Global Anhydrous Aluminum Fluoride Market Size, Share, and COVID-19 Impact Analysis, By Type (High Purity, Low Purity, and Others), By Application (Aluminum Production, Glass Manufacturing, Ceramics, Pharmaceuticals, and Others), By End User Industry (Automotive, Aerospace, Construction, Electronics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Anhydrous Aluminum Fluoride Market Insights Forecasts to 2033

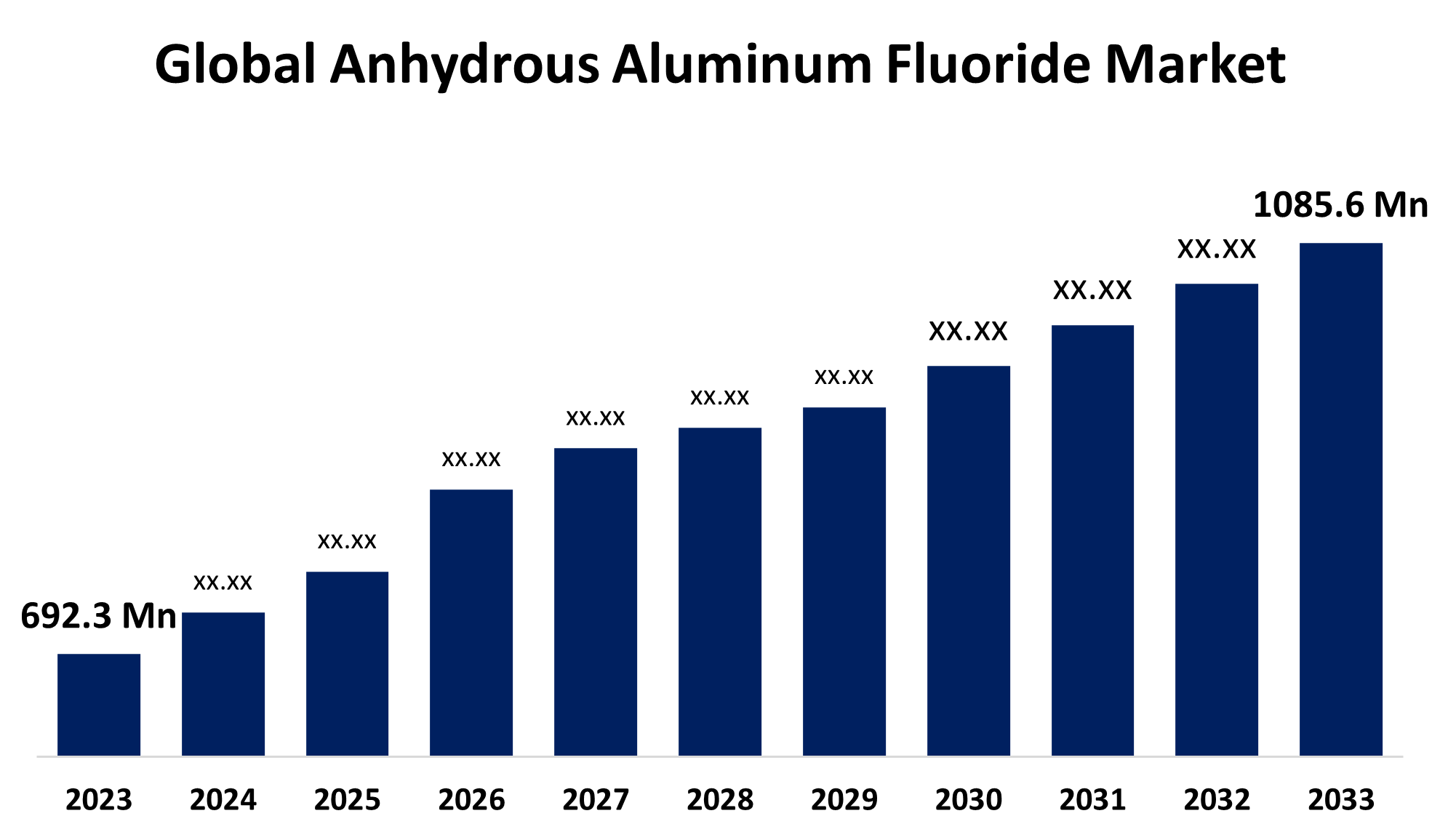

- The Global Anhydrous Aluminum Fluoride Market Size was estimated at USD 692.3 Million in 2023

- The Market Size is Expected to Grow at a CAGR of around 4.60% from 2023 to 2033

- The Worldwide Anhydrous Aluminum Fluoride Market Size is Expected to Reach USD 1085.6 Million by 2033

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Anhydrous Aluminum Fluoride Market Size is expected to cross USD 1085.6 Million by 2033, growing at a CAGR of 4.60% from 2023 to 2033. The market for anhydrous aluminum fluoride is seeing a surge in the usage of innovative manufacturing technologies that are designed to boost productivity while reducing environmental impact. Furthermore, the market for anhydrous aluminum fluoride is being supported by an increasing emphasis on recycling aluminum to reduce demand for primary aluminum production.

Market Overview

The global anhydrous aluminum fluoride market includes the manufacture, distribution, and usage of anhydrous (water-free) aluminum fluoride, an important inorganic compound used in aluminum smelting, fluorinated compounds, ceramics, and glass making. Unlike its hydrated counterpart, anhydrous aluminum fluoride is more stable, absorbs less moisture, and performs better in industrial processes. The thriving automotive industry is a key growth driver for the anhydrous aluminum fluoride market, as it requires lightweight and durable materials to enhance fuel efficiency and reduce emissions. The proliferation of electric cars (EVs) is also driving up demand for aluminum, which is used in battery casings and other EV components. The aerospace industry follows this trend, using aluminum to improve aircraft performance while reducing weight. The rising production of aluminum is directly influencing the demand for anhydrous aluminum fluoride, which is required in the aluminum smelting process.

Furthermore, advances in manufacturing technologies and techniques are driving market expansion. Anhydrous aluminum fluoride is becoming more widely used due to advancements in glass and ceramic manufacture. The pharmaceutical business also has tremendous possibilities, as it is increasingly used in drug formulations and medicinal applications. These numerous applications broaden the market breadth and open up new opportunities for growth, making the anhydrous aluminum fluoride market more robust and dynamic.

Report Coverage

This research report categorizes the anhydrous aluminum fluoride market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the anhydrous aluminum fluoride market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the anhydrous aluminum fluoride market.

Global Anhydrous Aluminum Fluoride Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 692.3 Million |

| Forecast Period: | 2013-2033 |

| Forecast Period CAGR 2013-2033 : | 4.60% |

| 2033 Value Projection: | USD 1085.6 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application, By End User Industry, By Region |

| Companies covered:: | Solvay S.A., Fluorsid S.p.A., Gulf Fluor, Mexichem S.A.B. de C.V., Industries Chimiques du Fluor (ICF), Tanfac Industries Limited, Jiangxi Qucheng Chemical Co., Ltd., Do-Fluoride Chemicals Co., Ltd., PhosAgro Group, Henan Weilai Aluminum Group, PT Petrokimia Gresik, Rio Tinto Alcan Inc., Hunan Nonferrous Metals Corporation Limited, Alufluoride Ltd., and other key players. |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

Rapid urbanization and industrialization, particularly in emerging economies, are strengthening the construction sector, hence increasing demand for aluminum in building applications. This tendency is bolstered by government initiatives supporting sustainable and green building methods, in which aluminum's recyclability and durability are highly regarded. The resulting increase in aluminum output has a beneficial impact on the anhydrous aluminum fluoride market. Furthermore, with an increasing emphasis on sustainability and environmental concerns, the anhydrous aluminum fluoride market is seeing changes in production methods. Companies are working on lowering carbon emissions and improving resource efficiency, which has resulted in process improvements. Additionally, the anhydrous aluminum fluoride market has several potential, particularly in terms of technological advancements and environmental initiatives. The development of alternative materials for aluminum manufacturing may lessen reliance on traditional sources, providing a market for companies that specialize in sophisticated anhydrous aluminum fluoride formulations.

Restraining Factors

The volatility of raw material prices is a significant concern since it might affect the production cost of anhydrous aluminum fluoride. Furthermore, severe environmental rules governing emissions and waste management in industrial operations present hurdles for businesses. Compliance with these requirements may necessitate substantial investments in cleaner and more efficient manufacturing methods, thereby affecting profitability.

Market Segmentation

The anhydrous aluminum fluoride market share is classified into type, application, and end user industry.

- The high purity segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the anhydrous aluminum fluoride market is divided into high purity, low purity, and others. Among these, the high purity segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. High purity anhydrous aluminum fluoride is in high demand in applications with strict quality requirements, such as pharmaceutical and electronics manufacturing. The electronics industry, in particular, requires high-purity materials to ensure the dependability and performance of electronic components.

- The aluminum production segment accounted for the majority of the share in 2023 and is estimated to grow at the fastest CAGR during the projected timeframe.

Based on the application, the anhydrous aluminum fluoride market is divided into aluminum production, glass manufacturing, ceramics, pharmaceuticals, and others. Among these, the aluminum production segment accounted for the majority of the share in 2023 and is estimated to grow at the fastest CAGR during the projected timeframe. Anhydrous aluminum fluoride is an important fluxing agent in the electrolytic reduction process during aluminum smelting, lowering the melting point of alumina and increasing energy efficiency. This improves overall productivity, cost-effectiveness, and quality in aluminum production. The global development of aluminum production capabilities, fueled by rising demand from the automotive, aerospace, construction, and packaging industries, is a key growth driver for this industry.

- The automotive segment held the largest share in 2023 and is estimated to grow at the fastest CAGR during the predicted timeframe.

Based on the end user industry, the anhydrous aluminum fluoride market is divided into automotive, aerospace, construction, electronics, and others. Among these, the automotive segment held the largest share in 2023 and is estimated to grow at the fastest CAGR during the predicted timeframe. The automotive sector is a significant end-user, driven by rising demand for lightweight, fuel-efficient automobiles. Anhydrous aluminum fluoride is an essential component in the automobile industry due to its ability to reduce vehicle weight while retaining structural integrity.

Regional Segment Analysis of the Anhydrous Aluminum Fluoride Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

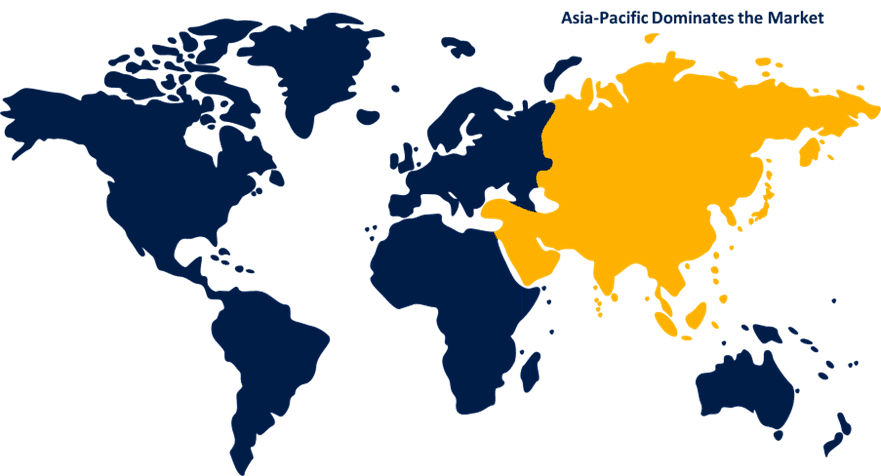

Asia-Pacific is anticipated to hold the largest share of the anhydrous aluminum fluoride market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is anticipated to hold the largest share of the anhydrous aluminum fluoride market over the predicted timeframe. This is attributable to its robust aluminum production base, expanding industrial sector, and rising demand for lightweight materials. Countries such as China, India, Japan, and South Korea are key contributors, driven by rising aluminum use in the automotive, construction, aerospace, and electronics sectors. China, the world's largest aluminum producer, has a well-established electrolytic aluminum smelting sector, resulting in a significant demand for anhydrous aluminum fluoride as a critical fluxing agent. Furthermore, government measures fostering industrial growth, infrastructure development, and renewable energy solutions are propelling market growth. The availability of raw materials, cheaper production costs, and large-scale investments in the metallurgical and chemical industries make the region an important hub for anhydrous aluminum fluoride production.

North America is expected to grow at the fastest CAGR growth of the anhydrous aluminum fluoride market during the forecast period. The region's emphasis on innovation and innovative manufacturing techniques bolsters demand for high-quality aluminum products. The United States, in particular, is a significant contributor to market growth, owing to its dominant position in aircraft manufacturing and the rising use of electric vehicles.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the anhydrous aluminum fluoride market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Solvay S.A.

- Fluorsid S.p.A.

- Gulf Fluor

- Mexichem S.A.B. de C.V.

- Industries Chimiques du Fluor (ICF)

- Tanfac Industries Limited

- Jiangxi Qucheng Chemical Co., Ltd.

- Do-Fluoride Chemicals Co., Ltd.

- PhosAgro Group

- Henan Weilai Aluminum Group

- PT Petrokimia Gresik

- Rio Tinto Alcan Inc.

- Hunan Nonferrous Metals Corporation Limited

- Alufluoride Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the anhydrous aluminum fluoride market based on the below-mentioned segments:

Global Anhydrous Aluminum Fluoride Market, By Type

- High Purity

- Low Purity

- Others

Global Anhydrous Aluminum Fluoride Market, By Application

- Aluminum Production

- Glass Manufacturing

- Ceramics

- Pharmaceuticals

- Others

Global Anhydrous Aluminum Fluoride Market, By End User Industry

- Automotive

- Aerospace

- Construction

- Electronics

- Others

Global Anhydrous Aluminum Fluoride Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the anhydrous aluminum fluoride market over the forecast period?The anhydrous aluminum fluoride market is projected to expand at a CAGR of 4.60% during the forecast period.

-

What is the market size of the anhydrous aluminum fluoride market?The Global Anhydrous Aluminum Fluoride Market Size is Expected to Grow from USD 692.3 Million in 2023 to USD 1085.6 Million by 2033, at a CAGR of 4.60% during the forecast period 2023-2033.

-

Which region holds the largest share of the anhydrous aluminum fluoride market?Asia-Pacific is anticipated to hold the largest share of the anhydrous aluminum fluoride market over the predicted timeframe

Need help to buy this report?