Global Amphoteric Surfactants Market Size, Share, and COVID-19 Impact Analysis, By Type (Amine Oxide, Amphoacetates, Amphopropionates, Betaine, Substituted Imidazoline, and Sultaines), By Function (Detergency, Emulsifiers, Foaming Agents, and Wetting Agents), By Application (Home Care, Industrial & Institutional Cleaning, Oil & Gas, Personal Care, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Amphoteric Surfactants Market Insights Forecasts to 2033

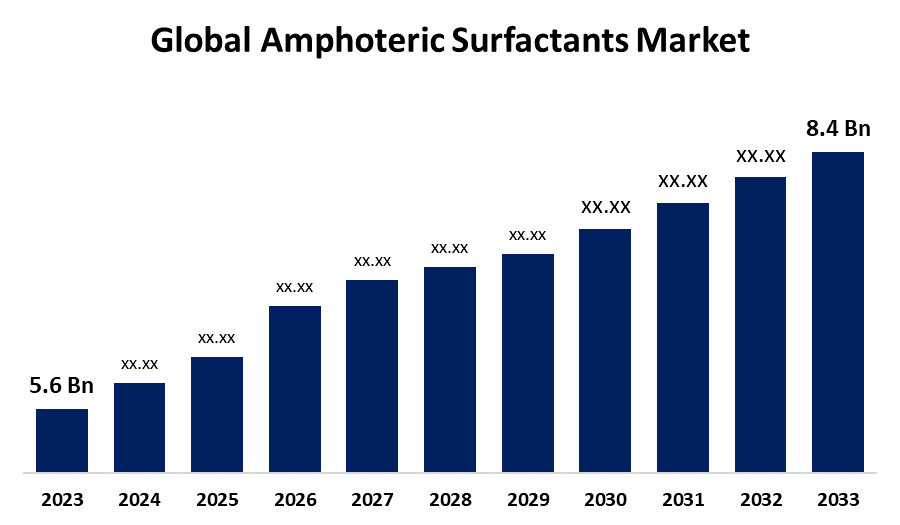

- The Global Amphoteric Surfactants Market Size was Estimated at USD 5.6 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 4.14% from 2023 to 2033

- The Worldwide Amphoteric Surfactants Market Size is Expected to Reach USD 8.4 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Amphoteric Surfactants Market Size is anticipated to exceed USD 8.4 Billion by 2033, growing at a CAGR of 4.14% from 2023 to 2033. The versatile properties of amphoteric surfactants and its growing need in various industries are responsible for driving the market growth.

Market Overview

The amphoteric surfactants market refers to the market for surface-active chemical compounds that can act as both cationic and anionic surfactants, having both acidic and alkaline properties. They are used in personal care products such as shampoos and cosmetics. Shampoos and body soaps mostly contain amphoteric surfactants to enhance detergency, lathering, feel of usage, and lessen irritation. The benefits of amphoteric surfactants include low CMC, good resistance to multivalent cations, high tolerance to salt, and compatibility with all other surfactant types. The mechanical performance, surface hydrophilicity, and dehydration of cotton textiles were all enhanced by the addition of amphoteric surfactants. Cotton fabric with amphoteric surfactants had reduced residual moisture content than when anionic surfactants were added. The increasing need for bio-based amphoteric surfactants and sustainable green surfactants is offering market growth opportunities for amphoteric surfactants as industries and consumers are focusing on sustainability and environmental responsibility.

Report Coverage

This research report categorizes the amphoteric surfactants market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the amphoteric surfactants market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the amphoteric surfactants market.

Global Amphoteric Surfactants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 5.6 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.14% |

| 023 – 2033 Value Projection: | USD 8.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Function, By Application, By Regional |

| Companies covered:: | BASF, Croda International, Nouryon, Akzo Nobel, Clariant, Dow, DuPont, Evonik Industries AG, The Lubrizol, ADEKA CORPORATION, Stepan, Galaxy Surfactants, Huntsman International, STOCKMEIER Group, Innospec, Others, and |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The increasing demand for personal care products like shampoos, body washes, and facial cleansers is driving the amphoteric surfactants market due to its increased usage. Amphoteric surfactants have significant environmental benefits due to their high biodegradability and milder nature, reducing potential irritation to skin and eyes. The innovation in product development achieved via the use of bio-based raw materials and optimized formulation technologies to cater to the increasing demand for eco-friendly personal care and cleaning products is propelling the market growth for amphoteric surfactants.

Restraining Factors

The availability of alternative products including anionic, cationic, and non-ionic surfactants that are relatively inexpensive, accessible, and effectively meet the desired objective in different industries may hamper the amphoteric surfactants market.

Market Segmentation

The amphoteric surfactants market share is classified into type, function, and application.

- The betaine segment dominates the market with the largest market share and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the amphoteric surfactants market is classified into amine oxide, amphoacetates, amphopropionates, betaine, substituted imidazoline, and sultaines. Among these, the betaine segment dominates the market with the largest market share and is anticipated to grow at a significant CAGR during the forecast period. Betaine amphoteric surfactants that have positive and negative charges in the same molecule are used in many products such as cosmetics, dish liquids, and hard surface cleaners.

- The foaming agents segment is expected to hold the largest market share and is anticipated to grow at a significant CAGR during the forecast period.

Based on the function, the amphoteric surfactants market is classified into detergency, emulsifiers, foaming agents, and wetting agents. Among these, the foaming agents segment is expected to hold the largest market share and is anticipated to grow at a significant CAGR during the forecast period. Amphoteric surfactants are frequently used as foaming agents as they can produce rich and stable foam, especially in personal care products like shampoos and body washes. This makes them both versatile and gentle on the skin.

- The personal care segment is dominating the market with the largest market share and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the amphoteric surfactants market is classified into home care, industrial & institutional cleaning, oil & gas, personal care, and others. Among these, the personal care segment is dominating the market with the largest market share and is expected to grow at a significant CAGR during the forecast period. Personal care products, including body washes, face cleansers, and infant shampoos, frequently contain amphoteric surfactants. They are perfect for products meant for sensitive skin because of their gentle nature and compatibility with the skin.

Regional Segment Analysis of the Amphoteric Surfactants Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the amphoteric surfactants market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the amphoteric surfactants market over the predicted timeframe. The increasing need for soaps and detergents for home applications is driving the market demand for amphoteric surfactants. The growing environmental awareness and laws supporting green chemicals are driving the need for bio-based surfactants in Southeast Asia, which is fueling the market growth in the region.

Asia Pacific is expected to grow at the fastest CAGR growth of the amphoteric surfactants market during the forecast period. The rising demand for amphoteric surfactants in personal care, household cleaning products, and industrial applications is driving the market demand. India's growing cleaning and personal care sectors and China's strong industrial infrastructure have established both nations as major players responsible for propelling regional market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the amphoteric surfactants market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF

- Croda International

- Nouryon

- Akzo Nobel

- Clariant

- Dow

- DuPont

- Evonik Industries AG

- The Lubrizol

- ADEKA CORPORATION

- Stepan

- Galaxy Surfactants

- Huntsman International

- STOCKMEIER Group

- Innospec

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, Galaxy Surfactants, one of the leading manufacturers of performance surfactants and specialty care ingredients used in the Home and Personal Care industry is set to unveil its latest innovations and new product offerings to address the growing demands of consumers for effective, safe, and sustainable solutions in the home and personal care sectors.

- In February 2023, Croda International Plc announced that it has agreed to acquire Solus Biotech, a global leader in premium, biotechnology-derived beauty actives, from Solus Advanced Materials for a total consideration of KRW350bn (approximately £232m) on a debt-free, cash-free basis.

Market Segment

- This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the amphoteric surfactants market based on the below-mentioned segments:

Global Amphoteric Surfactants Market, By Type

- Amine Oxide

- Amphoacetates

- Amphopropionates

- Betaine

- Substituted Imidazoline

- Sultaines

Global Amphoteric Surfactants Market, By Function

- Detergency

- Emulsifiers

- Foaming Agents

- Wetting Agents

Global Amphoteric Surfactants Market, By Application

- Home Care

- Industrial & Institutional Cleaning

- Oil & Gas

- Personal Care

- Others

Global Amphoteric Surfactants Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the amphoteric surfactants market over the forecast period?The amphoteric surfactants market is projected to expand at a CAGR of 4.14% during the forecast period.

-

2. What is the market size of the amphoteric surfactants market?The Amphoteric Surfactants Market Size is Expected to Grow from USD 5.6 Billion in 2023 to USD 8.4 Billion by 2033, at a CAGR of 4.14% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the amphoteric surfactants market?North America is anticipated to hold the largest share of the amphoteric surfactants market over the predicted timeframe.

Need help to buy this report?