APAC and MENA Pilot Training Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Commercial Aircraft and General Aviation Aircraft), By Training Mode (Ground Training, Flight Training, and Simulator Training), By License & Certification (Commercial Pilot License (CPL), Private Pilot License (PPL), and Multi-Crew Pilot License (MPL)), and APAC and MENA Pilot Training Market Insights, Industry Trend, Forecasts to 2033

Industry: Aerospace & DefenseAPAC and MENA Pilot Training Market Insights Forecasts to 2033

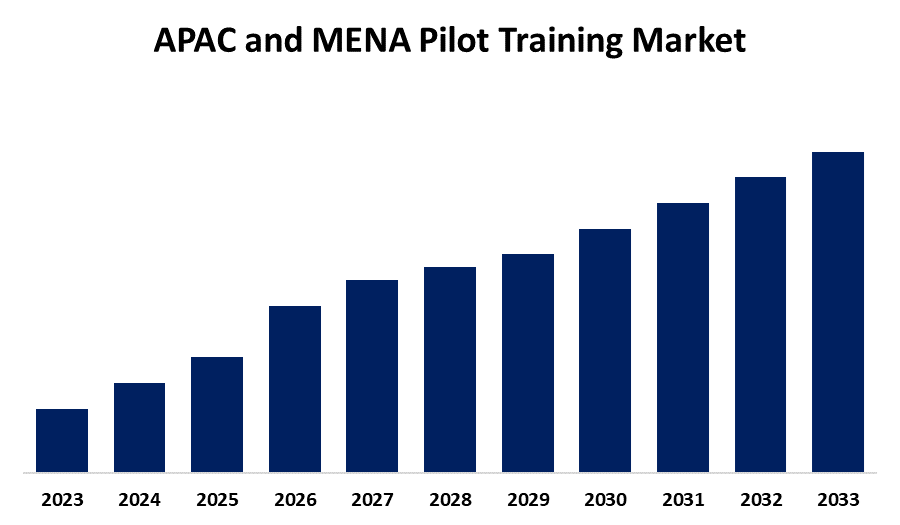

- The Market Size is Expected to Grow at a CAGR of around 9.7% from 2023 to 2033

- The APAC and MENA Pilot Training Market Size is Expected to hold a significant share by 2033

Get more details on this report -

The APAC and MENA Pilot Training Market Size is anticipated to hold a significant share by 2033, Growing at a CAGR of 9.7% from 2023 to 2033.

Market Overview

The industry that offers services and training programs to those who want to become pilots is known as the "pilot training market." Pilot training is the process of gaining the expertise, experience, and information required to safely and effectively pilot and control an aircraft. The lack of local pilots in the Middle East forces regional airlines to concentrate on nurturing homegrown talent. This strategy aids airlines in lowering the expenses related to employing foreign pilots and supports the government's objective of generating employment opportunities locally. Pilot training will become more in demand in the upcoming years due to these proactive airline actions. Additionally, the need for pilots from the UAE's main airlines, Emirates and Etihad Airways, as well as a consistent increase in air traveler volume are driving the country's aviation industry's boom. Airports in the United Arab Emirates handled 58.328 million transit passengers in 2023, with an estimated 38 million arrivals and 37.805 million departures. Furthermore, pilots are becoming more and more necessary to oversee their flight operations as airlines proliferate. Increased demand for air travel, growing tourism industries, and supportive government policies that support aviation all contribute to the opening of new airlines.

Report Coverage

This research report categorizes the APAC and MENA pilot training market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the APAC and MENA pilot training market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the APAC and MENA pilot training market.

APAC and MENA Pilot Training Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 9.7% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 249 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Aircraft Type, By Training Mode, By License & Certification and COVID-19 Impact Analysis. |

| Companies covered:: | EGYPTAIR TRAINING ACADEMY, Etihad Aviation Training, CAE Inc., Emirates Flight Training Academy (Emirates Group), Asia Pacific Flight Training Academy, All Asia Aviation Academy, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is expanding due to the rise of new airlines worldwide. Numerous new airlines are entering the civil aviation sector, especially in developing nations and areas with expanding economies. For example, Saudi Arabia announced in March 2023 that it will launch a new national airline, Riyadh Air, with the goal of becoming Riyadh a major international aviation hub that would compete with other significant regional companies like Dubai and Doha. By 2030, Riyadh Air hopes to have started flights to more than 100 foreign locations. Additionally, more experienced pilots will be required as many aviation companies plan to increase the number of services they offer. Over the next 20 years, Airbus expects the Asia-Pacific area will require 999,000 additional trained professionals or nearly 45% of the world's workforce. These professionals will include 268,000 new pilots, 298,000 new technicians, and 433,000 new cabin crew members. The Asia-Pacific and MENA pilot training industry is expanding due in part to the significant increase in demand for qualified professionals or pilots in the Asia-Pacific area. Furthermore, air travel is becoming more and more popular for both business and pleasure as economies expand and people's disposable budgets rise. The need for more airline services has resulted from this, and new carriers have been established to satisfy the rising demand.

Restraints & Challenges

Pilot training firms face challenges due to the intricate legal frameworks in various nations, particularly in the Asia-Pacific and MENA regions. Strict rules and certification standards are enforced by aviation authorities to guarantee flight training uniformity and safety. The sector is further constrained by the high expense of training.

Market Segmentation

The APAC and MENA pilot training market share is classified into aircraft type, training mode, and license & certification.

- The commercial aircraft segment held a significant share in 2023 and is expected to grow at a substantial CAGR during the forecast period.

Based on the aircraft type, the APAC and MENA pilot training market is categorized as commercial aircraft and general aviation aircraft. Among these, the commercial aircraft segment held a significant share in 2023 and is expected to grow at a substantial CAGR during the forecast period. A specialized educational program called commercial aircraft pilot training is intended to give pilots the skills they need to get a commercial pilot license. This is because of the growing need for commercial pilots, this market is likely to increase significantly.

- The flight training segment held a significant share in 2023 and is expected to grow at a substantial CAGR during the forecast period.

Based on the training mode, the APAC and MENA pilot training market is categorized as ground training, flight training, and simulator training. Among these, the flight training segment held a significant share in 2023 and is expected to grow at a substantial CAGR during the forecast period. Practical flight training techniques are becoming more and more important throughout the entire pilot training process. Through hands-on experience, practical flight training enables aspiring pilots to become acquainted with emergency protocols, aircraft handling, and real-life circumstances.

- The commercial pilot license (CPL) segment accounted for a significant share in 2023 and is anticipated to grow at a substantial CAGR during the projected timeframe.

On the basis of license & certification, the APAC and MENA pilot training market is categorized as commercial pilot license (CPL), private pilot license (PPL), and multi-crew pilot license (MPL). Among these, the commercial pilot license (CPL) segment held a significant share in 2023 and is anticipated to grow at a substantial CAGR during the projected timeframe. The training courses and prerequisites for earning a commercial pilot's license are referred to as CPL. Pilots with this license are permitted to fly aircraft for business, including charter flights and airline flights. This is due to the rise in commercial aviation, this market sector is expected to grow at the quickest rate.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the APAC and MENA pilot training market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- EGYPTAIR TRAINING ACADEMY

- Etihad Aviation Training

- CAE Inc.

- Emirates Flight Training Academy (Emirates Group)

- Asia Pacific Flight Training Academy

- All Asia Aviation Academy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In March 2023, the UAE-based flight training company Airways Aviation partnered with the India-based Asia Pacific Flight Training Academy Limited (APFT) to offer potential Indian students and airline cadets access to a cutting-edge pilot pathway curriculum.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the APAC and MENA pilot training market based on the below-mentioned segments:

APAC and MENA Pilot Training Market, By Aircraft Type

- Commercial Aircraft

- General Aviation Aircraft

APAC and MENA Pilot Training Market, By Training Mode

- Ground Training

- Flight Training

- Simulator Training

APAC and MENA Pilot Training Market, By License & Certification

- Commercial Pilot License (CPL)

- Private Pilot License (PPL)

- Multi-Crew Pilot License (MPL)

Need help to buy this report?