Asia Pacific Electric vehicle (EV) Market Size, Share, and COVID-19 Impact Analysis, By Propulsion (Battery Electric Vehicle (BEV) Hybrid Vehicle (HEV)), By Vehicle (Two-wheelers, Passenger Cars, Commercial), By Drive (All Wheel Drive, Front Wheel Drive, Rear Wheel Drive), By Component (Battery Pack & High Voltage Component, Motor, Brake, Wheel & Suspension, Body & Chassis, Low Voltage Electric Component), By Country (China, Japan, India, South Korea, Australia, Rest of the APAC), and Asia Pacific Electric vehicle (EV) Market Insights Forecasts to 2032.

Industry: Automotive & TransportationAsia Pacific Electric Vehicle (EV) Market Insights Forecasts to 2032

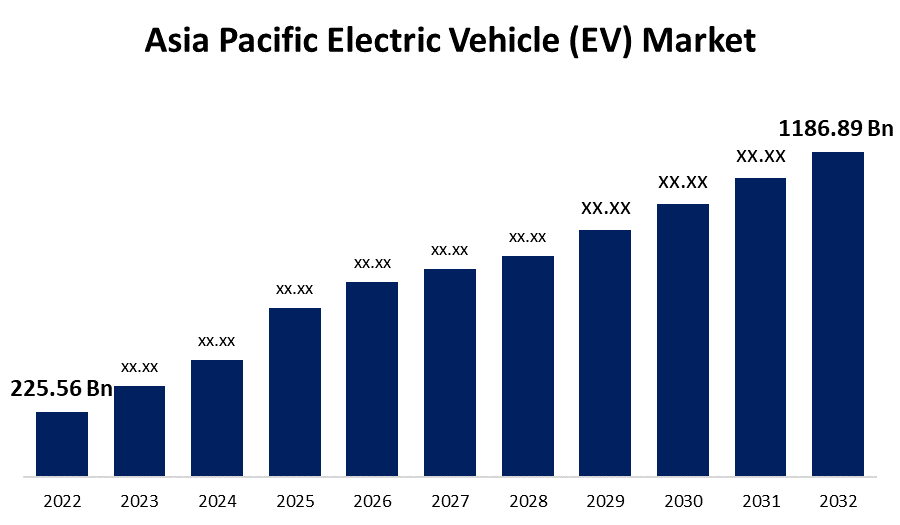

- The Asia Pacific Electric vehicle (EV) Market Size was valued at USD 225.56 Billion in 2022.

- The Market is growing at a CAGR of 18.06% from 2022 to 2032.

- The Asia Pacific Electric vehicle (EV) Market Size is expected to reach 1186.89 Billion by 2032.

Get more details on this report -

The Asia Pacific Electric vehicle (EV) Market Size is expected to reach USD 1186.89 Billion by 2032, at a CAGR of 18.06% during the forecast period 2022 to 2032.

Market Overview

An electric vehicle (EV) is a vehicle that can be driven by one or more electric motors. It can be powered by a collector system, extravehicular sources of electricity, or by batteries (sometimes charged by sunlight from solar panels, or by converting fuel to electricity using fuel cells or a generator). EVs include but are not limited to, road and rail vehicles, as well as electric boats and underwater vessels (submersibles and, technically, nuclear submarines), electric aircraft, and electric spacecraft. The Asia-Pacific electric vehicle industry has seen rapid growth. This is highlighted by the region accounting for the largest share of the global battery electric vehicle (BEV) market. Furthermore, Individual's rising awareness of environmental issues is also boosting the revenue of these vehicles across Asia-Pacific. Vehicle penetration remains lower in emerging economies such as India and China than in Western countries. Rising income levels and aspirations to own a vehicle in these countries would benefit electric vehicle companies. Since businesses would not have to wait for conventional automobiles to be replaced by electric vehicles, the Asia-Pacific electric vehicle market would grow faster than in North America and Europe. Because of the low vehicle penetration in Asia-Pacific, many first-time vehicle owners would opt for an electric vehicle.

Report Coverage

This research report categorizes the market for Asia Pacific electric vehicle (EV) Market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific electric vehicle (EV) market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific electric vehicle (EV) market.

Asia Pacific Electric vehicle (EV) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 225.56 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 18.06% |

| 022 – 2032 Value Projection: | USD 1186.89 Bn |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Propulsion, By Vehicle, By Drive, By Component, By Country. |

| Companies covered:: | Hyundai Motor Company, BYD Company Ltd., TOYOTA MOTOR CORPORATION, Nissan Motor Co., LTD., SAIC Motor Corporation Limited, Kia Motors Corporation, Honda Motor Co., Ltd., TATA Motors, Mitsubishi Motors Corporation, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing prices of conventional fuel are expected to accentuate the development of vehicle electrification. The stringent emission norms being drafted by the government and the growing environmental awareness among Indian consumers are also expected to fuel the demand for electric vehicles. Furthermore, Indian automakers, such as Tata Motors, and Mahindra and Mahindra Ltd., have embarked upon aggressive efforts to add electrified vehicles to their product portfolio, which is expected to encourage Indian consumers to opt for electric vehicles. All these factors bode well for the growth of the electric vehicle market in India over the forecast period. The demand for high-performance, fuel-efficient, and low-emission vehicles is growing, and the Asia-Pacific electric vehicle market is expanding as a result of tightening rules and regulations regarding vehicle emissions, falling battery prices, and rising fuel prices. Furthermore, governments are making investments in charging infrastructure, whether directly in public charging points or indirectly in home and workplace charging stations.

Restraining Factors

The price of an electric vehicle is the most significant factor. These vehicles are more expensive than gasoline-powered ones since they have batteries, which may account for between 35% and 40% of the vehicle's price. Since the price of an electric vehicle (passenger/commercial) is nearly 50% higher than that of an ICE vehicle, customers may be reluctant to purchase electric vehicles in the near future, restricting market growth. However, with the rising manufacturing of electric vehicle batteries in large quantities and improvements in technology, the price of batteries is expected to have an impact on the growth of the region's electric vehicle market.

Market Segment

- In 2022, the battery electric vehicle (BEV) segment accounted for the largest revenue share over the forecast period.

Based on the propulsion, the Asia Pacific Electric Vehicle (EV)Market is segmented into battery electric vehicle (BEV) and hybrid vehicle (HEV)). Among these, the battery electric vehicle (BEV) segment has the largest revenue share over the forecast period. The segment's dominant market share can be attributed to consumers' increasing preference for EVs over ICE vehicles, as well as restrictions on vehicular CO2 emissions. BEVs have the potential to significantly reduce vehicular emissions while also lowering the total cost of ownership in the future. Battery technology advancements and falling lithium-ion battery prices are also expected to drive BEV demand over the forecast period.

- In 2022, the commercial segment accounted for the largest revenue share over the forecast period.

On the basis of vehicles, the Asia Pacific electric vehicle (EV) market is segmented into two-wheelers, passenger cars, and commercial. Among these, the commercial segment has the largest revenue share over the forecast period. The segment's growth can be attributed to the India’s ongoing implementation of electric light-duty commercial trucks and electric buses. Electric buses are already gaining traction as the government pursues aggressive plans to increase the number of electric vehicles on the road in order to reduce vehicular pollution in major cities across the country. Electric light-duty commercial vehicles and electric buses are already available in the country from companies such as Tata Motors, Mahindra and Mahindra Ltd, and Olectra Greentech Limited.

- In 2022, the front-wheel drive segment is expected to hold the largest share of the Asia Pacific Electric vehicle (EV) Market during the forecast period.

Based on the drive, the Asia Pacific electric vehicle (EV) Market is classified into wheel drive, front-wheel drive, and rear-wheel drive. Among these, the front-wheel drive segment is expected to hold the largest share of the Asia Pacific electric vehicle (EV) Market during the forecast period. Front-wheel drive systems are generally less expensive to manufacture and maintain than rear-wheel drive or all-wheel drive systems. Customers can now afford front-wheel drive vehicles, which is fueling the segment's growth. In 2022, the four-wheel-drive segment held a sizable market share. The growing acceptance of four-wheel-drive systems in the worldwide automotive sector can be attributed to the growth.

- In 2022, the battery pack and high voltage components segment accounted for the largest revenue share over the forecast period.

On the basis of components, the Asia Pacific electric vehicle (EV) market is segmented into battery pack and high voltage components, motor, brake, wheel & suspension, body & chassis, and low voltage electric components. Among these, the battery pack and high voltage components segment has the largest revenue share over the forecast period. The price/value of these packs will fall significantly in the coming years. Furthermore, major manufacturers are concentrating on developing batteries and high-voltage components that help to improve performance while lowering costs, which will drive market growth during the forecast period. Furthermore, due to its use as an EV, the motor has the second largest share. Rising EV demand in major countries, in addition to technological advancements by OEMs, is expected to fuel market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific electric vehicle (EV) market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hyundai Motor Company

- BYD Company Ltd.

- TOYOTA MOTOR CORPORATION

- Nissan Motor Co., LTD.

- SAIC Motor Corporation Limited

- Kia Motors Corporation

- Honda Motor Co., Ltd.

- TATA Motors

- Mitsubishi Motors Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2023, BYD expanded its dealer network in Europe with the addition of two new companies. Motor Distributors Ltd (MDL) is present in Ireland and will sell BYD models in select cities such as Dublin and Cork. BYD already works with RSA in Norway, and it will offer Chinese-made EVs in Finland and Iceland. BYD will initially launch three electric vehicle models in select European countries at the end of 2022. Two more series could premiere in 2023.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Asia Pacific Electric Vehicle (EV) Market based on the below-mentioned segments:

Asia Pacific Electric Vehicle (EV) Market, By Propulsion

- Battery Electric Vehicle (BEV)

- Hybrid Vehicle (HEV)

Asia Pacific Electric Vehicle (EV) Market, By Vehicle

- Two-wheelers

- Passenger Cars

- Commercial

Asia Pacific Electric Vehicle (EV) Market, By Drive

- All Wheel Drive

- Front Wheel Drive

- Rear Wheel Drive

Asia Pacific Electric Vehicle (EV) Market, By Component

- Battery Pack & High Voltage Component

- Motor

- Brake

- Wheel & Suspension

- Body & Chassis

- Low Voltage Electric Component

Asia Pacific Electric Vehicle (EV)Market, By Country

- China

- Japan

- India

- South Korea

- Australia

- Rest Of APAC

Need help to buy this report?