Global Anti Money Laundering Software Market Size, Share, and COVID-19 Impact Analysis, By Component (Software, Service); By Deployment (On Cloud, On Premise); By Application (Transaction Monitoring, Customer Identity Management, Currency Transaction Reporting, Compliance Management, Others); By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Information & TechnologyGlobal Anti Money Laundering Software Market Insights Forecasts to 2032

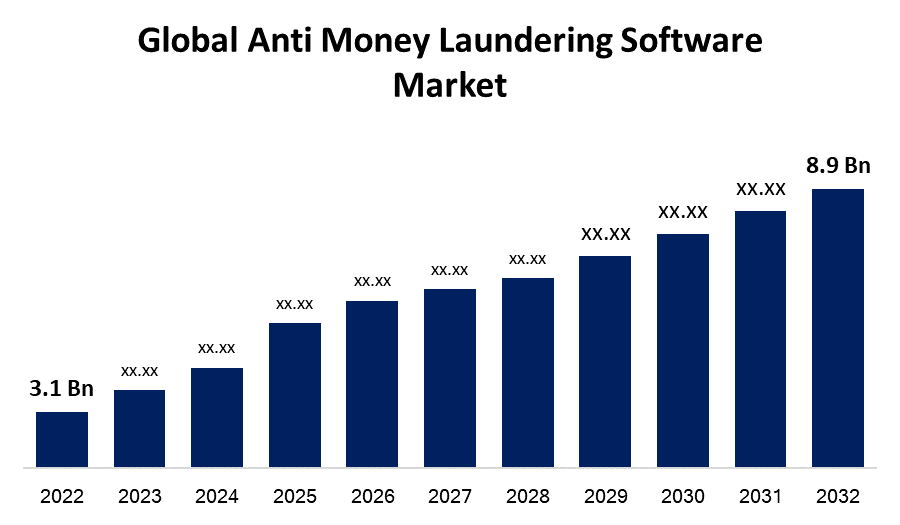

- The Anti Money Laundering Software Market Size was valued at USD 3.1 Billion in 2022.

- The Market Size is Gowing at a CAGR of 12.3% from 2022 to 2032.

- The Worldwide Anti Money Laundering Software Market Size is expected to reach USD 8.9 Billion by 2032.

- Europe is Expected To Grow the fastest during the forecast period

Get more details on this report -

The Global Anti Money Laundering Software Market is expected to reach USD 8.9 Billion by 2032, at a CAGR of 12.3% during the forecast period 2022 to 2032.

Software used to monitor customer data and spot any strange transactions is referred to as anti-money laundering software. A strange transaction is one that involves a rapid increase or big outflow of funds. The legal and financial sectors utilise the programme a lot. Various applications, including client identification monitoring systems, current transaction reporting, transaction monitoring systems, and compliance management, are made easier with the use of anti-money laundering software. In addition, it is utilised for procedural filtering, predictive analysis, and data administration.

Impact of COVID 19 On Global Anti Money Laundering Software Market

The COVID 19 pandemic has impacted had resulted into the significant on the anti money laundering system market. In reality, the global lockdown which are to blame for the losses in the most companies have boosted demand for anti money laundering solutions. The rise in the use of electronic wallets which results in a strong trend. The anti money laundering software market has made an expansion due to its transition which has increased the likelihood that illegal money will be transferred or received and various other kind of anti money laundering hazards. The demand for anti money laundering systems is going to increase over the forecast period because online transactions is becoming common across the world these days.

As per the Anti Money Laundering Preparedness Survey Report 2020 prepared by Deloitte, a survey was done which comprised of popular banks present in South Asia in order to understand the challenges faced by the banks in the AML compliance programs. The survey has started that about 45% of the banks are facing technological challenges owing to integration of core banking solutions. Apart from this, 46% of the existing systems are not able to cover products as well as businesses in the transaction monitoring systems within a short period of time.

Global Anti Money Laundering Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 3.1 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 12.3% |

| 2032 Value Projection: | USD 8.9 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Deployment, By Application, By Region |

| Companies covered:: | Accenture, SAS Institute Inc., Fiserv, Inc, Open Text Corporation, Experian Information Solutions, Inc., Oracle, FICO TONBELLER, Ascent Business, EastNets, Trulioo, BAE Systems, ACI Worldwide, Inc., Actimize, NameScan, Verafin Inc., LexisNexis, INETCO Systems Ltd, Global RADAR, Experian plc |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Key Market Drivers

The increase in the adoption of Big Data analytics will help the businesses in analyzing enterprises which can spot patterns as well as find the valuable data from the available data sets. Leveraging Big Data analytics is going to create huge demand for the anti money laundering software. In the same way, Big Data analytics is considered as an ultimate tool for AML compliance because it can be personalized for improving as well as automating various AML compliance processes. Big Data analytics will helps in reducing the risk and detecting fraud patterns.

Key Market Challenges

The huge cost associated with the deployment of software as well as complications related to it are restraining the capacity for early detection of fraud activities. The adoption of practices to new and untested technology solutions or systems are creating new operational challenges. Not only this but also the small and medium sized fintech companies does not have internal capacity to estimate the effectiveness of advanced solutions among the popular vendors and their products which are creating significant challenges in operating the solutions. All these factors are anticipated to hamper the growth of the market over the forecast period.

Market Segmentation

Component Insights

Software segment is dominating the market over the forecast period

On the basis of component, the global anti money laundering software market is segmented into software and service. Among these, the software segment is dominating the market with the largest market share over the forecast period. The growth is attributed to the strong presence of various domestic and global financial institutions across the world and rise in demand for software in order to meet the regulatory requirements of the government authorities. Not only this but also the software segment is playing primary role in identifying the customers and their transactions and help the regulators in taking necessary action against any kind of frauds. The availability of software from the popular manufacturer has propelled the growth of the market. The anti money laundering software are specifically developed to monitor the transaction, manage customer information, compliance management, and report currency transactions which allows the Financial Institutions in tracking the money transfer and identifying any kind of frauds. The increasing regulatory compliances and financial frauds across the world are driving the overall market growth and the segment.

The services segment on the other hand is estimated to witness the fastest market growth over the forecast period due to the lack of skilled anti money laundering software operators which has increased the demand of third party service providers. Apart from this the integration of artificial intelligence, machine learning, and big data analysis has made the software operation more specialised. Hence the demand for the services segment is going to increase honest significant rate over the upcoming years.

Deployment Insights

On premise segment holds the largest market share over the forecast period

On the basis of deployment, the global anti money laundering software is segmented into on cloud and on premise. Among these, the on premise segment holds the largest market share over the forecast period. The rising demand for the safer deployment mode among the financial institution has resulted into the increase in the use of on-premise deployment. Apart from this, the rise in the demand for making improvement in the control over the financial data of the customer has resulted into the growth of the segment. The strong security on the onpramis deployment as compared to the on cloud deployment is the leading factor which has propelled the growth of the segment across the world.

The on cloud segment on the other hand is anticipated to witness the fastest market growth over the podcast period due to the increasing demand for reduction of cost related to setting up of servers and saving time is properly the demand of the segment. In addition high flexibility, higher scalability, and increasing efficiency are the other factors which are boosting the need of on cloud deployment.

Application Insights

Transaction Monitoring segment is dominating the market over the forecast period.

Based on application, the global anti money laundering software market is segmented into transaction monitoring, customer identity management, compliance management, currency transaction reporting, and others. Among these, the transaction monitoring segment is dominating the market over the forecast period. The increasing demand to monitor the activities of the customer on a real time bases has resulted into the dominance of this segment. Transaction monitoring helps in identifying any situation which violets the rules that goes against the customer profile hence reporting to the counterfeiting the financing of terrorism and anti monetary laundering regime. Apart from this the increasing adoption of digital payments system across the world has increased the demand of transaction monitoring that helps the financial institution in tracking large amount of electronic payments.

Regional Insights

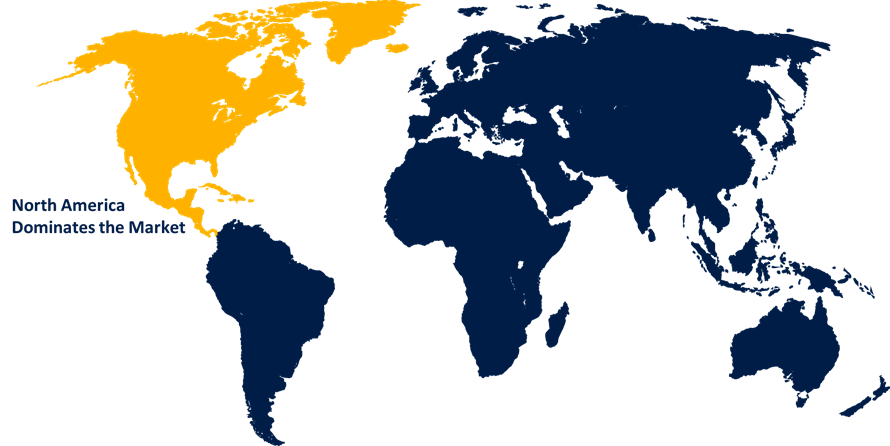

North America is dominating the market with the largest market share over the forecast period

Get more details on this report -

North America is dominating the global anti money laundering software market over the forecast period. The expansion is credited to the significant presence of a number of top AML software providers in North America, including SAS Institute, Oracle Corporation, Fidelity National Information Services, and Fiserv, Inc. The risk of criminal activity has increased as a result of the growing use of eBanking and mobile banking for money transfers, which has sharply increased the demand for AML software among North American financial institutions. In addition, the region's wealth of prestigious financial institutions and tight government rules governing anti-money laundering practises have fueled the expansion of the North American AML software market.

Europe, on the other hand is witnessing the fastest market growth over the forecast period. The numerous financial institutions in Europe are becoming more in need of AML software due to the strict government rules and higher demand for the newest technologies in the finance industry. The industry is growing as a result of multiple legislative changes, including the General Data Protection Regulation, Anti-Money Laundering Directive 5, and Payment Card Industry Data Security Standard. AML software sales in Europe are rising as a result of a number of variables, including trade-based money laundering, virtual currencies, a trend towards non-banking financial institutions, and non-financial professions.

Recent Market Developments

- In September 2021, FICO has partnered with MSG Group. The aim of this partnership is to resale FICO’s financial crime compliance and fraud products across Europe and the Middle East & Africa.

List of Key Companies

- Accenture

- SAS Institute Inc.

- Fiserv, Inc

- Open Text Corporation

- Experian Information Solutions, Inc.

- Oracle

- FICO TONBELLER

- Ascent Business

- EastNets

- Trulioo

- BAE Systems

- ACI Worldwide, Inc.

- Actimize

- NameScan

- Verafin Inc.

- LexisNexis

- INETCO Systems Ltd

- Global RADAR, Experian plc

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global Anti Money Laundering Software Market based on the below-mentioned segments:

Anti Money Laundering Software Market, Component Analysis

- Software

- Service

Anti Money Laundering Software Market, Deployment Analysis

- On-Cloud

- On Premise

Anti Money Laundering Software Market, Application Analysis

- Transaction Monitoring

- Customer Identity Management

- Currency Transaction Reporting

- Compliance Management

- Others

Anti Money Laundering Software Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the Market Size of Anti Money Laundering Software Market?The Global Anti Money Laundering Software Market is expected to grow from USD 3.1 Billion in 2022 to USD 8.9 Billion by 2032, at a CAGR of 12.3% during the forecast period 2022-2032.

-

2. Who are the key Market players of Anti Money Laundering Software Market?Some of the key Market players of Accenture, SAS Institute Inc., Fiserv, Inc, Open Text Corporation, Experian Information Solutions, Inc., Oracle, FICO TONBELLER, Ascent Business, EastNets, Trulioo, BAE Systems, ACI Worldwide, Inc., Actimize, NameScan, Verafin Inc., LexisNexis, INETCO Systems Ltd, Global RADAR, Experian plc.

-

3. Which Segment hold the largest Market share?Supermarkets and Hypermarkets segment hold the largest Market share is going to continue its dominance.

-

4. Which Region is dominating the Anti Money Laundering Software Market?Europe is dominating the Anti Money Laundering Software Market with the highest Market share.

-

1. What is the Market Size of Anti Money Laundering Software Market?The Global Anti Money Laundering Software Market is expected to grow from USD 3.1 Billion in 2022 to USD 8.9 Billion by 2032, at a CAGR of 12.3% during the forecast period 2022-2032.

-

2. Who are the key Market players of Anti Money Laundering Software Market?Some of the key Market players of Accenture, SAS Institute Inc., Fiserv, Inc, Open Text Corporation, Experian Information Solutions, Inc., Oracle, FICO TONBELLER, Ascent Business, EastNets, Trulioo, BAE Systems, ACI Worldwide, Inc., Actimize, NameScan, Verafin Inc., LexisNexis, INETCO Systems Ltd, Global RADAR, Experian plc.

-

3. Which Segment hold the largest Market share?Supermarkets and Hypermarkets segment hold the largest Market share is going to continue its dominance.

-

4. Which Region is dominating the Anti Money Laundering Software Market?Europe is dominating the Anti Money Laundering Software Market with the highest Market share.

Need help to buy this report?