Global Aluminum Composite Panels Market Size, Share, and COVID-19 Impact Analysis, By Product (Polyvinylidene Difluoride, Polyester, Laminating Coating, Oxide Film, and Others), By Application (Building & Construction, Automotive, Advertising Board, Railways & Others): By Region (U.S., Canada, Mexico, Rest of North America, The UK, France, Germany, Italy, Spain, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, the Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America) - Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2021-2030

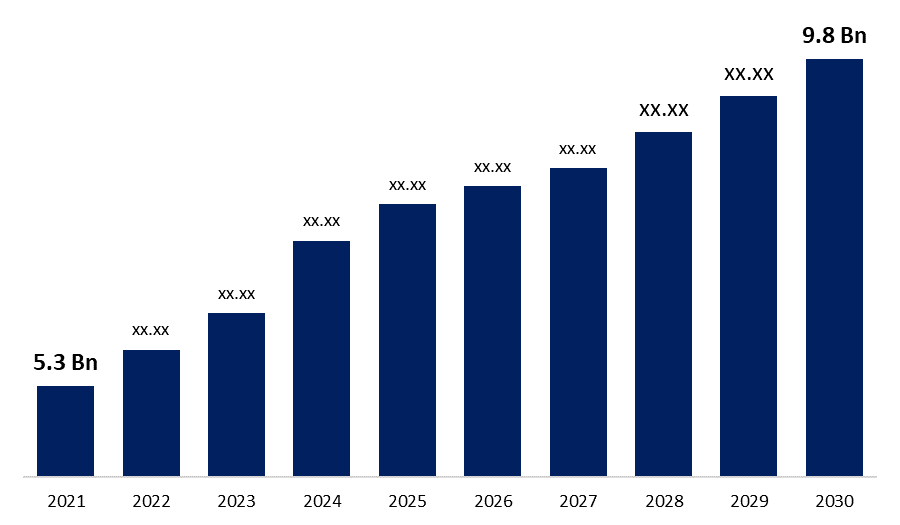

Industry: Advanced MaterialsThe Global Market For Aluminum Composite Panels Estimated at US$ 5.3 Bn in the year 2021, is projected to reach a revised size of US$ 9.8 Billion by 2030, growing at a CAGR of 5.8%. The non-toxic polyethylene (PE) core of aluminum composite panels (ACP) is surrounded by two pre-coated, thermally bonded aluminum skins on either side. In essence, they are flat panels constructed of an aluminum composite material that consists of two thin coil-coated sheets of aluminum connected to a core made of another material. ACPs are also employed in the construction of insulation, signs, and outside facades or cladding. Additionally, letter backing for channels and outdoor signs both employ aluminum composite panel sheets.

Get more details on this report -

ACPs are predicted to have a favourable impact on market growth over the course of the forecast period due to its good air and water barrier, flexibility, high load performance, and durability. By 2025, light-duty vehicles must meet Corporate Average Fuel Efficiency (CAFE) criteria of 54.5 mpg, according to rules laid forth by the US government. Thus, it is anticipated that the federal proposal to raise CAFE regulations will act as a significant catalyst for the use of lightweight materials, such as aluminum composites, in automobiles, ultimately propelling the market.

According to the survey, Business Monitor International (BMI) witnessed that European construction had real growth of 2.4% in 2018, supported by an uptick in demand, a rise in industry trust, higher exports, and an increase in supply. Real GDP growth has increased in emerging economies like Argentina, Brazil, and Chile every quarter. Emerging nations are exploring lifting technologies that are extremely competitive, efficient, and ecologically benign. Cranes with vertical lifting capabilities are in great demand in these nations because of their dense metropolitan populations. According to projections, the Asia Pacific region accounts for half of all construction investment worldwide, with China, Indonesia, Japan, South Korea, and Malaysia having the highest potential for growth.

A flat panel made of two aluminum alloy sheets joined together with a non-aluminum core is known as an aluminum composite panel (ACP). It is utilized in structures as cladding or facade material, insulation, and signs. ACPs are also used in a wide variety of vehicle body paneling-related applications. During the projected period, the market demand is anticipated to be driven by the rising need for PVDF-based aluminum composite panels. The presence of less expensive alternatives will probably impede market expansion. The market is expected to benefit in the future from significant investments made in hotels in ASEAN nations.

The increase in non-residential, residential, and several infrastructure projects is expected to cause the industry to grow at a rate of 4.2% annually in terms of market value. The construction industry in India is growing faster than average. The U.S. construction industry is growing quickly as a result of a healthy economy, favorable commercial real estate market conditions, and an increase in federal and state funds for institutional development and public infrastructure. Due to cheap financing rates, robust economic development, and unmet needs, the European construction industry is expanding quickly. The residential, non-residential, and civil engineering sectors—both new and renovated—support the expansion in Europe.

Aluminum Composite Panels Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 5.3 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 5.8% |

| 2030 Value Projection: | USD 9.8 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Product, By Application, By Region |

| Companies covered:: | 3A Composites GmbH, Arconic, Mitsubishi Chemical Corporation, Hyundai Alcomax Co.,Ltd., Fairfield Metal LLC, Alstrong Enterprises India (Pvt) Ltd, Jyi Shyang Industrial Co., Ltd., ALUMAX INDUSTRIAL CO., LTD., Yatai Industrial Group Co., Ltd., Shanghai Huayuan New Composite Materials Co., Ltd., Guangzhou Xinghe Aluminum Composite Panel Co., and other key vendors. |

| Growth Drivers: | 1)The Polyvinylidene Difluoride (PVDF) segment dominated the global aluminum composite panels market 2)The building & construction segment dominated the global aluminum composite panels market |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Product Outlook

The Polyvinylidene Difluoride (PVDF) segment dominated the global aluminum composite panels market owing to a variety of applications, such as lightweight buildings, fast trains, and billboards. Additionally, the market expansion is anticipated to profit from their properties, such as durability, corrosion resistance, and wear resistance. Due to qualities including exceptional stiffness, surface flatness, smoothness, and thermal and acoustical insulation, PE panels are among the most widely utilized materials. Future growth is predicted to be significant due to advantages including simple manufacture and processing.

Application Outlook

The building & construction segment dominated the global aluminum composite panels market owing to product's eco-friendly features are anticipated to boost demand for it in green structures, driving market expansion. Benefits provided by the product, such as thermal and acoustic insulation and corrosion resistance, are also anticipated to fuel their demand in the contemporary construction business. The segment growth product is also projected to be boosted over the coming few years by increasing product use in decorative and cladding applications to meet transitional building and energy standards.

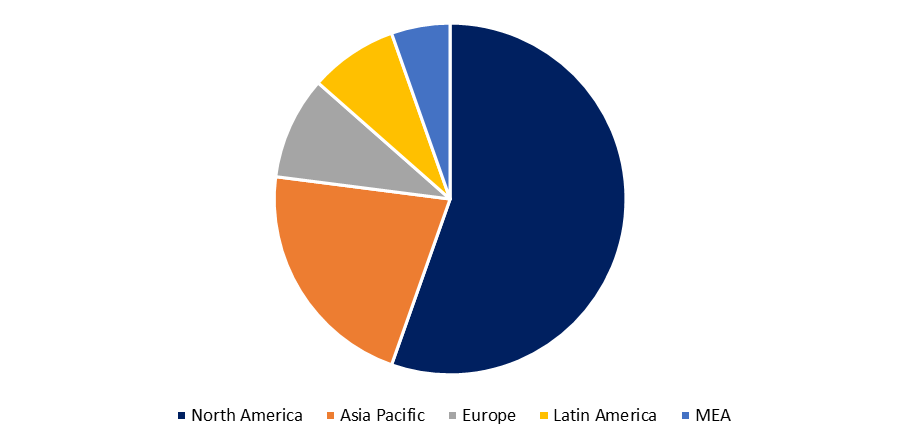

Regional Outlook

Asia Pacific region is dominating the market share of global aluminum composite panels market owing due to rapidly expanding construction sector is expected to positively affect the regional market, particularly in rising markets like China, India, Indonesia, and Vietnam. One of the main reasons influencing the region's growth is the expanding population in conjunction with government initiatives encouraging basic utilities and high demand for inexpensive homes.

Get more details on this report -

Key Companies & Recent Developments

Partnerships, strategic mergers, and acquisitions are expected to be the most successful strategies for industry participants to get speedy access to growing markets while also improving technological capabilities. In addition, product differentiation and developments, as well as service expansion, are projected to help organizations thrive in the market. Generic strategies adopted by the companies usually include mergers & acquisitions, distribution network expansion, and product portfolio expansion. For instance, in December 2020, The Fire-Retardant A1 Aluminum Composite Panels, created by Alubond, are a perfect sustainable alternative to façade cladding materials because they are completely non-combustible and emit no smoke in the case of a fire. In july 2017, 3A Composites acquired Athlone Extrusions which would enhance the company to strengthen its market in the transportation business across Europe. The major companies profiled in this report include Chinese manufacturers. Hyundai Alcomax Co, Mitsubishi Plastics, Inc.; Ltd, Arconic, Inc., Fairfield Metal LLC, Jyi Shyang Industrial and others.

Segmentation:

By Product

- Polyvinylidene Difluoride

- Polyester

- Laminating Coating

- Oxide Film

- Others

By Application

- Building & Construction

- Automotive

- Advertising Board

- Railways

- Others

By Region

- North America- U.S., Mexico, Canada

- Europe- UK, France, Germany, Italy

- Asia-Pacific- China, Japan, India

- Latin America- Brazil, Argentina, Colombia

- The Middle East and Africa- United Arab Emirates, Saudi Arabia

Key Players

- 3A Composites GmbH

- Arconic

- Mitsubishi Chemical Corporation

- Hyundai Alcomax Co.,Ltd.

- Fairfield Metal LLC

- Alstrong Enterprises India (Pvt) Ltd

- Jyi Shyang Industrial Co., Ltd.

- ALUMAX INDUSTRIAL CO., LTD.

- Yatai Industrial Group Co., Ltd.

- Shanghai Huayuan New Composite Materials Co., Ltd.

- Guangzhou Xinghe Aluminum Composite Panel Co., Ltd.

Need help to buy this report?