Asia Pacific Adhesives and Sealants Market Size, Share, and COVID-19 Impact Analysis, By Technology (Water-Based, Solvent-Based, Hot Melt, Reactive and Others), By Product (Acrylic, PVA, Polyurethanes, Styrenic Block, Epoxy, EVA, and Others), By Application (Pressure Sensitive Applications, Packaging, Construction, Furniture, Footwear, Automotive, and Other), and Asia Pacific Adhesives and Sealants Market Insights, Industry Trend, Forecasts to 2033

Industry: Specialty & Fine ChemicalsAsia Pacific Adhesives and Sealants Market Insights Forecasts to 2033

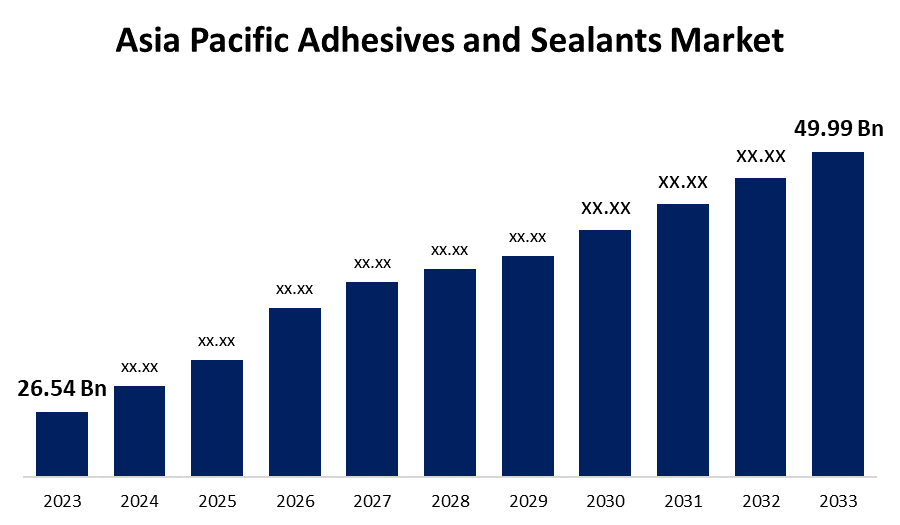

- The Asia Pacific Adhesives and Sealants Market Size was valued at USD 26.54 Billion in 2023.

- The Market is Growing at a CAGR of 6.54% from 2023 to 2033

- The Asia Pacific Adhesives and Sealants Market Size is Expected to Reach USD 49.99 Billion by 2033

Get more details on this report -

The Asia Pacific Adhesives and Sealants Market is Anticipated to Reach USD 49.99 Billion by 2033, growing at a CAGR of 6.54% from 2023 to 2033

Market Overview

The production and application of materials that adhere to one another and create leak-proof seals are related to the Asia Pacific adhesives and sealants market. The majority of industries, including automotive, construction, packaging, electronics, and healthcare, depend on these items. Several types meet diverse needs in terms of performance, application, and material compatibility, including structural adhesives, pressure-sensitive adhesives, and sealants. Rapid urbanization, industrialization, and the growing construction industry have all increased the region's need for adhesives and sealants. The growing need for lightweight materials and fuel-efficient vehicles has led to a major contribution to market growth from the automotive industry, especially in countries like China and India. Product adoption is also influenced by rising disposable income and shifting consumer preferences for technology and packaging. Government policies in countries like China and India are boosting the adhesives and sealants market by encouraging infrastructure development and sustainable construction practices. These policies and investments in R&D encourage manufacturers to create eco-friendly solutions that meet consumer demand and environmental standards, thereby boosting the manufacturing of high-performance, safe adhesives and sealants. For instance, the China Manufacturing 2025 plan, a significant government initiative in the Asia-Pacific region, aims to enhance China's manufacturing capabilities and promote high-end industries, including the adhesives and sealants sector, focusing on innovation, quality improvement, and green manufacturing.

Report Coverage

This research report categorizes the market for the Asia Pacific adhesives and sealants market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific adhesives and sealants market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific adhesives and sealants market.

Asia Pacific Adhesives and Sealants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 6.54% |

| 023 – 2033 Value Projection: | USD 49.99 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Technology, By Product, By Application |

| Companies covered:: | Henkel AG & Company KGaA H.B. Fuller Company Arkema Inc. Pioneer Adhesives Inc. Sika AG Wacker Chemie AG Saint-Gobain S.A Evonik Chemicals Limited Pidilite Industries Limited Shandong Evergain Adhesive Co. Ltd. ITLS (H.K.) Co. Limited Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Asia Pacific adhesives and sealants market is fueled by rapid industrialization and urbanization in emerging economies like China and India, resulting in increased demand for adhesives and sealants in the construction, automotive, and packaging industries. The shift towards lightweight, fuel-efficient vehicles in the automotive sector, e-commerce growth, and consumer demand for durable packaging contribute to the market's growth. Innovation in adhesive technology also caters to sustainable and environmentally safe solutions.

Restraining Factors

The market for adhesives and sealants faces challenges such as high raw material prices, stringent environmental regulations, and limited skilled labor and technical expertise. High prices, particularly in specialty resins and chemicals, could impact profitability, especially in price-sensitive regions. Additionally, the lack of skilled labor and technical expertise in some areas may delay the adoption of advanced adhesive technologies, potentially slowing market growth.

Market Segmentation

The Asia Pacific adhesives and sealants market share is classified into technology, product, and application.

- The reactive & other segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific adhesives and sealants market is segmented by technology into water-based, solvent-based, hot melt, reactive & others. Among these, the reactive & other segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This is due to their superior performance and wide applications. Reactive adhesives like polyurethane, epoxy, and silicone form chemical bonds during curing, increasing adhesive strength and sealant strength. These properties, along with excellent resistance to environmental factors, make them suitable for demanding industries like automotive, construction, and electronics.

- The acrylic segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product, the Asia Pacific adhesives and sealants market is divided into acrylic, PVA, polyurethanes, styrene block, epoxy, EVA, and others. Among these, the acrylic segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The market is dominated because it is affordable, adaptable, and performs well in a range of applications. These adhesives and sealants are primarily used for adhesion to glass, plastics, and metals, and their fast-curing feature and high-volume production processes make them suitable for automotive, construction, and electronics.

- The construction segment accounted for the fastest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific adhesives and sealants market is segmented by application into pressure sensitive applications, packaging, construction, furniture, footwear, automotive, and other. Among these, the construction segment accounted for the fastest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This is due to the rising demand for advanced materials for high-performance building and infrastructure projects. Rapid urbanization, particularly in developing countries like China and India, has led to a significant increase in innovative construction solutions. Adhesives and sealants are crucial for efficient, durable, and sustainable construction structures.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific adhesives and sealants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Henkel AG & Company

- KGaA

- H.B. Fuller Company

- Arkema Inc.

- Pioneer Adhesives Inc.

- Sika AG

- Wacker Chemie AG

- Saint-Gobain S.A

- Evonik Chemicals Limited

- Pidilite Industries Limited

- Shandong Evergain Adhesive Co. Ltd.

- ITLS (H.K.) Co. Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, Henkel's Loctite WT 3001 and Loctite WT 3003 are cutting-edge products in the medical adhesives industry. Because of their ISO 10993-compliant formulation and lack of IBOA, they are ideal for wearable medical devices, guaranteeing both performance and safety.

Market Segment

This study forecasts revenue at Asia Pacific, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Asia Pacific adhesives and sealants market based on the below-mentioned segments:

Asia Pacific Adhesives and Sealants Market, By Technology

- Water-Based

- Solvent-Based

- Hot Melt

- Reactive and Others

Asia Pacific Adhesives and Sealants Market, By Product

- Acrylic

- PVA

- Polyurethanes

- Styrenic Block

- Epoxy

- EVA

- Others

Asia Pacific Adhesives and Sealants Market, By Application

- Pressure Sensitive Applications

- Packaging

- Construction

- Furniture

- Footwear

- Automotive

- Other

Need help to buy this report?