Global Animal Fats And Oils Market Size, Share, and COVID-19 Impact Analysis, By Source (Bovine fats and oils, Poultry fats and oils, Pork fats and oils, Fish fats and oils, Other), By Form (Tallow, Lard, Poultry Fat, Fish Oil, Butterfat, Others), By Application (Food Industry, Industrial Uses, Animal Feed, Pharmaceuticals, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Food & BeveragesGlobal Animal Fats and Oils Market Insights Forecasts to 2033

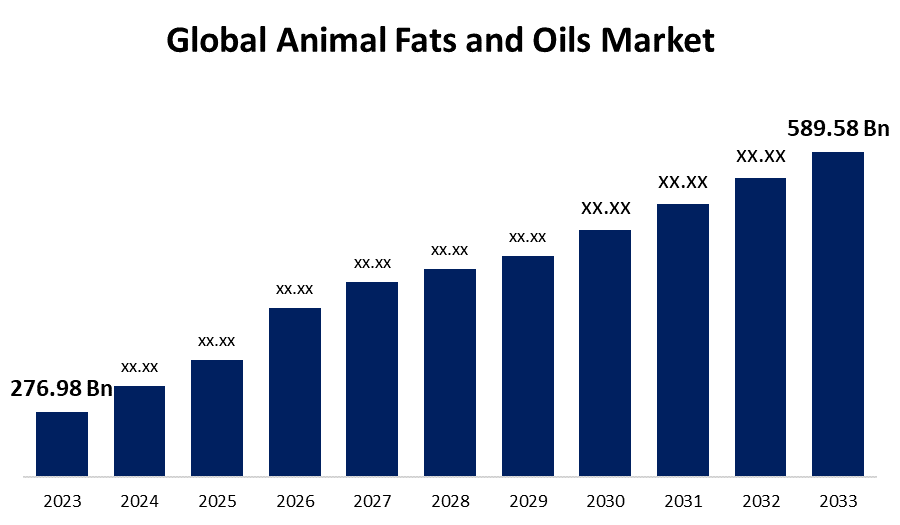

- The Global Animal Fats and Oils Market Size was estimated at USD 276.98 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 7.85% from 2023 to 2033

- The Worldwide Animal Fats and Oils Market Size is Expected to Reach USD 589.58 Billion by 2033

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Animal Fats and Oils market size was valued at USD 276.98 Billion in 2023 and is slated to cross USD 589.58 Billion by 2033, growing at a CAGR of 7.85% from 2023 to 2033. The animal fats and oils market is being driven by the nutritional benefits, growing food processing industries, and biodiesel production, and North America is an emerging region.

Market Overview

The animal fats and oils market entail the industry whereby the production of animal fats, their distribution, and commercialization are produced. These various fats and oils are derived from animals such as cattle, pigs, sheep, and poultry. Animal fats and oils are water-insoluble, hydrophobic, animal-derived compounds. It contributes significantly to humans and animals for energy and as essential fatty acids. Animal fats and oils are consumed in food products, feed production, oleochemicals, and biodiesel. Moreover, the growth in the animal fats and oils market is driven mainly by the upsurge of demand for these animal-based food products, among which are meat, poultry, and dairy products. Consumers are becoming very interested in natural, organic, and less-processed ingredients, a category that now includes animal fats. Animal-based fats are gaining preference over synthetic oils. This is perceived as being better for health as it provides a more balanced fatty acid profile. Furthermore, many governments incentivize the usage of biofuels by subsidizing them, giving tax rebates, and even through mandates, which drives up the demand for animal fats in biodiesel production.

Report Coverage

This research report categorizes the animal fats and oils market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the animal fats and oils market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the animal fats and oils market.

Global Animal Fats and Oils Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 276.98 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 7.85% |

| 023 – 2033 Value Projection: | USD 589.58 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 233 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Source, By Form, By Application and By Region |

| Companies covered:: | Bunge Limited Archer Daniels Midland Company Cargill, Incorporated Wilmar International Limited Tyson Foods, Inc. JBS S.A. Darling Ingredients Inc. IOI Corporation Berhad Ventura Foods, LLC BRF S.A. Ajinomoto Co., Inc. Premium Vegetable Oils Sdn Bhd AAK AB Conagra Brands, Inc. Richardson International Limited Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

Animal fats are widely used in the food processing industry for frying, cooking, and as added ingredients in prepared foods. Animal fats have higher smoking points, which makes them ideal for cooking snacks, baked goods, and fast foods, and it impart flavor to them. Animal fats, particularly grass-fed animal fat, are becoming the subject of interest as their nutritional benefits include higher concentrations of omega-3 fatty acids and CLA, which have a variety of benefits to health.

Restraining Factors

Animal fats contain saturated fatty acids, similar to lard and tallow, which are found to have connections with the disease of heart problems and more health issues. Since more and more consumers are becoming conscious of the health risks associated with heart disease and obesity, a lot of people avoid animal fats to consume lower-fat or unsaturated oils, like olive or canola oil.

Market Segmentation

The animal fats and oils market share is classified into source, form, and application.

- The bovine fats and oils segment accounted for the highest share in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the source, the animal fats and oils market is divided into bovine fats and oils, poultry fats and oils, pork fats and oils, fish fats and oils, and others. Among these, the bovine fats and oils segment accounted for the highest share in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to the fact that bovine fat from the processing of beef is highly available and one of the most abundant animal fats employed in various uses, especially within food production and biofuels. Bovine fats, particularly tallow, have gained more prominence in the biodiesel production market as of their high energy content and increasing demand for renewable sources of energy across the globe.

- The tallow segment dominated the market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the form, the animal fats and oils market is divided into tallow, lard, poultry fat, fish oil, butterfat, and others. Among these, the tallow segment dominated the market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The growth is driven by the fact that it is the most cost-effective fat; tallow is produced in vast quantities as a by-product from slaughterhouses. Its low cost makes it a good choice for industries that use fats and oils.

- The food industry segment accounted for the largest share in 2023 and is expected to grow at a remarkable CAGR during the forecast period.

Based on the application, the animal fats and oils market is divided into the food industry, industrial uses, animal feed, pharmaceuticals, and others. Among these, the food industry segment accounted for the largest share in 2023 and is expected to grow at a remarkable CAGR during the forecast period. The segmental growth is due to the common use of animal fats and oils in food processing and preparation. Lard, tallow, and poultry fat are commonly used for cooking, frying, and baking purposes because these fats impart desirable properties like texture, flavor, and longer shelf life to food products.

Regional Segment Analysis of the Animal Fats and Oils Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

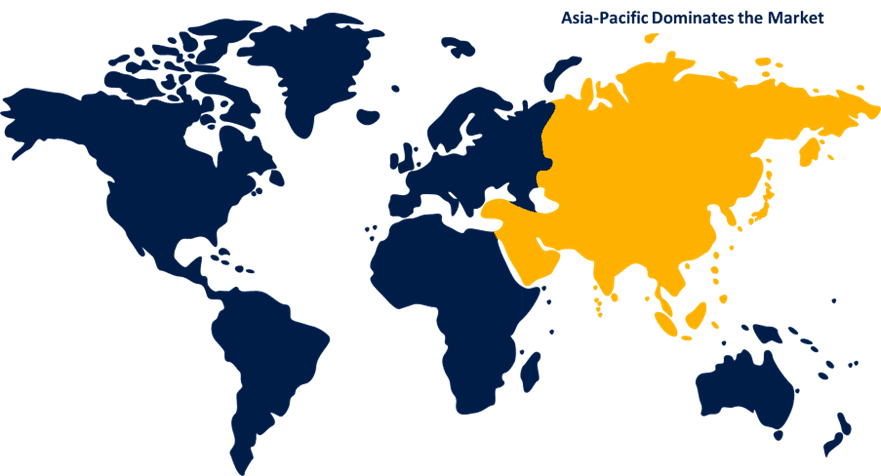

Asia Pacific is anticipated to hold the largest share of the animal fats and oils market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the animal fats and oils market over the predicted timeframe. Meat consumption is relatively the highest in the Asia-Pacific, especially in China, India, and Japan. Pork, beef, and poultry are increasing at a tremendous speed because of high incomes, changed diets, and increased urbanization. Demand for fats from animals, in the regional market, arises mainly due to the increasing popularity of processed foodstuffs frying, baking, and flavoring.

North America is expected to grow at a rapid CAGR in the animal fats and oils market during the forecast period. The United States and Canada are the world's largest producers of beef and pork, and high meat production is one reason of the animal fats dominate the regional market. There is an increasing trend toward low-carb, keto, and paleo diets in North America, which all prefer animal fats over carbohydrates. This shift in diet is forcing consumers to opt for healthy fats like beef tallow and lard, which are considered more natural and less processed than vegetable oils.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the animal fats and oils market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers and acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bunge Limited

- Archer Daniels Midland Company

- Cargill, Incorporated

- Wilmar International Limited

- Tyson Foods, Inc.

- JBS S.A.

- Darling Ingredients Inc.

- IOI Corporation Berhad

- Ventura Foods, LLC

- BRF S.A.

- Ajinomoto Co., Inc.

- Premium Vegetable Oils Sdn Bhd

- AAK AB

- Conagra Brands, Inc.

- Richardson International Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2024, high seasonal rendering activity and regulatory influences on vegetable oil supply drove the EU animal fats prices up by 5-10% due to increased demand from various industries.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the animal fats and oils market based on the below-mentioned segments:

Global Animal Fats and Oils Market, By Source

- Bovine fats and oils

- Poultry fats and oils

- Pork fats and oils

- Fish fats and oils

- Other

Global Animal Fats and Oils Market, By Form

- Tallow

- Lard

- Poultry Fat

- Fish Oil

- Butterfat

- Others

Global Animal Fats and Oils Market, By Application

- Food Industry

- Industrial Uses

- Animal Feed

- Pharmaceuticals

- Others

Global Animal Fats and Oils Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East and Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East and Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the animal fats and oils market over the forecast period?The global animal fats and oils market is projected to expand at a CAGR of 7.85% during the forecast period.

-

2. What is the market size of the animal fats and oils market?The global animal fats and oils market size is expected to grow from USD 276.98 Billion in 2023 to USD 589.58 Billion by 2033, at a CAGR of 7.85 % during the forecast period 2023-2033.

Need help to buy this report?