Global ArF Dry and Immersion Resist Materials Market Size, Share, and COVID-19 Impact Analysis, By Type (ArF Dry, and ArF Immersion), By Application (Semiconductors & Integrated Circuits, and Printed Circuit Boards), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Advanced MaterialsGlobal ArF Dry and Immersion Resist Materials Market Insights Forecasts to 2033

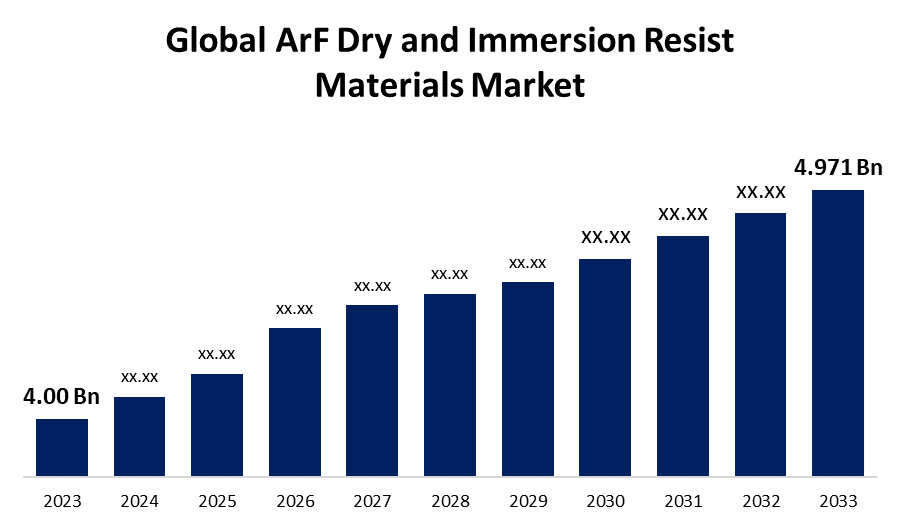

- The Global ArF Dry and Immersion Resist Materials Market Size was Valued at USD 4.00 Billion in 2023

- The Market Size is Growing at a CAGR of 2.20% from 2023 to 2033

- The Worldwide ArF Dry and Immersion Resist Materials Market Size is Expected to Reach USD 4.971 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global ArF Dry and Immersion Resist Materials Market Size is Anticipated to Exceed USD 4.971 Billion by 2033, Growing at a CAGR of 2.20% from 2023 to 2033.

Market Overview

ArF dry and immersion resist materials are used in the manufacturing of semiconductor devices. These materials are essential because they produce a crucial layer, known as the resist, on the semiconductor wafer during the lithography process. The resist layer is then shaped to generate complicated circuit patterns on the semiconductor wafer, allowing for the manufacturing of high-performance electronic components. The ArF Dry and Immersion Resistant Materials Market is predicted to grow significantly in the upcoming years. The increasing demand for electronic products, like as smartphones, tablets, and wearables, is pushing the need for better semiconductor manufacturing technologies, such as ArF Dry and Immersion lithography. Furthermore, the increasing use of advanced packaging technologies like fan-out wafer-level packaging (FOWLP) and 3D integrated circuits is driving up demand for these materials.

Report Coverage

This research report categorizes the market for ArF dry and immersion resist materials market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the ArF dry and immersion resist materials market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the ArF dry and immersion resist materials market.

Global ArF Dry and Immersion Resist Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.00 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 2.20% |

| 2033 Value Projection: | USD 4.971 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Tokyo Ohka Kogyo, Hitachi Chemical, Eternal Materials, AZ Electronic Materials, Sumitomo Chemical, JSR Corporation, Kolon Industries, Dow, DuPont, Shin-Etsu Chemical Co., Ltd., LG Chem, Merck AZ Electronics Materials, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ArF dry and immersion resist materials market is driven by several key factors. Technological advancements in semiconductor manufacturing require materials capable of achieving higher resolutions, driving the demand for advanced ArF resist materials. Node transitions towards smaller semiconductor nodes, such as from 7nm to 5nm and beyond, increase the need for more sensitive and effective resist materials. The adoption of immersion lithography for finer patterning further boosts demand for ArF immersion-resistant materials. Balancing cost-effectiveness with performance, regulatory considerations, and the overall growth of the semiconductor industry also significantly influences market dynamics. Continuous improvements in semiconductor technology, such as electronic component downsizing and the emergence of new materials for resist formulations, are moving the market forward.

Restraining Factors

The ArF dry and immersion resist materials market encounters several constraints that affect market growth. High costs and technological complexities associated with developing these materials can hinder widespread adoption, particularly among smaller semiconductor manufacturers. Emerging lithography alternatives such as EUV (Extreme Ultraviolet) pose competitive threats by offering potential advantages in resolution and cost-effectiveness for future nodes. Furthermore, performance constraints and fierce competition among suppliers add to market complications, potentially affecting innovation and market dynamics. Economic fluctuations and global market conditions also play a role in shaping the landscape for resisting materials.

Market Segmentation

The ArF dry and immersion resist materials market share is classified into type and application.

- The ArF immersion segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the ArF dry and immersion resist materials market is classified into ArF dry, and ArF immersion. Among these, the ArF immersion segment is estimated to hold the highest market revenue share through the projected period. This dominance is driven by the semiconductor industry's shift towards advanced lithography techniques like immersion lithography, which enable higher resolution and finer patterning capabilities necessary for manufacturing nodes at 7nm and beyond. ArF immersion resist materials are specifically formulated to work effectively in immersion lithography systems, offering enhanced performance in terms of resolution, line edge roughness, and sensitivity. Continuous innovation and development in this segment enhance market growth worldwide.

- The semiconductors & integrated circuits segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the ArF dry and immersion resist materials market is divided into semiconductors & integrated circuits, and printed circuit boards. Among these, the semiconductors & integrated circuits segment is anticipated to hold the largest market share through the forecast period. This segment is attributed to the semiconductor industry's continual pursuit of higher integration densities and smaller feature sizes, necessitating advanced lithography solutions. ArF resist materials, including both dry and immersion types, play a critical role in meeting the precise patterning requirements essential for manufacturing advanced semiconductor devices at nodes such as 7nm and below. The sector's scale, high precision demands, ongoing innovation in lithography techniques, and global market dynamics, driven by applications in consumer electronics, automotive electronics, telecommunications, and emerging technologies like AI and 5G, collectively contribute to the robust growth and dominance of the semiconductors & integrated circuits segment in the ArF resist materials market.

Regional Segment Analysis of the ArF Dry and Immersion Resist Materials Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the ArF dry and immersion resist materials market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the ArF dry and immersion resist materials market over the predicted timeframe. Asia Pacific is predicted to dominate the ArF dry and immersion resist materials market, owing to the presence of key semiconductor manufacturers in Taiwan, South Korea, China, and Japan. These countries are driving the demand for sophisticated lithography technologies, resulting in the expansion of the ArF dry and immersion resist materials market in the region. The demand for ArF dry and immersion resist materials is propelled by the region's rapid growth in consumer electronics, automotive electronics, and telecommunications industries, all reliant on high-performance semiconductor components. Supportive government policies and a well-established semiconductor supply chain further enhance Asia Pacific's market position.

North America is expected to grow at the fastest CAGR growth of the ArF dry and immersion resist materials market during the forecast period. This growth is driven by the region's leadership in technological innovation, particularly in semiconductor manufacturing and related industries. Strong research and development capabilities, coupled with strategic investments and partnerships, support advancements in semiconductor fabrication techniques that rely on ArF dry and immersion lithography. Industries such as aerospace, defense, telecommunications, and automotive in North America are increasingly adopting high-performance semiconductor components, driving demand for advanced ArF resist materials. As the region continues to expand its market presence and capitalize on emerging technologies like IoT, AI, and 5G, the demand for ArF dry and immersion resist materials is expected to grow rapidly.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the ArF dry and immersion resist materials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tokyo Ohka Kogyo

- Hitachi Chemical

- Eternal Materials

- AZ Electronic Materials

- Sumitomo Chemical

- JSR Corporation

- Kolon Industries

- Dow

- DuPont

- Shin-Etsu Chemical Co., Ltd.

- LG Chem

- Merck AZ Electronics Materials

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2023, Nikon Corporation is pleased to announce the availability of the NSR-S636E ArF immersion scanner. The NSR-S636E is an immersion lithography scanner for crucial layers that provides excellent overlay precision and ultra-high throughput.

- In September 2021, Sumitomo Chemical announced establishing an ArFi photoresist production line at the Iksan factory of Dongwoo Fine Chem, a 100% owned subsidiary of Sumitomo Chemical.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the ArF dry and immersion resist materials market based on the below-mentioned segments:

Global ArF Dry and Immersion Resist Materials Market, By Type

- ArF Dry

- ArF Immersion

Global ArF Dry and Immersion Resist Materials Market, By Application

- Semiconductors & Integrated Circuits

- Printed Circuit Boards

Global ArF Dry and Immersion Resist Materials Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the ArF dry and immersion resist materials market over the forecast period?The ArF dry and immersion resist materials market is projected to expand at a CAGR of 2.20% during the forecast period.

-

2.What is the market size of the ArF dry and immersion resist materials market?The Global ArF Dry and Immersion Resist Materials Market Size is Expected to Grow from USD 4.00 Billion in 2023 to USD 4.971 Billion by 2033, at a CAGR of 2.20% during the forecast period 2023-2033.

-

3.Which region holds the largest share of the ArF dry and immersion resist materials market?Asia Pacific is anticipated to hold the largest share of the ArF dry and immersion resist materials market over the predicted timeframe.

Need help to buy this report?