Global Antiscalant Market Size, Share, and COVID-19 Impact Analysis, By Type (Phosphonates, Carboxylates, and Sulfonates), By Application (Power & Construction, Mining, Water & Waste Treatment, and Oil & Gas), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Antiscalant Market Insights Forecasts to 2033

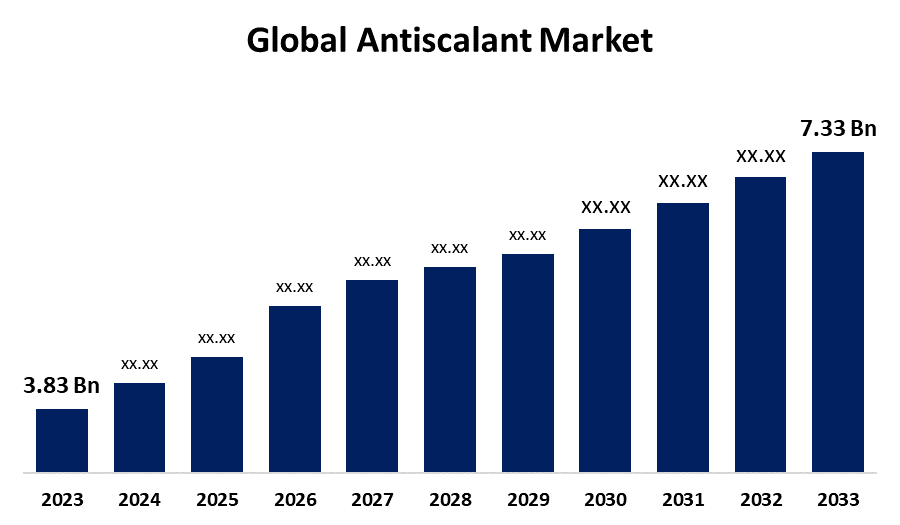

- The Global Antiscalant Market Size was Valued at USD 3.83 Billion in 2023

- The Market Size is Growing at a CAGR of 6.71% from 2023 to 2033

- The Worldwide Antiscalant Size is Expected to Reach USD 7.33 Billion by 2033

- Asia-Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Antiscalant Market Size is Anticipated to Exceed USD 7.33 Billion by 2033, Growing at a CAGR of 6.71% from 2023 to 2033. The market for antiscalants is driven by infrastructure projects such as water treatment plants, power production facilities, and industrial units.

Market Overview:

Antiscalants are chemical compounds or additives that prevent or diminish the production and buildup of scale deposits in industrial processes and water treatment systems. It is largely used in water treatment operations, including industrial and municipal water treatment, desalination, and a variety of industrial applications, to avoid or reduce the formation of scale deposits. Scale deposits can form on surfaces, notably in pipes, boilers, and heat exchangers, and are frequently formed of minerals or salts such as calcium carbonate, calcium sulfate, and silica. Antiscalants prevent the crystallization and precipitation of scale-forming minerals, hence preserving the productivity and effectiveness of industrial equipment and water treatment systems.

Report Coverage:

This research report categorizes the market for the global antiscalant market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global antiscalant market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global antiscalant market.

Global Antiscalant Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 3.83 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.71% |

| 2033 Value Projection: | USD 7.33 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 203 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Ashland, Avista Technologies, Solenix, Solvay SA, Clariant AG, Kemira Oyg, General Electric, Dow Chemicals, BWA Water Additives, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors:

The expansion of numerous sectors, including power production, oil and gas, chemical manufacture, and mining, results in increased water consumption and a larger demand for water treatment and scale prevention. As industrial activity increases, so does the demand for antiscalants. Scaling industrial equipment, such as boilers and heat exchangers, can degrade energy efficiency while increasing running expenses. Businesses are becoming more conscious of the value of energy efficiency, which is boosting the use of antiscalants to preserve equipment performance.

Restraining Factors:

Environmental concerns regarding the chemicals used to manufacture antiscalants deliver a major obstacle to the antiscalant industry.

Market Segmentation:

The global antiscalant market share is classified into type and application.

- The sulfonates segment has the highest share of the market over the forecast period.

Based on the type, the global antiscalant market is categorized into phosphonates, carboxylates, and sulfonates. Among these, the sulfonates segment has the highest share of the market over the forecast period. Sulfonates are antiscalants with sulfonic acid groups. They are employed in a variety of applications, such as water treatment and scaling prevention. It effectively prevents scale development, particularly in situations where calcium sulfate scaling is an issue. It is extensively used in sectors like as oil and gas, where sulfate scaling in drilling and production facilities could pose an important issue.

- The water & waste treatment segment holds the largest share of the market during the forecast period.

Based on the application, the global antiscalant market is categorized into power & construction, mining, water & waste treatment, and oil & gas. Among these, the water & waste treatment segment holds the largest share of the market during the forecast period. Antiscalants assist avoid scaling, assuring the quality and dependability of water treatment procedures such as desalination, reverse osmosis, and municipal water treatment. Antiscalants are used in the water and wastewater treatment industry to keep treatment equipment including membranes, filters, and evaporators operating efficiently. Scaling can lower the performance of these systems.

Regional Segment Analysis of the Global Antiscalant Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global antiscalant market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global antiscalant market over the forecast period. The North America will lead the worldwide antiscalant market as consumers' disposable incomes rise and building sites expand. A rising level of life, increased demand in the healthcare business, and new aeronautical technology are just a few of the factors driving the market in the United States. The antiscalant sector in the United States has been rather robust in recent years, and it is expected to develop even more over the projected period because of increased demand for horticultural farming.

Asia-Pacific region is expected to fastest CAGR growth during the forecast period. The Asia-Pacific area is generating massive industrial enterprises, healthcare infrastructure, and numerous medical breakthroughs. Antiscalants assist clean water used in industrial technologies while also lowering maintenance time, making them more cost-effective.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global antiscalant market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies:

- Ashland

- Avista Technologies

- Solenix

- Solvay SA

- Clariant AG

- Kemira Oyg

- General Electric

- Dow Chemicals

- BWA Water Additives

- Others

Key Market Developments:

- In July 2024, Kemira broadened its product offerings by acquiring Norit's UK reactivation business. This strategic decision enables Kemira to provide activated carbon services in addition to its current water treatment chemicals.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global antiscalant market based on the below-mentioned segments:

Global Antiscalant Market, By Type

- Phosphonates

- Carboxylates

- Sulfonates

Global Antiscalant Market, By Application

- Power & Construction

- Mining

- Water & Waste Treatment

- Oil & Gas

Global Antiscalant Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global antiscalant market over the forecast period?The global antiscalant market size is expected to grow from USD 3.83 Billion in 2023 to USD 7.33 Billion by 2033, at a CAGR of 6.71% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global antiscalant market?North America is projected to hold the largest share of the global antiscalant market over the forecast period.

-

3. Who are the top key players in the antiscalant market?Ashland, Avista Technologies, Solenix, Solvay SA, Clariant AG, Kemira Oyg, General Electric, Dow Chemicals, BWA Water Additives, and Others.

Need help to buy this report?