Global Aramid Fiber Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Para-aramid and Meta-aramid), By End-user Industry (Security and Protection Equipment, Aerospace, Automotive, Electronics and Telecommunication, and Other End-user Industries), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030.

Industry: Chemicals & MaterialsGlobal Aramid Fiber Market Insights Forecasts to 2030

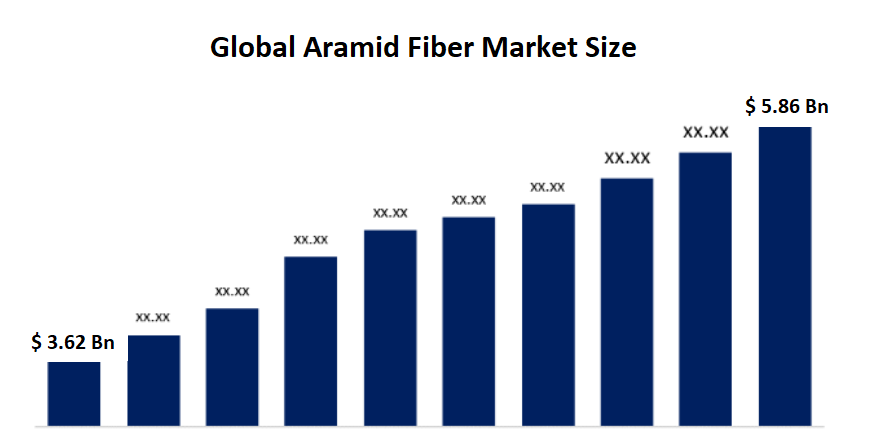

- The Aramid Fiber Market Size was valued at USD 3.62 billion in 2021.

- The market is growing at a CAGR of 5.5% from 2022 to 2030

- The Aramid Fiber Market Size is expected to reach USD 5.86 billion by 2030

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Aramid Fiber Market Size is expected to reach USD 5.86 billion by 2030, at a CAGR of 5.5% during the forecast period 2022 to 2030. The aramid fiber market has grown because of the increasing product demand from a variety of industries, including oil & gas, healthcare, manufacturing, and others.

Market Overview

Due to its beneficial mechanical characteristics, including impact resistance, high strength, abrasion resistance, and thermal degradation resistance, aramid fiber is widely employed in various applications. Protective apparel frequently uses para-aramid and meta-aramid fiber. The aramid fiber market has grown significantly due to the constantly expanding need for lightweight materials in security and protection applications. In addition, a significant factor supporting the expansion of the aramid fiber market throughout the forecast period is the increasing need for lightweight materials that offer considerable pollution reduction in cars. Furthermore, the need for aramid fiber is prospering due to the rising demand for the product from numerous sectors, including healthcare, oil and gas manufacturing, and others, due to stringent government requirements for worker safety. The high cost of production, on the other hand, has the potential to pose a threat to the expansion of the aramid fiber market. High R&D expenses and the non-biodegradable nature of aramid fibers may function as significant inhibitors to the aramid fiber market's growth rate in the forecast period.

Furthermore, the forecast mentioned above will present several potential possibilities for the aramid fiber market due to the escalating need for homeland security, increased defense spending, and quick advancements in aramid materials manufacturing technology. The epidemic also caused significant financial losses for several manufacturers, which led some of them to delay installing new automation systems. However, the market benefited from a substantial increase in product demand from the medical business. The cement sector is predicted to adopt more cutting-edge material handling equipment, such as wagon tipplers, belt conveyor systems, and bucket elevators, to facilitate the movement and handling of materials, which will propel market expansion in the U.S.

Global Aramid Fiber Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 3.62 Billion |

| Forecast Period: | 2022-2030 |

| Forecast Period CAGR 2022-2030 : | 5.5 % |

| 2030 Value Projection: | USD 5.86 Billion |

| Historical Data for: | 2019-2020 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Product, By End-user Industry, By region |

| Companies covered:: | Teijin Ltd., Yantai Tayho Advanced Materials Co, E. I. du Pont de Nemours and Company (DowDuPont), Hyosung Corp., Toray Chemicals South Korea, Inc., Kermel S.A., Kolon Industries, Inc., Huvis Corp., China National Bluestar (Group) Co., Ltd., and SRO Aramid (Jiangzu) Co., Ltd. |

| Growth Drivers: | Rapidly increasing demand for lightweight materials in security and protection is expected to drive the markets growth over the forecast period. |

| Pitfalls & Challenges: | Covid-19 Impact Analysis |

Get more details on this report -

Report Coverage

This research report categorizes the market for global aramid fiber based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global aramid fiber market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each global aramid fiber market sub-segments.

Segmentation Analysis

- In 2021, the para-aramid segment dominated the market with the largest market share of 57% and market revenue of 2.06 billion.

Based on the product type, the global aramid fiber market is categorized into Para-aramid and Meta-aramid. In 2021, the para-aramid segment dominated the market with the largest market share of 57% and market revenue of 2.06 billion. Over the forecast period, it is anticipated that the good strength-to-weight ratio and high tensile strength and modulus behavior will favor the segment's growth. The product possesses qualities that are expected to increase demand, including low elongation to break, good chemical resistance, good heat & flame resistance, and excellent ballistic capabilities. Additionally, it is anticipated that its strong cut resistance and good chemical resistance would encourage its use in various applications, including frictional materials, aerospace, security & protection, etc.

- In 2021, the security and protection equipment segment accounted for the largest share of the market, with 27% and market revenue of 0.97 billion.

Based on the end-user, the ceramic ink market is categorized into Security and Protection Equipment, Aerospace, Automotive, Electronics and Telecommunication, and Other End-user Industries. In 2021, the security and protection equipment segment accounted for the largest share of the market, with 27% and a market revenue of 0.97 billion. The application segment is anticipated to rise thanks to the rising use of the product in protective apparel. Aramid fiber is increasingly used in aerospace components, including the leading and trailing edge panels, landing gear doors, and new-generation aircraft's primary wing and fuselage structure. The product's characteristics, such as its exceptional strength, impact resistance, and lightweight, are anticipated to lead to a high consumption rate.

Regional Segment Analysis of the Aramid Fiber Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Get more details on this report -

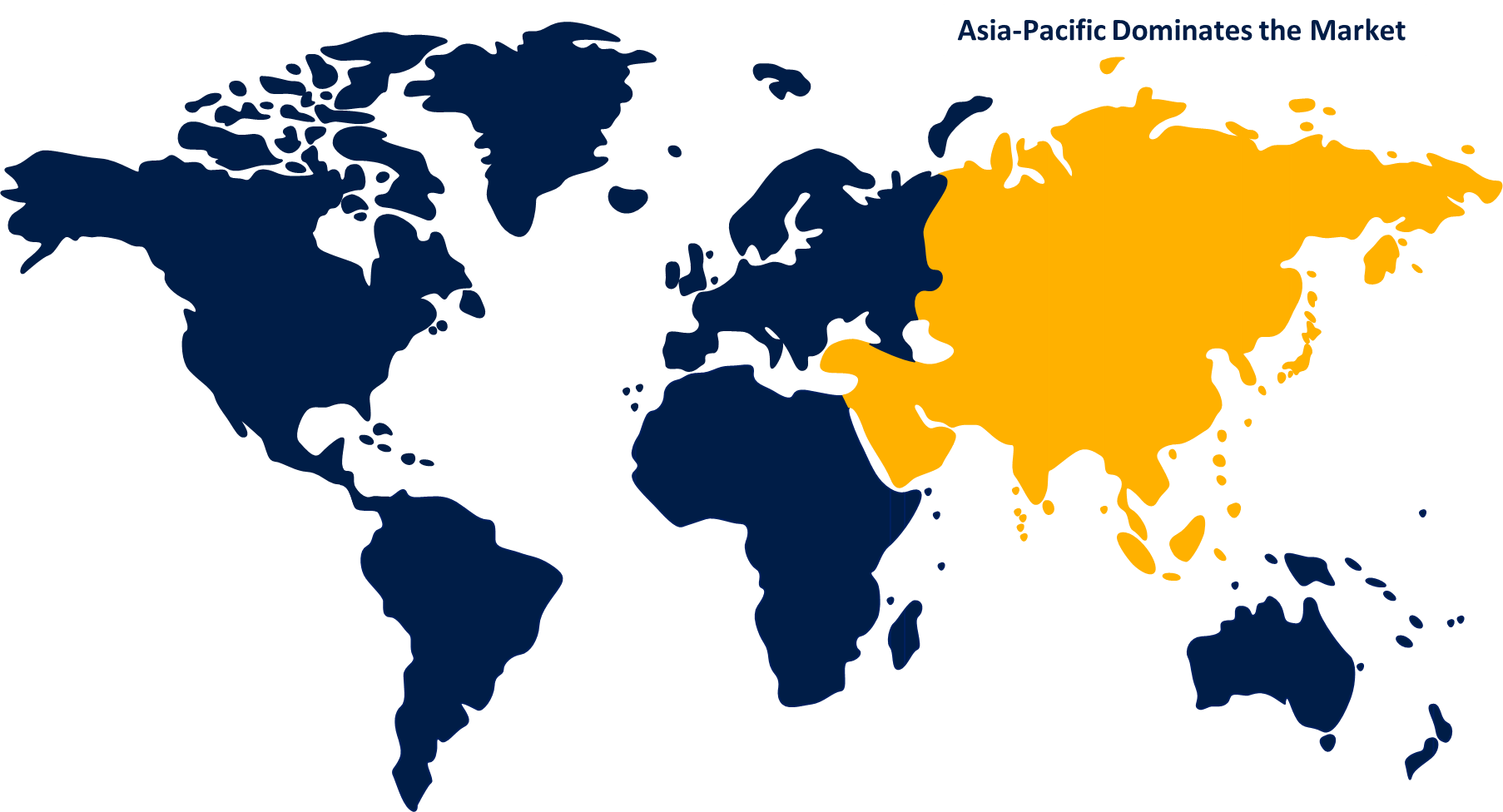

Asia-Pacific emerged as the largest market for the global aramid fiber market, with a market share of around 37.6% and 3.62 billion of the market revenue in 2021.

- Asia-Pacific emerged as the largest market for the global aramid fiber market, with a market share of around 37.6% and 3.62 billion of the market revenue in 2021. Due to the increased use of security and protection measures across several industries, growth is anticipated. The demand for products in APAC is also projected to be influenced by growing internet usage in emerging economies, fast industrialization, and substantial expansion in the telecom sector. Increasing geopolitical tensions and rising military spending in big economies like China and India are projected to present growth possibilities for the market. Additionally, throughout the forecast period, significant investments are expected to fuel demand for the product in the building, industrial, and healthcare sectors.

- The Europe market is expected to grow at the fastest CAGR between 2021 and 2030, The region's expanding refurbishment operations, along with strict rules governing worker safety & protection in a variety of industries, are expected to drive market expansion. The American National Standards Institute (ANSI) in the United States has established protection standards that are projected to increase demand for goods such as protective gloves, helmets, and apparel. Over the forecast period, this is anticipated to help the market expansion in North America.

Competitive Landscape

The report offers the appropriate analysis of the key organizations/companies involved within the global aramid fiber market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- Teijin Ltd.

- Yantai Tayho Advanced Materials Co

- E. I. du Pont de Nemours and Company (DowDuPont)

- Hyosung Corp.

- Toray Chemicals South Korea, Inc.

- Kermel S.A.

- Kolon Industries, Inc.

- Huvis Corp.

- China National Bluestar (Group) Co., Ltd.

- SRO Aramid (Jiangzu) Co., Ltd.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Some of the Key Developments:

- In May 2020, A MOU for investment in the expansion of the latter's Aramid factory in Ulsan City, South Korea, was signed with HYOSUNG. Following the terms of the MOU, HYOSUNG intends to invest a total of USD 54 million in its Ulsan Aramid factory, complete the expansion by the first half of 2021, and increase the firm's annual production capacity from 1,200 tonnes to 3,700 tonnes.

- In November 2019, The second stage of TEIJIN LIMITED's 25% capacity expansion for its Twaron aramid fibers. Two of its facilities, in the Netherlands at Delfzijl and Emmen, are anticipated to boost their capacity by 2022, which will benefit the company's operations.

Market Segment

This study forecasts global, regional, and country revenue from 2019 to 2030. Spherical Insights has segmented the global aramid fiber market based on the below-mentioned segments:

Global Aramid Fiber Market, By Product Type

- Para-aramid

- Meta-aramid

Global Aramid Fiber Market, By End-User

- Security and Protection Equipment

- Aerospace

- Automotive

- Electronics and Telecommunication

- Other End-user Industries

Global Aramid Fiber Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Aramid Fiber market?As per Spherical Insights, the size of the Aramid Fibre market was valued at USD 3.62 billion in 2022 to USD 5.86 billion by 2030.

-

What is the market growth rate of the Aramid Fibre market?The Aramid Fibre market is growing at a CAGR of 5.5% from 2022 to 2030.

-

Which country dominates the Aramid Fibre market?Asia-Pacific emerged as the largest market for Aramid Fibre.

-

Who are the key players in the Aramid Fibre market?Key players in the Aramid Fibre market are Teijin Ltd., Yantai Tayho Advanced Materials Co, E. I. du Pont de Nemours and Company (DowDuPont), Hyosung Corp., Toray Chemicals South Korea, Inc., Kermel S.A., Kolon Industries, Inc., Huvis Corp., China National Bluestar (Group) Co., Ltd., and SRO Aramid (Jiangzu) Co., Ltd.

-

Which factor drives the growth of the Aramid Fibre market?Rapidly increasing demand for lightweight materials in security and protection is expected to drive the market's growth over the forecast period.

Need help to buy this report?