Global Amino Acid For Agriculture Market Size, Share, and COVID-19 Impact Analysis, By Crop Type (Turf & Ornamentals, Oilseeds & Pulses, Fruits & Vegetables, Cereals & Grains, and Other Crops), By Product (Liquid, Powder, and Granules), By Application (Fertilizers, Animal Feed, and Plant Growth Regulators), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: AgricultureGlobal Amino Acid For Agriculture Market Insights Forecasts to 2033

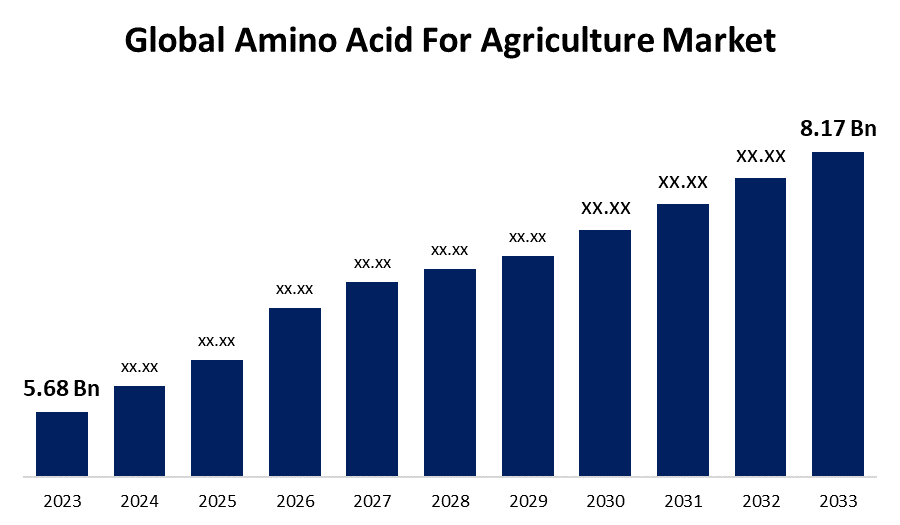

- The Global Amino Acid For Agriculture Market Size was Valued at USD 5.68 Billion in 2023

- The Market Size is Growing at a CAGR of 3.7% from 2023 to 2033

- The Worldwide Amino Acid For Agriculture Market Size is Expected to Reach USD 8.17 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Amino Acid For Agriculture Market Size is Anticipated to Exceed USD 8.17 Billion by 2033, Growing at a CAGR of 3.7% from 2023 to 2033.

Market Overview

The most fundamental components of proteins, amino acids are vital to plants and have a significant role in their functioning. Minerals that are vital to plant growth and abundant in amino acids. Nearly all crops, including potatoes, chili, tomatoes, onions, wheat, corn, and groundnuts, might be grown with it. These organic molecules are the most energy-efficient form of nitrogen fertilizer for plants to use, which, when properly applied, will ultimately result in larger, higher-quality yields. They are also environmentally friendly, require far less energy to produce, can be entirely derived from plants, and promote beneficial microbial activity and soil fertility.

To address changing agricultural needs and customer preferences, the amino acid fertilizer industry is concentrated on innovation, technological integration, and market expansion. To improve the efficacy, stability, and compatibility of amino acid fertilizer formulations with other inputs and farming systems, manufacturers are spending money on research and development. Novel approaches to addressing specific nutrient deficits and improving crop nutrition management tactics include slow-release formulations, biofortified fertilizers, and micronutrient-enriched amino acid complexes.

For Instance, according to the International Fertilizers Association (IFA), Between 2022 and 2024, ammonia capacity is expected to rise by 2%, to 193.8 Mt N. The US and Russia, where natural gas-based projects are already under development, are the low-cost regions where nitrogen capacity growth is concentrated. Tax incentives in the US have made investing in blue ammonia CO2 sequestered through carbon capture and storage much more profitable.

The adoption of organic agricultural techniques drives revenue growth in the agricultural amino acid market. Growing public awareness of the detrimental effects that chemical fertilizers have on the environment and human health has led to an increase in the usage of organic farming practices.

Report Coverage

This research report categorizes the market for amino acid for agriculture market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the amino acid for agriculture market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the amino acid for agriculture market.

Global Amino Acid For Agriculture Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.68 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.7% |

| 2033 Value Projection: | USD 8.17 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 177 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Crop Type, By Product, By Application, and By Region. |

| Companies covered:: | Ajinomoto Group, CJ CheilJedang Corp., Degussa Corporation, Kyowa Hakko Kirin Co. Ltd., Yara International ASA, Novozymes A/S, CHS Inc., BASF SE, Evonik Industries AG, Haifa Chemicals, Arab Potash Company, Omex, Everris, Bunge, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Agriculture production is a highly labor-intensive industry where higher yield and quality are directly correlated with increased profitability. Proteins are the fundamental unit of living cells, and their building blocks are amino acids. Amino acid sequences combine to produce proteins. By forming carbonate through photosynthesis and combining it with the nitrogen they draw from the soil, plants use secondary metabolic pathways to synthesize amino acids. Plants synthesize amino acids from primary elements such as carbon and oxygen from the air, hydrogen from water in the soil, and carbon. The adoption of organic agricultural techniques drives revenue growth in the agricultural amino acid market. Growing public awareness of the detrimental effects that chemical fertilizers have on the environment and human health has led to an increase in the usage of organic farming practices. Amino acids from natural sources including fish, seaweed, and plant extracts are preferred in the organic farming industry.

Restraining Factors

The market for agricultural amino acids is growing in income due to the use of organic farming methods. Increased use of organic farming techniques is a result of growing public awareness of the harmful impact that chemical fertilizers have on the environment and human health. In the world of organic farming, amino acids derived from natural sources like fish, seaweed, and plant extracts are favored.

Market Segmentation

The amino acid for agriculture market share is classified into crop type, product, and application.

- The fruits & vegetables segment is estimated to hold the highest market revenue share through the projected period.

Based on the crop type, the amino acid for agriculture market is classified into turf & ornamentals, oilseeds & pulses, fruits & vegetables, cereals & grains, and other crops. Among these, the fruits & vegetables segment is estimated to hold the highest market revenue share through the projected period. The application of amino acids to fruits & vegetables has the advantage of saving a significant amount of energy during production. This energy savings can be seen in improved plant vigor and stress tolerance, as well as a significant reduction in the harm that stress situations cause to fruits & vegetables' quality and performance. The availability of amino acids in the amounts required by the plant at different stages of growth, particularly crucial stages like fruit set, fertilization, and pollination; or when exposed to any conditions of environmental or pathological stress, improves the plant's properties and yield. Spraying vegetative plants with amino acids, which have been shown to improve the production and quality of many vegetable and fruit crops, is one of the most significant strategies to give these organic resources.

For instance, in January 2022, For the Chinese market, Bayer Crop Science announced the release of Ambition, a crop supplement formulation including fulvic and amino acids. The substance enhances photosynthesis and encourages plant development. It improves fruit setting and fertility. Additionally, it has been demonstrated that amino acids activate defense enzymes for greater tolerance to abiotic stress and enhance nutrient penetration in the plant system (glycine's chelating activity). Strong transporters of vital nutrients into plant cells are fulvic acids. They increase the antioxidant enzymes' activity, which helps plants withstand abiotic stress.

- The liquid segment is anticipated to hold the largest market share through the forecast period.

Based on the product, the amino acid for agriculture market is divided into liquid, powder, and granules. Among these, the liquid segment is anticipated to hold the largest market share through the forecast period. This is attributed to the liquid amino acids' ease of application and quick uptake by plants. Liquid amino acids are quickly absorbed by the roots and foliage of a plant when they are sprayed on the leaves or applied directly to the soil. Furthermore, they are more effective in increasing nutrient uptake, stress tolerance, and plant growth and productivity. Liquid amino acids are a popular choice for farmers and crops because they are also affordable and easy to transport.

- The fertilizers segment dominates the market with the largest market share through the forecast period.

Based on the application, the amino acid for agriculture market is categorized into fertilizers, animal feed, and plant growth regulators. Among these, the fertilizers segment dominates the market with the largest market share through the forecast period. Amino acid fertilizers are used to increase the fertility of the soil and provide essential nutrients to plants. They enhance nutrient uptake, promote root growth, and increase plant production. Furthermore, fertilizers containing amino acids improve plants' stress tolerance, strengthening their resistance to adverse weather. They are also environmentally friendly and have no adverse effects on plant growth or soil fertility.

Regional Segment Analysis of the Amino Acid For Agriculture Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

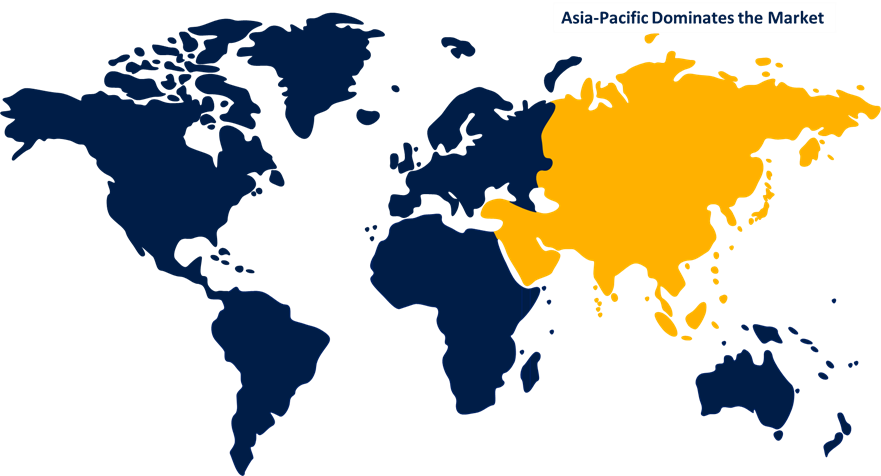

Asia Pacific is anticipated to hold the largest share of the amino acid for agriculture market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the amino acid for agriculture market over the predicted timeframe. Top of FormGrowing economies like China and India, where agriculture accounts for a sizable portion of GDP, are expected to see an increase in the need for amino acids in agriculture. Another element increasing demand is the accessibility of low-cost fertilizers and animal feed that is based on amino acids in the area. The region's need for amino acids in agriculture is being further stimulated by the expansion of the e-commerce industry, which is making it easier to obtain a variety of agricultural inputs, including goods based on amino acids. It is also expected that the presence of major rivals offering a variety of incentives, such as rebates and discounts, will draw more consumers to the area and quicken the rise of market revenue.

North America is expected to grow at the fastest CAGR growth of the amino acid for agriculture market during the forecast period. Ammonia fertilizer is becoming more and more in demand, and many see it as the fuel of the future, particularly for the maritime sector. The US ammonia market is projected to expand by 7.8% between 2020 and 2025. The fertilizer sector is the main cause of the need for ammonia during that time. The US ranks among the top manufacturers and users of ammonia worldwide. An estimated 14 million metric tons of ammonia were produced in the United States in 2023. In the US that year, ammonia was produced at 36 plants by 17 different corporations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the amino acid for agriculture market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ajinomoto Group

- CJ CheilJedang Corp.

- Degussa Corporation

- Kyowa Hakko Kirin Co. Ltd.

- Yara International ASA

- Novozymes A/S

- CHS Inc.

- BASF SE

- Evonik Industries AG

- Haifa Chemicals

- Arab Potash Company

- Omex

- Everris

- Bunge

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2023, Redox and CJ Bio partnered to bring AMIBOOST, a premium biostimulant enhanced with specific amino acids, to help in this continuous battle. With consideration for the demands of different plant types and growth phases, this amazing product is painstakingly crafted to enhance crop output and quality. These amino acids function as immune system builders, boosting a plant's ability to withstand hardship by acting as catalysts for its secondary metabolism.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the amino acid for agriculture market based on the below-mentioned segments:

Global Amino Acid For Agriculture Market, By Crop Type

- Turf & Ornamentals

- Oilseeds & Pulses

- Fruits & Vegetables

- Cereals & Grains

- Other Crops

Global Amino Acid For Agriculture Market, By Product

- Liquid

- Powder

- Granules

Global Amino Acid For Agriculture Market, By Application

- Fertilizers

- Animal Feed

- Plant Growth Regulators

Global Amino Acid For Agriculture Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the amino acid for the agriculture market over the forecast period?The amino acid for agriculture market is projected to expand at a CAGR of 3.7% during the forecast period.

-

2. What is the market size of the amino acid for the agriculture market?The global amino acid for agriculture market Size is Expected to Grow from USD 5.68 Billion in 2023 to USD 8.17 Billion by 2033, at a CAGR of 3.7% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the amino acid agriculture market?Asia Pacific is anticipated to hold the largest share of the amino acid agriculture market over the predicted timeframe.

Need help to buy this report?