Global Aquafeed Market Size, Share, and COVID-19 Impact Analysis, By Form (Dry, Moist, and Wet), By Additive (Amino Acids, Antibiotics, Vitamins & Minerals, Feed Acidifiers, Antioxidants), By Application (Carp, Rainbow Trout, Salmon, Crustaceans, Tilapia, Catfish), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Aquafeed Market Insights Forecasts to 2033

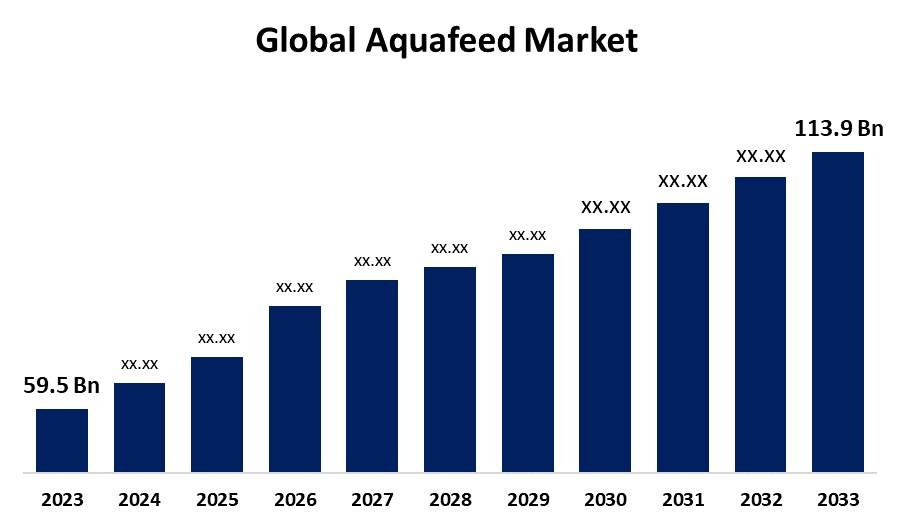

- The Global Aquafeed Market Size was Valued at USD 59.5 Billion in 2023

- The Market Size is Growing at a CAGR of 6.71% from 2023 to 2033

- The Worldwide Aquafeed Market Size is Expected to Reach USD 113.9 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aquafeed Market Size is Anticipated to Exceed USD 113.9 Billion by 2033, Growing at a CAGR of 6.71% from 2023 to 2033.

Market Overview

Aquafeed, a mixture of unprocessed ingredients, pigments, and additional nutrients from natural or artificial sources, is fed to aquaculture. Mixing different ingredients and additions to create compounded meals for aquatic animals is known as aqua feeding. The composition of these mixes is determined by the age of the animal as well as the particular needs of the species. Fish feed is often made up of the following ingredients: amino acids, vitamins, minerals, enzymes, probiotics, antibiotics, tastes, and colorants. Aquaculture and capture are the main methods used to produce fish in the globe. Fish includes, among other things, carp, salmon, tilapia, and catfish. The dependence on caught fisheries has declined as a result of declining natural resources and other causes. Just a tiny percentage of fish produced is utilized as animal feed; the majority is consumed directly by people. The final recipients of aquafeed include fish, mollusks, crabs, etc. Shrimp is the most important aquaculture product, although tilapia is the most farmed fish, grown in 135 nations. Many governments looking to boost their countries' economic performance have welcomed aquaculture, which is a vital component of their economic development, and have even put certain helpful laws into place. Even though the old approach is slow and ineffective, it is still commonly utilized. The method of production is different depending on what the customers in the local and international markets want and need. Since fish is a low-fat protein in comparison to other meats like cow and chicken, its direct human consumption has increased. The availability of a wider range of fish in the retail sector is the cause of this increase in consumption. Additionally, it provides a number of health advantages, including improving children's cognitive development, lowering body fat, and decreasing the risk of cardiovascular illnesses.

Report Coverage

This research report categorizes the market for the global aquafeed market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global aquafeed market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global aquafeed market.

Global Aquafeed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 59.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.71% |

| 2033 Value Projection: | USD 113.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Form, By Additive, By Application, By Region |

| Companies covered:: | Cargill, Inc., BioMar Group, Ridley Corp. Ltd., Aller Aqua, BENEO, Alltech, Aker Biomarine, Charoen Pokphand Foods PCL, Skretting, Purina Animal Nutrition LLC, Dibaq Aquaculture, INVE Aquaculture, Avanti Feeds Ltd., Biostadt India Ltd., The Waterbase Ltd., and other key of companies |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

It is anticipated that the growing popularity of organic fish farming will open up profitable chances for market development. Though organic fish farming is still relatively new, customer desire is rising, which will probably drive market expansion. The increasing demand for animal protein in major Western nations and the expanding global seafood trade is expected to support the expansion of the aquafeed industry globally. Aquaculture production and market development are expected to be stimulated by the increasing demand for seafood and consumer expenditure on fish and fish products, including fish oils, fish meals, and silage. The world's population is expanding, which helps the fish market develop and, in turn, increases demand for aquafeed. Growing market share would be positively impacted by increasing R&D expenditures made by industry associations and market players for novel items. To fight the present market's high pricing for feed, this new research seeks to develop substitutes for the substances now used in fish feed. The fish meal that mostly consists of plant-based proteins is a creative substitute. The companies have made the decision to explore mergers and acquisitions in order to increase the range of goods and services they provide to customers.

Restraining Factors

The major price fluctuation of the raw materials needed to prepare feed is a barrier to the market's expansion. The price of the product itself might be directly impacted, for instance, by a notable increase in the cost of maize, soybeans, or any other raw material used in the production. Individuals are choosing vegetarian diets and cutting out non-vegetarian foods in greater numbers. This might hurt the market as it is expected to decrease the demand for seafood. The use of some compounds, such as antibiotics, is restricted by the regulatory framework of the animal feed sector. The key problem impeding market development is the growing cost of raw materials.

Market Segmentation

The global aquafeed market share is classified into form, additive, and application.

- The dry segment is expected to hold the largest share of the global aquafeed market during the forecast period.

Based on the form, the global aquafeed market is divided into dry, moist, and wet. Among these, the dry segment is expected to hold the largest share of the global aquafeed market during the forecast period. The ability to raise the fish feed conversion ratio is responsible for this. Given the great taste of the dry-form feed, the sector is predicted to continue growing at the quickest rate and hold its top spot for the duration of the prediction.

- The amino acids segment is expected to hold the largest share of the global aquafeed market during the forecast period.

Based on the additive, the global aquafeed market is divided into amino acids, antibiotics, vitamins & minerals, feed acidifiers, and antioxidants. Among these, the amino acid segment is expected to hold the largest share of the global aquafeed market during the forecast period. This high percentage is explained by its benefits, which include boosting immunity, raising larval performance, optimizing fish metabolic transformation efficiency, raising tolerance to environmental stressors, regulating spawning efficiency and timing, and enhancing the flavor and texture of fillets when added to aquafeed. Antibiotics are another common component of aquafeed, in addition to amino acids. They increase general health, which fosters greater growth, and they are employed to increase output and efficiency.

- The carp segment is expected to hold the largest share of the global aquafeed market during the forecast period.

Based on the application, the global aquafeed market is divided into carp, rainbow trout, salmon, crustaceans, tilapia, and catfish. Among these, the carp segment is expected to hold the largest share of the global aquafeed market during the forecast period. The significant consumption of this species can be attributed to its related health advantages, which include boosting immunity, improving heart health, managing chronic illnesses, and safeguarding gastrointestinal functioning. The increasing intake of this species, which enhances heart health, decreases the risk of chronic illnesses, increases immunity, and safeguards gastrointestinal functions, is responsible for the segment's large share. With rice, corn, and soybeans used as aquafeed, catfish, a sustainable fish species, are raised in freshwater ponds. Due to its ease of cultivation in less-than-ideal climatic circumstances, it is the favored category of aquaculture species.

Regional Segment Analysis of the Global Aquafeed Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

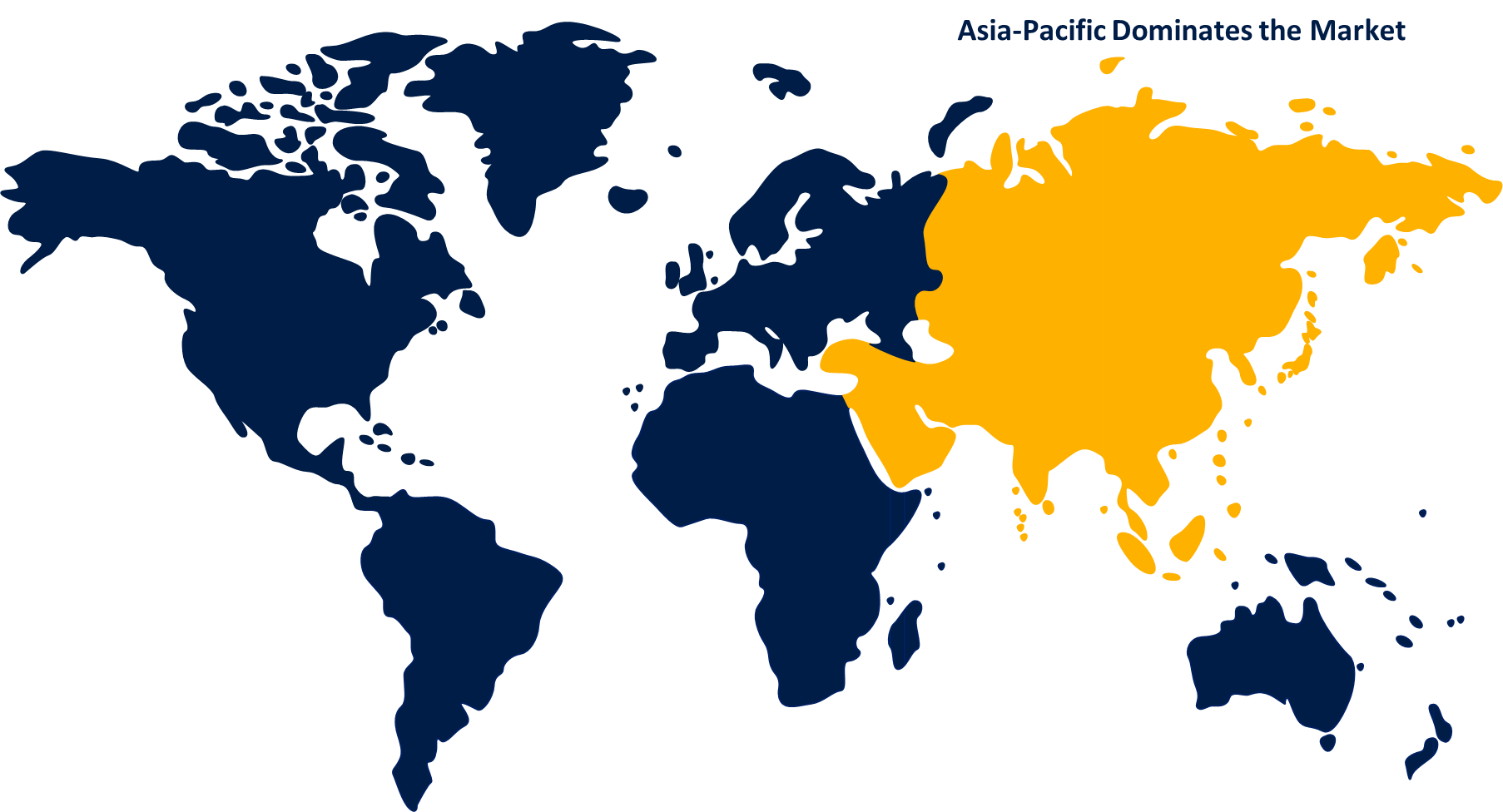

Asia Pacific is anticipated to hold the largest share of the global aquafeed market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global aquafeed market over the predicted timeframe. The regional market is anticipated to continue growing at the highest rate possible and to hold its leading position throughout the duration of the projection. This is a result of the local aquaculture industry's rapid expansion. The increase will also be aided by the region's natural resources, the availability of inexpensive labor, and environmental factors that encourage aquaculture expansion.

North America is expected to grow at the fastest pace in the global aquafeed market during the forecast period. It is anticipated that throughout the projection years, the regional market in North America will also see considerable expansion. Since more people are eating seafood like salmonids, mollusks, hard clams, oysters, and mussels, the aquaculture industry in North America is predicted to expand quickly throughout the projection period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global aquafeed market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and swot analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill, Inc.

- BioMar Group

- Ridley Corp. Ltd.

- Aller Aqua

- BENEO

- Alltech

- Aker Biomarine

- Charoen Pokphand Foods PCL

- Skretting

- Purina Animal Nutrition LLC

- Dibaq Aquaculture

- INVE Aquaculture

- Avanti Feeds Ltd.

- Biostadt India Ltd.

- The Waterbase Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, BioMar, a Danish company, and Benson Hill, Inc., a food innovation company that unlocks the natural genetic variation of plants, formed a strategic partnership after using Benson Hill soy and further analyzing its sustainability impact on high-performance aquafeed formulations.

- In November 2022: Skretting opened its new fish feed factory, Lotus II, in Vietnam. The fish feed factory consists of two independent lines with a production capacity of 100,000 tons per year.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global aquafeed market based on the below-mentioned segments:

Global Aquafeed Market, By Form

- Dry

- Moist

- Wet

Global Aquafeed Market, By Additive

- Amino Acids

- Antibiotics

- Vitamins & Minerals

- Feed Acidifiers

- Antioxidants

Global Aquafeed Market, By Application

- Carp

- Rainbow Trout

- Salmon

- Crustaceans

- Tilapia

- Catfish

Global Aquafeed Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Cargill, Inc., BioMar Group, Ridley Corp. Ltd., Aller Aqua, BENEO, Alltech, Aker Biomarine, Charoen Pokphand Foods PCL, Skretting, Purina Animal Nutrition LLC, Dibaq Aquaculture, INVE Aquaculture, Avanti Feeds Ltd., Biostadt India Ltd., The Waterbase Ltd., others.

-

2. What is the size of the global aquafeed market?The global aquafeed market is expected to grow from USD 59.5 Billion in 2023 to USD 113.9 Billion by 2033, at a CAGR of 6.71 % during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global aquafeed market over the predicted timeframe.

Need help to buy this report?