Global Analytical Instrumentation Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Instruments, Services, and Software), By Technology (Polymerase Chain Reaction, Spectroscopy, Microscopy, Chromatography, and Flow Cytometry), By Application (Life Sciences, Chemical and Petrochemical, Material Sciences, and Food Testing), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal Analytical Instrumentation Market Insights Forecasts to 2033

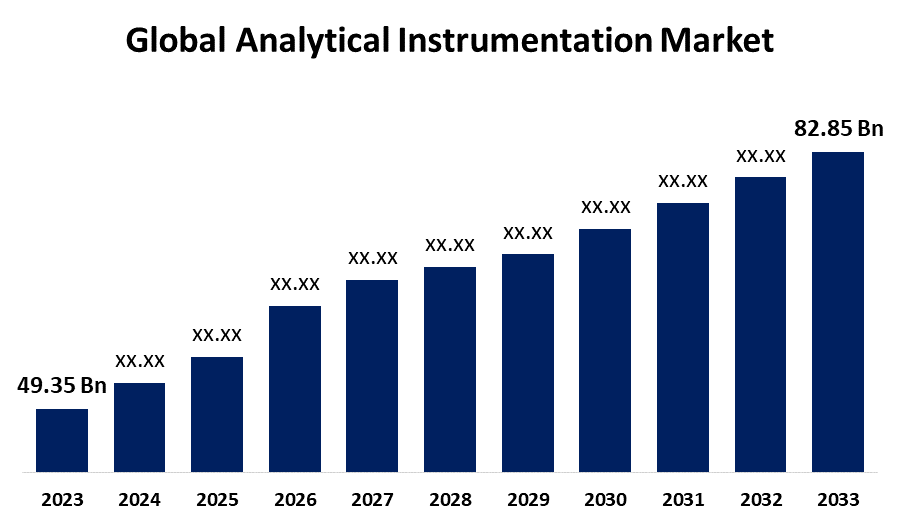

- The Global Analytical Instrumentation Market Size was Valued at USD 49.35 Billion in 2023

- The Market Size is Growing at a CAGR of 5.32% from 2023 to 2033

- The Worldwide Analytical Instrumentation Size is Expected to Reach USD 82.85 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Analytical Instrumentation Market Size is Anticipated to Exceed USD 82.85 Billion by 2033, Growing at a CAGR of 5.32% from 2023 to 2033.

Market Overview:

Analytical instrumentation is utilized to separate, identify, and quantify chemical components in materials. Analytical instrumentation gained immense technological importance due to the growth of devices, programming, and material science, enabling inconceivable advances in the identification of matter in various formats, kinds, and numbers which will drive the growth of the market. The major players in the market are making significant R&D investments to create new analytical tools that are customized to the unique requirements of various industries. Miniaturization, digitization, and data analytics connection have all improved analytical processes' effectiveness and precision. There is an increasing focus on producing advantageous analytical instruments without sacrificing quality or efficiency, which can help drive the analytical instrumentation market. In addition, laboratory computerization and automated test equipment boost the effectiveness and precision of testing procedures. In the health industry, pyrolysis-evolved gas analysis and pyrolysis gas chromatography are effective analytical instruments for polymer analysis that can contribute to market growth. Government initiatives such as the SAIF scheme have been executed geographically to provide sophisticated analytical instruments to research employees in general and in particular those from organizations that are lacking such instruments, allowing them to carry out research and development endeavors.

Report Coverage:

This research report categorizes the market for the global analytical instrumentation based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global analytical instrumentation market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global analytical instrumentation market.

Global Analytical Instrumentation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 49.35 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.32% |

| 2033 Value Projection: | USD 82.85 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Product Type, By Technology, By Application, and By Region |

| Companies covered:: | Bruker Corp., PerkinElmer, Inc., Mettler Toledo, Zeiss Group, Bio-Rad Laboratories, Inc., Illumina, Inc., Eppendorf SE, F. Hoffmann-La Roche AG, Sartorius AG, Avantor, Inc, Thermo Fisher Scientific, Inc., Waters Corp., Shimadzu Corp., Danaher, Agilent Technologies, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors:

The market is dynamic due to increased product application in a variety of sectors, including pharmaceuticals and food and beverages. The swift automation and greater accuracy provided by digital technology allowed for more rapid and precise analysis, propelling the market forward. In line with this, the growing adoption of quality control guidelines around the world is driving enterprises toward high-tech instrumentation, creating a more optimistic outlook for the market. Aside from that, the growing market for biotechnology and the increasing demand for certain diagnostic tools in healthcare are driving the analytical instrumentation market.

Restraining Factors:

Analytical instruments used by lacking skilled professionals can hurt potential benefits, limiting market growth. The shortage of competent individuals to handle analytical instruments could have an adverse effect on the market.

Market Segmentation:

The global analytical instrumentation market share is classified into product type, technology, and application.

- The instruments segment has the highest share of the market during the forecast period.

Based on the product type, the global analytical instrumentation market is categorized into instruments, services, and software. Among these, the instruments segment has the highest share of the market during the forecast period. They offer specific and reliable information, letting researchers and scientists make informed selections. Instruments are extensively used in several fields, including biological sciences, medicinal diagnosis, food and beverage analysis, and ecological testing. Analytical instruments are an important tool in these industries due to their compliance and versatile application. The amalgamation of automation and technological advances in analytical instruments has augmented their adoption.

- The polymerase chain reaction accounted for the largest share of the market during the projected timeframe.

Based on the technology, the global analytical instrumentation market is categorized into polymerase chain reaction, spectroscopy, microscopy, chromatography, and flow cytometry. Among these, the polymerase chain reaction accounted for the largest share of the market during the projected timeframe. The invention of techniques for amplifying DNA segments has resulted in huge benefits in gene analysis, genetic illness diagnosis, and bacterial, viral, and fungal pathogen detection. Another useful PCR use is the cloning of a specific DNA fragment, which permits the analysis of gene expression and has significant potential in forensic medicine. The growing need for molecular diagnostics is helping to drive the segment growth over the estimated period.

- The life science segment owing to the greatest share of the market over the forecast period.

Based on the application, the global analytical instrumentation market is categorized into life sciences, chemical and petrochemical, material sciences, and food testing. Among these, the life science segment owing to the greatest share of the market over the forecast period. The life sciences segment is being driven by the growing demand for precision in pharmaceutical research, biotechnology developments, and the emergence of personalized medicine. Analytical equipment serves an important role in molecular diagnostics, genomics, and proteomics, allowing researchers to evaluate biological samples more accurately. Regulatory compliance is particularly important, as life sciences organizations must follow tight requirements, which require the consistent use of analytical technology for validation and testing.

Regional Segment Analysis of the Global Analytical Instrumentation Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global analytical instrumentation market over the forecast period.

Get more details on this report -

The North American regional market is being pushed by increased demand for sophisticated analytical instruments in pharmaceutical research, surveillance of the environment, and food safety testing. The region's thriving pharmaceutical industry, particularly in the United States, necessitates high-precision instruments for drug research, quality control, and regulatory compliance. Increasing environmental rules aimed at reducing air and water pollution are driving up the demand for monitoring technologies in a variety of industries. Another key driver is the food and beverage industry, which requires intensive product testing due to stringent safety standards. Furthermore, improvements in biotechnology, healthcare diagnostics, and material sciences are driving up demand for analytical tools.

Asia Pacific region is also expected to fastest CAGR growth during the forecast period. The fast development of the region's economies, particularly China and India, is driving market expansion. The increasing industrialization and urbanization in these countries have resulted in an increased demand for analytical instruments in a variety of industries, including pharmaceuticals, food and beverage, and electronics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global analytical instrumentation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies:

- Bruker Corp.

- PerkinElmer, Inc.

- Mettler Toledo

- Zeiss Group

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- Eppendorf SE

- F. Hoffmann-La Roche AG

- Sartorius AG

- Avantor, Inc

- Thermo Fisher Scientific, Inc.

- Waters Corp.

- Shimadzu Corp.

- Danaher

- Agilent Technologies, Inc.

- Others

Key Market Developments:

- In February 2022, Sartorius AG announced the acquisition of Novasep's chromatography division. The portfolio bought includes chromatography systems designed for smaller biomolecules including oligonucleotides, peptides, and insulin, as well as new technologies for continuous biologics manufacture.

- In February 2022, AMETEK Spectro Scientific, one of the world's leading producers of oil and fuel analysis instruments and software, announced the launch of its online Fluid Management Academy. The FMA is an online learning platform that provides clients with a variety of courses on Spectro Scientific and Grabner Instruments' fluid analysis equipment.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global analytical instrumentation market based on the below-mentioned segments:

Global Analytical Instrumentation Market, By Product Type

- Instruments

- Services

- Software

Global Analytical Instrumentation Market, By Technology

- Polymerase Chain Reaction

- Spectroscopy

- Microscopy

- Chromatography

- Flow Cytometry

Global Analytical Instrumentation Market, By Application

- Life Sciences

- Chemical and Petrochemical

- Material Sciences

- Food Testing

Global Analytical Instrumentation Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global analytical instrumentation market over the forecast period?The global analytical instrumentation market size is expected to grow from USD 49.35 Billion in 2023 to USD 82.85 Billion by 2033, at a CAGR of 5.32 % during the forecast period 2023-2033.

-

1. Which region is expected to hold the highest share in the global analytical instrumentation market?North America is projected to hold the largest share of the global analytical instrumentation market over the forecast period.

-

3. Who are the top key players in the analytical instrumentation market?Bruker Corp, PerkinElmer Inc, Mettler Toledo, Zeiss Group, Bio-Rad Laboratories, Inc, Illumina, Inc, Eppendorf SEF, Hoffmann-La Roche AG, Sartorius AG, Avantor, Inc, Thermo Fisher Scientific, Inc, Waters Corp, Shimadzu Corp, Danaher, Agilent Technologies, Inc, and Others.

Need help to buy this report?