyle PLC, Louis Dreyfus Company LLC., AGT Food and Ingredients, Glanbia plc, and Others.

-

2. What is the size of the global alternative protein market?The Global Alternative Protein Market is expected to grow from USD 14.97 Billion in 2023 to USD 32.68 Billion by 2033, at a CAGR of 8.12% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global alternative protein market over the predicted timeframe.

Need help to buy this report?