Global Ambroxol Hydrochloride Market Size, Share, and COVID-19 Impact Analysis, By Dosage Form (Inhalation, Syrup, Tablets, and Others), By Indication (Cough Treatment, Respiratory Diseases, Mucolytic Therapy, and Others), By Distribution Channel (Online Pharmacies, Retail Pharmacies, Hospital Pharmacies, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Ambroxol Hydrochloride Market Insights Forecasts to 2033

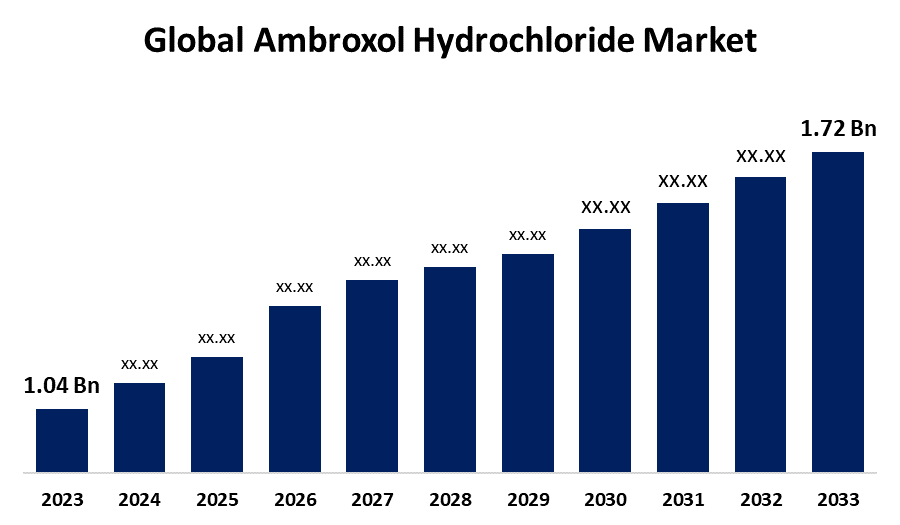

- The Global Ambroxol Hydrochloride Market Size was estimated at USD 1.04 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 5.16% from 2023 to 2033

- The Worldwide Ambroxol Hydrochloride Market Size is Expected to reach USD 1.72 Billion By 2033

- Asia Pacific is predicted to Grow at the fastest CAGR throughout the projection period

Get more details on this report -

The Global Ambroxol Hydrochloride Market Size is predicted to Exceed USD 1.72 Billion By 2033, growing at a CAGR of 5.16% from 2023 to 2033. The ambroxol hydrochloride market expansion is attributed to the increasing prevalence of respiratory diseases, increasing demand for the cough syrups, technological advancements in the drug formulation, the growing number of FDA approvals for the medicines.

Market Overview

The ambroxol hydrochloride market aims to develop, formulate, and commercialize ambroxol hydrochloride as a mucolytic agent. This mucolytic agent is used to manage respiratory diseases such as asthma, chronic obstructive pulmonary disease (COPD), and bronchitis. Ambroxol is used to treat bronchopulmonary diseases with excessive mucus secretion, including bronchiectasis, tracheobronchitis, bronchospasm asthma, and emphysema with bronchitis pneumoconiosis. These diseases cause pulmonary infections, inflammation of the trachea or windpipe, narrowing of airways, thick, sticky mucus, and difficulty in coughing out air. Ambroxol, a synthetic derivative of vasicine from the plant Adhatoda Vasica, is approved for use in 74 countries for respiratory diseases, particularly fluidizing bronchial secretions. Its favorable safety profile and low side effects make it available over the counter in most of the European Union. Ambroxol's properties have been determined due to its safety and tolerance, allowing for the development of various treatments.

The increasing prevalence of respiratory diseases accelerates the need for mucolytics such as ambroxol drugs and their combined derivatives, which results in the growth of the ambroxol hydrochloride market. For instance, the data provided by the National Library of Medicine states that acute bronchitis, a common outpatient illness in the United States, is characterized by inflammation in the bronchi lining and affects around 5% of adults annually, making it a frequent condition in emergency departments and primary care offices.

The demand for over-the-counter (OTC) ambroxol hydrochloride products is increasing as consumers seek accessible solutions for managing mild to moderate respiratory symptoms without prescription medications. The trend toward digital healthcare and telemedicine also contributes to the market growth, with online platforms and digital pharmacies providing greater accessibility and convenience. As demand for effective and safe respiratory therapies continues to rise, the global ambroxol hydrochloride market is expected to benefit from ongoing innovations and expanding applications, driving further market growth.

Report Coverage

This research report categorizes the global ambroxol hydrochloride market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the global ambroxol hydrochloride market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the global ambroxol hydrochloride market.

Global Ambroxol Hydrochloride Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.04 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.16% |

| 2033 Value Projection: | USD 1.72 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 116 |

| Segments covered: | By Dosage Form, By Indication, By Distribution, By Region |

| Companies covered:: | Cipla Ltd., Novartis AG, Zydus Cadila, AstraZeneca, Merck & Co., Inc., Lupin Limited, Sun Pharmaceuticals Industries Ltd., Mylan N.V., Hikma Pharmaceuticals PLC, GlaxoSmithKline plc, Aurobindo Pharma Limited, Torrent Pharmaceuticals Ltd., Glenmark Pharmaceuticals Ltd., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rise of personalized medicine accompanies the market growth and targeted therapies, with ambroxol hydrochloride being incorporated into specific treatment regimens based on genetic and clinical profiles. The ambroxol hydrochloride market is experiencing a surge in combination therapies, combining ambroxol hydrochloride with other active pharmaceutical ingredients (APIs) to offer comprehensive treatment options for respiratory disorders. This approach improves treatment efficacy and patient outcomes by addressing multiple aspects of respiratory health. Manufacturers are focusing on extended-release and sustained-release formulations, offering prolonged therapeutic effects and reducing dosing frequency.

Restraining Factors

Stringent regulatory environments like the FDA and EMA can delay new formulations and limit market entry for smaller players. Patent expiries can increase competition from generic drugs, affecting pricing and market share. Alternative treatments and potential side effects of ambroxol hydrochloride can additionally affect patient preference and market growth.

Market Segmentation

The global ambroxol hydrochloride market share is classified into dosage form, indication, and distribution channel.

- The tablets segment held a significant share in 2023 and is anticipated to grow at a remarkable CAGR throughout the forecast period.

Based on the dosage form, the global ambroxol hydrochloride market is categorized into inhalation, syrup, tablets, and others. Among these, the tablets segment held a significant share in 2023 and is anticipated to grow at a remarkable CAGR throughout the forecast period. The segment's growth is attributed to the ease of administration, patient compliance, tablet coating procedures that mask the unpleasant taste of the tablet, accurate and precise dosing, greater stability, longer shelf life, cost-effectiveness, and rapid onset of action.

- The respiratory diseases segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR throughout the projected timeframe.

Based on the indication, the global ambroxol hydrochloride market is categorized into cough treatment, respiratory diseases, mucolytic therapy, and others. Among these, the respiratory diseases segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR throughout the projected timeframe. The segmental expansion is attributed to the rising prevalence of chronic obstructive pulmonary diseases (COPD), asthma, bronchitis, growing use of the ambroxol hydrochloride for the symptomatic relief of respiratory diseases, and growing number of geriatric populations.

- The hospital pharmacies segment accounted for a significant share in 2023 and is expected to grow at a remarkable CAGR throughout the projected timeframe.

Based on the distribution channel, the global ambroxol hydrochloride market is categorized into online pharmacies, retail pharmacies, hospital pharmacies, and others. Among these, the hospital pharmacies segment accounted for a significant share in 2023 and is expected to grow at a remarkable CAGR throughout the projected timeframe. The segment growth is attributed to the accessibility of specialized care units, availability of wide stocks of mucolytic medications, presence of the skilled pharmacist, and collaborations of the hospital pharmacies with hospital and healthcare professionals, resulting in better outcomes of the patient health and provision of the cost-effective medications with insurance and Mediclaim services.

Regional Segment Analysis of the Global Ambroxol Hydrochloride Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global ambroxol hydrochloride market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global ambroxol hydrochloride market over the predicted timeframe. The ambroxol market in North America is driven by the rising cases of airway diseases, asthma, bronchitis, COPD, the geriatric population, and rising diagnostic procedures. The high incidence of chronic respiratory diseases, the sophisticated healthcare system, and the emphasis on research and development are the drivers behind development. In addition to its established healthcare system and high level of patient awareness, the United States, in particular, contributes significantly to the industry. The ongoing development of novel formulations and the growing uptake of cutting-edge drug delivery technologies are anticipated to propel the North American market's growth.

Asia Pacific is anticipated to grow at the fastest CAGR throughout the projected timeframe. The high prevalence of respiratory disorders, rising healthcare costs, and a sizable and expanding population are the primary contributors to the market growth in Asia Pacific. Government programs are helping nations like China and India increase their capacity to manufacture pharmaceuticals and improve access to medical services and medications by making large investments in healthcare infrastructure.

Competitive Analysis:

The report offers an appropriate analysis of the key organizations/companies involved within the global ambroxol hydrochloride market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cipla Ltd.

- Novartis AG

- Zydus Cadila

- AstraZeneca

- Merck & Co., Inc.

- Lupin Limited

- Sun Pharmaceuticals Industries Ltd.

- Mylan N.V.

- Hikma Pharmaceuticals PLC

- GlaxoSmithKline plc

- Aurobindo Pharma Limited

- Torrent Pharmaceuticals Ltd.

- Glenmark Pharmaceuticals Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, Ambroxol, the active ingredient in cough syrup, is set to enter a Phase 3 clinical trial in Parkinson's disease patients. The compound has been shown to help clear mucus and display anti-inflammatory properties. In a Phase 2 trial, it increased levels of glucocerebrosidase (GCase), a protein that helps cells clear waste products. Ambroxol crossed the blood-brain barrier and was safe and well-tolerated. The international Linked Clinical Trials (iLCT) program, a partnership between Cure Parkinson's and Van Andel Institute, has prioritized research of ambroxol. Over 300 patients were randomized to treatment with ambroxol or placebo for two years.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global ambroxol hydrochloride market based on the below-mentioned segments:

Global Ambroxol Hydrochloride Market, By Dosage Form

- Inhalation

- Syrup

- Tablets

- Others

Global Ambroxol Hydrochloride Market, By Indication

- Cough Treatment

- Respiratory Diseases

- Mucolytic Therapy

- Others

Global Ambroxol Hydrochloride Market, By Distribution Channel

- Online Pharmacies

- Retail Pharmacies

- Hospital Pharmacies

- Others

Global Ambroxol Hydrochloride Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global ambroxol hydrochloride market?The global ambroxol hydrochloride market is projected to expand at a CAGR of 5.16% during the forecast period.

-

2. Who are the top key players in the global ambroxol hydrochloride market?The key players in the global ambroxol hydrochloride market are Cipla Ltd., Novartis AG, Zydus Cadila, AstraZeneca, Merck & Co., Inc., Lupin Limited, Sun Pharmaceuticals Industries Ltd., Mylan N.V., Hikma Pharmaceuticals PLC, GlaxoSmithKline plc, Aurobindo Pharma Limited, Torrent Pharmaceuticals Ltd., Glenmark Pharmaceuticals Ltd., and others.

-

3. Which region holds the largest share of the market?North America is anticipated to hold the largest share of the global ambroxol hydrochloride market over the predicted timeframe.

Need help to buy this report?