Global Anti-aging Supplements Market Size, Share, and COVID-19 Impact Analysis, By Ingredient (Collagen, Resveratrol, Vitamins, Minerals, Hyaluronic Acid, NMN, Others), By Application (Hair, Skin, and Nail Care, Bone and Joint Health, Energy and Stamina, Others), By Distribution Channel (Offline and Online), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Anti-aging Supplements Market Size Forecasts to 2033

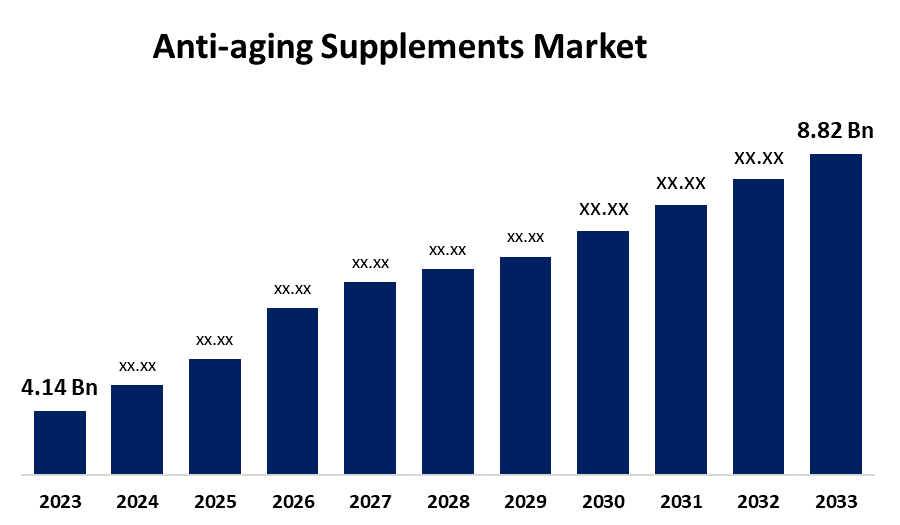

- The Global Anti-aging Supplements Market Size was estimated at USD 4.14 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 7.86% from 2023 to 2033

- The Worldwide Anti-aging Supplements Market Size is Expected to Reach USD 8.82 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Gobal anti-aging supplements market size was worth around USD 4.14 billion in 2023 and is predicted to grow to around USD 8.82 billion by 2033 with a compound annual growth rate (CAGR) of 7.86% between 2023 and 2033. The anti-aging supplements market is influenced by increasing health consciousness, a global aging population, growing demand for longevity products, innovation in nutraceuticals, influencer marketing, greater disposable incomes, increased interest in preventive healthcare, and increased e-commerce access to wellness products.

Market Overview

The anti-aging supplements industry is a worldwide business revolving around the manufacturing and marketing of dietary supplements designed to slow, hinder, or reverse the physical and biological processes of aging. The supplements are designed to promote skin health, brain function, energy, joint strength, and general longevity. Anti-aging supplements are now more personalized and emphasize natural compounds and holistic solutions to aging. Shoppers are attracted to science-supported formulations that provide more than one benefit, such as enhancing cognitive function and skin health. Moreover, consumers are increasingly opting for formulas with no harsh additives or artificial chemicals, indicating an enhanced sensitivity to the ingredients used and applied on their skin. This change is driven by a need for products that not only provide anti-aging benefits but also reflect values of environmental stewardship and individual health. Furthermore, natural and organic anti-aging products are attractive to a wide cross-section of consumers, both younger and older, who view them as safer and more beneficial to the skin than synthetic products. This trend is driving the increasing revenue in the anti-aging supplements industry.

Report Coverage

This research report categorizes the anti-aging supplements market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the anti-aging supplements market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the anti-aging supplements market.

Global Anti-aging Supplements Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.14 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.86% |

| 2033 Value Projection: | USD 8.82 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Ingredient, By Application, By Distribution Channel, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Shaklee Corporation, Decode Age, Thorne., GNC Holdings, LLC, Life Extension., Nu Skin Enterprises, Nutrova, Cureveda, ChromaDex, Inc., Oziva, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Customers are increasingly health-focused and active regarding aging. Rather than waiting for issues to emerge, individuals now desire supplements to protect long-term wellness, retard age, and contribute to the quality of life driving solid demand for solutions against aging. Additionally, steady innovation in the nutraceuticals space involving improved ingredient bioavailability, clinical trials, and patented products raised consumer confidence. Drugs with NMN, collagen, resveratrol, and coenzyme Q10 are increasing in popularity for their scientifically tested anti-aging effects at the cellular level.

Restraining Factors

High-end anti-aging supplements, particularly those containing patented compounds such as NMN or marine collagen, are costly. Such high prices keep price-conscious consumers away and limit availability in emerging markets where price is a determinant of purchasing decisions. Additionally, certain supplements can produce side effects or allergic reactions upon use, particularly when consumed without first consulting a healthcare professional. Such occurrences can result in negative word-of-mouth and undermine consumer trust in the entire supplement category.

Market Segmentation

The anti-aging supplements market share is classified into ingredient, application, and distribution channels.

- The collagen segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the ingredients, the anti-aging supplements market is divided into collagen, resveratrol, vitamins, minerals, hyaluronic acid, NMN, and others. Among these, the collagen segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by collagen is a primary structural protein responsible for keeping skin elastic, firm, and hydrated. Since collagen production decreases naturally with age, supplements restore levels, making it one of the most popular anti-aging ingredients. Consumers across the board are familiar with collagen for its anti-aging properties, especially for wrinkle reduction, skin texture improvement, and joint health. This familiarity greatly increases its popularity across all age groups.

- The hair, skin, and nail care segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the application, the anti-aging supplements market is divided into hair, skin, and nail care, bone and joint health, energy and stamina, and others. Among these, the hair, skin, and nail care segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is due to the hair, skin, and nails showing the most obvious and immediate manifestations of aging, such as wrinkles, hair loss, and fragile nails. Because of their visibility, consumers are more likely to spend on supplements addressed to these areas to seek visible signs of improvement and confidence in appearance.

- The offline segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the anti-aging supplements market is divided into offline and online. Among these, the offline segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed due to in physical stores, consumers can directly engage with sales representatives, pharmacists, or healthcare professionals who offer advice, product suggestions, and information about supplement advantages. The personalized service ensures trust and impacts purchasing, primarily for consumers concerned about health.

Regional Segment Analysis of the Anti-aging Supplements Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the anti-aging supplements market over the predicted timeframe.

North America is anticipated to hold the largest share of the anti-aging supplements market over the predicted timeframe. North America possesses a large aging population, specifically in the United States and Canada, with a large number of people over 50 looking for solutions to age-related issues. This group of people is a key driver of anti-aging supplements that provide vitality, skin, and mental health benefits. North America has many top-ranked pharmaceutical and nutraceutical businesses, which result in ongoing innovation in the anti-aging market. The creation of innovative products, supported by scientific evidence, draws consumers looking for the most recent advances in health and aging solutions, further driving market expansion.

Asia Pacific is expected to grow at a rapid CAGR in the anti-aging supplements market during the forecast period. Asia Pacific is expected to grow at a rapid CAGR in the anti-aging supplements market during the forecast period. Herbal medicines and natural supplements have been a long-standing tradition in the majority of Asia-Pacific countries. The region's growing embrace of preventive healthcare coupled with rising awareness of the advantages of anti-aging products has led to unprecedented interest in supplements that are focused on longevity. Increased awareness, particularly through influencer marketing and social media, is driving the market for anti-aging supplements. Celebrities and influencers are increasingly influential within Asia-Pacific as they drive more and more consumers towards beauty and wellness supplements, generating higher awareness and higher purchasing from younger consumers and aging adults.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the anti-aging supplements market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shaklee Corporation

- Decode Age

- Thorne.

- GNC Holdings, LLC

- Life Extension.

- Nu Skin Enterprises

- Nutrova

- Cureveda

- ChromaDex, Inc.

- Oziva

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2024, Healthy Extracts launched LONGEVITY Anti-Aging™, a blend containing trans-resveratrol, quercetin, vitamin D, and vitamin K2. The formula targets skin vibrancy, artery elasticity, and joint health.

- In January 2024, Watsons Singapore launched Tru Niagen Immune, a new formula created specifically for age transformation and boosting immunity.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the anti-aging supplements market based on the below-mentioned segments:

Global Anti-aging Supplements Market, By Ingredient

- Collagen

- Resveratrol

- Vitamins

- Minerals

- Hyaluronic Acid

- NMN

- Others

Global Anti-aging Supplements Market, By Application

- Hair, Skin, and Nail Care

- Bone and Joint Health

- Energy and Stamina

- Others

Global Anti-aging Supplements Market, By Distribution Channel

- Offline

- Online

Global Anti-aging Supplements Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?