Global Application Server Market Size, Share, and COVID-19 Impact Analysis, By Type (Java, Microsoft Windows, and Others), By Deployment (Hosted and On-premise), By End-Use (BFSI, Government, Healthcare, IT & Telecom, Manufacturing, Retail, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Information & TechnologyGlobal Application Server Market Insights Forecasts to 2032

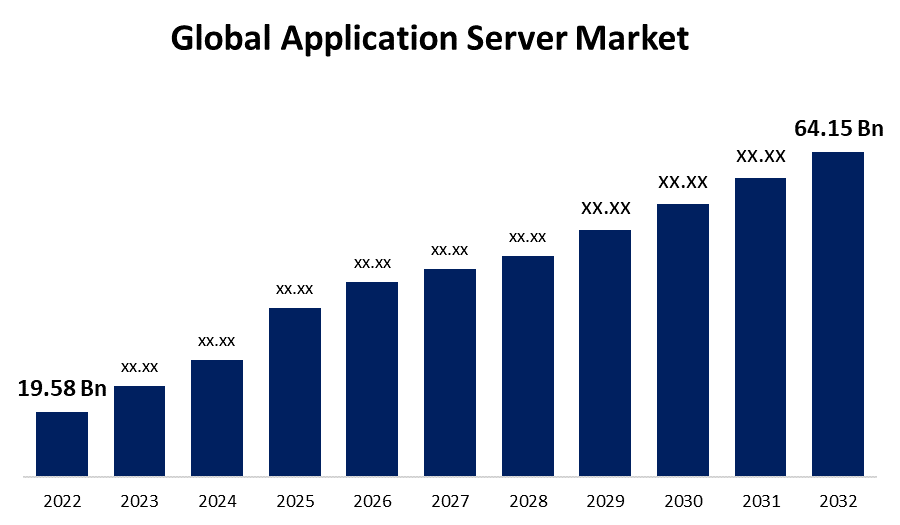

- The Global Application Server Market Size was valued at USD 19.58 Billion in 2022.

- The Market Size is Growing at a CAGR of 12.6% from 2022 to 2032

- The Worldwide Application Server Market Size is expected to reach USD 64.15 Billion by 2032

- Asia-Pacific is expected To Grow significant during the forecast period

Get more details on this report -

The Global Application Server Market Size is expected to reach USD 64.15 Billion by 2032, at a CAGR of 12.6% during the forecast period 2022 to 2032.

Market Overview

An application server is a software framework that provides an environment for developing, deploying, and running applications. It acts as an intermediary between the client and the backend systems, managing the execution of application code and facilitating communication between different components. The main purpose of an application server is to handle the complex tasks of application scalability, security, and transaction management. It offers a range of services such as database connectivity, session management, messaging, and caching. Application servers are commonly used in web-based applications, where they host and execute dynamic content, including server-side scripts and business logic. They provide a robust and scalable infrastructure that enables efficient application development and deployment, making them essential in modern software architectures.

Report Coverage

This research report categorizes the market for application server market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the application server market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the application server market.

Global Application Server Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 19.58 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 12.6% |

| 2032 Value Projection: | USD 64.15 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Deployment, By End-Use, By Region. |

| Companies covered:: | Adobe, FUJITSU, F5, Inc., Hewlett Packard Enterprise Development LP, International Business Machines Corporation, Microsoft Corporation, Nastel Technologies, NEC Corporation, Oracle Corporation, Payara Services Ltd., Red Hat, Inc., SAP SE, TIBCO Software, Inc., The Apache Software Foundation, VMware, and Inc. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The application server market is driven by several key factors, because of the increasing demand for web-based applications and services fuels the growth of application servers as they provide the necessary infrastructure for hosting and executing these applications. The rapid adoption of cloud computing and the shift towards scalable and flexible architectures drive the market as application servers play a vital role in enabling cloud deployment models. Additionally, the rising emphasis on security and data protection drives the demand for application servers that offer robust security features and ensure compliance with regulations. Furthermore, the proliferation of mobile devices and the need for seamless integration with diverse platforms and devices propel the market growth. Overall, the continuous advancements in technology, such as containerization and microservices, create opportunities for application servers to optimize resource utilization and enhance application performance, further driving the market.

Restraining Factors

The application server market also faces certain restraints due to the increasing adoption of serverless computing models and the emergence of containerization technologies pose a challenge to the traditional application server market. These alternatives offer more lightweight and flexible deployment options, potentially reducing the demand for traditional application servers. The complexity and cost associated with managing and maintaining application servers may deter some organizations from adopting or upgrading their existing infrastructure. Additionally, the availability of open-source alternatives and the growing trend towards open platforms create pricing pressures for commercial application server vendors. Overall, concerns around data privacy and security in cloud environments may create hesitancy among businesses to fully leverage application servers for hosting critical applications.

Market Segmentation

- In 2022, the Java segment accounted for around 48.2% market share

On the basis of the technology, the global application server market is segmented into java, microsoft windows, and others. The Java-type segment is estimated to occupy a significant share in the application server market. There are several key factors contributing to the dominance of the Java-type segment, because Java has been widely adopted as a popular programming language for developing enterprise-level applications. Its robustness, scalability, and platform independence make it a preferred choice for building complex and large-scale applications. This popularity translates into a higher demand for application servers that support Java-based applications. Java-based application servers provide extensive support for various frameworks and libraries that facilitate application development and deployment. The Java Enterprise Edition (Java EE) platform offers a comprehensive set of APIs and specifications, enabling developers to build enterprise-grade applications with ease. Application servers that are specifically designed to support Java EE provide a range of features and services that streamline the development process and enhance application performance. Furthermore, Java-based application servers offer a mature ecosystem with a vast array of tools, documentation, and community support. Developers can leverage these resources to troubleshoot issues, access libraries, and collaborate with other developers, making the development process more efficient and productive. Additionally, Java-based application servers have a strong presence in sectors such as finance, telecommunications, and e-commerce, where reliability, scalability, and security are crucial. The stability and performance of Java-based application servers make them well-suited for handling high-volume and mission-critical applications. Overall, the combination of Java's popularity as a programming language, its rich ecosystem, and its suitability for enterprise-level applications contribute to the higher market share of the Java-type segment in the application server market.

- In 2022, the IT & telecom segment dominated with more than 24.6% market share

Based on the end-use, the global application server market is segmented into BFSI, government, healthcare, IT & telecom, manufacturing, retail, and others. The IT & telecom segment is estimated to occupy the largest share of the application server market by the end-use segment. This dominance can be attributed to the IT & telecom industry relies heavily on robust and scalable applications to support its complex operations. Application servers play a critical role in hosting and executing these applications, ensuring efficient communication, and managing large volumes of data. The industry's constant need for high-performance and secure applications drives the demand for application servers. The IT & telecom sector is characterized by rapid technological advancements, evolving consumer demands, and increasing competition. To stay competitive, companies in this sector require agile and adaptable application infrastructures. Application servers provide the necessary flexibility and scalability to meet changing business requirements, enabling organizations to deliver innovative services and experiences to their customers. Additionally, the IT & telecom sector has a vast network infrastructure that requires efficient management and integration. Application servers facilitate seamless communication and data exchange between various components of the network, enabling smooth operation and enhanced performance. Moreover, with the advent of 5G technology and the Internet of Things (IoT), the IT & telecom industry is experiencing a surge in data traffic and the need for real-time applications. Application servers are essential in handling the increased data load and ensuring low latency and high responsiveness, thereby enabling the delivery of advanced services and applications. Furthermore, the IT & telecom sector is a major contributor to digital transformation initiatives across industries. As organizations across sectors embrace digital technologies, they require robust application infrastructures supported by application servers to drive their digital initiatives and ensure seamless integration of services. Overall, the IT & telecom segment's dominant share in the application server market is driven by the industry's reliance on high-performance applications, the need for agility and scalability, the management of network infrastructure, and its role in driving digital transformation initiatives.

Regional Segment Analysis of the Application Server Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 40.7% revenue share in 2022.

Get more details on this report -

Based on region, North America has emerged as the leading region in the application server market, holding the largest market share. North America is home to a large number of tech-savvy enterprises and a thriving IT industry. The region has witnessed significant advancements in digital transformation initiatives, driving the demand for robust application server solutions. North America has a mature and well-established infrastructure, making it conducive for the deployment and integration of application servers. Furthermore, the region has a high concentration of major players in the technology sector, leading to increased innovation and competition. Additionally, North America has a strong emphasis on data security and compliance, which fuels the adoption of application servers that offer robust security features. Overall, these factors contribute to North America's leading market position in the application server market.

Recent Developments

- In December 2022, Microsoft and the London Stock Exchange Group (LSEG) worked together to update LSEG's data infrastructure using Microsoft Cloud. It benefited both organisations' clients in automating labor-intensive & complicated procedures, improving application deployments, and developing solutions for data and analytics collaboratively.

- In June 2022, HPE declared that it is the first significant server manufacturer to provide a new range of cloud-native computing solutions utilising chips from Ampere. The new HPE ProLiant RL Gen 11 servers have a single socket that can support scale-out computing with up to 128 cores per socket. Customers who offer digital services, video streaming, social platforms, e-commerce, financial, or online services, as well as cloud-based services like IaaS, PaaS, and SaaS, are the best candidates for these servers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global application server market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Adobe

- FUJITSU

- F5, Inc.

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Microsoft Corporation

- Nastel Technologies

- NEC Corporation

- Oracle Corporation

- Payara Services Ltd.

- Red Hat, Inc.

- SAP SE

- TIBCO Software, Inc.

- The Apache Software Foundation

- VMware, Inc.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Global Application Server Market based on the below-mentioned segments:

Application Server Market, By Type

- Java

- Microsoft Windows

- Others

Application Server Market, By Deployment

- Hosted

- On-premise

Application Server Market, By End-Use

- BFSI

- Government

- Healthcare

- IT & Telecom

- Manufacturing

- Retail

- Others

Application Server Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?