Global Antifoaming Agent Market Size, Share, and COVID-19 Impact Analysis, By Type (Water-Based, Oil-Based, Silicone-Based, Others), By Application (Adhesives, Coatings, Detergents, Wood Pulp, Food Processing), By End-User (Oil and Gas, Paint and coatings, Food and Beverages, Pharmaceuticals, Textile), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Specialty & Fine ChemicalsGlobal Antifoaming Agent Market Insights Forecasts to 2033

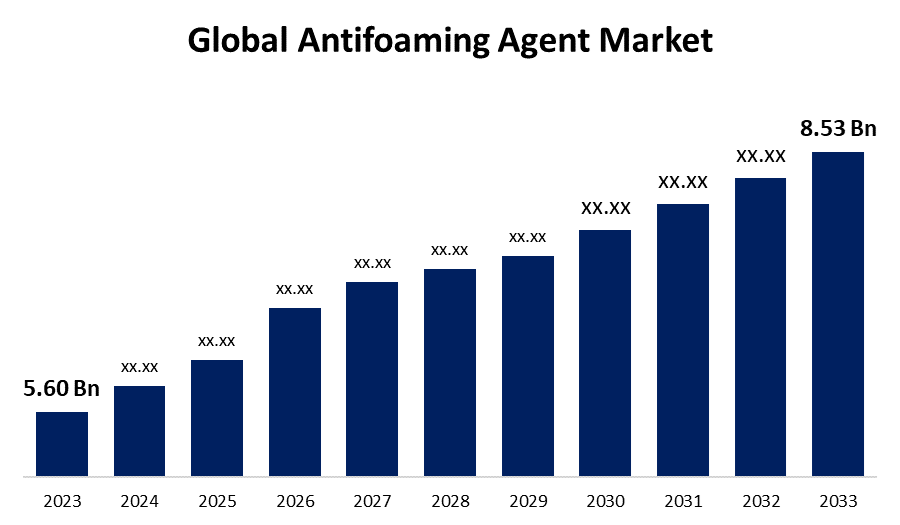

- The Global Antifoaming Agent Market Size was Valued at USD 5.60 Billion in 2023

- The Market Size is Growing at a CAGR of 4.30% from 2023 to 2033

- The Worldwide Antifoaming Agent Market Size is Expected to Reach USD 8.53 Billion by 2033

- Aisa Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Antifoaming Agent Market Size is Anticipated to Exceed USD 8.53 Billion by 2033, Growing at a CAGR of 4.30% from 2023 to 2033.

Market Overview

An antifoaming agent, often called a defoamer or antifoam, is a chemical additive that prevents or reduces foam production in industrial processes and products. Antifoaming agents are less viscous, easily spreadable over foamy surfaces, and have a propensity for the air-liquid interface, where they destabilize foam lamellas, rupturing air bubbles and breaking down surface foam. Commonly used antifoaming agents are some alcohols (cetostearyl alcohol), insoluble oils (castor oil), stearates, polydimethylsiloxanes, and other silicone derivatives, ether, and glycols. The antifoaming agent market encompasses the production and use of chemical additives designed to control foam in various industrial processes across sectors such as food and beverages, pharmaceuticals, chemicals, pulp and paper, and wastewater treatment. Key drivers include the need for efficient production, regulatory compliance, and product quality enhancement. Technological advancements and environmental considerations shape market dynamics, influencing innovation and competitive strategies among industry players.

Report Coverage

This research report categorizes the market for antifoaming agent market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the antifoaming agent market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the antifoaming agent market.

Global Antifoaming Agent Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.60 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.30% |

| 2033 Value Projection: | USD 8.53 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By End-User, By Region |

| Companies covered:: | BASF, Harmony Additives, Evonik Industries AG, Ashland Global Holdings Inc., Clariant AG, Air Products and Chemicals, Inc., The Dow Corning Corporation, Wacker Chemie AG, ZILIBON Chemicals, Sanco Industries Inc, Elements Plc, PennWhite, Kemira, Shin-Etsu Chemicals Company Ltd., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The anti-foaming agent market is being driven by the expansion of different end-use sectors, including oil and gas, food and beverage, pharmaceuticals, textiles, paints and coatings, and wastewater treatment. Antifoaming compounds are used in various sectors to increase process efficiency, product quality, and safety. In the oil and gas sector, anti-foaming chemicals are used to avoid foaming during crude oil extraction and refining. Increased demand in food and beverage processing, where these agents prevent foaming to enhance product quality and shelf life, such as in breweries. Manufacturers are continually innovating to develop new agents that offer improved performance and compatibility across various industries, driving further growth in the market. Technological advancements and innovations in formulations further propel market growth, catering to a wide range of applications including biotechnology and wastewater treatment. Globalization of industries and increasing consumer demands for high-quality products also contribute to the expanding market for antifoaming agents, making them essential components across various industrial sectors worldwide.

Restraining Factors

The antifoaming agent market faces several restraining factors that impact its growth and adoption across industries including environmental concerns regarding chemical composition and sustainability, along with stringent regulatory requirements, pose challenges to market expansion. Cost considerations and performance limitations of antifoaming agents also influence industry decisions, leading to a cautious approach to adoption. Additionally, market fragmentation, technological hurdles, and potential substitution by alternative technologies further complicate market dynamics.

Market Segmentation

The antifoaming agent market share is classified into type, application, and end-user.

- The silicone-based segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the antifoaming agent market is classified into water-based, oil-based, silicone-based, and others. Among these, the silicone-based segment is estimated to hold the highest market revenue share through the projected period. Silicone-based agents provide stronger and longer-lasting foam control than other choices due to silicone's distinct characteristics. Being hydrophobic and lipophobic, silicones can spread easily across interfaces and provide an efficient barrier against foam and bubble formation. Silicone-based agents are also more thermally and chemically stable than other agents, such as oil and water. This flexibility implies that silicone formulations provide sustained anti-foaming without degradation over time under various situations.

- The food processing segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the antifoaming agent market is divided into adhesives, coatings, detergents, wood pulp, and food processing. Among these, the food processing segment is anticipated to hold the largest market share through the forecast period. Foam control is crucial in food manufacturing to promote efficient processing and packing while maintaining product quality. It is also used in the fermentation process in breweries to remove foam and increase efficiency. The food processing business is a developed sector that is going through a difficult period due to increased worldwide demands for food safety, rising food insecurity, and rising customer demand for higher quality and sustainability. With increased imports and exports, processed foods rely on longer supply chains, posing a significant challenge to guaranteeing food safety.

- The pharmaceuticals segment dominates the market with the largest market share through the forecast period.

Based on the end-user, the antifoaming agent market is categorized into oil and gas, paint and coatings, food and beverages, pharmaceuticals, and textiles. Among these, the pharmaceuticals segment dominates the market with the largest market share through the forecast period. Antifoaming substances are utilized in pharmaceutical fermentation, including antibiotics and enzymes. The growing and aging population, as well as the increased prevalence of chronic diseases, are important factors driving global pharmaceutical sector growth. In the United States, the overall pharmaceutical spending increase is driven by a variety of factors, including new product adoption and brand pricing, while being mitigated by patent expirations and generics.

Regional Segment Analysis of the Antifoaming Agent Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the antifoaming agent market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the antifoaming agent market over the predicted timeframe. North America region has attributed due to the region's strong presence in end-use sectors such as oil and gas, paints and coatings, pharmaceuticals, and detergents. Countries such as the United States and Canada have sophisticated industrial infrastructures and extensive distribution networks to facilitate the supply of antifoaming chemicals. Furthermore, regulatory requirements such as the Occupational Safety and Health Administration (OSHA) in the United States require the use of defoamers to protect worker safety in industries like oil and gas. Leading antifoaming agent manufacturers have also established manufacturing facilities and research and development centers in the region to cater to both local demand and exports.

Asia Pacific is expected to grow at the fastest CAGR growth of the antifoaming agent market during the forecast period. Rapid industrialization, burgeoning populations, and rising disposable incomes in China, India, and other Southeast Asian countries have fueled demand for antifoaming chemicals in end-use products. China, in particular, has emerged as a significant importer of antifoaming agents to suit the demands of its thriving chemical industry. Meanwhile, India is also experiencing an expansion of end-use industries such as pharmaceuticals and food and drinks, which gives considerable prospects for producers and suppliers of antifoaming agents to enhance exports to India.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the antifoaming agent market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF

- Harmony Additives

- Evonik Industries AG

- Ashland Global Holdings Inc.

- Clariant AG

- Air Products and Chemicals, Inc.

- The Dow Corning Corporation

- Wacker Chemie AG

- ZILIBON Chemicals

- Sanco Industries Inc

- Elements Plc

- PennWhite

- Kemira

- Shin-Etsu Chemicals Company Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, BASF, a global leader in the provision of coatings additives, announced an increase in defoamer capacity at its Dilovasi factory in Turkey. The new production line enhances the company's on-site capacity, allowing it to better respond to increased demand for high-performance Foamaster and Foamstar products throughout Southeast Europe, the Middle East, and Africa.

- In February 2024, DIC Corporation announced that it had developed an antifoaming compound for use in lubricating oils for electric vehicles (EVs) that is free of perfluoroalkyl and polyfluoroalkyl substances (PFASs) and has excellent performance characteristics.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the antifoaming agent market based on the below-mentioned segments:

Global Antifoaming Agent Market, By Type

- Water-Based

- Oil-Based

- Silicone-Based

- Others

Global Antifoaming Agent Market, By Application

- Adhesives

- Coatings

- Detergents

- Wood Pulp

- Food Processing

Global Antifoaming Agent Market, By End-User

- Oil and Gas

- Paint and coatings

- Food and Beverages

- Pharmaceuticals

- Textile

Global Antifoaming Agent Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the antifoaming agent market over the forecast period?The antifoaming agent market is projected to expand at a CAGR of 4.30% during the forecast period.

-

2.What is the market size of the antifoaming agent market?The Global Antifoaming Agent Market Size is Expected to Grow from USD 5.60 Billion in 2023 to USD 8.53 Billion by 2033, at a CAGR of 4.30% during the forecast period 2023-2033.

-

3.Which region holds the largest share of the antifoaming agent market?North America is anticipated to hold the largest share of the antifoaming agent market over the predicted timeframe.

Need help to buy this report?