Global Ammonium Sulfate Market Size, Share, and COVID-19 Impact Analysis, By Form (Solid, Liquid), By Production Process (Caprolactam, Coke Oven Gas, Gypsum, Neutralization, Others), By Application (Fertilizers, Water Treatment, Pharmaceuticals, Food and Feed Additives, Other Applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Ammonium Sulfate Market Insights Forecasts to 2033

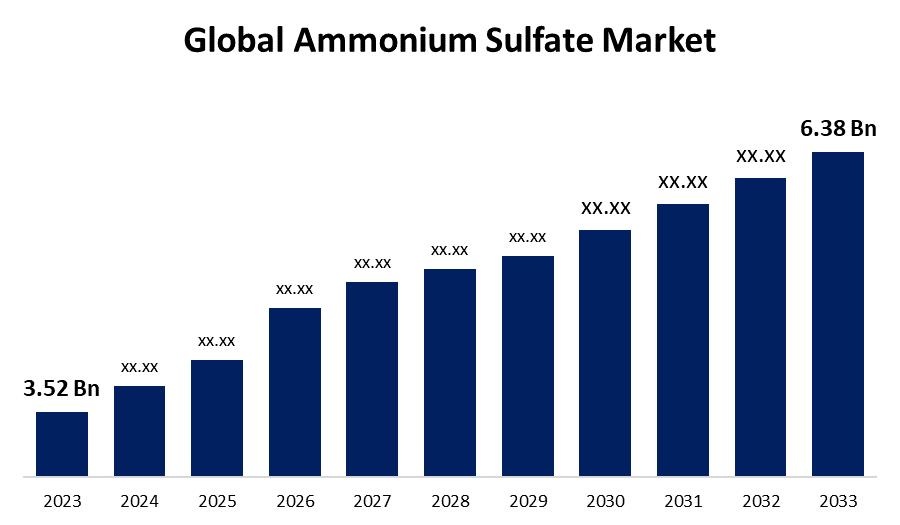

- The Global Ammonium Sulfate Market Size Was Estimated at USD 3.52 Billion in 2023

- The Market Size is expected to grow at a CAGR of around 6.13% from 2023 to 2033

- The Worldwide Ammonium Sulfate Market Size is Expected to Reach USD 6.38 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global ammonium sulfate market size was valued at USD 3.52 Billion in 2023 and is expected to exceed USD 6.38 Billion by 2033, growing at a CAGR of 6.13% from 2023 to 2033. The global market of ammonium sulfate is expanding due to the growing agricultural practices and the heightened need for nitrogen-based fertilizers significantly contributes, as ammonium sulfate efficiently resolves nitrogen and sulfur shortages in plants. Moreover, its increasing use in industrial sectors like chemical production and water purification boosts market expansion. Additionally, the movement toward sustainable farming and the use of environmentally friendly fertilizers boost the demand for ammonium sulfate, making it a crucial element in both agricultural and industrial uses.

Market Overview

The ammonium sulfate market includes the production, manufacturing, and distribution of ammonium sulfate. This is a chemical compound mostly used in the agriculture sector as a fertilizer because of its high amount of nitrogen and sulfur ingredients. These are important nutrients for plant growth. It is a key element of the agriculture sector, particularly in areas with sulfur-deficient soils.

Increased food demand from population growth leads to elevated agricultural production. In 2023, worldwide nitrogen fertilizer usage reached at 187.92 million metric tons, making up 58% of overall fertilizer consumption. The need for greater yields led to increased consumption, with China alone consuming 24.81 million metric tons. Quick consumption accelerates market expansion since many soils do not have enough nitrogen for farming. Fertilizers containing nitrogen are essential for the growth of plants. Farmers depend on these fertilizers to supply the essential nitrogen needed for robust plant growth and maximum crop yields.

Moreover, the operating manufacturers contribute market growth of ammonium sulfate by optimizing production processes, developing innovative products, expanding market reach through partnerships and collaborations, and investing in research and development to create more efficient and sustainable production methods, while focusing on enhancing product quality to meet the increasing demands from various sector such as Agriculture, leather industry, water treatment, and alum production. Which helps to enhance product sales as well as empower to ammonium sulfate industry growth.

Report Coverage

This research report categorizes the global ammonium sulfate market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global ammonium sulfate market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global ammonium sulfate market.

Global Ammonium Sulfate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.52 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 6.13% |

| 023 – 2033 Value Projection: | USD 6.38 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Form, By Production Process, By Application and By Region |

| Companies covered:: | Domo Chemicals J.R. Simplot Company BASF SE Sumitomo Chemical Co., Ltd. Arkema Aarti Industries Ltd Honeywell International Inc Evonik Industries AG Gujarat State Fertilizers & Chemicals Limited (GSFC) Novus International, Inc. AdvanSix Inc. Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising population across the world causes high consumption of food and demands for more crop yield. So, agriculture productivity needs to be boosted, and regions with nitrogen deficiency raise the need for the ammonium sulfate content to recover and enhance crop production. And making ammonium sulfate vital for soil enrichment to sustain crop health and yield. Because of this fertilizer usage in the agricultural sector has increased. Also, the granting of fertilizer purchase subsidies by the governments of several countries. Over the years, increased demands for fertilizer steadily.

Additionally, water treatment facilities are also embracing the compound. The compound regulates the pH balance in water treatment facilities and minimizes scaling in industrial processes. Ammonium sulfate is also utilized in pharmaceuticals, flame retardants, and the processing of food. Its industrial uses continue to grow. Due to the demand for dependable and affordable chemical processing, ammonium sulfate remains an essential element across various industries.

Restraints and Challenges

Ammonium sulfate has become essential for agricultural growth and is under research because of its environmental and health hazards. It leads to soil deterioration, water contamination, and emissions of greenhouse gases. As awareness increases, tougher regulations could impede its market expansion. Additionally, its harmfulness presents significant health dangers with extended exposure, leading to skin and eye irritation, and threatening aquatic ecosystems.

Market Segmentation

The global ammonium sulfate market share is classified by form, production process, and application.

- The solid held a major share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the form, the global ammonium sulfate market is divided into solid and liquid. Among these, the solid segment held a major share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The major share holding of the segment is mainly driven by its widespread use in agriculture as a nitrogen and sulfur-based fertilizer that improves soil quality and promotes plant growth. Solid ammonium sulfate is preferred, especially for large-scale farming operations, as it is simpler to manage, store, and use. Due to its sturdy form, it excels at evenly and accurately distributing fertilizer.

- The caprolactam secured the largest share in 2023 and is anticipated to grow at a notable CAGR during the forecast period.

Based on the production process, the global ammonium sulfate market is separated into caprolactam, coke oven gas, gypsum, neutralization, others. Among these, the caprolactam segment secured the largest share of the market in 2023 and is anticipated to grow at a notable CAGR during the forecast period. The segmental dominance is attributed to the widespread application of caprolactam in producing nylon, an essential synthetic material. Ammonium sulfate is an essential element of the chemical sector as it is a byproduct in the manufacturing of caprolactam.

- The fertilizers held a dominant market position in 2023 and are anticipated to grow at a remarkable CAGR during the forecast period.

Based on the application, the global ammonium sulfate market is classified into fertilizers, water treatment, pharmaceuticals, food and feed additives, and other applications. Among these, the fertilizers segment held a dominant market position in 2023 and is anticipated to grow at a notable CAGR during the forecast period. The segmental growth is attributed to the vital role of nitrogen and sulfur fertilizers that improve soil health and boost crop production. Its rich nutrient composition, offering essential nitrogen and sulfur to support plant development, renders it a favored option in farming. To guarantee robust crop production and enhance overall soil health.

Regional Segment Analysis of the Global Ammonium Sulfate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

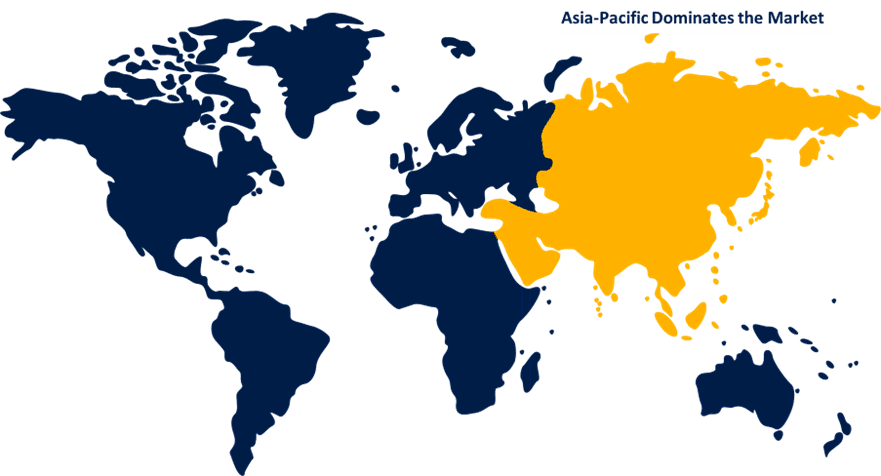

Asia Pacific region is expected to hold the largest share of the global ammonium sulfate market during the forecast period.

Get more details on this report -

Asia Pacific region is expected to hold the largest share of the global ammonium sulfate market during the forecast period. Regional growth is attributed to the growing demand for fertilizers based on nitrogen and an increase in agricultural activity. Effective ammonium sulfate-based fertilizers are essential to increasing food yields in the area, which is rapidly becoming more industrialized and populated. Ammonium sulfate usage is further accelerated by government schemes that promote sustainable farming methods and enhance soil health. Also, government initiatives related to fertilizers reduce the expense of fertilizer and increase the popularity across the region.

Europe is anticipated to fastest growth during the forecasting period. This regional development is driven by conventional farming techniques alongside the growing adoption of sustainable agricultural methods. The advanced economies have driven consumer purchasing power, while the growing awareness of eco-friendly fertilizers is increasing the revenue of sustainable options like ammonium sulfate. Additionally, government regulations aimed at reducing the use of harmful chemical fertilizers indirectly promote market growth throughout the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global ammonium sulfate market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers and acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Domo Chemicals

- J.R. Simplot Company

- BASF SE

- Sumitomo Chemical Co., Ltd.

- Arkema

- Aarti Industries Ltd

- Honeywell International Inc

- Evonik Industries AG

- Gujarat State Fertilizers and Chemicals Limited (GSFC)

- Novus International, Inc.

- AdvanSix Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2023, Azersulfat LLC has produced fertilizers that include ammonium sulphate. The company plans to increase production of sulfuric acid and ammonium sulphate fertilizer to counter the elevated prices in the fertilizer market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global ammonium sulfate market based on the below-mentioned segments:

Global Ammonium Sulfate Market, By Form

- Solid

- Liquid

Global Ammonium Sulfate Market, By Production Process

- Caprolactam

- Coke Oven Gas

- Gypsum

- Neutralization

- Others

Global Ammonium Sulfate Market, By Application

- Fertilizers

- Water Treatment

- Pharmaceuticals

- Food and Feed Additives

- Other Applications

Global Ammonium Sulfate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East and Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global ammonium sulfate market over the forecast period?The global ammonium sulfate market size was estimated at USD 3.52 billion in 2023 and is expected to exceed USD 6.38 billion by 2033, growing at a CAGR of 6.13% from 2023 to 2033.

-

2. Which region holds the largest share of the global ammonium sulfate market?The Asia Pacific region is expected to possess the largest share of the global ammonium sulfate market during the forecast period.

-

3. Who are the top key players in the global ammonium sulfate market?Domo Chemicals, J.R. Simplot Company, BASF SE, Sumitomo Chemical Co., Ltd., Arkema, Aarti Industries Ltd, Honeywell International Inc, Evonik Industries AG, Gujarat State Fertilizers and Chemicals Limited (GSFC), Novus International, Inc., AdvanSix Inc., and Others.

Need help to buy this report?