Global Antibody Drug Conjugates Market Size, Share, and COVID-19 Impact Analysis, By Application (Blood Cancer, Breast Cancer, Ovary Cancer, Lung Cancer, Skin Cancer, Brain Tumor, and Other Applications), By Technology (Cleavable and Non-Cleavable), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: HealthcareGlobal Antibody Drug Conjugates Market Insights Forecasts to 2032

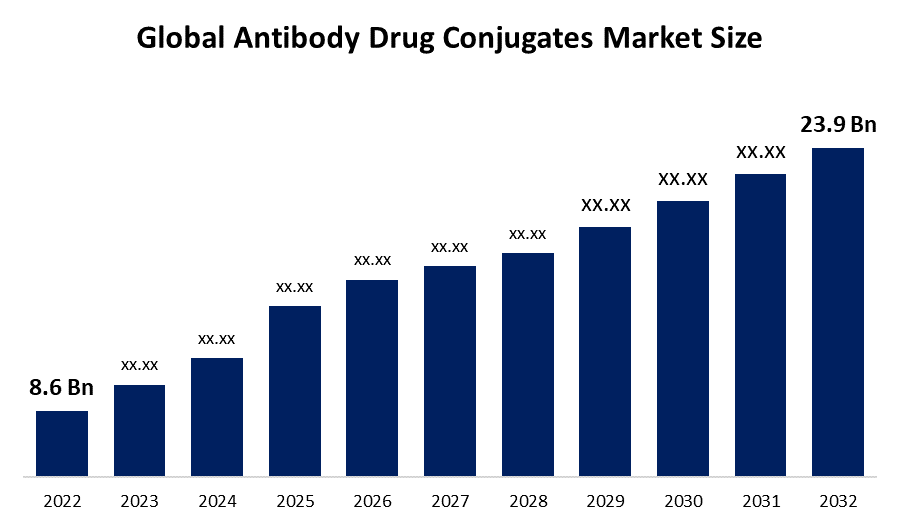

- The Global Antibody Drug Conjugates Market Size was valued at USD 8.6 Billion in 2022.

- The market is growing at a CAGR of 10.7% from 2022 to 2032.

- The worldwide Antibody Drug Conjugates Market size is expected to reach USD 23.9 billion by 2032.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Antibody Drug Conjugates Market Size is expected to reach USD 23.9 billion by 2032, at a CAGR of 10.7% during the forecast period 2022 to 2032.

Market Overview

Combining the intense cell-killing effect of highly cytotoxic small molecule medicines with distinct anti-tumor activity, antibody-drug conjugates provide a novel and useful therapeutic use. Contrarily, antibody-drug conjugates diminish systemic toxicity. Conventional protracted chemotherapy, on the other hand, fails to distinguish between cancerous cells and healthy cells that are susceptible to negatively affecting human health. A powerful cytotoxic agent, a monoclonal antibody that is highly selective, and a stable linker are the components of a perfect antibody-drug combination. To successfully and selectively target cancer cells, antibody-drug conjugates minimize the harm to healthy cells. These antibody-drug conjugates target the cancer cells and deliver the medication straight there. The majority of businesses perform clinical studies to release novel products into the market and to get label extensions for goods that have previously received approval. For instance, Seagen launched phase 1 clinical studies of two new antibody-drug conjugates, SGN-B7H4V & SGN-PDL1V, in patients with advanced solid cancers in January 2022. Additionally, the cohort K EV-103 study for the treatment of first-line metastatic urothelial cancer (mUC) was completed by the business in partnership with Astellas. It is projected that the successful conclusion of the clinical trial research and the subsequent approval of goods would propel market expansion.

Report Coverage

This research report categorizes the global antibody drug conjugates market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global antibody drug conjugates market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global antibody drug conjugates market. Technological innovation and advancement will further optimize the performance of the product, enabling it to acquire a wider range of applications in the downstream market.

Global Antibody Drug Conjugates Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 8.6 Billion |

| Forecast Period: | 2022 - 2032 |

| Forecast Period CAGR 2022 - 2032 : | 10.7% |

| 2032 Value Projection: | USD 23.9 Billion |

| Historical Data for: | 2018 - 2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By Technology, By Region |

| Companies covered:: | Seagen, Inc., Takeda Pharmaceutical Company Limited, AstraZeneca, F. Hoffmann-La Roche Ltd., Pfizer, Inc., Gilead Sciences, Inc., Daiichi Sankyo Company Limited, GlaxoSmithKline plc, Astellas Pharma, Inc., ADC Therapeutics SA |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for antibody-drug conjugates is expanding as a result of increased expenditure in research and development (R&D) efforts. Because the antibody-drug conjugates have few adverse effects, they are a perfect cancer therapy. The relevance of antibody-drug conjugates is being highlighted globally by the fact that they provide a combination of traditional and cutting-edge therapies that ensure excellent outcomes. Also, the development of the market is being driven by technological improvements. For instance, ImmunoGen Inc. entered into a global, multi-year, definitive licensing agreement with Eli Lilly and Company in February 2022, giving Lilly the sole right to conduct research on, develop, and market antibody-drug conjugates (ADCs) that are aimed at targets chosen by Lilly based on ImmunoGen's cutting-edge camptothecin technology. Moreover, the rising geriatric population, rising cancer prevalence, and rising R&D for the creation of innovative therapies are anticipated to significantly contribute to the market's growth throughout the forecast period.

Restraining Factors

Low penetration capability and unsuccessful results are a couple of the restrictions and difficulties that antibody-drug conjugates face. Some additional restrictions and challenges with antibody-drug conjugates, such as immunogenicity, lack of stable linkage in blood circulation, drug resistance, unclear toxicity, inadequate mechanism of penetration, and unusual size of mAbs, might harm the treatment results for cancer patients. Moreover, the cost of manufacturing antibody-drug conjugates is mostly determined by the price of raw materials, the use of technology, the lengthy production process, and the necessary qualified and professional labor. Additionally, changes in the cost of raw materials have an impact on manufacturing costs. Companies in the biotechnology and pharmaceutical industries spend a lot of money on R&D.

Market Segmentation

- In 2022 the breast cancer segment is dominating the market with the largest market revenue of 50.6% over the forecast period.

On the basis of application, the global antibody drug conjugates market is segmented into blood cancer, breast cancer, ovary cancer, lung cancer, skin cancer, brain tumor, and other applications. Among these segments, the breast cancer segment is dominating the market with the largest revenue share of 50.6% due to the relatively high prevalence of the disease globally. Around 2.26 million new instances of breast cancer were anticipated to have been identified globally in 2020, and 685,000 cancer-related deaths were thought to have occurred. Trodelvy, an antibody-drug conjugate product from Gilead Sciences, Inc., Enhertu, an AstraZeneca product, and Kadcyla, a Hoffmann-La Roche Ltd. product, are the three medications now available for the treatment of breast cancer. The availability of these medicines through patient assistance programs is anticipated to fuel market expansion. Kadcyla provides qualifying patients with financial aid who are covered by both public and private insurance.

The blood cancer segment is expected to hold a significant share over the projected period, owing to the second most prevalent cause of cancer-related fatalities worldwide is blood cancer, which is the fifth most common disease overall.

- In 2022, the cleavable linker segment is dominating the largest market share over the forecast period.

Based on technology, the global antibody drug conjugates market is segmented into cleavable and non-cleavable. Among these segments, the cleavable linker segment is dominating the market. As it can release cytotoxin from the antibody-drug conjugates, the cleavable linker technology is the most widely utilized technique in antibody-drug conjugate treatment. By harnessing the natural characteristics of tumor cells, cleavable linkers contribute significantly to the success of antibody-drug conjugates; their unrivaled benefits in the treatment of cancer further support the segment's expansion.

Regional Segment Analysis of the Antibody Drug Conjugates Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America leads the market with the largest market revenue of 53.2% during the forecast period

Get more details on this report -

North America is dominating the significant market growth of 53.2% during the forecast period. The main drivers of the region's dominance include the region's well-established research facilities for the creation of new ADCs, growing per capita healthcare costs, and rising cancer prevalence. According to American Cancer Society projections, there will be around 609,360 cancer-related deaths in the United States in 2022, with 1.9 million new cases. Market expansion is anticipated to be fueled by the approval of additional antibody drug conjugates in the area.

Asia Pacific is expected to experience high revenue market growth during the forecast period. The approval of additional antibody drug conjugates in the area is responsible for the region's expansion. For example, Japan's MHLW gave Astellas' enfortumab vedotin for the treatment of metastatic or locally advanced urothelial carcinoma priority evaluation in May 2021.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the global antibody drug conjugates market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Seagen, Inc.

- Takeda Pharmaceutical Company Limited

- AstraZeneca

- F. Hoffmann-La Roche Ltd.

- Pfizer, Inc.

- Gilead Sciences, Inc.

- Daiichi Sankyo Company Limited

- GlaxoSmithKline plc

- Astellas Pharma, Inc.

- ADC Therapeutics SA

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2023, Hillstream BioPharma, an innovative biotechnology company, announced that it had entered into an exclusive option agreement with Applied Biomedical Science Institute (ABSI) to license the technology for HER2 and HER3 in human monoclonal antibodies for the development of multi-format biologics and antibody drug conjugates for the treatment of gastric, ovarian, and breast cancer.

- In February 2023, Lantern Pharma, a clinical-stage pharmaceutical business, announced enhancements and additions to RADR, its main platform, to speed up and lower the cost of cancer medication development. The expansion intends to quicken the speed of discoveries in the field of developing cancer drugs.

- In January 2023, A Memorandum of Understanding (MoU) between Bridge Biotherapeutics and Pinotbio to develop fresh cancer treatment options was made public. The platform technology for antibody-drug conjugates will be used by the firms by the MoU. Bridge Biotherapeutics will provide exclusive anticancer targets, while Pinotbio intends to add linkers and medications to its platform. Over the following two years, the agreement to trade information and technology will remain in effect.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Global Antibody Drug Conjugates Market based on the below-mentioned segments:

Global Antibody Drug Conjugates Market, By Application

- Blood Cancer

- Breast Cancer

- Ovary Cancer

- Lung Cancer

- Skin Cancer

- Brain Tumor

- Other

Global Antibody Drug Conjugates Market, By Technology

- Cleavable

- Non-cleavable

Antibody Drug Conjugates Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?