Global Aluminum Caps & Closures Market Size, Share & Trends, COVID-19 Impact Analysis Report, by Product Type (Roll-on pilfer-proof caps, Easy open end lids, Non-refillable closures), End-Use Sector (Beverage, Pharmaceutical, Food, Home & personal care): By Region (U.S., Canada, Mexico, Rest of North America, The UK, France, Germany, Italy, Spain, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, the Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America) – Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2021-2030

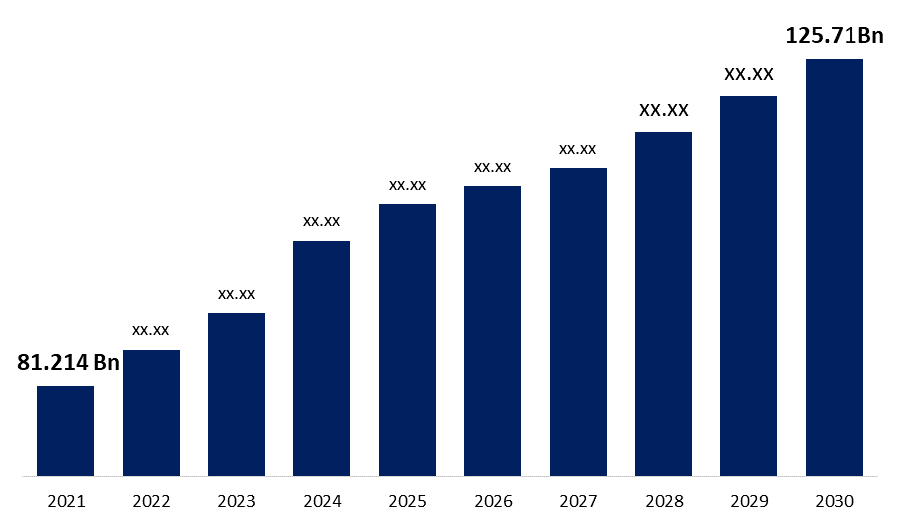

Industry: Advanced MaterialsThe Global Market for Aluminum Caps & Closures estimated at US$ 81.214Bn in the year 2021, is projected to reach a revised size of US$ 125.71 Bn by 2030, growing at a CAGR of 43.8%. The market for aluminum caps & closures is being driven by rising demand for convenience foods, worries about product security and safety, product distinctiveness and branding, and shrinking pack sizes. The packaging industry is expanding and growing, especially in developing nations like India and China, and there is a growing demand for creative packaging solutions made using cutting-edge manufacturing techniques. These factors, along with rising rates of consumption of both alcoholic and non-alcoholic beverages and rising personal disposable income, are what are fueling the growth of the packaging industry.

Get more details on this report -

Aluminum caps and closures are the aluminum-based coverings or lids that are used to cover the open ending mouth of bottles, jars, containers, and other items to avoid leakage. This is obvious from the term itself. The aluminum closures and caps provide further protection against external contamination.

The interest for FMCG items that emphasize enhanced lifestyles is increasing as the health and wellness trend shifts to preventative care. The unlawful refilling of syrups and soft drinks, as well as their counterfeiting, present a severe risk to consumer sentiment, welfare, and human health in a highly competitive market. To reassure customers about the safety and authenticity of the products they're purchasing, caps that prevent contamination, tampering, and counterfeiting are becoming more and more crucial.

Product Type Outlook

The roll-on pilfer-proof closures segment dominated the global aluminum caps & closures market owing to cost-efficient, compatible with the contents, simple to open, capable of providing an effective seal, and compliant with all applicable product, package, and environmental laws and regulations. Aluminum caps and closures in the beverage industry are tamper-resistant, which further aids in combating the problems with counterfeiting. The fact that roll-on tamper-proof caps combine the traditional decorating function of tamper-proof sealing and aid in maintaining the qualities of packaged goods is one of the main factors supporting this expansion. Either continuous threads or lugs are present in these closures.

Global Aluminum Caps & Closures Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | 81.214 billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 5.6% |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 116 |

| Segments covered: | By Product, By Region |

| Companies covered:: | Alameda Packaging, Alcopack, Alupac India, Alutop, Amcor, Cap & Seal Pvt Ltd, Closure Systems International, Crown Holding, Dyzdn Metal Packaging, EMA Pharmaceuticals, Federfin Tech S.R.L, Guala Closure, Helicap Closures, Herti JSC, ITC Packaging, Osias Berk, Shangyu Sanyou Electro-Chemical Aluminium Products, Silgan Holdings, Torrent Closures. |

| Growth Drivers: | 1)The roll-on pilfer-proof closures segment dominated the global aluminum caps & closures market 2)The pharmaceutical segment dominated the global aluminum caps & closures market |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

End-User Outlook

The pharmaceutical segment dominated the global aluminum caps & closures market owing to aluminum caps and closures are used to seal the medications to prevent contamination. To protect the contents from air, dust, and moisture, healthcare supplies must be packaged with the highest care. The demand for healthcare items in developing countries is driven by a growth in chronic illnesses, an ageing population, and a rise in disposable money, which drives the market for aluminum caps & closures.

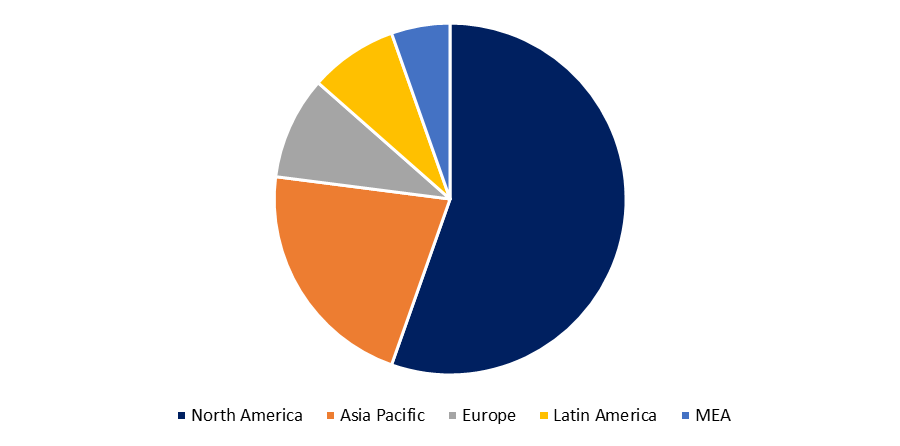

Regional Outlook

Asia Pacific region is dominating the market share of global Aluminum Caps & Closures market owing due to urbanization, industrialization, and rising population all contribute to the market's expansion for aluminum caps and closures. The demand for aluminum caps and closures has expanded as a result of China's growth as a major global manufacturing hub. The production of these goods in the area is boosted by the accessibility of raw materials and cheap labor.

Get more details on this report -

Key Companies & Recent Developments

Partnerships, strategic mergers, and acquisitions are expected to be the most successful strategies for industry participants to get speedy access to growing markets while also improving technological capabilities. In addition, product differentiation and developments, as well as service expansion, are projected to help organizations thrive in the market. Generic strategies adopted by the companies usually include mergers & acquisitions, distribution network expansion, and product portfolio expansion.

A new capping solutions package was unveiled in February 2018 by Crown Food Europe, a Crown Holdings subsidiary, to assist food processors in reducing total cost of ownership. The deal included selling its capping technology, extra parts, and qualified technical support for the duration of the machine's service life. This package included the selling of three of Crown's capping solutions: Smart Capper, Euro Capper, and Global Capper.

On September 2019, Berlin Packaging acquired Vetroservicesrl, a packaging supplier strategically positioned in central Italy's food and olive oil region. This will enable the business to grow and become a significant supplier of glass packaging to the food and wine industries.

Amcor purchased Bemis Company Inc. in June 2019. The new name of the business will be Amcor Plc (Amcor). The addition of scale, skills, and footprint from the purchase of Bemis has enhanced. The major companies profiled in this report include Alameda Packaging, Alcopack Group, Alutop, Alupac India, Cap & Seal Pvt. Ltd., Amcor, Dyzdn Metal Packaging, Closure Systems International, EMA Pharmaceuticals, Crown Holdings amongst others.

Segmentation:

By Product Type

- Roll-On-Pilfer-Proof

- Easy open ends

- Non-refillable closures

- Others

By End-Use

- Beverage

- Pharmaceutical

- Food

- Home & personal care

- Others

By Region

- North America- U.S., Mexico, Canada

- Europe- UK, France, Germany, Italy

- Asia-Pacific- China, Japan, India

- Latin America- Brazil, Argentina, Colombia

- The Middle East and Africa- United Arab Emirates, Saudi Arabia

Key Players

- Alameda Packaging

- Alcopack

- Alupac India

- Alutop

- Amcor

- Cap & Seal Pvt Ltd

- Closure Systems International.

- Crown Holding

- Dyzdn Metal Packaging

- EMA Pharmaceuticals

- Federfin Tech S.R.L

- Guala Closure

- Helicap Closures

- Herti JSC

- ITC Packaging

- Osias Berk

- Shangyu Sanyou Electro-Chemical Aluminium Products

- Silgan Holdings

- Torrent Closures

Need help to buy this report?