APAC Pet Food Ingredients Market Size, Share, and COVID-19 Impact Analysis, By Ingredient Functionality (Texture Solutions, Healthful Solutions, and Fillers and Bulking Age), By Ingredient Source (Plant-based and Animal-based), By Pet Type (Cats, Dogs, Fish, and Others), By Form (Dry Pet Food, Wet Pet Food, and Treats & Supplements), and APAC Pet Food Ingredients Market Analysis and Forecast 2023 - 2033

Industry: Food & BeveragesAPAC Pet Food Ingredients Market Insights Forecasts to 2033

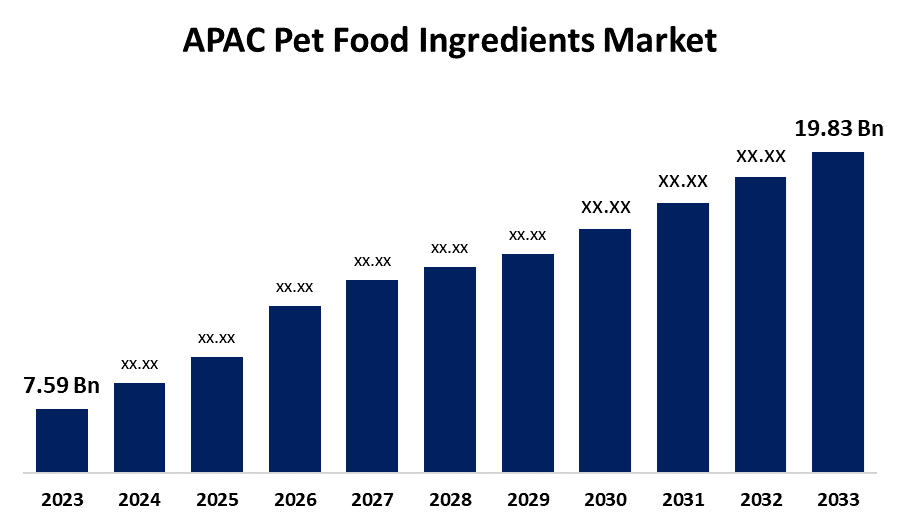

- The APAC Pet Food Ingredients Market Size was estimated at USD 7.59 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 10.08% from 2023 to 2033

- The APAC Pet Food Ingredients Market Size is Expected to Reach USD 19.83 Billion by 2033

- Asia-Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The APAC Pet Food Ingredients Market Size is Expected to cross USD 19.83 Billion by 2033, growing at a CAGR of 10.08% from 2023 to 2033.

Market Overview

The Asia-Pacific pet food ingredients market refers to the industry focused on the production, formulation, and distribution of ingredients used in pet food across the Asia-Pacific region. The production and distribution of vital raw materials needed to formulate pet diets that meet the nutritional requirements of various pet species are referred to as the pet food ingredients market. These components come from both plant and animal sources and include proteins, carbs, lipids, vitamins, and minerals. The demand for pet food ingredients among producers is driven by the rapidly growing pet population and the growing pet ownership. Quality pet food that meets the nutritional demands of these animals is becoming more and more necessary as more households adopt pets. Because pet ownership is on the rise, manufacturers are being forced to concentrate on finding high-quality ingredients and developing novel formulas to meet the evolving tastes of pet owners. Manufacturers are forced by the rise in pet ownership to concentrate on locating high-quality components and developing novel formulas to satisfy the evolving tastes of pet owners. An estimated 62 million stray canines live in India, according to May 2024 National Library of Medicine research.

Report Coverage

This research report categorizes the APAC pet food ingredients market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the APAC pet food ingredients market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the APAC pet food ingredients market.

Driving Factors

Pet owners are prioritizing high-quality components for their pets diets, which is driving up demand for pet food ingredients. In addition to boosting sales, this shifting consumer demand pushes manufacturers to develop and expand their product lines, which boosts the regions pet food ingredient industry. A World Animal Foundation survey from August 2024 states that 26% of Asian-Pacific (APAC) households have a cat, and 32% have a dog. Pet ownership is on the rise, which emphasizes the necessity for a variety of nutrient-dense ingredients in pet food to accommodate pet owners shifting tastes. Additionally, China's growing disposable income enables people to spend money on high-end pet food items that offer improved nutritional value. This shift in consumer spending indicates a greater dedication to the health and welfare of pets, which raises demand for premium ingredients like natural, organic, and specialty formulations. According to a United Nations Development Programme (UNDP) estimate, China's per capita disposable income in 2023 was USD 3,052.97 in rural areas and USD 7,293.71 in urban areas. The increase in disposable income demonstrates the rising demand for high-end pet food products that prioritize pet nutrition and general health.

Restraining Factors

The market for pet food ingredients is hampered by the restricted supply of resources because, as demand for high-end pet food rises, shortages of necessary ingredients like meat and particular grains lead to shortages and increased manufacturing costs. In addition to limiting producers' capacity to create premium pet food, this shortage drives them to look for alternatives, which lowers the end product's quality and nutritional content.

Market Segmentation

The APAC pet food ingredients market share is classified into ingredient functionality, ingredient source, pet type, and form.

- The healthful solutions segment held a significant share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the ingredient functionality, the APAC pet food ingredients market is divided into texture solutions, healthful solutions, and fillers & bulking age. Among these, the healthful solutions segment held a significant share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The need for functional ingredients that promote immunity, digestion, and general well-being is being driven by growing consumer awareness of pet nutrition and health.

- The plant-based segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe.

Based on the ingredient source, the APAC pet food ingredient market is divided into plant-based and animal-based. Among these, the plant-based segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe. The shift toward natural and sustainable pet food options has led to a rise in plant-based ingredients, including starches, fibers, and gums, which enhance texture and nutrition

- The dogs segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe.

Based on the pet type, the APAC pet food ingredients market is divided into cats, dogs, fish, and others. Among these, the dogs segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe. Dogs have the largest pet population in the Asia-Pacific region, and owners are more likely to invest in premium pet food, driving higher demand for specialized ingredients.

- The dry pet food segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe.

Based on the form, the APAC pet food ingredients market is divided into dry pet food, wet pet food, and treats & supplements. Among these, the dry pet food segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe. Dry pet food dominates due to its convenience, longer shelf life, and affordability, making it the preferred choice for pet owners across the region.

Regional Segment Analysis of the APAC Pet Food Ingredients Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the APAC pet food ingredients market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Chr. Hansen Holding A/S

- Kemin Industries, Inc

- ADM

- Omega Protein Corporation

- Ingredion

- DSM

- Cargill

- BASF SE

- Darling Ingredients Inc.

- AFB International

- DuPont Nutrition

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at country levels from 2023 to 2033. Spherical Insights has segmented the APAC pet food ingredients market based on the below-mentioned segments:

APAC Pet Food Ingredients Market, By Ingredient Functionality

- Texture Solutions

- Healthful Solutions

- Fillers and Bulking Age

APAC Pet Food Ingredients Market, By Ingredient Source

- Plant-based

- Animal-based

APAC Pet Food Ingredients Market, By Pet Type

- Cats

- Dogs

- Fish

- Others

APAC Pet Food Ingredients Market, By Form

- Dry Pet Food

- Wet Pet Food

- Treats & Supplements

Need help to buy this report?