Global Artillery Systems Market Size, Share, and COVID-19 Impact Analysis, By Range (Short, Medium, Long), By Component (Fire Control Systems, Engines, Turrets, Chassis), By Type (Howitzer, Mortars, Rocket Launchers, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Artillery Systems Market Insights Forecasts to 2033

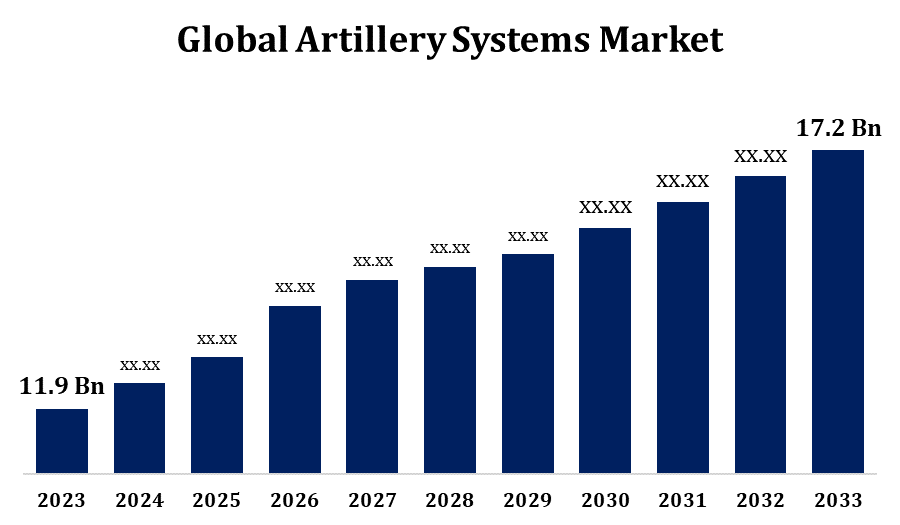

- The Global Artillery Systems Market Size was valued at USD 11.9 Billion in 2023.

- The Market Size is growing at a CAGR of 3.75% from 2023 to 2033.

- The Worldwide Artillery Systems Market Size is expected to reach USD 17.2 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Artillery Systems Market is expected to reach USD 17.2 Billion by 2033, at a CAGR of 3.75% during the forecast period 2023 to 2033.

The Global Artillery Systems Market is experiencing significant growth driven by rising defense budgets and modernization initiatives across militaries worldwide. These systems, including howitzers, mortars, and rocket artillery, are integral to ground combat operations, offering enhanced firepower, precision, and mobility. Increasing geopolitical tensions and border disputes are propelling nations to upgrade and acquire advanced artillery systems. Technological advancements such as automated fire control systems, GPS integration, and extended-range capabilities are further boosting demand. The market is also witnessing a shift toward self-propelled and lightweight systems to improve operational flexibility. Key regions contributing to growth include North America, Europe, and the Asia-Pacific, with notable investments in emerging economies. However, challenges like high costs and stringent regulatory norms may impact market expansion.

Artillery Systems Market Value Chain Analysis

The artillery systems market value chain encompasses several stages, from raw material procurement to end-user deployment. It begins with the sourcing of key components, such as metals, alloys, and advanced electronic systems, supplied by specialized manufacturers. The design and development phase follows, where defense contractors and technology firms integrate cutting-edge innovations like automated fire control, GPS guidance, and enhanced mobility features. Manufacturing and assembly are critical, requiring high precision to meet stringent quality and safety standards. Post-production, systems undergo rigorous testing and validation before being supplied to defense agencies through direct contracts or government procurement programs. Maintenance, repair, and upgrade services form a vital part of the value chain, ensuring long-term performance. Collaboration among suppliers, OEMs, and military organizations is essential to ensure seamless integration and operational efficiency.

Artillery Systems Market Opportunity Analysis

The artillery systems market presents significant opportunities driven by evolving military needs and technological advancements. Increasing geopolitical tensions and border conflicts are prompting nations to modernize their artillery capabilities, creating demand for advanced systems with greater precision, range, and mobility. Innovations like autonomous artillery systems, smart munitions, and GPS-guided targeting offer substantial growth potential. Emerging economies in Asia-Pacific, the Middle East, and Africa are investing heavily in defense modernization, providing lucrative opportunities for manufacturers. Additionally, the rise in joint ventures and defense collaborations between countries is expanding market access. Upgrades and retrofitting of existing systems also offer revenue streams. The growing focus on lightweight, self-propelled systems and digital integration further enhances opportunities for companies offering cutting-edge solutions to meet modern warfare requirements.

Global Artillery Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 11.9 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 3.75% |

| 023 – 2033 Value Projection: | USD 17.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | Range Analysis, Component Analysis, Type Analysis, Regional Analysis |

| Companies covered:: | Elbit Systems Ltd.; RTX Corporation; Leonardo S.p.A; BAE Systems plc; General Dynamics; Thales Group; Lockheed Martin Corporation; KNDS France; Hanwha Corporation; RUAG International Holding Ltd.; Denel SOC Ltd.; Singapore Technologies Engineering Ltd.; Aubert & Duval; Avibras |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Market Dynamics

Artillery Systems Market Dynamics

- Increased global defense spending to drive market growth

The surge in global defense spending is a key driver for the growth of the artillery systems market. Rising geopolitical tensions, regional conflicts, and border security challenges are prompting nations to prioritize military modernization and enhance their artillery capabilities. Governments worldwide are increasing budgets to procure advanced artillery systems, including self-propelled howitzers, rocket launchers, and precision-guided munitions, to ensure superior firepower and tactical advantages. The integration of cutting-edge technologies such as GPS-guided targeting, automated fire control systems, and extended-range projectiles is further fueling investments. Emerging economies, particularly in the Asia-Pacific and Middle East regions, are significantly contributing to market expansion through large-scale procurement programs. This increased spending ensures continuous advancements in artillery systems, providing lucrative growth opportunities for manufacturers and defense contractors globally.

- Restraints & Challenges

High development and procurement costs pose significant barriers, particularly for smaller economies with limited defense budgets. The complexity of integrating advanced technologies, such as GPS-guided targeting, automated systems, and extended-range capabilities, further escalates costs and requires substantial R&D investments. Stringent government regulations and lengthy procurement processes often delay system adoption. Additionally, geopolitical factors, including export restrictions and international sanctions, limit market access for certain manufacturers. Maintenance, repair, and upgrade requirements for existing systems can strain resources and budgets. The rise of asymmetric warfare and increased focus on unmanned systems also shift priorities away from traditional artillery. Lastly, ensuring interoperability among diverse systems in multinational operations remains a technical and operational challenge for defense forces globally.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Artillery Systems Market from 2023 to 2033. The United States, being the largest contributor, invests heavily in advanced artillery systems to maintain its tactical edge. Initiatives like the U.S. Army’s Long Range Precision Fires (LRPF) program focus on developing next-generation systems with extended range, precision targeting, and enhanced mobility. Canada is also upgrading its artillery capabilities, emphasizing interoperability and modern technologies. The region benefits from a robust defense manufacturing base, cutting-edge R&D, and collaborations with global allies. Rising geopolitical tensions and commitments to NATO defense objectives further boost demand. However, stringent regulatory frameworks and lengthy acquisition cycles could pose challenges for manufacturers operating in the North American market.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China leads the region with advancements in self-propelled howitzers and rocket artillery, while India focuses on indigenous development through programs like the Dhanush and K9 Vajra systems. Emerging economies in Southeast Asia are also acquiring advanced artillery systems to address security challenges. The region’s emphasis on long-range precision firepower and mobile artillery platforms further boosts market demand. However, procurement delays, budget constraints, and dependency on imports in some nations remain challenges, prompting a growing focus on domestic manufacturing and defense collaborations.

Segmentation Analysis

- Insights by Range

The medium range segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by its versatility and cost-effectiveness. These systems, typically offering a range between 30-70 kilometers, are ideal for a wide range of combat scenarios, including counter-battery fire and tactical support. Their ability to balance firepower, range, and mobility makes them highly sought after by militaries worldwide. Advancements in ammunition, such as extended-range projectiles and precision-guided munitions, further enhance their effectiveness, boosting adoption. Rising geopolitical tensions and border conflicts have fueled demand for medium-range systems, particularly in regions like Asia-Pacific, the Middle East, and Eastern Europe. Additionally, modernization programs focused on upgrading legacy systems with advanced targeting and fire control technologies contribute significantly to the growth of this segment.

- Insights by Type

The howitzer segment accounted for the largest market share over the forecast period 2023 to 2033. Howitzers, known for their ability to deliver both direct and indirect fire support, are increasingly in demand as militaries focus on upgrading their ground-based combat capabilities. The shift towards self-propelled and lightweight howitzers enhances operational mobility and rapid deployment in diverse terrains. Technological advancements, such as extended-range guided munitions and automated fire control systems, have further bolstered the segment's growth. Rising defense budgets in regions like Asia-Pacific and Eastern Europe, driven by geopolitical tensions, are fueling procurement of advanced howitzers. Programs like the U.S. Army’s Extended Range Cannon Artillery (ERCA) highlight the global focus on enhancing howitzer capabilities for long-range precision strikes.

- Insights by Component

The fire control systems segment accounted for the largest market share over the forecast period 2023 to 2033. Modern fire control systems improve targeting accuracy, reduce response times, and enhance operational effectiveness through advanced features like automated targeting, ballistic computation, and integration with GPS and radar systems. The growing adoption of network-centric warfare strategies further boosts demand, as FCS enables seamless data sharing and coordination among units. Defense modernization programs worldwide, particularly in the U.S., China, and India, are prioritizing the integration of advanced FCS into existing and new artillery platforms. Additionally, the increasing use of unmanned and autonomous artillery systems has accelerated the need for sophisticated fire control technologies to optimize long-range and precision strike capabilities.

Recent Market Developments

- In August 2024, Elbit Systems Ltd. has secured a contract valued at approximately USD 270 million to supply rocket artillery to an international client over a four-year period.

Competitive Landscape

Major players in the market

- Elbit Systems Ltd.

- RTX Corporation

- Leonardo S.p.A

- BAE Systems plc

- General Dynamics

- Thales Group

- Lockheed Martin Corporation

- KNDS France

- Hanwha Corporation

- RUAG International Holding Ltd.

- Denel SOC Ltd.

- Singapore Technologies Engineering Ltd.

- Aubert & Duval

- Avibras

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Artillery Systems Market, Range Analysis

- Short

- Medium

- Long

Artillery Systems Market, Component Analysis

- Fire Control Systems

- Engines

- Turrets

- Chassis

Artillery Systems Market, Type Analysis

- Howitzer

- Mortars

- Rocket Launchers

- Others

Artillery Systems Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Artillery Systems Market?The global Artillery Systems Market is expected to grow from USD 11.9 billion in 2023 to USD 17.2 billion by 2033, at a CAGR of 3.75% during the forecast period 2023-2033.

-

2. Who are the key market players of the Artillery Systems Market?Some of the key market players of the market are Elbit Systems Ltd.; RTX Corporation; Leonardo S.p.A; BAE Systems plc; General Dynamics; Thales Group; Lockheed Martin Corporation; KNDS France; Hanwha Corporation; RUAG International Holding Ltd.; Denel SOC Ltd.; Singapore Technologies Engineering Ltd.; Aubert & Duval; Avibras.

-

3. Which segment holds the largest market share?The howitzer segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Artillery Systems Market?North America dominates the Artillery Systems Market and has the highest market share.

Need help to buy this report?