Asia Pacific Defoamers Market Size, Share, and COVID-19 Impact Analysis, By Product (Water-Based, Oil-Based, Silicone-Based, and Others), By End-Use (Paints, Coatings, & Inks, Adhesives & Sealants, and Others), and by Asia Pacific Defoamers Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsAsia Pacific Defoamers Market Insights Forecasts to 2033

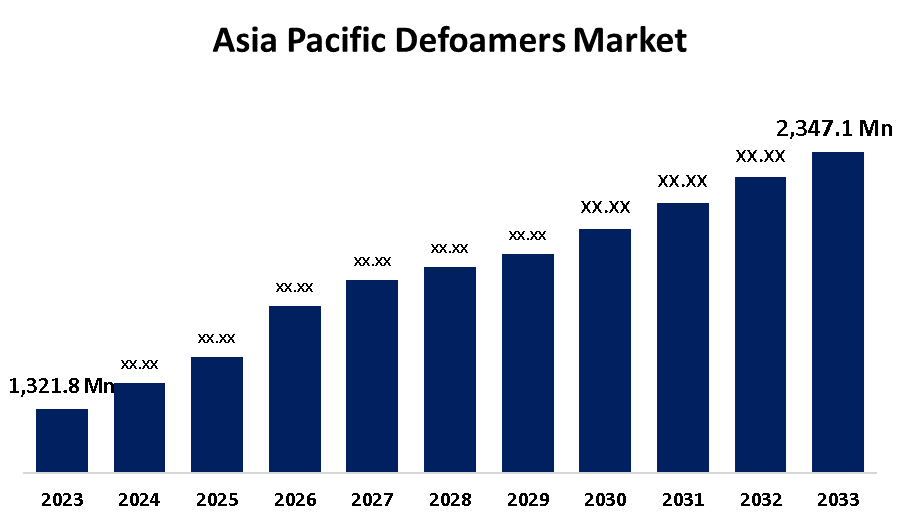

- The Asia Pacific Defoamers Market Size was valued at USD 1,321.8 Million in 2023.

- The Market is growing at a CAGR of 5.91% from 2023 to 2033

- The Asia Pacific Defoamers Market Size is expected to reach USD 2,347.1 Million by 2033

Get more details on this report -

The Asia Pacific Defoamers Market is anticipated to exceed USD 2,347.1 Million by 2033, growing at a CAGR of 5.91% from 2023 to 2033.

Market Overview

The Asia Pacific defoamers market refers to the industry focused on the production, distribution, and application of defoaming agents used to reduce or eliminate foam in various industrial processes. Defoamers are widely utilized in industries such as wastewater treatment, food and beverage processing, pulp and paper production, paints and coatings, and pharmaceuticals. These agents enhance process efficiency by preventing foam-related disruptions, improving product quality, and optimizing operational performance. The market includes different types of defoamers, including silicone-based, oil-based, and water-based formulations, catering to diverse industry requirements. Several factors drive the growth of the Asia Pacific defoamers market. Rapid industrialization and urbanization have led to increased demand for defoamers across multiple sectors, particularly in wastewater treatment and manufacturing. The expanding food and beverage industry, coupled with stringent quality and safety standards, further fuels market growth. Additionally, the rising adoption of high-performance coatings and adhesives in the construction and automotive industries boosts the demand for defoaming solutions. Government initiatives play a crucial role in market development. Policies promoting environmental sustainability and wastewater management regulations have increased the adoption of defoamers in water treatment facilities. Furthermore, investments in industrial innovation and manufacturing sector expansion across emerging economies support market growth, fostering advancements in eco-friendly and biodegradable defoamer formulations.

Report Coverage

This research report categorizes the market for the Asia Pacific defoamers market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific defoamers market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific defoamers market.

Asia Pacific Defoamers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1,321.8 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.91% |

| 2033 Value Projection: | USD 2,347.1 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Product , By End-Use |

| Companies covered:: | Kemira Oyj, Air Products and Chemicals, Inc., Ashland Inc., Bluestar Silicones International, Dow Inc., Evonik Industries AG, Wacker Chemie AG, Shin-Etsu Chemical Co., Ltd., BASF SE, Elementis PLC, Clariant AG, KCC Basildon, Others, and |

| Pitfalls & Challenges: | COVID-19 impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rapid industrialization and urbanization have significantly increased demand for defoamers across industries such as wastewater treatment, pulp and paper, food and beverage, and paints and coatings. The expansion of manufacturing and processing industries, particularly in emerging economies, further supports market growth. Additionally, stringent regulatory standards for wastewater treatment and industrial emissions have accelerated the adoption of defoamers. The growing demand for high-performance coatings and adhesives in the construction and automotive sectors also contributes to market expansion. Furthermore, advancements in eco-friendly and biodegradable defoamer formulations enhance sustainability and drive industry growth.

Restraining Factors

The Asia Pacific defoamers market faces challenges such as stringent environmental regulations on chemical formulations, high raw material costs, potential health hazards associated with certain defoamers, and limited awareness regarding eco-friendly alternatives in some industries.

Market Segmentation

The Asia Pacific defoamers market share is classified into product and end-use.

- The silicone-based segment is expected to hold the largest market share through the forecast period.

The Asia Pacific defoamers market is segmented by product into water-based, oil-based, silicone-based, and others. Among these, the silicone-based segment is expected to hold the largest market share through the forecast period. This dominance is attributed to the superior efficiency of silicone-based defoamers in controlling foam across various industrial applications, including wastewater treatment, pulp and paper, paints and coatings, and food processing. These defoamers offer high thermal stability, chemical inertness, and long-lasting foam suppression, making them highly preferred over water-based and oil-based alternatives.

- The paints, coatings, & inks segment dominates the market with the largest market share over the predicted period.

The Asia Pacific defoamers market is segmented by end-use into paints, coatings, & inks, adhesives & sealants, and others. Among these, the paints, coatings, & inks segment dominates the market with the largest market share over the predicted period. This dominance is driven by the rapid expansion of the construction, automotive, and packaging industries, which significantly increases the demand for high-performance paints, coatings, and inks. Defoamers play a crucial role in improving product quality by preventing foam formation during manufacturing and application processes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific defoamers market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kemira Oyj

- Air Products and Chemicals, Inc.

- Ashland Inc.

- Bluestar Silicones International

- Dow Inc.

- Evonik Industries AG

- Wacker Chemie AG

- Shin-Etsu Chemical Co., Ltd.

- BASF SE

- Elementis PLC

- Clariant AG

- KCC Basildon

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-added resellers (VARs)

Market Segment

This study forecasts revenue at Asia Pacific, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Asia Pacific defoamers market based on the below-mentioned segments:

Asia Pacific Defoamers Market, By Product

- Water-Based

- Oil-Based

- Silicone-Based

- Others

Asia Pacific Defoamers Market, By End Use

- Paints, Coatings, & Inks

- Adhesives & Sealants

- Others

Need help to buy this report?