Global Alumina Market Size, Share, and COVID-19 Impact Analysis By Product (Smelter, Chemical, Calcined, Tabular, Fused, Reactive and Aluminum Trihydrate) By Application (Aluminum Production, Non-Aluminum Production, Abrasives, Ceramics, Refractories, Filtration and Others) and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Analysis and Forecast 2021 - 2030

Industry: Advanced MaterialsGlobal Alumina Market Insights Forecasts to 2030

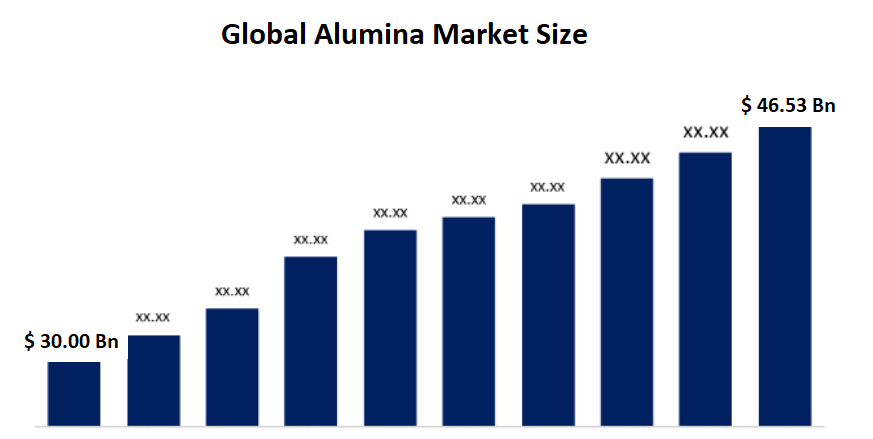

- The Global Alumina Market Size was valued at USD 30.00 Billion in 2021.

- The Market is growing at a CAGR of 5% from 2022 to 2030

- The global Alumina Market Size is expected to reach USD 46.53 Billion by 2030

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Alumina Market Size is expected to reach USD 46.53 Billion by 2030, at a CAGR of 5% during the forecast period 2022 to 2030. Over the projected period, the demand for alumina in the market will increase due to changing consumer preferences for lightweight materials and increased aluminium consumption for the building and automotive industries.

Market Overview

A white crystalline chemical substance with the popular name Alumina or aluminium oxide, is often made from bauxite. It is extensively widely used in a variety of technical applications, such as those involving anti-corrosion materials, wear- and abrasion-resistant components, and the electronics sector. The quality attributes of alumina include great durability, brightness, minimal heat radiation, and good stability at high temperatures. Alumina is a cost-effective substance. The automobile industry is constantly being dominated by advanced aluminium materials because of their superior performance and safety. Global automakers are changing their preferences by swapping out iron and steel components with lighter materials as lightweight materials increase fuel economy. Superb Purity an essential ingredient in the production of synthetic sapphire is alumina. It is a commodity with a high value, high margin, and strong demand. Artificial sapphire is used to create semiconductor wafers for the electronics sector, substrates for LED lights, and scratch-resistant sapphire glass for watch faces, optical windows, and smartphone parts. There is no HPA replacement for creating synthetic sapphire. In lithium-ion batteries, HPA is increasingly used as a separator sheet coating.

The growing production of electric cars is a significant driver for the high purity alumina market (EVs). As the number of electric vehicles (EVs) increases, so does the need for lithium-ion batteries. Lithium-ion battery separators are coated with HPA, which has led to a significant increase in HPA use. The growing production of electric cars is a major driver for the market for high purity alumina (EVs). The growing use of electric vehicles (EVs) is increasing demand for lithium-ion batteries. The coating of lithium-ion battery separators with HPA has led to a significant increase in HPA usage. Rising HPA costs and stringent regulatory restrictions on the excavation of "Red Mud" may hinder the worldwide market for high purity alumina.

Global Alumina Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 30.00 Billion |

| Forecast Period: | 2022-2030 |

| Forecast Period CAGR 2022-2030 : | 5 % |

| 2030 Value Projection: | USD 46.53 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 258 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Application, By region |

| Companies covered:: | C Alcoa, Queensland Alumina Limited (QAL), Hindalco, Safo Luas (Alumar), Hydro, Porto Trombetas, Aluminum Corporation of China, BHP Billiton Group, Glencore International, CVG Bauxilum, National Aluminum Company, United Company RUSAL Alumina Limited, Sangaredi, Hariom Rocks, and Rio Tinto. |

| Growth Drivers: | Increasing demand in Developing nations is expected to drive the markets growth over the forecast period. |

| Pitfalls & Challenges: | Covid-19 Impact Analysis |

Get more details on this report -

Report Coverage

This research report categorizes the Market for global Alumina based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Global Alumina Market. Recent Market developments and competitive strategies such as expansion, Product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the Market. The report strategically identifies and profiles the key Market players and analyses their core competencies in each global Alumina Market sub-segments.

Segmentation Analysis

- In 2021, the Smelter segment accounted for the largest share of the Market, with 25.6% and a Market revenue of 7.68 Billion.

Based on the product, the Alumina Market is categorized into Smelter, Chemical, Calcined, Tabular, Fused, Reactive and Aluminum Trihydrate. In 2021, the Smelter segment accounted for the largest share of the Market, with 25.6% and a Market revenue of 7.68 Billion. Throughout the forecast period, the Smelter segment is anticipated to maintain its leading position while expanding at the fastest CAGR Because this is explained by the increasing demand for aluminium from end-use industries is to blame for this sector's expansion. Over the course of the research period, the emergence of the automobile sector in emerging nations will increase demand for high-quality aluminium for use in interior and exterior body panels, engine components, and other applications.

- In 2021, the Aluminum Production segment accounted for the largest share of the Market, with 30.6% and a Market revenue of 9.18 Billion.

Based on the application, the Alumina Market is categorized into Aluminum Production, Non-Aluminum Production, Abrasives, Ceramics, Refractories, Filtration and Others. In 2021, the Aluminum Production segment accounted for the largest share of the Market, with 30.6% and a Market revenue of 9.18 Billion. Throughout the forecast period, the Aluminum Production segment is anticipated to maintain its leading position while expanding at the fastest CAGR Because Due to the increasing applications in end-use industries, there is a steady demand for high-quality aluminium products from the Asia Pacific and North American areas. The car industry's increased use of aluminium parts for external and interior parts will increase the market share for alumina. 80% of the weight of modern commercial aircraft is made up of aluminium. Additionally, the infrastructure sector in emerging nations will grow quickly, which will increase demand for aluminium.

Regional Segment Analysis of the Alumina Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Get more details on this report -

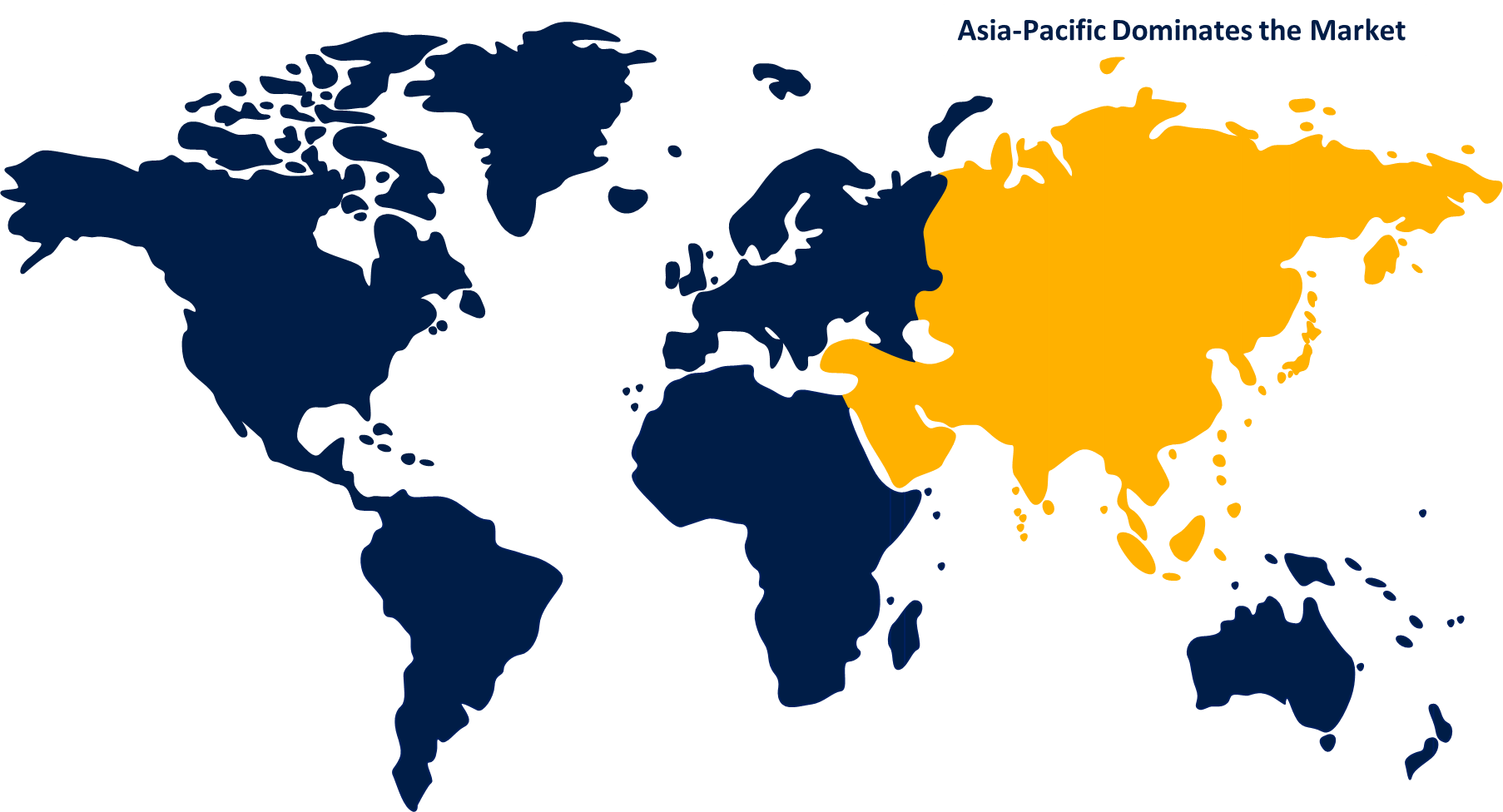

Asia Pacific emerged as the largest Market for the global Alumina Market, with a Market share of around 45.5% and 13.6 Billion of the Market revenue in 2021.

- Asia Pacific emerged as the largest Market for the global Alumina Market, with a Market share of around 45.5% and 13.65 Billion of the Market revenue in 2021. The demand for Alumina is being driven by the rising acceptance by the market. The market for Alumina was dominated by the Asia Pacific region Over the projection period, in recent years, nations including China, India, Japan, Malaysia, and South Korea have constantly promoted electric automobiles. Thanks to its supportive governmental policies and central planning, China produces more than half of the world's primary aluminium. Additionally, several nations are concentrating on the wastewater treatment sector to lessen water constraint, which boosts the overall income from the alumina market.

- North America Market is expected to grow at the fastest CAGR between 2021 and 2030, The demand for Alumina from the Cosmetics & Personal Care industries is expected to expand over the course of the forecast period, which reflects well for the North American Alumina market. Due to the increasing applications in end-use industries, there is a steady demand for high-quality aluminium products from North America areas.

Competitive Landscape

The report offers the appropriate analysis of the key organizations/companies involved within the global Alumina Market along with a comparative evaluation primarily based on their Product offering, business overviews, geographic presence, enterprise strategies, segment Market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including Product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the Market.

List of Key Market Players:

- C Alcoa

- Queensland Alumina Limited (QAL)

- Hindalco

- Safo Luas (Alumar)

- Hydro

- Porto Trombetas

- Aluminum Corporation of China

- BHP Billiton Group

- Glencore International

- CVG Bauxilum

- National Aluminum Company

- United Company RUSAL Alumina Limited

- Sangaredi

- Hariom Rocks

- Rio Tinto

Key Target Audience

- Market Players

- Investors

- Applications

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Some of the Key Developments:

- In November 2020, The second production line of the Huasheng, China-based Aluminum Corporation of China Ltd.'s alumina refinery has begun operation. The firm will be able to produce more alumina thanks to the new manufacturing line, which will also help them gain more market share.

- In June 2020, For its refineries in the Western Australian bauxite mines of Pinjarra and Huntly, Alcoa of Australia announced expansion plans. This will aid the business in satisfying the rising customer demand for alumina in the Australian and Asia-Pacific regions.

Market Segment

This study forecasts global, regional, and country revenue from 2019 to 2030. Spherical Insights has segmented the global Alumina Market based on the below-mentioned segments:

Market Drivers:

- Rising demand for alumina from the automotive industry

- Increasing demand in Developing nations

- The rising awareness about energy-saving initiatives among end-users

Restraint,

- High Cost and Low Awareness of Benefits

- Availability of Raw material

- Negative impact on demand of the product due to Covid 19

Opportunities:

- Increasing demand of HPA for electric vehicles

- Businesses are focusing on releasing new items to gain market share.

Global Alumina Market, By Product

- Smelter

- Chemical

- Calcined

- Tabular

- Fused

- Reactive

- Aluminum Trihydrate

Global Alumina Market, By Application

- Aluminum Production

- Non-Aluminum Production

- Abrasives

- Ceramics

- Refractories

- Filtration

- Others

Global Alumina Market, Regional Analysis

North America

- US

- Canada

- Mexico

Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

South America

- Brazil

- Argentina

- Rest of South America

Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Alumina market?As per Spherical Insights, the size of the Alumina market was valued at USD 30.00 billion in 2022 to USD 46.53 billion by 2030.

-

What is the market growth rate of the Alumina market?The Alumina market is growing at a CAGR of 5% from 2022 to 2030.

-

Which country dominates the Alumina market?Asia Pacific emerged as the largest market for Alumina.

-

Who are the key players in the Alumina market?Key players in the Alumina market are C Alcoa, Queensland Alumina Limited (QAL), Hindalco, Safo Luas (Alumar), Hydro, Porto Trombetas, Aluminum Corporation of China, BHP Billiton Group, Glencore International, CVG Bauxilum, National Aluminum Company, United Company RUSAL Alumina Limited, Sangaredi, Hariom Rocks, and Rio Tinto.

-

Which factor drives the growth of the Alumina market?Increasing demand in Developing nations is expected to drive the market's growth over the forecast period.

Need help to buy this report?