Global Application Performance Management Market Size, Share, and COVID-19 Impact Analysis, By Platform Type (Software and Service), By Deployment Mode (On-premise, Cloud, and Hybrid), By Enterprise Size (SMEs and Large Enterprises), By Access Type (Web APM and Mobile APM), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Information & TechnologyGlobal Application Performance Management Market Insights Forecasts to 2033

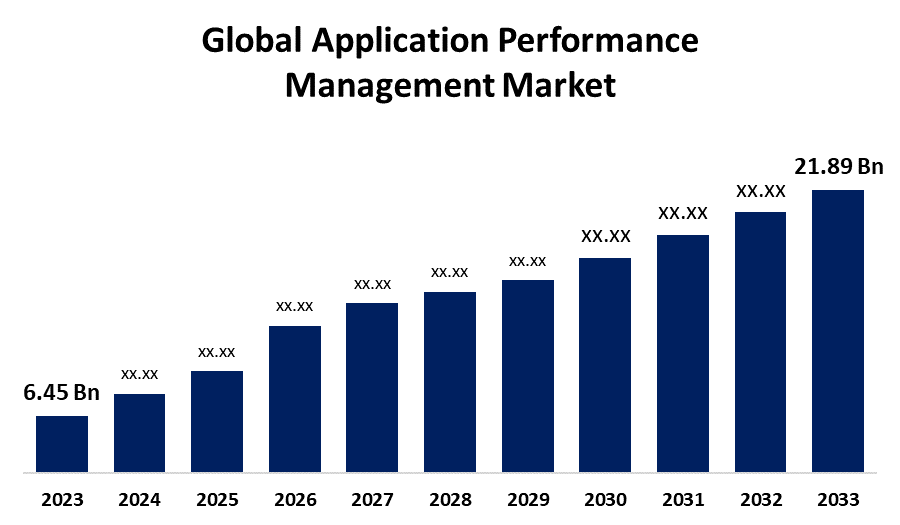

- The Global Application Performance Management Market Size Was Estimated at USD 6.45 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 13.00% from 2023 to 2033

- The Worldwide Application Performance Management Market Size is Expected to Reach USD 21.89 Billion by 2033

- Europe is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Application Performance Management Market Size is anticipated to exceed USD 21.89 Billion by 2033, growing at a CAGR of 13.00% from 2023 to 2033. The market growth is due to the rise in digital platform usage and remote work, the growing use of digital technologies, especially cloud computing and mobile.

Market Overview

The application performance management market refers to the sector concentrated on software tools and solutions that were made to track, control, and enhance the functionality of applications during their lifetime. These technologies assist businesses in making sure that their applications are operating effectively, satisfying user needs, and offering flawless user experiences. The application performance management used for real-time monitoring, transaction tracing, performance analytics, error detection, resource management, and infrastructure monitoring are frequently included in APM solutions. Proactively detecting and fixing performance problems, reducing downtime, and enhancing application dependability are the objectives.

NIC's application performance management (APM) service is an agent-based solution for managing the performance, availability, and user experience of online applications. The service is supplied as Software-as-a-Service (SaaS) through NIC National Cloud and operates on a client-server basis, with monitoring agents distributed across various components of the application delivery ecosystem.

The requirement for comprehensive application performance management (APM) and efficient program performance monitoring has grown crucial in government organizations, particularly large and complex agencies such as the National Institutes of Health (NIH). The National Institutes of Health (NIH), a prominent organization within the United States Department of Health and Human Services (HHS), promotes scientific research and is in charge of expanding medical knowledge and treatment. Its research portfolio is extensive, with several initiatives targeted at understanding, treating, and curing diseases.

The rising use of government initiatives and their investment in application performance management expand the market growth.

Report Coverage

This research report categorizes the application performance management market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the application performance management market. Recent market developments and competitive strategies such as expansion, Type of Software launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the application performance management market.

Global Application Performance Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 6.45 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 13.00% |

| 2033 Value Projection: | USD 21.89 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Platform Type, By Deployment Mode, By Enterprise Size, By Access Type and By Region |

| Companies covered:: | IBM, Akamai Technologies, Broadcom Inc., AppDynamics, Dynatrace LLC, Microsoft, Datadog Inc., Oracle, New Relic Inc., OpenText Corporation, Splunk Inc., BMC Software Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The application performance management market is experiencing rapid growth driven by the increase in remote work and the use of digital platforms. As businesses become more reliant on mobile and cloud technologies, guaranteeing consistent application performance has become critical. The adoption of DevOps and CI/CD processes increases the demand for APM solutions to manage application health in real-time. These tools are critical for ensuring productivity and user happiness in dispersed contexts. As mobile app usage grows, APM solutions are critical for optimizing performance and providing high-quality digital experiences.

Restraining Factors

Market expansion is hampered by the deployment of APM solutions can be expensive, particularly for small and medium-sized businesses (SMEs), as it includes software licenses, implementation, and maintenance. It can be expensive and time-consuming to integrate APM tools with current IT applications and infrastructure, which may discourage businesses from implementing these solutions. Concerns regarding data security and privacy are raised by the collection and analysis of performance data by APM tools, which may contain proprietary or sensitive information.

Market Segmentation

The application performance management market is classified into platform type, deployment mode, enterprise size, and access type.

- The software segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the platform type, the application performance management market is categorized into software and service. Among these, the software segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the rising complexity of IT industries and the increasing use of cloud-based applications. APM technologies are now essential for tracking and improving application performance as companies embrace remote and hybrid environments more and more. By assisting IT workers in quickly identifying problems, these solutions guarantee that applications run smoothly. The need for such solutions in contemporary businesses is further highlighted by the expanding use of complex cloud services.

- The cloud segment held the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the deployment mode, the application performance management market is segmented into on-premise, cloud, and hybrid. Among these, the cloud segment held the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the cloud APM tools' scalability and flexibility are key factors propelling this market's expansion. Without having to make significant investments in on-premise hardware, cloud-based APM solutions enable enterprises to extend their monitoring capabilities as their application environments grow.

- The large enterprises segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the enterprise size, the application performance management market is divided into SMEs and large enterprises. Among these, the large enterprises segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be propagated to businesses that incorporate more digital technologies into their operations, such as big data, artificial intelligence (AI), and Internet of Things (IoT) platforms. Large businesses may ensure that these technologies operate smoothly within the larger IT ecosystem by monitoring and optimizing their performance with the help of APM solutions.

- The web AMP segment held the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the access type, the application performance management market is segmented into web APM and mobile APM. Among these, the web AMP segment held the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to optimizing the performance of websites, online services, and web applications requires web application performance management (APM) solutions. They optimize load times, server responsiveness, and user experience by monitoring important parameters. These tools are essential for improving SEO ranks, lowering bounce rates, and guaranteeing seamless website operation.

Regional Segment Analysis of the Application Performance Management Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the application performance management market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the application performance management market over the predicted timeframe. The region's growth can be attributed to the rising need for immediate application performance insight and real-time monitoring. To ensure smooth user experiences and promptly address performance bottlenecks, businesses need real-time insights. To meet this need, APM solutions that provide real-time dashboards and warnings are growing in popularity. Various technology hubs and major technology companies are present in these regions.

Europe is expected to grow at the fastest CAGR of the application performance management market during the forecast period. In these regions a rising demand for AMP solutions customized to particular industries such as healthcare, finance, and retail. These industry-specific solutions appeal to the particular performance management demands and legal specifications of various sectors. The growing focus on data protection is promoting market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the application performance management market along with a comparative evaluation primarily based on their Type of Software offerings, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes Type of Software development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IBM

- Akamai Technologies

- Broadcom Inc.

- AppDynamics

- Dynatrace LLC

- Microsoft

- Datadog Inc.

- Oracle

- New Relic Inc.

- OpenText Corporation

- Splunk Inc.

- BMC Software Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In August 2024, Broadcom Inc. launched VMware Tanzu Platform 10, a new solution for improving intelligent application delivery in private cloud environments. This platform has been created to improve governance and operational efficiency while also streamlining team development operations.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the application performance management market based on the below-mentioned segments:

Global Application Performance Management Market, By Platform Type

- Software

- Service

Global Application Performance Management Market, By Deployment Mode

- On-premise

- Cloud

- Hybrid

Global Application Performance Management Market, By Enterprise Size

- SMEs

- Large Enterprises

Global Application Performance Management Market, By Access Type

- Web APM

- Mobile APM

Global Application Performance Management Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the application performance management market over the forecast period?The application performance management market is projected to expand at a CAGR of 13.00% during the forecast period.

-

2. What is the market size of the application performance management market?The Global Application Performance Management Market Size is Expected to Grow from USD 6.45 Billion in 2023 to USD 21.89 Billion by 2033, at a CAGR of 13.00% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the Application Performance Management market?North America is anticipated to hold the largest share of the application performance management market over the predicted timeframe.

Need help to buy this report?