Asia Pacific Abaca Fiber Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Primary (Raw) Fiber, Secondary (Pulp) Fiber, and Blended Fiber), By Application (Paper & Pulp, Textiles, Cordage & Ropes, Composites, and Others), and by Asia Pacific Abaca Fiber Market Insights, Industry Trend, Forecasts to 2033

Industry: Construction & ManufacturingAsia Pacific Abaca Fiber Market Insights Forecasts to 2033

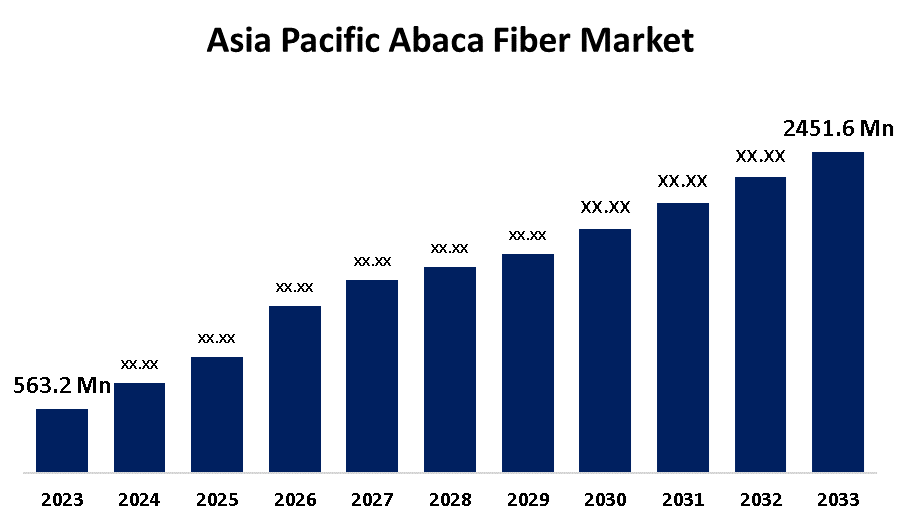

- The Asia Pacific Abaca Fiber Market Size was valued at USD 563.2 Million in 2023.

- The Market is growing at a CAGR of 15.85% from 2023 to 2033

- The Asia Pacific Abaca Fiber Market Size is expected to reach USD 2451.6 Million by 2033

Get more details on this report -

The Asia Pacific Abaca Fiber Market Size is anticipated to exceed USD 2451.6 Million by 2033, growing at a CAGR of 15.85% from 2023 to 2033.

Market Overview

The Asia Pacific abaca fiber market refers to the industry involved in the production, processing, and distribution of abaca fiber; a natural fiber derived from the Musa textilis plant. Known for its exceptional strength, durability, and resistance to saltwater, abaca fiber is widely used in applications such as specialty paper production, ropes, textiles, and composites. The market holds significant economic importance in the region, particularly in countries such as the Philippines, which is the largest global producer of abaca fiber, followed by Indonesia and other Southeast Asian nations. Several factors are driving the growth of the Asia Pacific abaca fiber market. Increasing demand for sustainable and biodegradable materials has led to a surge in the use of abaca fiber in eco-friendly packaging, textiles, and automotive components. The expansion of the global specialty paper industry, particularly for currency notes and tea bags, is further contributing to market growth. Additionally, technological advancements in fiber processing and the development of innovative composite materials are enhancing the versatility of abaca fiber. Government initiatives play a crucial role in industry expansion. Policies promoting sustainable agriculture, financial support for abaca farmers, and research initiatives aimed at improving fiber yield and quality are fostering market development across the region.

Report Coverage

This research report categorizes the market for the Asia Pacific abaca fiber market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific abaca fiber market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific abaca fiber market.

Asia Pacific Abaca Fiber Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 563.2 Million |

| Forecast Period: | 2023 -2033 |

| Forecast Period CAGR 2023 -2033 : | 15.85% |

| 2033 Value Projection: | USD 2451.6 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Application , By Product Type |

| Companies covered:: | M.A.P. Enterprises, Yzen Handicraft Export Trading, Specialty Pulp Manufacturing, Inc. (SPMI), Ching Bee Trading Corporation, Peral Enterprises, Sellinrail International Trading Company, DGL Global Ventures LLC, Terranova Papers, Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The Asia Pacific abaca fiber market is driven by increasing demand for sustainable and biodegradable materials, particularly in packaging, textiles, and automotive applications. The expansion of the specialty paper industry, including currency notes, tea bags, and filter papers, is significantly contributing to market growth. Rising environmental concerns and stringent regulations on plastic usage are further boosting the adoption of abaca fiber-based products. Technological advancements in fiber extraction and processing are enhancing production efficiency and quality. Additionally, growing investments in research and development, along with government support for sustainable agriculture and financial assistance to abaca farmers, are propelling market expansion.

Restraining Factors

The Asia Pacific abaca fiber market faces challenges such as limited cultivation areas, high production costs, susceptibility to plant diseases, fluctuating raw material prices, and competition from synthetic fiber alternatives in various applications.

Market Segmentation

The Asia Pacific abaca fiber market share is classified into product type and application.

- The primary (raw) fiber segment is expected to hold the largest market share through the forecast period.

The Asia Pacific abaca fiber market is segmented by product type into primary (raw) fiber, secondary (pulp) fiber, and blended fiber. Among these, the primary (raw) fiber segment is expected to hold the largest market share through the forecast period. Raw abaca fiber is widely used in various high-demand applications, including specialty paper production, ropes, and marine cordage, due to its exceptional strength, durability, and resistance to saltwater. The increasing adoption of abaca fiber in sustainable packaging and industrial textiles further supports the dominance of this segment.

- The paper & pulp segment dominates the market with the largest market share over the predicted period.

The Asia Pacific abaca fiber market is segmented by application into paper & pulp, textiles, cordage & ropes, composites, and others. Among these, the paper & pulp segment dominates the market with the largest market share over the predicted period. Abaca fiber is extensively used in the production of specialty paper, including currency notes, tea bags, filter papers, and security documents, due to its high tensile strength, durability, and resistance to degradation. The increasing global demand for sustainable and biodegradable paper products is further driving the growth of this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific abaca fiber market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- M.A.P. Enterprises

- Yzen Handicraft Export Trading

- Specialty Pulp Manufacturing, Inc. (SPMI)

- Ching Bee Trading Corporation

- Peral Enterprises

- Sellinrail International Trading Company

- DGL Global Ventures LLC

- Terranova Papers

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-added resellers (VARs)

Market Segment

This study forecasts revenue at Asia Pacific, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Asia Pacific abaca fiber market based on the below-mentioned segments:

Asia Pacific Abaca Fiber Market, By Product Type

- Primary (Raw) Fiber

- Secondary (Pulp) Fiber

- Blended Fiber

Asia Pacific Abaca Fiber Market, By Application

- Paper & Pulp

- Textiles

- Cordage & Ropes

- Composites

- Others

Need help to buy this report?