Global Animal Wound Care Market Size, Share, and COVID-19 Impact Analysis, By Product (Surgical Wound Care, Advanced Wound Care, and Traditional Wound Care), By Animal Type (Companion Animals and Livestock Animals), By End-Use (Veterinary Hospitals/Clinics, Homecare, and Research Institutes), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: HealthcareGlobal Animal Wound Care Market Insights Forecasts to 2032.

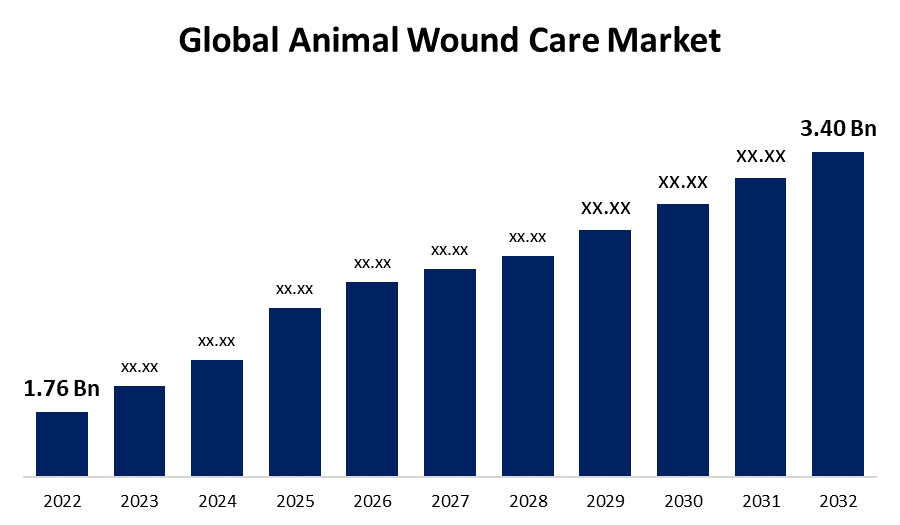

- The Global Animal Wound Care Market Size was valued at USD 1.76 Billion in 2022.

- The Market is growing at a CAGR of 6.8% from 2022 to 2032.

- The Worldwide Animal Wound Care Market Size is expected to reach USD 3.40 Billion by 2032.

- Asia-Pacific is expected to grow fastest during the forecast period.

Get more details on this report -

The Global Animal Wound Care Market Size is expected to reach USD 3.40 Billion by 2032, at a CAGR of 6.8% during the forecast period 2022 to 2032.

Market Overview

Animal wound care involves the assessment, treatment, and management of injuries sustained by animals. Whether it be pets, livestock, or wildlife, wounds can arise from various sources such as accidents, fights, or environmental hazards. Proper wound care is essential to prevent infection, promote healing, and minimize pain and discomfort for the animal. The process typically includes cleaning the wound, removing debris and foreign objects, applying appropriate antiseptics or wound dressings, and monitoring for signs of infection or complications. In some cases, veterinary professionals may need to suture the wound or perform more advanced interventions. Prompt and effective wound care is crucial for the well-being and recovery of animals, ensuring they regain their health and functionality as quickly and comfortably as possible.

Report Coverage

This research report categorizes the market for animal wound care market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the animal wound care market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the animal wound care market.

Global Animal Wound Care Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.76 Billion |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 6.8% |

| 022 – 2032 Value Projection: | USD 3.40 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Product, By Animal Type, By End-Use, By Region. |

| Companies covered:: | B. Braun Melsungen AG, Medtronic, 3M, Johnson & Johnson, Virbac, Advancis Veterinary Ltd., INNOVACYN, Inc., Vernacare, NEOGEN Corp., KeriCure, Inc., and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The animal wound care market is influenced by several drivers that impact its growth and development. The increasing pet ownership and rising awareness about animal healthcare drive the demand for wound care products. As more people consider pets as family members, they seek better treatment options for their injured animals. The growth of the livestock industry and the rising demand for animal-derived products lead to a higher need for wound care in livestock management. Additionally, the prevalence of injuries in animals due to accidents, fights, or infections remains a significant driver for wound care products and services. Advancements in veterinary medicine and the introduction of innovative wound care solutions further fuel the market. New technologies and products such as advanced wound dressings, tissue-engineered products, and regenerative therapies offer improved treatment outcomes, attracting both pet owners and veterinarians. Moreover, a surge in pet insurance coverage and government initiatives to improve animal welfare contribute to the expansion of the animal wound care market. Furthermore, the growing focus on research and development in veterinary care, along with increasing investments from key market players, fosters the introduction of cutting-edge wound care products. The rise in zoonotic diseases and awareness about the transmission of infections from animals to humans also boosts the demand for effective wound care solutions. Overall, the globalization of veterinary services and the expansion of online retail platforms enhance the accessibility of wound care products, driving market growth across regions.

Restraining Factors

The animal wound care market faces several restraints that hinder its growth and potential. One significant restraint is the high cost associated with advanced wound care products and treatments, limiting their adoption, especially in price-sensitive markets. Additionally, the lack of awareness about proper wound care practices among pet owners and caregivers can lead to delayed or inadequate treatment, affecting market growth. Regulatory challenges and stringent approval processes for new wound care products can also impede market expansion. Moreover, the shortage of skilled veterinarians and limited accessibility to veterinary facilities in certain regions pose obstacles to the widespread adoption of wound care solutions.

Market Segmentation

- In 2022, the surgical wound care products segment accounted for around 38.2% market share

On the basis of the product, the global animal wound care market is segmented into surgical wound care, advanced wound care, and traditional wound care. The surgical wound care products segment dominated the animal wound care market due to several reasons. Surgical wound care products, such as sutures, staples, and tissue adhesives, are extensively used in various animal surgeries to promote wound closure and healing. These products are essential in veterinary practices, especially in cases of trauma, surgeries, and wound management. The segment's dominance can be attributed to the increasing number of veterinary surgeries, advancements in surgical techniques, and the continuous development of innovative and efficient wound closure solutions. As a result, the surgical wound care products segment holds a significant market share in the animal wound care industry.

- The companion animal segment held the largest market with more than 60.5% revenue share in 2022

Based on the animal type, the global animal wound care market is segmented into companion animals and livestock animals. The companion animal segment dominated the global animal wound care industry and accounted for the maximum share due to the increasing pet ownership and the growing human-animal bond driving the demand for quality wound care products and services for companion animals. Additionally, rising awareness about pet health and the availability of pet insurance coverage encourage pet owners to seek better healthcare options, including wound care. Moreover, advancements in veterinary medicine and the introduction of specialized wound care products for pets further boost the segment's growth. As a result, the companion animal segment holds the largest market share in the global animal wound care industry.

- The homecare segment is expected to grow at a significant CAGR of around 6.7% during the forecast period

Based on the end-use, the global animal wound care market is segmented into veterinary hospitals/clinics, homecare, and research institutes. The homecare segment is anticipated to experience significant growth during the forecast period, there is an increasing trend of pet owners seeking convenient and cost-effective wound care solutions that can be administered at home. The availability of over-the-counter wound care products tailored for home use further fuels this growth. Moreover, advancements in telemedicine and remote veterinary consultations enable pet owners to receive guidance on wound management from the comfort of their homes. The homecare segment's growth is also influenced by the rising awareness about proper wound care practices, promoting early intervention, and care for companion animals at home.

Regional Segment Analysis of the Animal Wound Care Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 31.8% revenue share in 2022.

Get more details on this report -

Based on region, North America has a large and well-established pet population, with a high level of awareness and concern for animal health. Additionally, the region boasts advanced veterinary care facilities and a growing number of specialized veterinary professionals. Furthermore, increased pet insurance coverage and higher disposable income among pet owners contribute to the higher demand for quality wound care products and services.

The Asia Pacific region is anticipated to witness the fastest growth in the animal wound care market during the forecast period due to rising pet adoption rates, increasing disposable income, and growing awareness about animal healthcare drive the demand for wound care products and services. Additionally, the expanding livestock industry, driven by the growing population and changing dietary preferences, further boosts the need for effective wound care solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global animal wound care market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- B. Braun Melsungen AG

- Medtronic

- 3M

- Johnson & Johnson

- Virbac

- Advancis Veterinary Ltd.

- INNOVACYN, Inc.

- Vernacare

- NEOGEN Corp.

- KeriCure, Inc.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2021, Bactiguard extended its business and provided infection prevention for dogs through a relationship with the Nordic pet shop Musti Group. The collaboration revolves around a new line of wound care products (Aniocyn) for dogs.

- In April 2022, Elanco Animal Health and Ginkgo Bioworks are creating BiomEdit, a startup that will leverage microbiome science to produce medications, nutritional solutions, and disease-monitoring technologies for cattle.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global animal wound care market based on the below-mentioned segments:

Animal Wound Care Market, By Product

- Surgical Wound Care

- Advanced Wound Care

- Traditional Wound Care

Animal Wound Care Market, By Animal Type

- Companion Animals

- Livestock Animals

Animal Wound Care Market, By End-Use

- Veterinary Hospitals/Clinics

- Homecare

- Research Institutes

Animal Wound Care Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?